PROJECT REPORT

2021

Garment Manufacturing

Prepared By:

Ashok Kr. Verma

Joint Director

Office of Development Commissioner

(MSME)

A – Wing, Nirman Bhavan, New Delhi

1

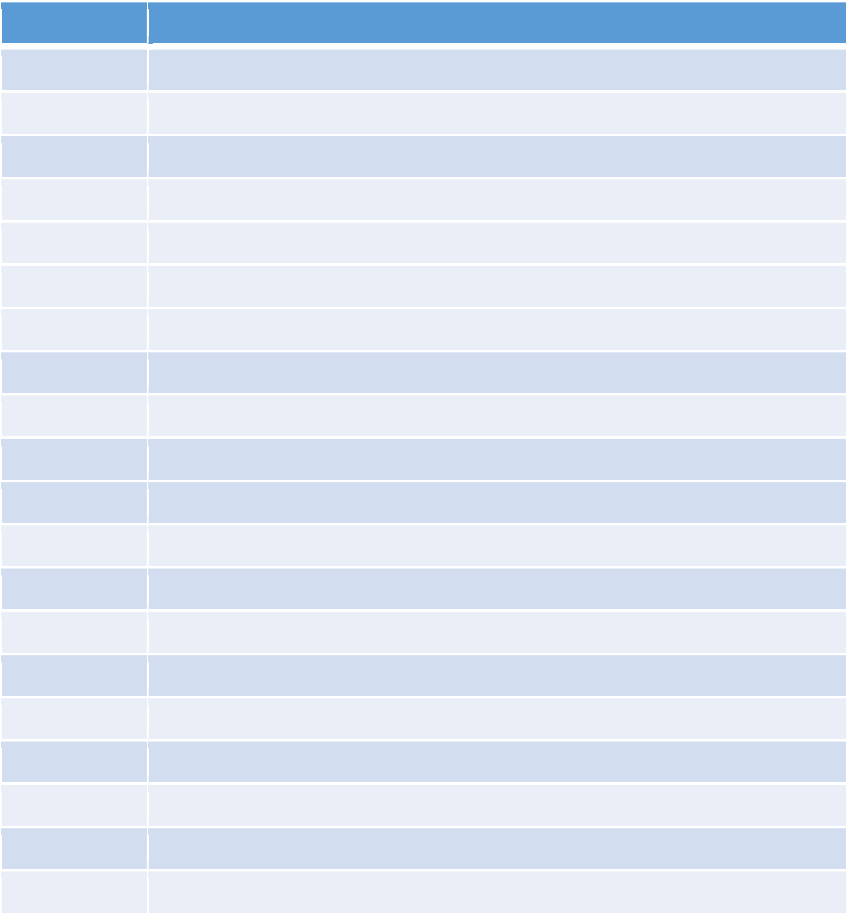

Contents

1. GARMENT MARKET OVERVIEW ....................................................................................... 3

GLOBAL GARMENT MARKET ............................................................................................................................................. 3

INDIAN GARMENT MARKET .............................................................................................................................................. 4

Domestic Market Size............................................................................................................................................ 4

India’s Garment Exports ........................................................................................................................................ 5

India’s Garment Imports ....................................................................................................................................... 6

2. GARMENT MANUFACTURING OVERVIEW ........................................................................ 7

TYPES OF GARMENTS ...................................................................................................................................................... 7

KEY RAW MATERIALS ...................................................................................................................................................... 7

GARMENT MANUFACTURING PROCESS ............................................................................................................................... 8

Spreading & Cutting .............................................................................................................................................. 8

Sewing ................................................................................................................................................................... 8

Finishing ................................................................................................................................................................ 9

Inspection .............................................................................................................................................................. 9

Packing & Dispatch ............................................................................................................................................... 9

Garment Testing ................................................................................................................................................... 9

GARMENT MANUFACTURING CLUSTERS IN INDIA ................................................................................................................ 10

SUITABLE LOCATIONS FOR GARMENT MANUFACTURING ...................................................................................................... 11

3. GARMENT FACTORY PROJECT DETAILS .......................................................................... 12

PROJECT OVERVIEW ..................................................................................................................................................... 12

PROJECT PROFITABILITY ................................................................................................................................................. 12

PROJECT COST DETAILING .................................................................................................. ERROR! BOOKMARK NOT DEFINED.

Miscellaneous Fixed Assets ................................................................................................................................. 13

Preliminary and Pre-Operative Expenses .............................................................................................................. 0

FINANCIAL ANALYSIS ......................................................................................................... ERROR! BOOKMARK NOT DEFINED.

Key Assumptions and Costing ............................................................................................................................. 13

Production and Sales .............................................................................................. Error! Bookmark not defined.

Machinery ........................................................................................................................................................... 16

Department ......................................................................................................................................................... 16

Number of Machines ........................................................................................................................................... 16

Cost (Rs. Crore) .................................................................................................................................................... 16

Operating Expenses .............................................................................................................................................. 0

Working Capital .................................................................................................................................................... 0

Utilities .................................................................................................................................................................. 1

Manpower Planning .............................................................................................................................................. 2

Profit and Loss Statement ..................................................................................................................................... 3

Balance Sheet ........................................................................................................................................................ 4

Cash Flow Statement ............................................................................................................................................ 5

Interest Calculation ............................................................................................................................................... 8

Break-even Points ................................................................................................................................................. 6

Depreciation and Taxation .................................................................................................................................... 7

KEY FINANCIAL INDICATORS ................................................................................................ ERROR! BOOKMARK NOT DEFINED.

Payback Period ...................................................................................................................................................... 9

IRR ......................................................................................................................................................................... 9

2

DSCR .................................................................................................................................................................... 10

Financial Ratios ................................................................................................................................................... 10

4. STATE GOVERNMENT INCENTIVES FOR GARMENT PROJECTS......................................... 11

ANDHRA PRADESH ....................................................................................................................................................... 11

GUJARAT .................................................................................................................................................................... 13

HARYANA ................................................................................................................................................................... 15

JHARKHAND ................................................................................................................................................................ 17

KARNATAKA ................................................................................................................................................................ 19

MADHYA PRADESH ....................................................................................................................................................... 21

TELANGANA ................................................................................................................................................................ 23

UTTAR PRADESH .......................................................................................................................................................... 26

5. ANNEXURE ..................................................................................................................... 0

HSN CODES OF GARMENTS ............................................................................................................................................. 0

NIC CODES OF GARMENTS ............................................................................................................................................. 12

GARMENT TESTING FACILITIES ........................................................................................................................................ 13

GARMENT MACHINERY SUPPLIERS ................................................................................................................................... 14

LEADING INDIAN FABRIC MILLS ....................................................................................................................................... 15

3

1. Garment Market Overview

Global Garment Market

The global garment market is estimated at US$ 1,280 billion in 2020. EU-27, China and USA are

the three largest global markets with a share of 17%, 14% and 13%, respectively.

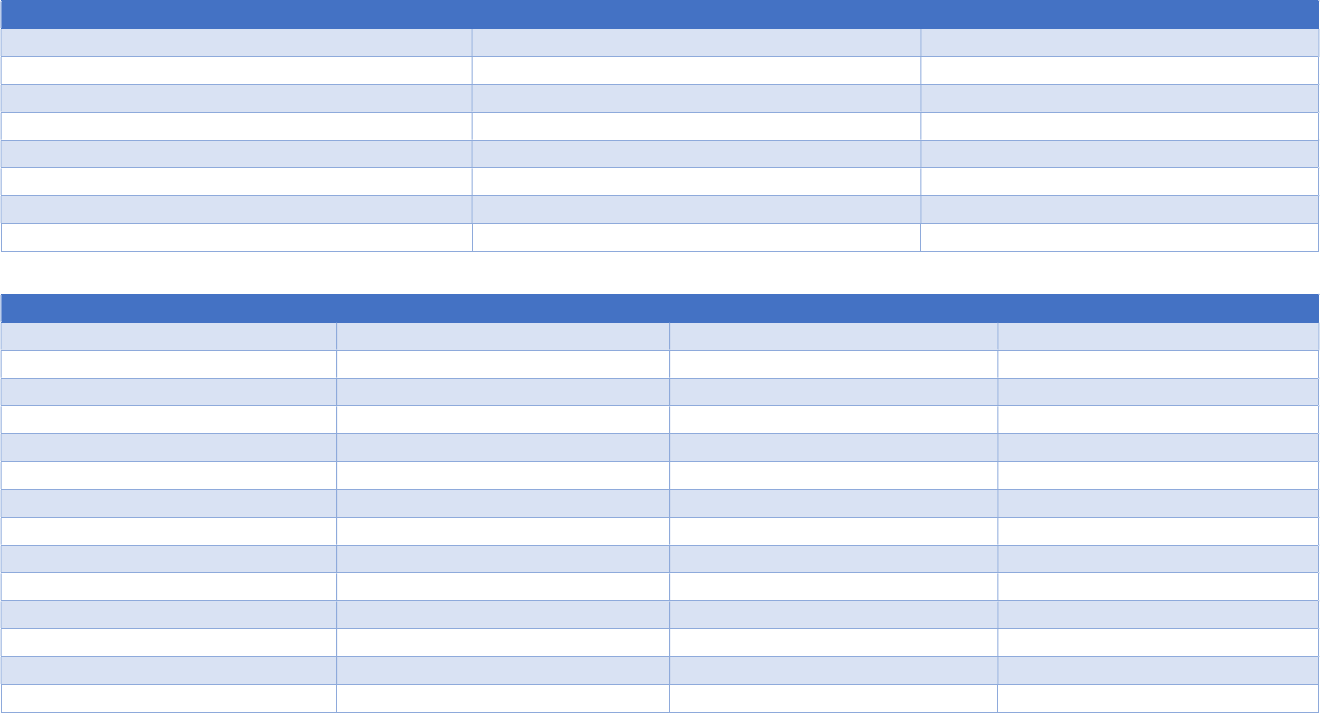

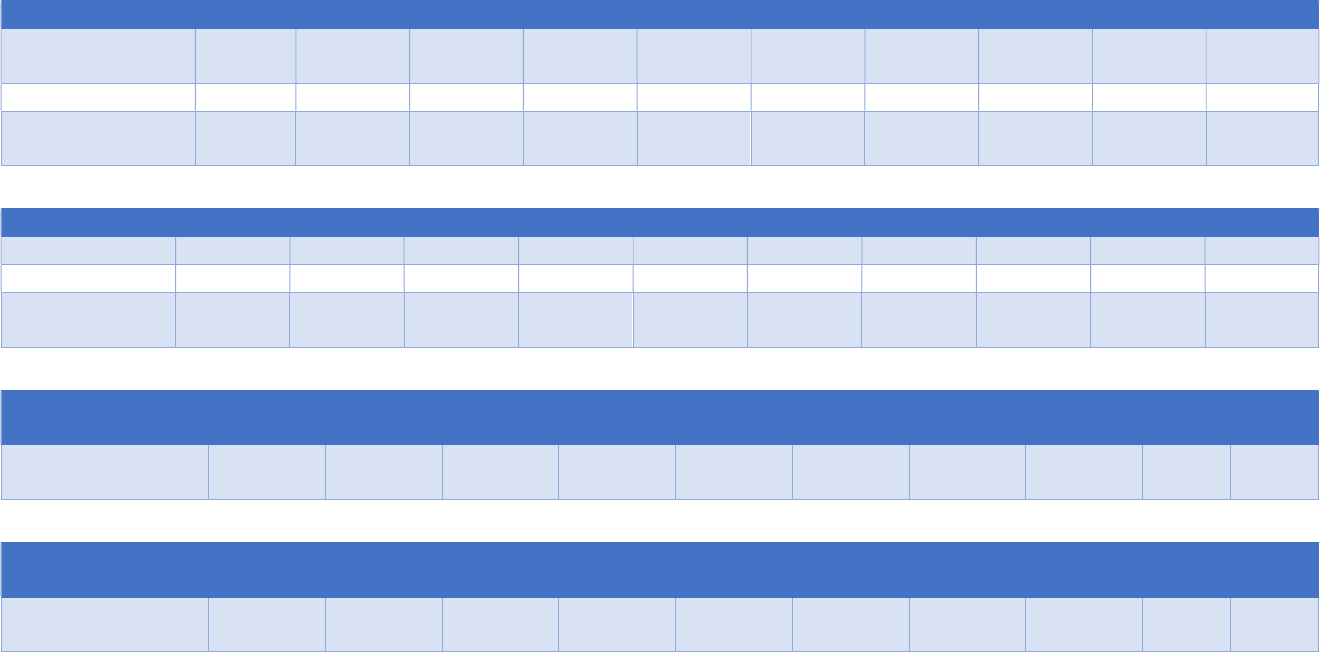

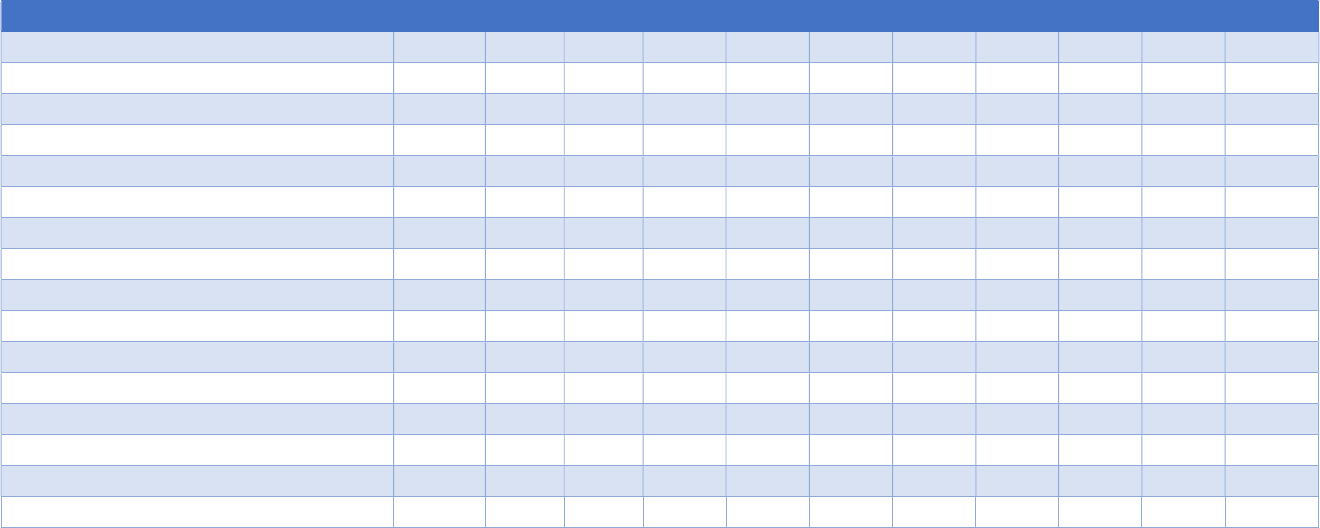

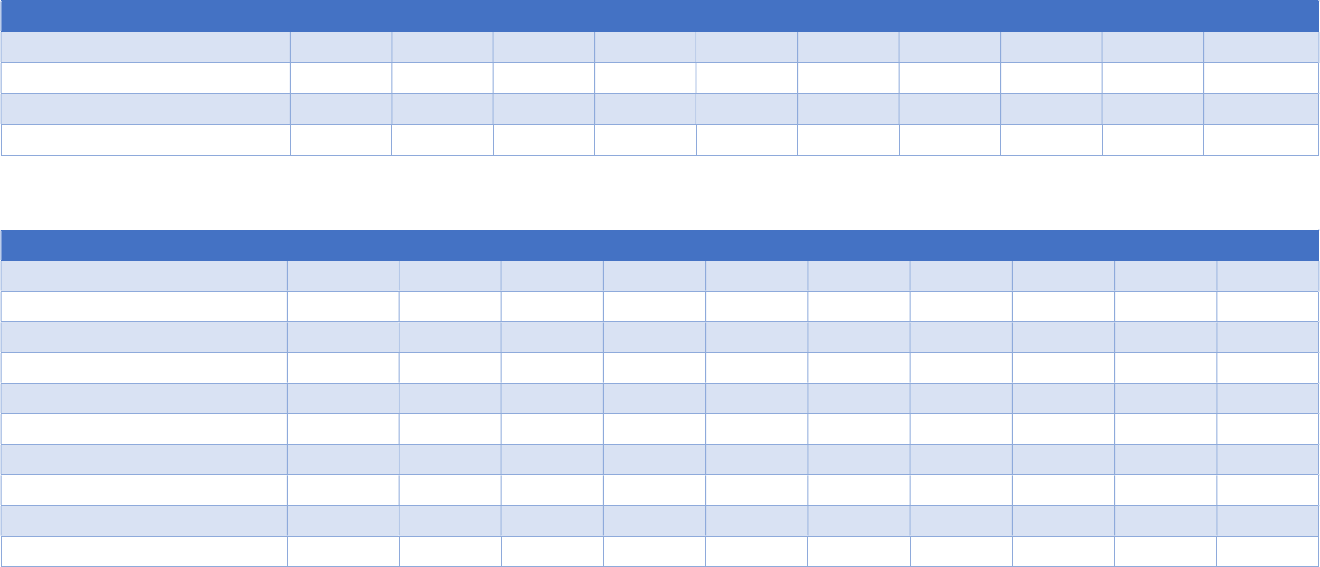

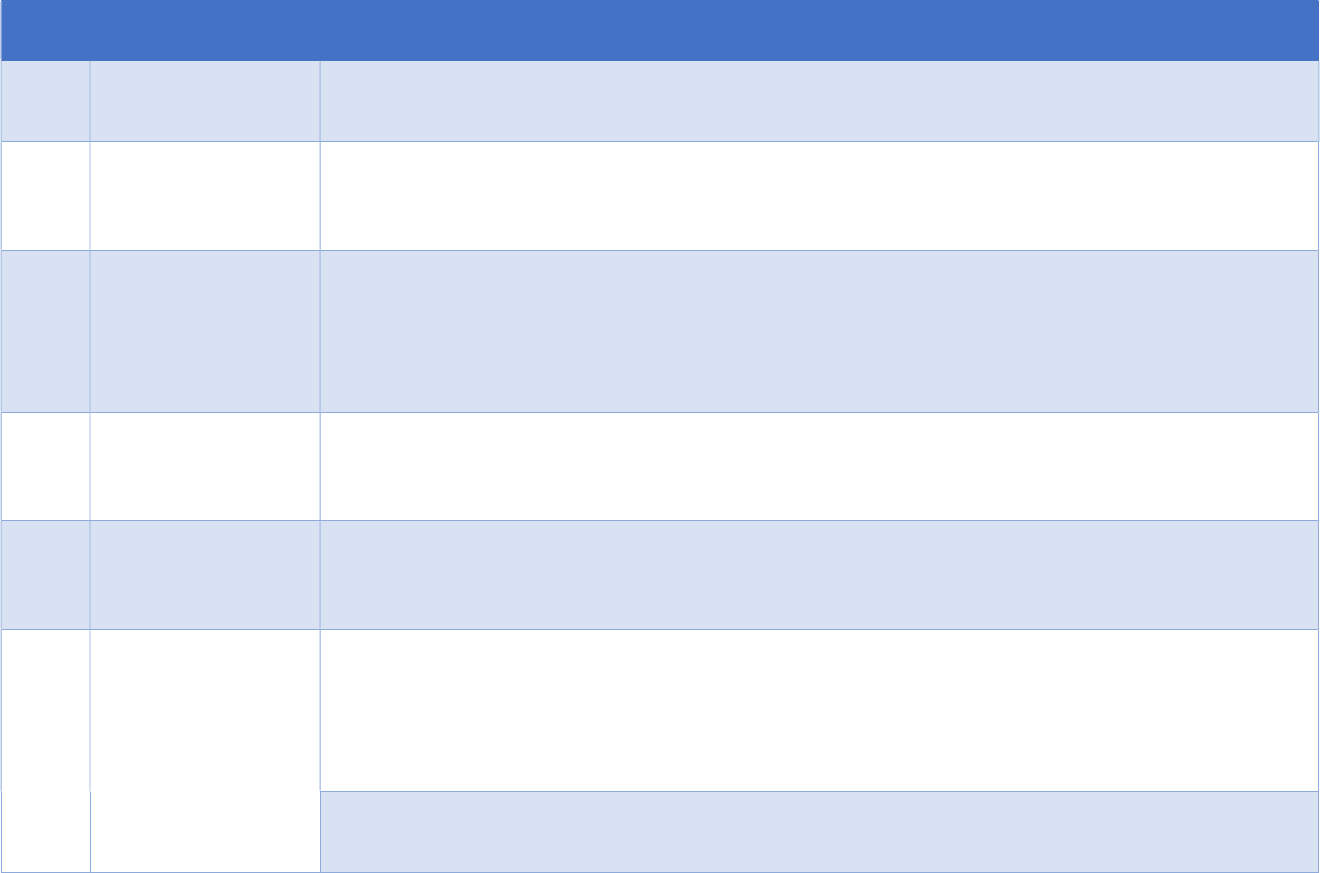

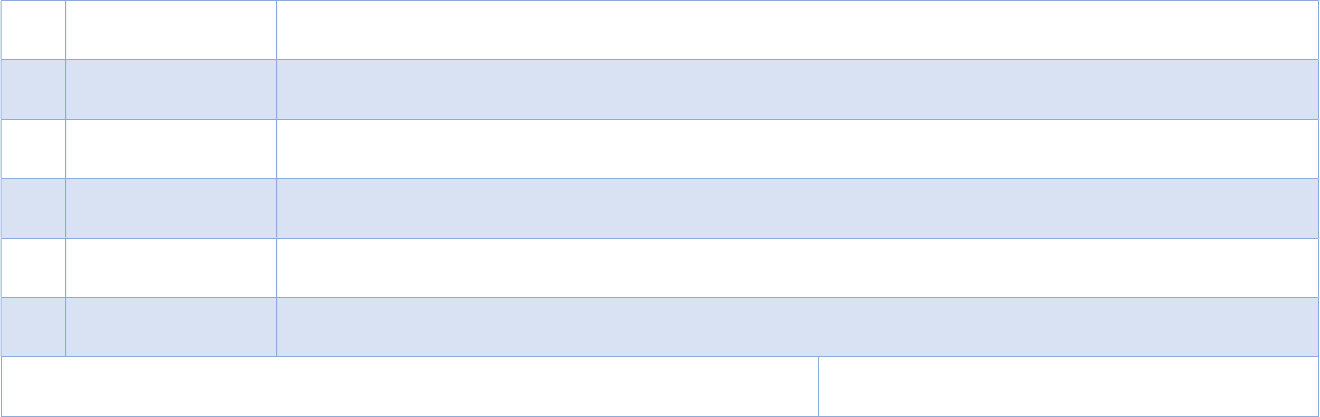

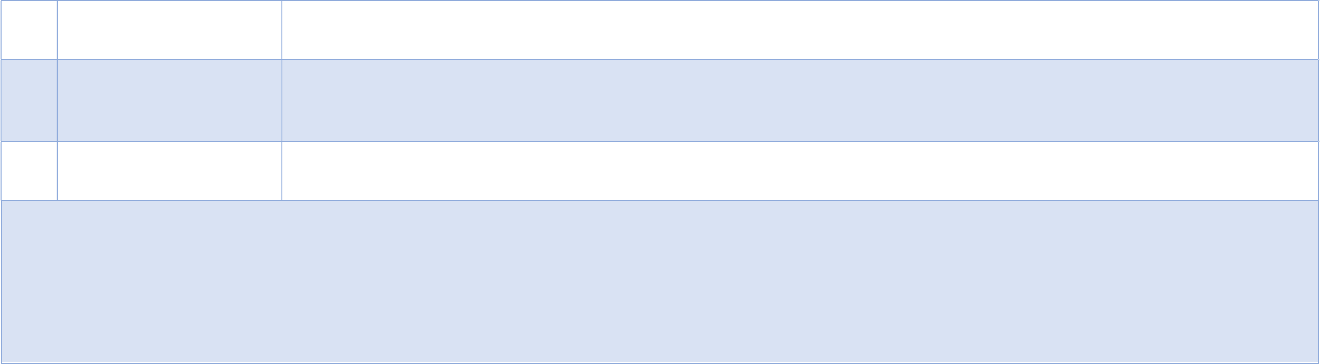

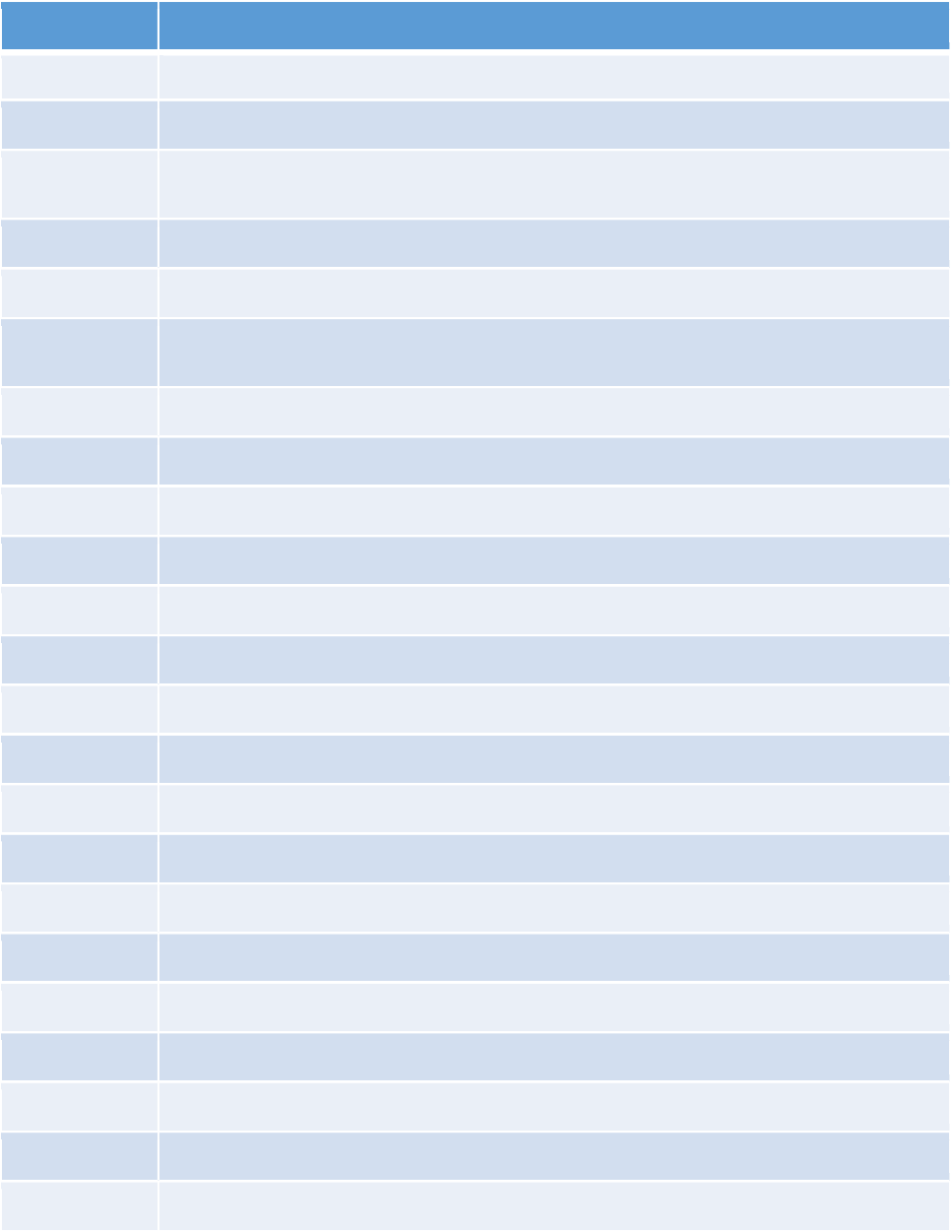

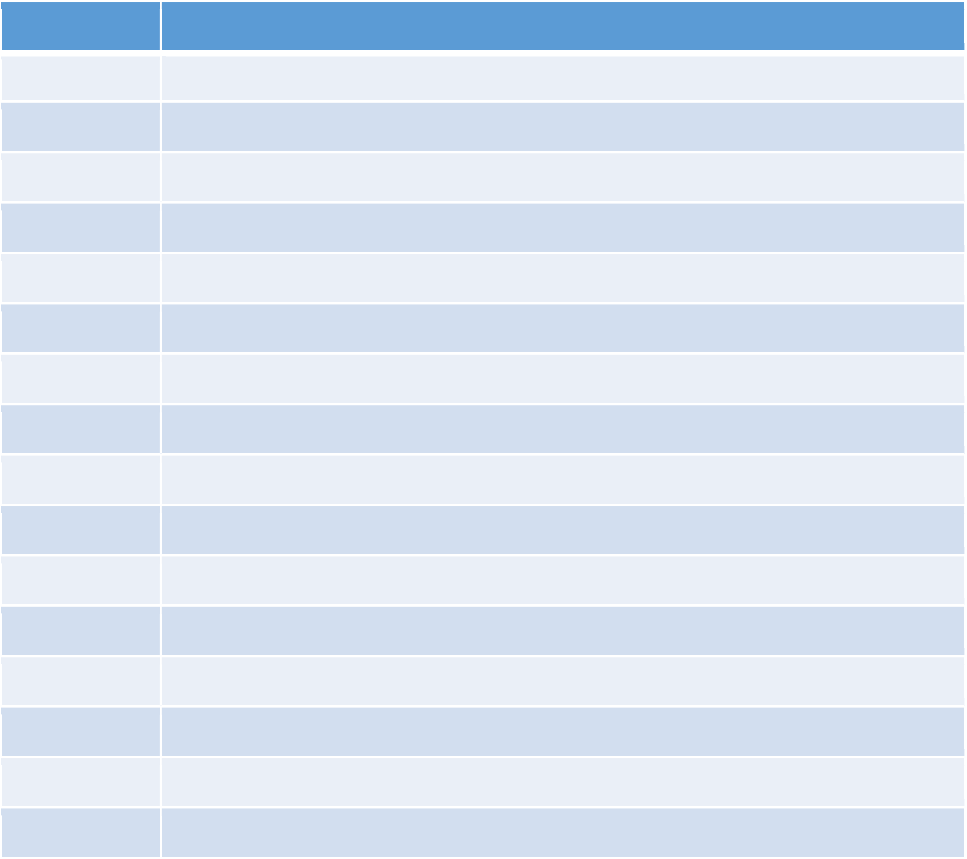

Table 1: Global Garment Market 2020

Region

Value In US$ bn.

Share

EU

-

27

219

17%

China

173

14%

United States

171

13%

Japan

83

6%

India

55

4%

Brazil

34

3%

Canada

27

2%

RoW

517

40%

World

1,280

Source: Wazir Advisors

The global garment trade stood at US$ 482 billion in 2019, with China as the largest exporter.

India is the 6

th

largest exporter of garment in the world.

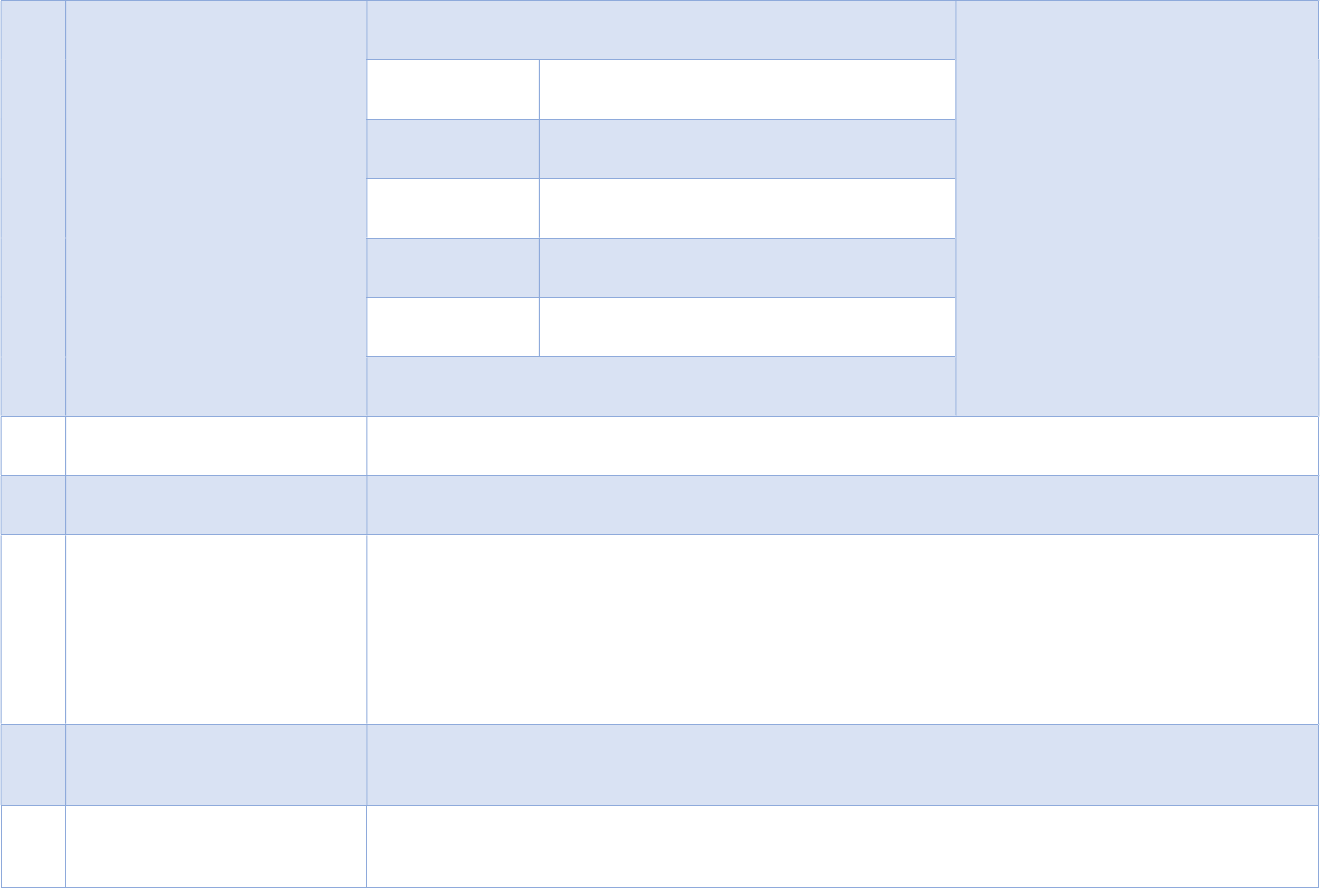

Table 2: Leading Global Garment Exporters

Country

Exports

in US$ bn.

Share

China

1

50

31%

Bangladesh

4

1

8%

Vietnam

3

4

7%

Germany

2

4

5%

Italy

2

4

5%

India

16

3%

Turkey

16

3%

Spain

14

3%

France

12

2%

USA

5

1%

R

oW

146

30%

Total

48

2

Source: United Nations Commercial Trade Database

The global garment demand has been growing at a year-on-year growth rate of about 4% from 2010.

However, the impact of Covid pandemic in 2020 led to approx. 30% decline in demand. The long term

growth trend of garment segment remains intact and it is expected to recover in next couple of years.

4

Indian Garment Market

India is among a few countries that has a large domestic demand as well as competitive in exports.

Presence of strong raw material base in terms of cotton and polyester fibres and large fabric

manufacturing capacities in the country have given a thrust to the garment sector.

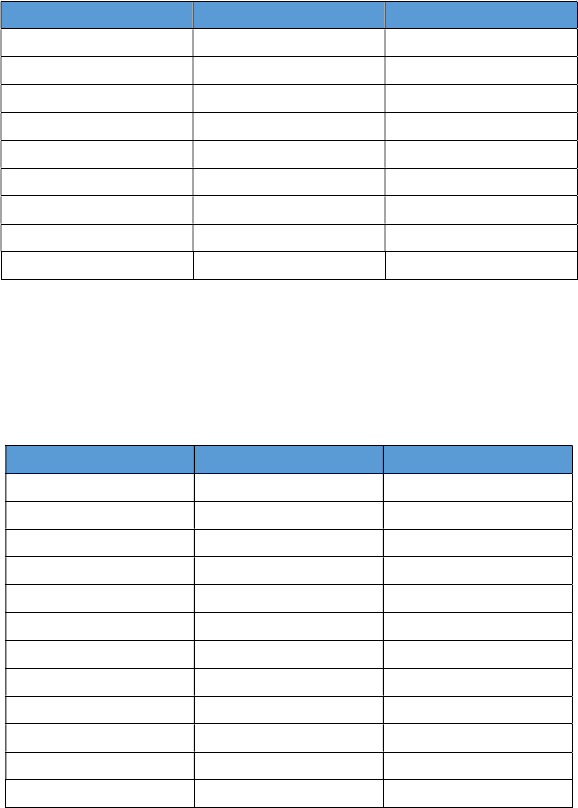

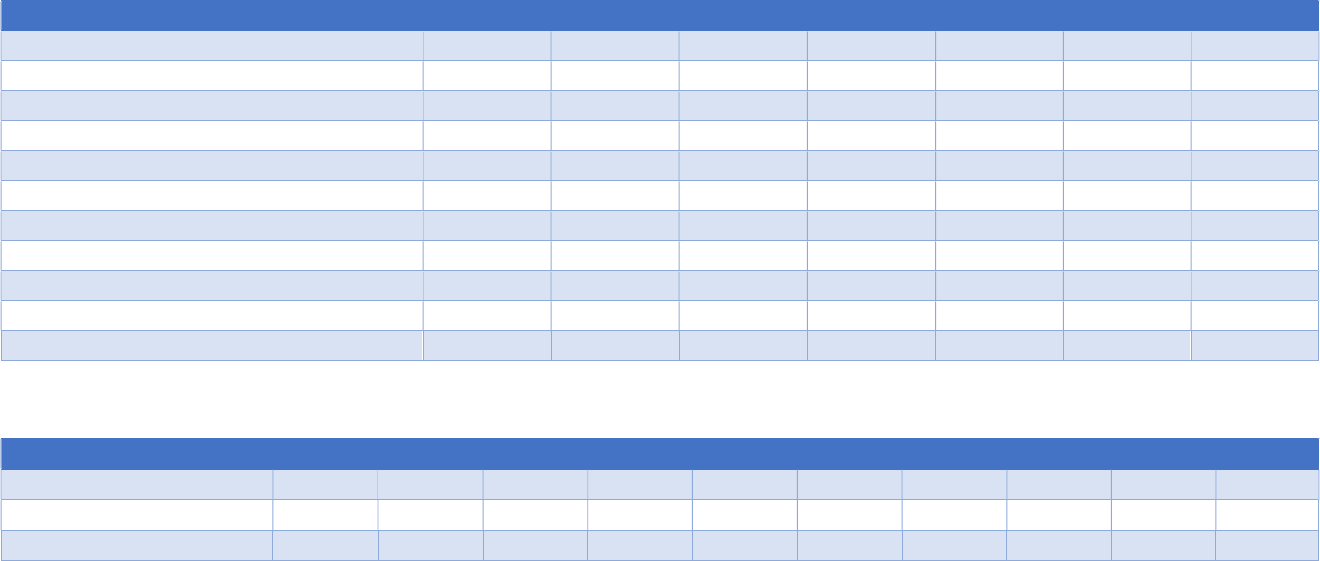

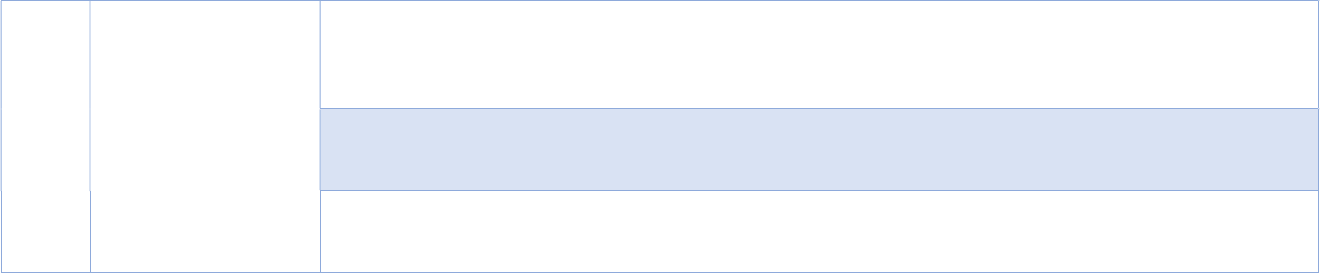

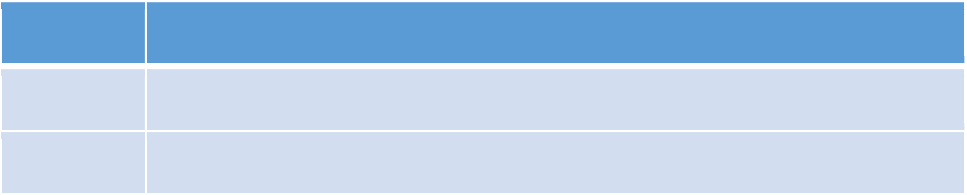

Domestic MarketSize

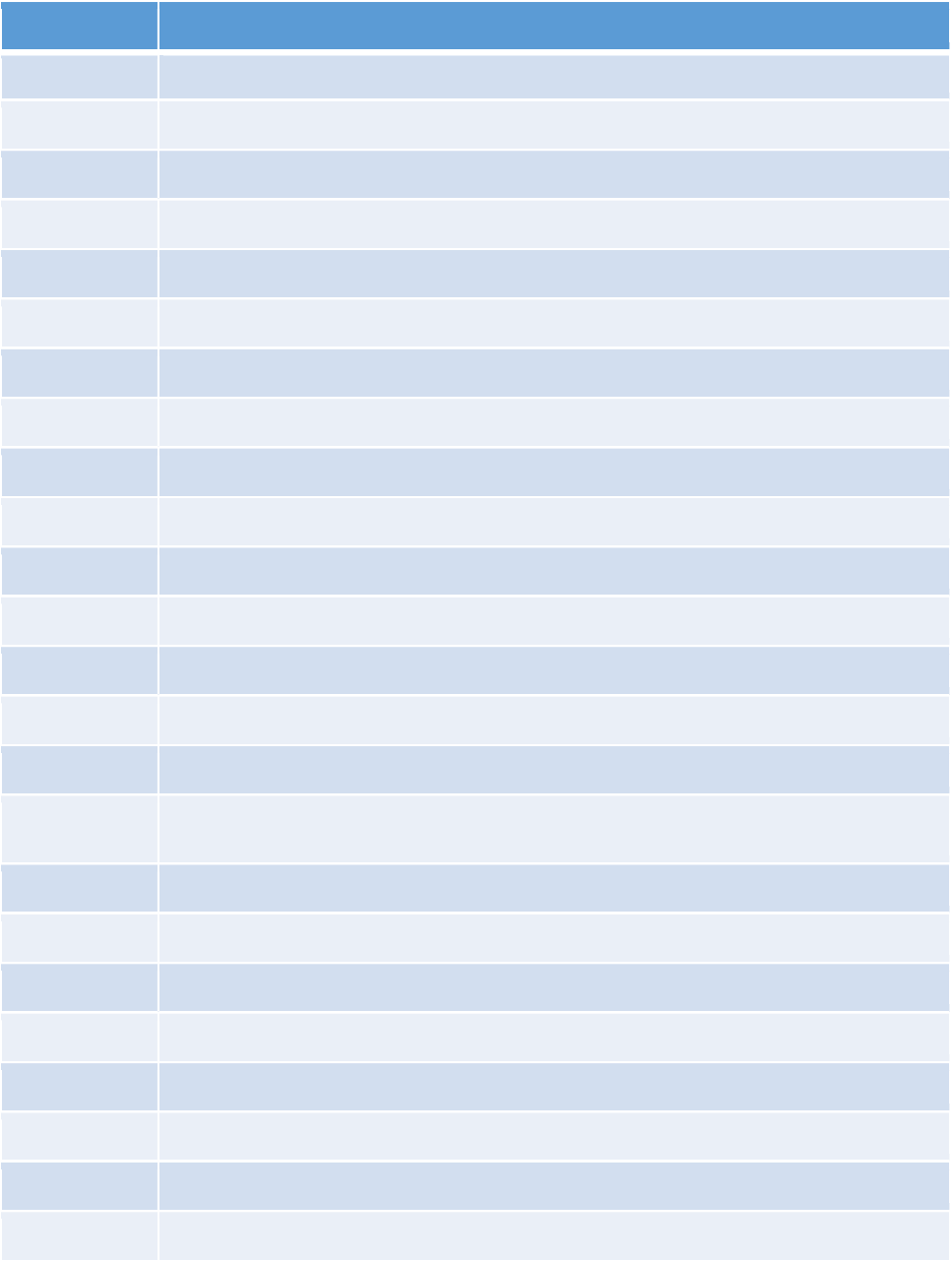

India’s domestic garment market was estimated to be US$ 68 billion in 2019 which has grown at an

annual growth rate of 9% in last 5-years.

Source: Wazir Advisors

In terms of value, men’s wear is the largest segment followed by women’s wear and kid’s wear

Figure 2: Indian GarmentMarket Segmentation

Source: Wazir Advisors

Men's

wear

42%

Women's

wear

39%

Kid's wear

19%

43

47

51

56

62

68

2014

2015

2016

2017

2018

2019

Figure 1 India’s GarmentMarket (In US$ bn.)

5

The market is dominated by ethnic garments (sarees, salwar-kameez-duppatta, etc.) but the western

wear categories are growing at a much faster rate.

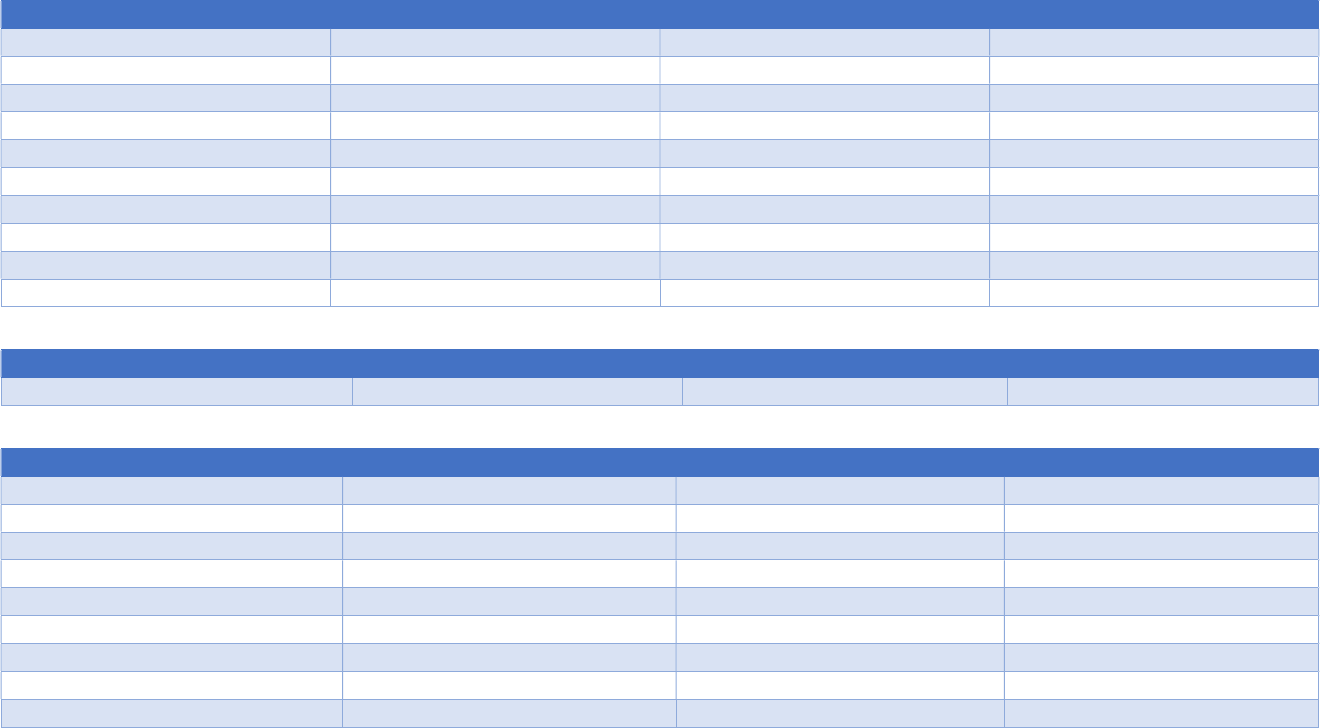

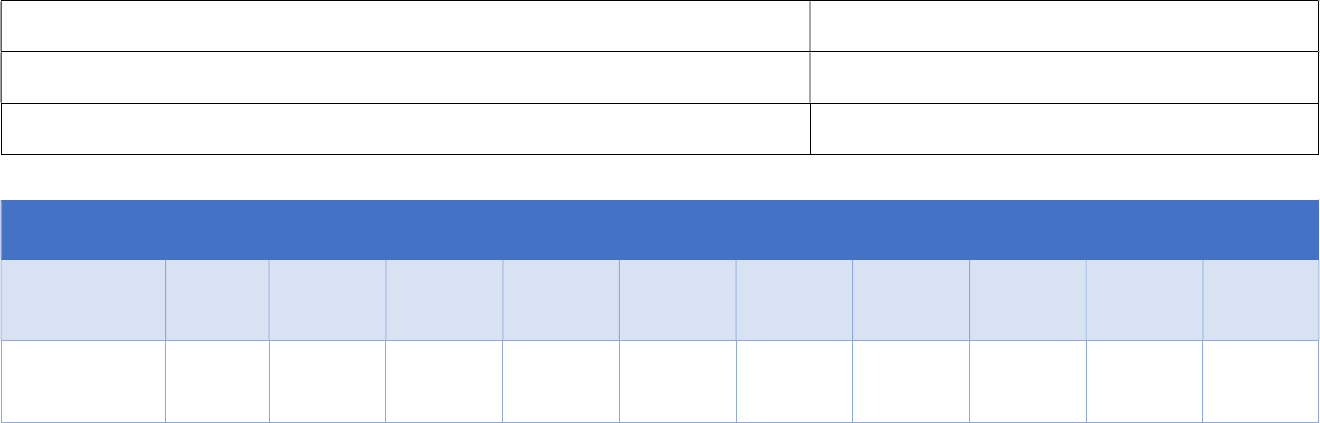

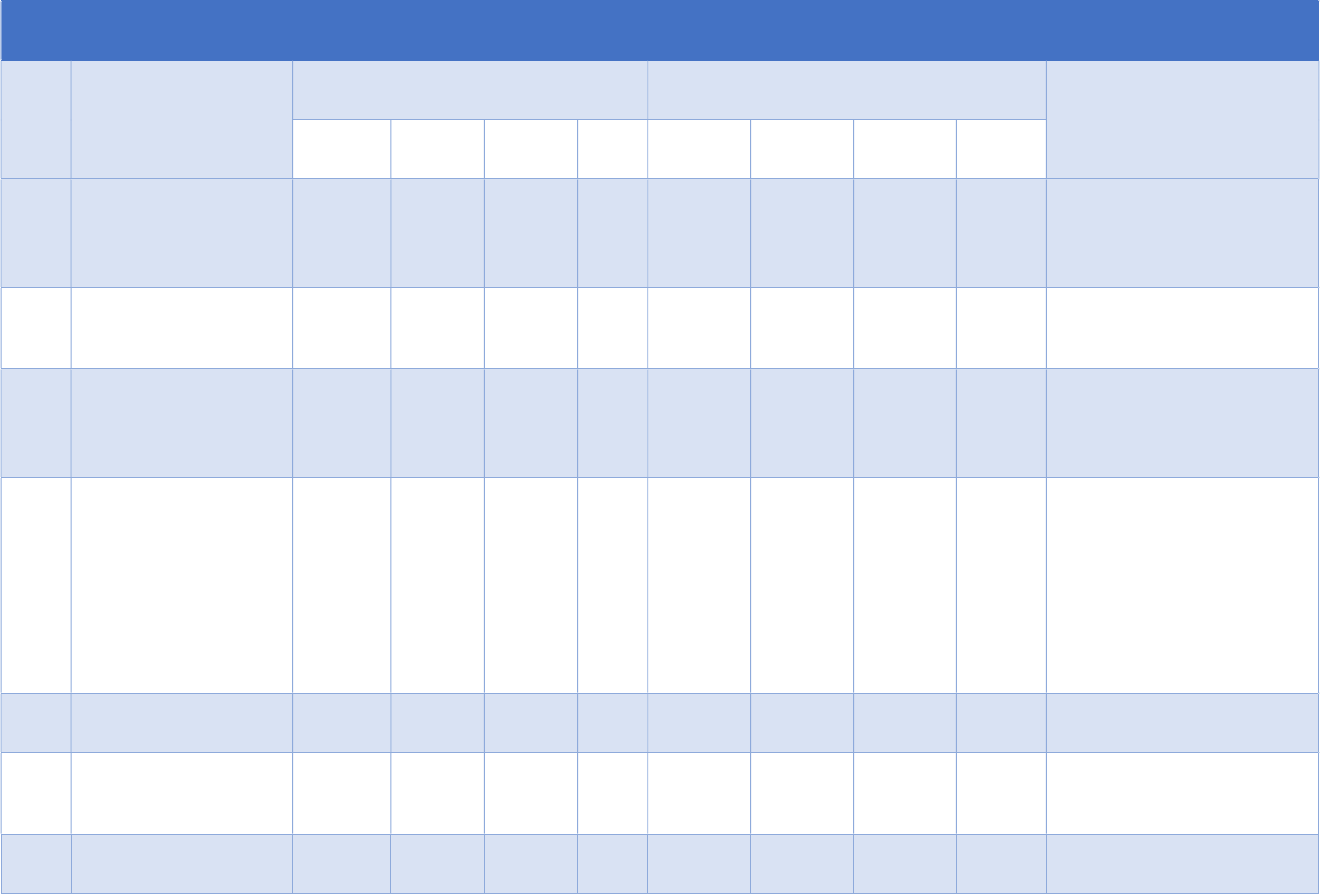

Figure 3: Category wise Indian Garment Demand and Growth

Key Categories 2014 2019

CAGR

Share 2019

Ethnic Wear

13.76

22.16

10%

33%

Bottoms

5.29

8.05

9%

12%

Innerwear

3.63

6.22

11%

9%

Men's Shirts

3.51

5.10

8%

8%

Outerwear

2.76

4.28

9%

6%

T

-

Shirts (Men’s/Boys)

2.46

4.24

12%

6%

Denim

2.69

4.06

9%

6%

Suits & Blazers

2.45

3.84

9%

6%

Women Tops & Dresses

1.45

2.77

14%

4%

Uniforms

1.73

2.63

9%

4%

Active wear

0.56

1.09

14%

2%

Others*

2.57

3.37

6%

5%

Total

42.85

67.80

Source: Wazir Advisors

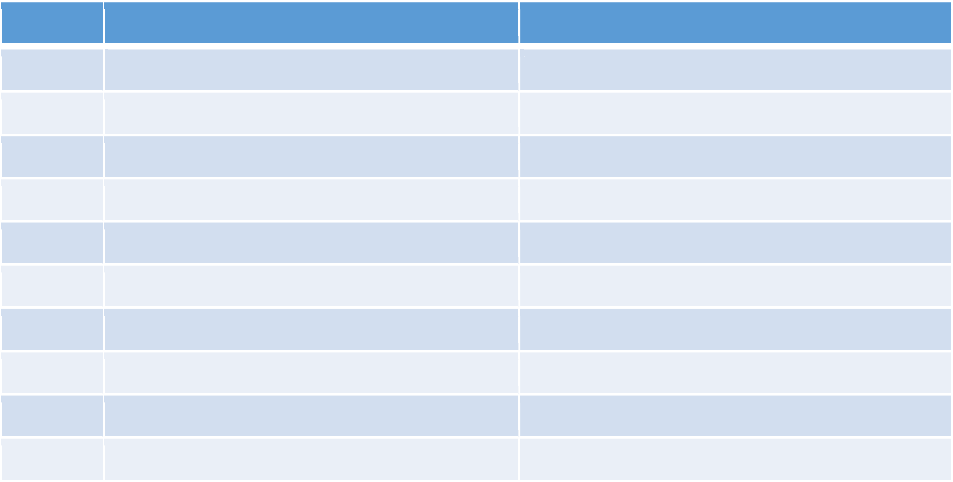

India’sGarmentExports

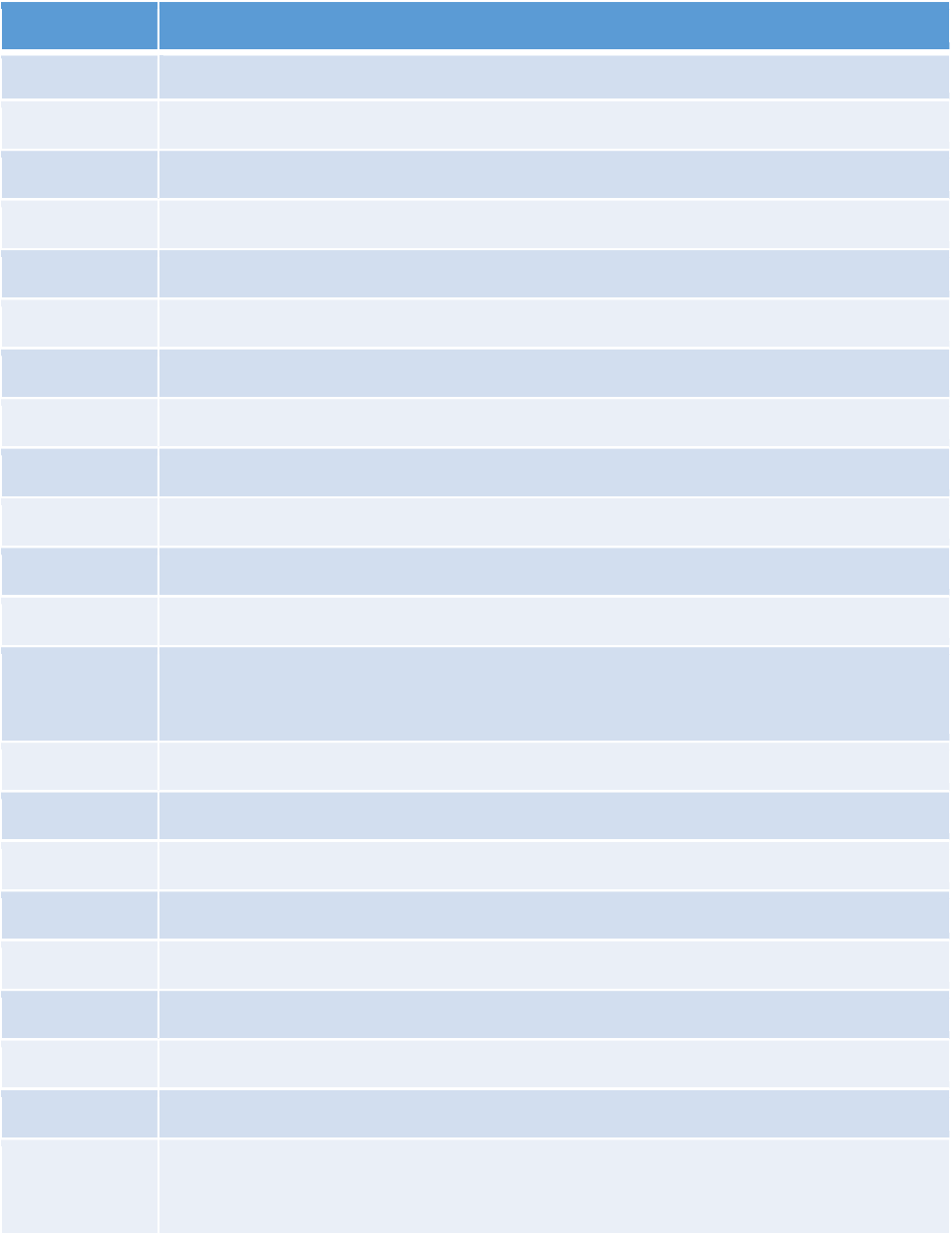

India’s garment exports were US$ 12.3 billion in 2020. It declined by almost 25% from 2019 value

because of reduced global demand in wake of COVID pandemic.

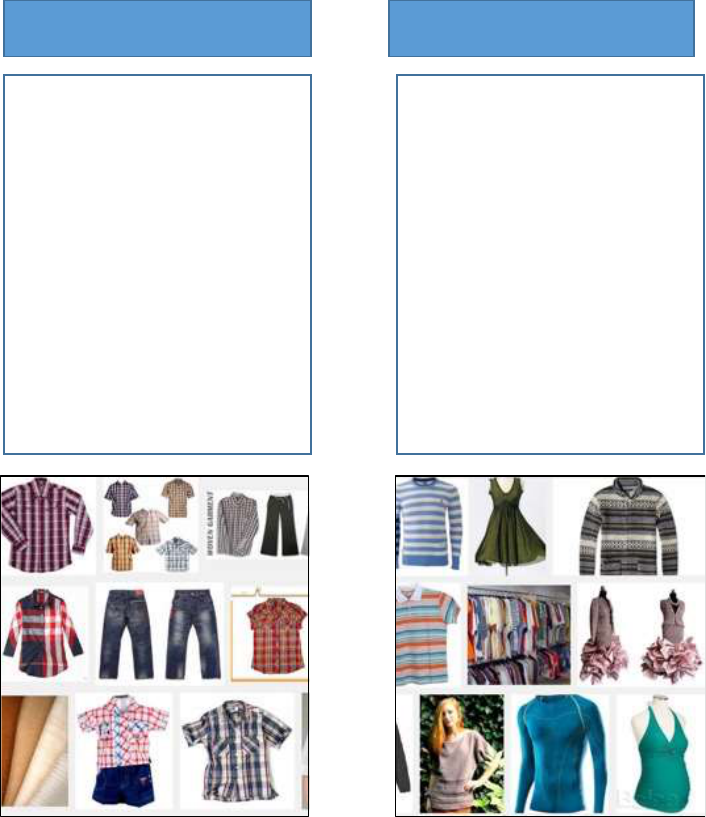

Figure 4: India’s Garment Exports (In US$ bn.)

Source: DGCIS, Govt. of India

USA is the largest market for India followed by United Arab Emirates and United Kingdom.

15.7

16.3

12.3

2018

2019

2020

6

Table 3: India’s Major Garment Markets

Markets

Trade Value (US$ Mn.)

USA

3,292

United Arab Emirates

1,515

United Kingdom

1,122

Germany

799

Spain

526

France

505

Others

4,541

Total

12,300

Source: DGCIS, Govt. of India

India’s Garment Imports

Garment worth US$ 900 mn. were imported in 2020 in India covering very cheap products from China to

high-end luxury garments.

Figure 5: India’s Garment Imports (In US$ bn.)

Source: DGCIS, Govt. of India

China is the biggest supplier to India followed by Bangladesh.

Table 4: India’s Major Garment Markets

Markets

Trade Value (US$ Mn.)

China

343

Bangladesh

298

Spain

68

Viet Nam

34

Sri Lanka

27

Indonesia

15

Others

115

Total

900

Source: DGCIS, Govt. of India

1.1

1.2

0.9

2018

2019

2020

7

2. Garment Manufacturing Overview

Types of Garments

There are two types of garments described according to the type of fabric used:

Key Raw Materials

Garment manufacturing requires fabric as the main input and several types of accessories for functional

and aesthetic purposes. Fabric variety to be used depends on the type of garment, its price, season for

usage, etc. In terms of fibres, cotton, polyester, viscose, linen, and their various blends are quite

popular. Accessories that are used in garment production include sewing threads, buttons, zips, laces,

hooks, labels, etc.

Woven Apparel Knitted Apparel

Shirts

Trousers

Dresses

Denims

Kurtas

Skirts

T-Shirts

Jerseys

Dresses

Sweaters

Cardigans

Skirts

8

Garment Manufacturing Process

Garmenting Process Flow Chart

Spreading & Cutting

Spreading is the process of laying fabric layers on a table, one on top of another so as to form a

“lay”. The fabric from the stores is issued to the cutting room daily in advance which is stored in

the cantilever rack provided next to the cutting tables. The fabric rolls are loaded on to the roll

holders.

The fabric is spread manually by spreaders or by a semi-automatic or automatic spreading

machine. After spreading, layers are cut with the help of straight knife cutting machines and

end cutters. In order to cut across on such a wide table, a mobile cutting machine guiding rail is

used. This rail is a “mobile” guide that is used along with a straight knife cutting machine having

a foldable handle bar.

Sewing

The production system to be implemented in the factory would be an Assembly Line System

whereby a group of operators would work on a product depending on the product type.

Operation sequences for sewing room operations would define the sequence of the operations

Spreading

Cutting

Sewing

Finishing

Garment Inspection

Folding & Packing

Dispatch

9

for the reference styles in the projected product mix, along with machine type and work-aids

required. Stitching quality and production are of immense importance; hence imported

machines are suggested which are capable of producing high quality end product at good

speeds. All the sewing machines would be procured from reputed sewing machine suppliers.

The line will have quality checks after every set of operations. All pieces will also be checked

fully at the end of the line before they are moved on to the finishing department

Finishing

In the finishing stage the sewn products are checked for any faults or defects. These if reparable

are mended or else the piece is rejected. The pieces are then ironed and packed, after a few

more check points. In case the pieces have any soiling/staining a stain removal station helps in

cleaning the same.

Inspection

The garment pieces produced are checked thoroughly for various types of defects such

asBroken Needle, Fly, Hole, Thick Yarn, Thin Yarn and Barre

Packing& Dispatch

After inspection, the defective products are sent for correction while the other products are wrapped in

polythene bags and sent for packing in suitable form as per the buyers’ specifications. After packing, the

final products are dispatched.

Garment Testing

Garment testing assess the quality of garment and workmanship, using a no. of quality control checks

and tests, including:

Colour shading

Colour fastness check (Rub test)

Symmetry check

Size fitting test

Adhesive check

Fabric weight test

Fasteners fatigue and zip quality test

Waterproof test

Down feather leakage test

Seam slippage test

Care labelling

Needle damage check

Barcode scanning test

Burn test

Mold contamination prevention

Metal contamination prevention

Ventilation test

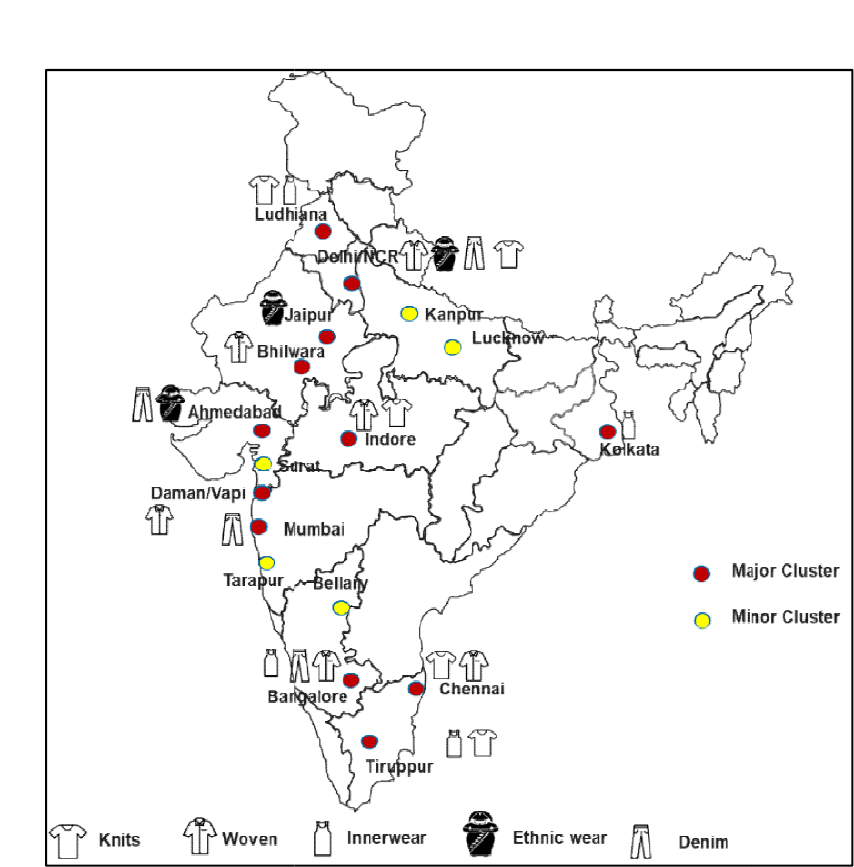

Garment Manufacturing

Clusters in India

The Indian garment manufacturing industry is 60

units operating

in specific clusters across the country. The organized part of the industry is dominated

by export oriented garment manufacturing units.

Figure 6

: India's Key Garment Manufacturing Clusters

10

Clusters in India

The Indian garment manufacturing industry is 60

-

70% unorganized which is characterized by MSME

in specific clusters across the country. The organized part of the industry is dominated

by export oriented garment manufacturing units.

: India's Key Garment Manufacturing Clusters

70% unorganized which is characterized by MSME

in specific clusters across the country. The organized part of the industry is dominated

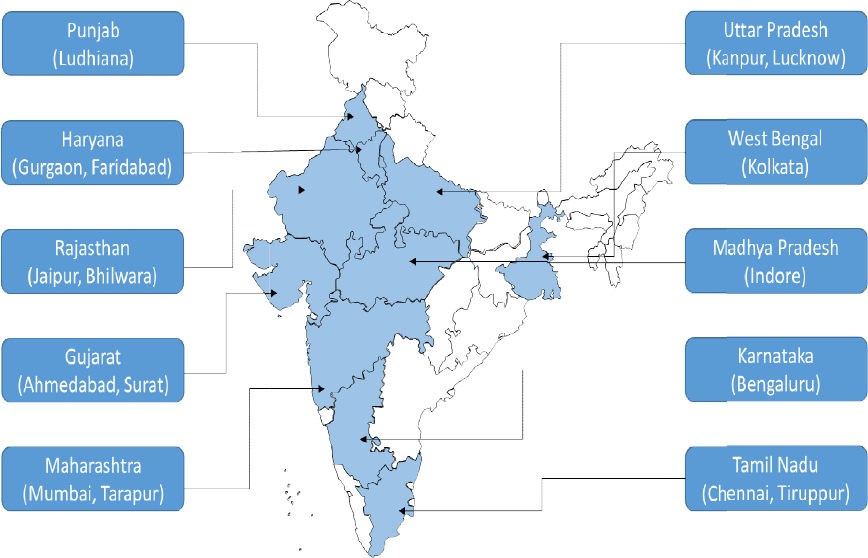

Suitable Locations

for Garment Manufacturing

Garment manufacturing happens in e

market oriented. The success factors for garment business lies mainly in availability of trained manpower

and presence of supply chain (fabrics, accessories, dyeing facilities, etc.) in the

suitable

locations for garment manufacturing in the country are given below

11

for Garment Manufacturing

Garment manufacturing happens in e

very

state of India. Some focus on exports while some are domestic

market oriented. The success factors for garment business lies mainly in availability of trained manpower

and presence of supply chain (fabrics, accessories, dyeing facilities, etc.) in the

regi

locations for garment manufacturing in the country are given below

:

state of India. Some focus on exports while some are domestic

market oriented. The success factors for garment business lies mainly in availability of trained manpower

regi

on. Some of the

12

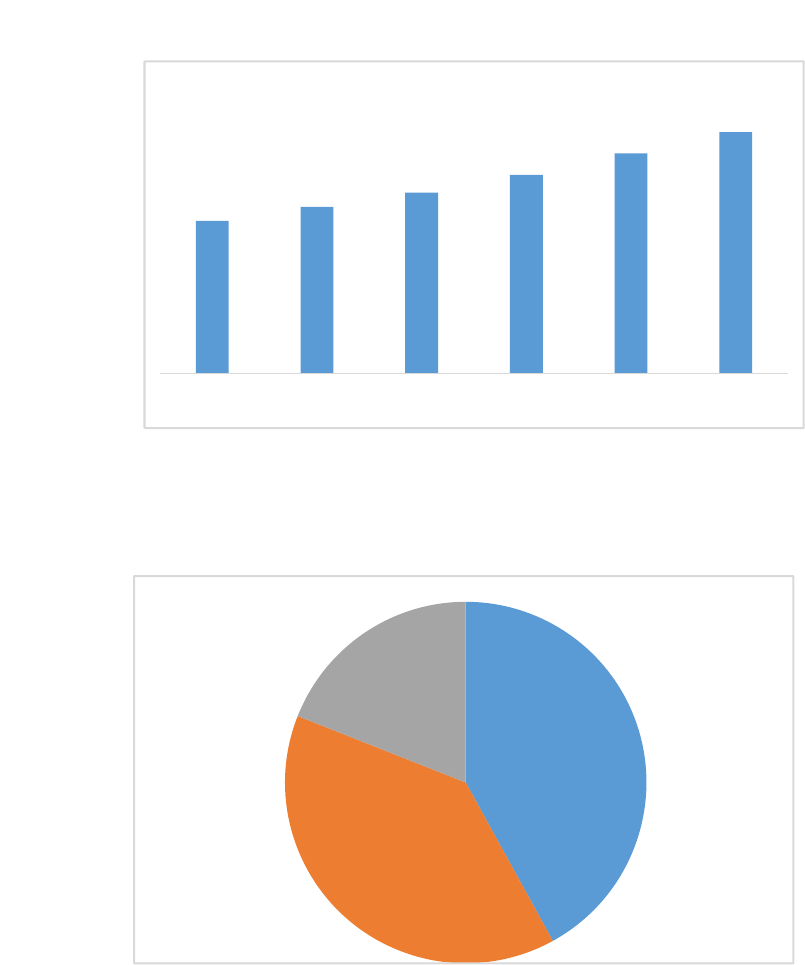

3. Garment Factory Project Details

Project Overview

Target product Basic Polo T-shirt

Capacity 100 sewing machines

Factory size 13,000 sq. ft. (on rent)

Employment 200

Factory working 8 hours a day, 26 days per month

Production 54,000 pieces per month

Project cost Rs. 2.96 Crores

Promoter’s contribution Rs. 1.18 Crores (40%)

Bank Finance Rs. 1.78 Crores (60%)

Working capital 26% of sales revenue

Project Profitability

3

rd

year numbers:

Sales Rs. 16.34 crores

EBITDA Rs. 2.28 crores (14%)

Cash profit Rs. 1.49 crores (9%)

Break Even Point 23%

Cash Break Even Point 21%

Return on Equity 63%

Return on Capital Employed 35%

Payback period 3.5 years

Average DSCR 3.20

Post Tax project IRR 27%

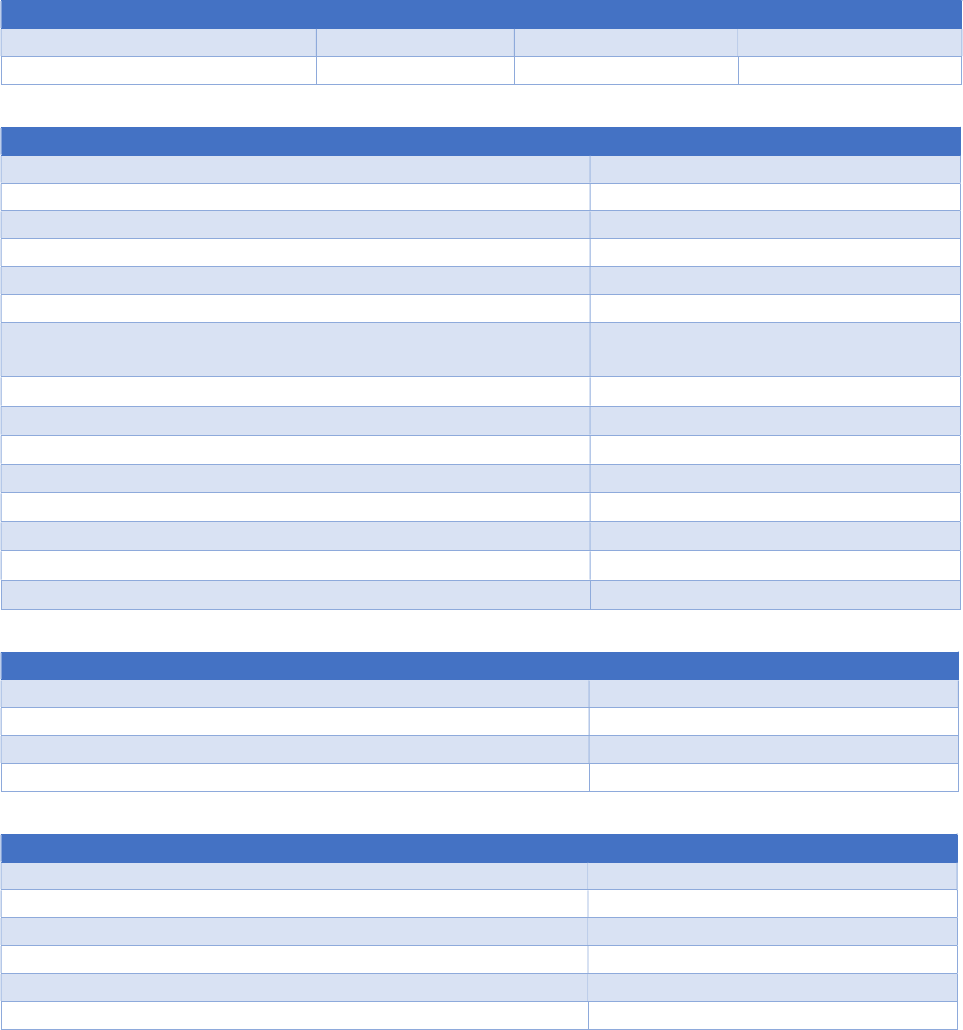

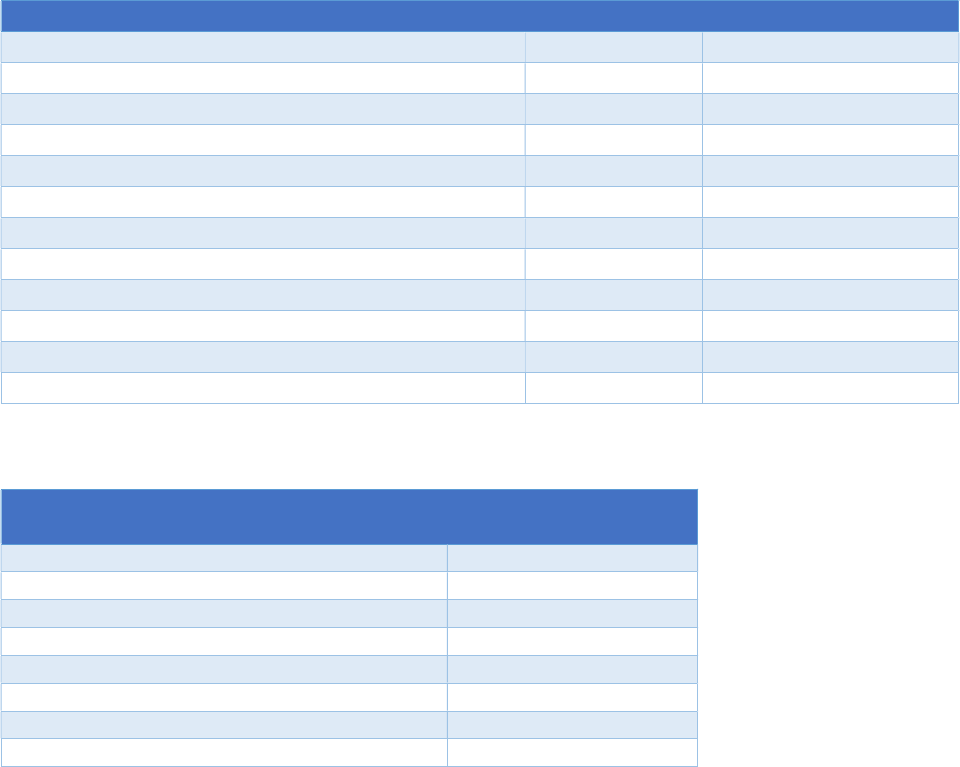

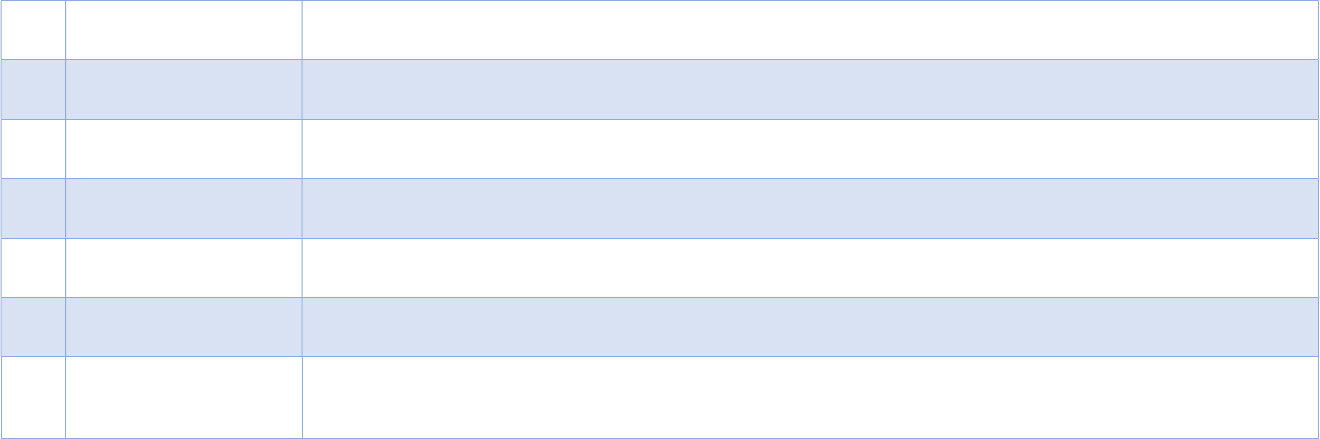

Project Cost Summary

Description Value (Rs Cr)

Machinery 1.67

Miscellaneous Fixed Assets 0.48

Preliminary & Pre-operative Expenses 0.17

Contingency on capital items 0.11

Total 2.96

13

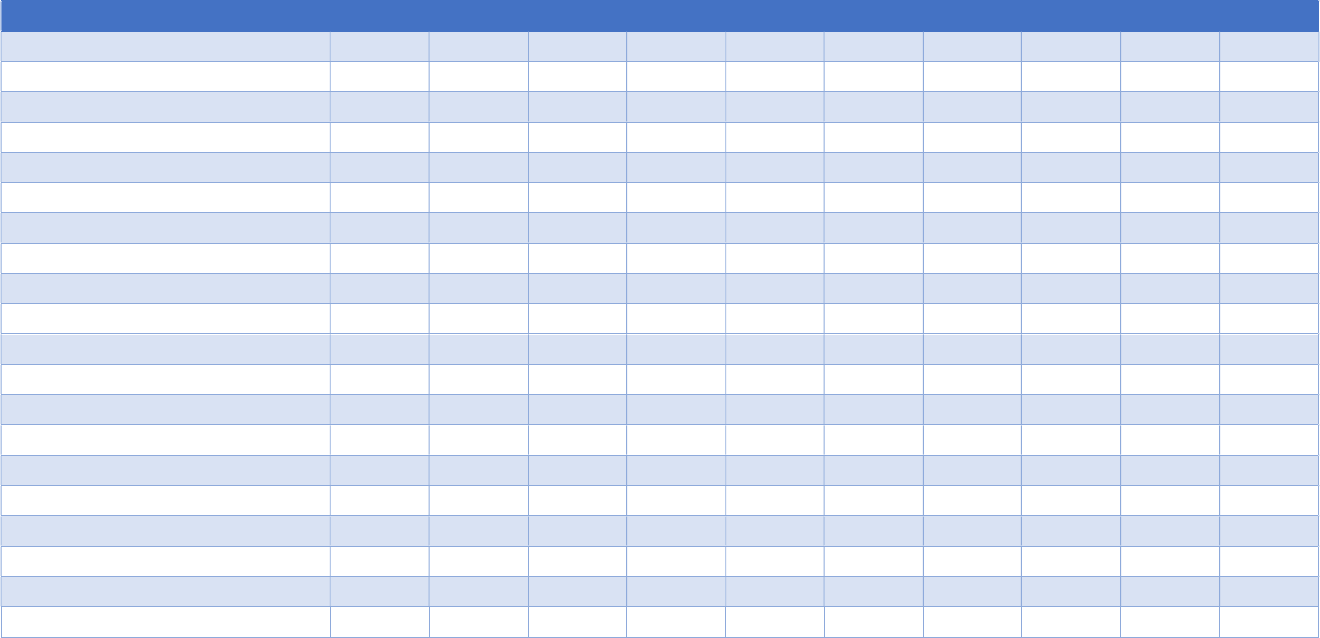

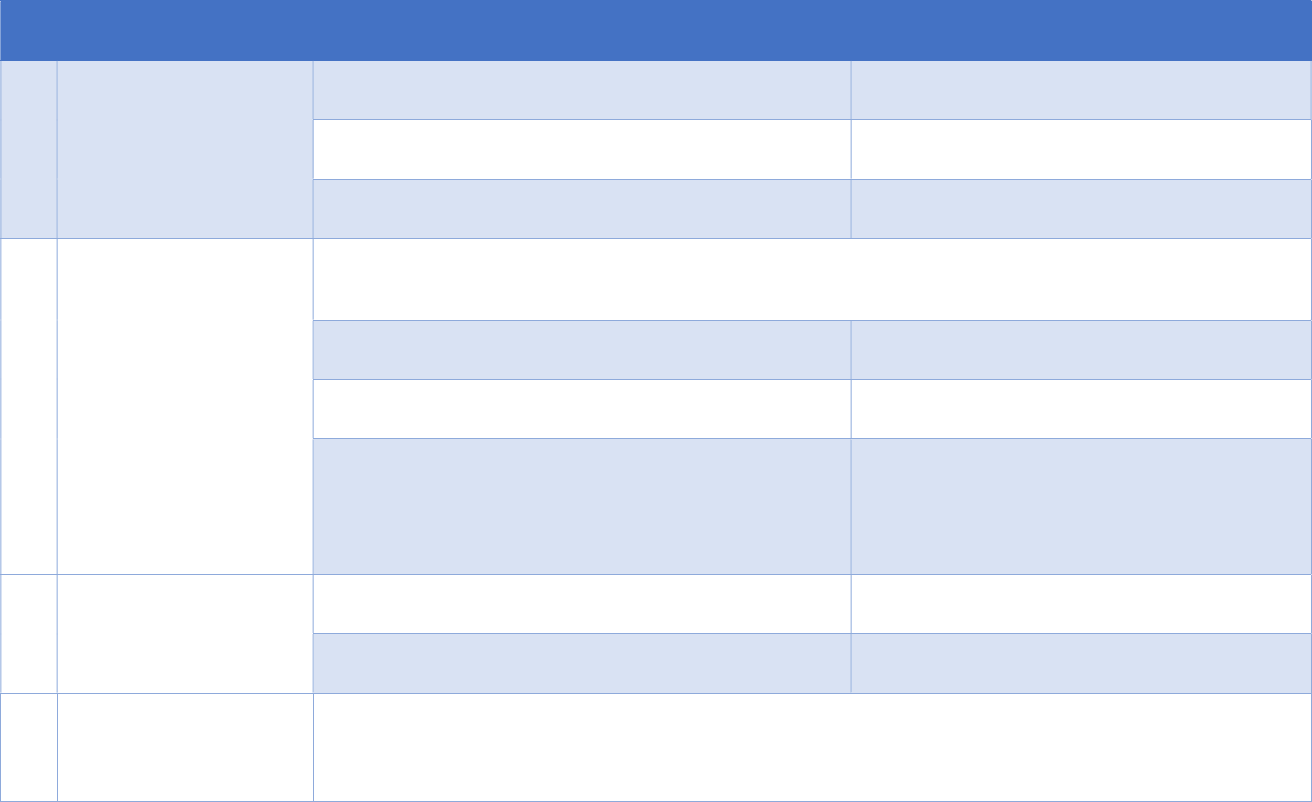

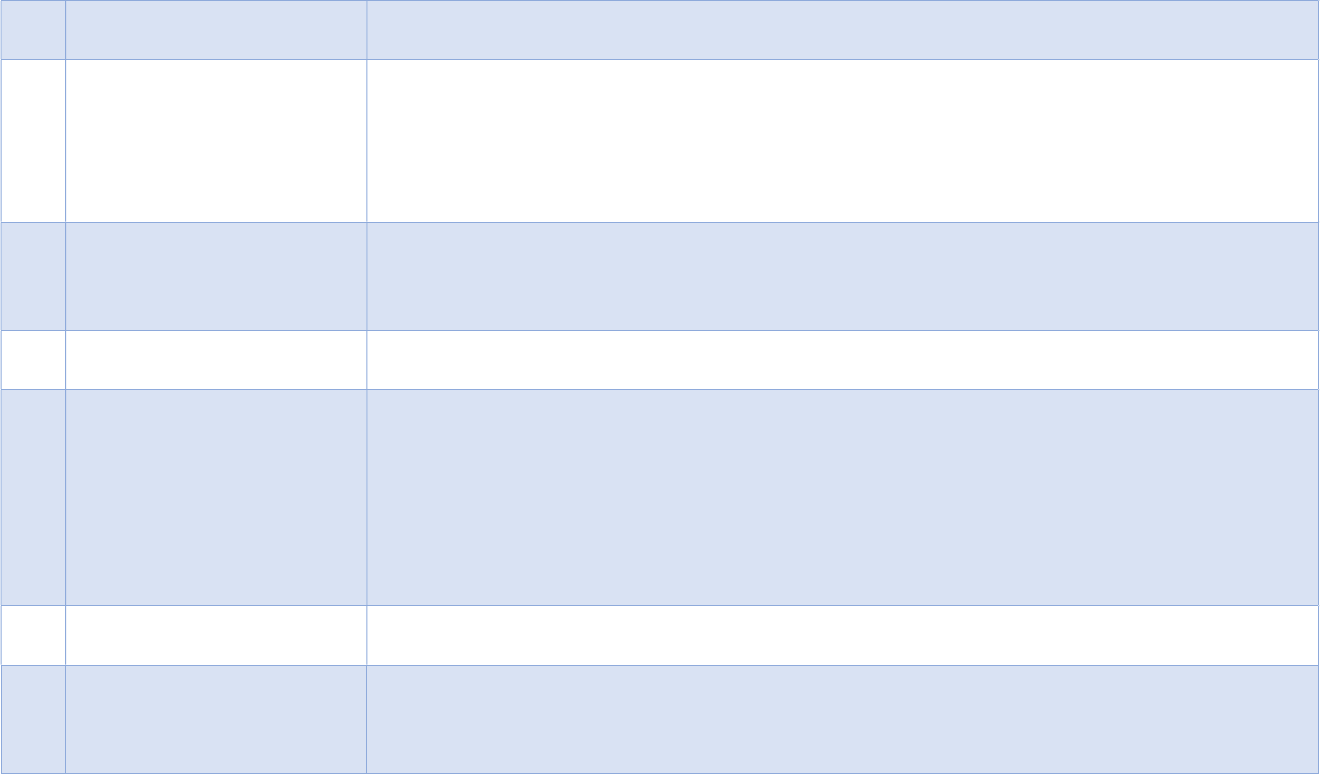

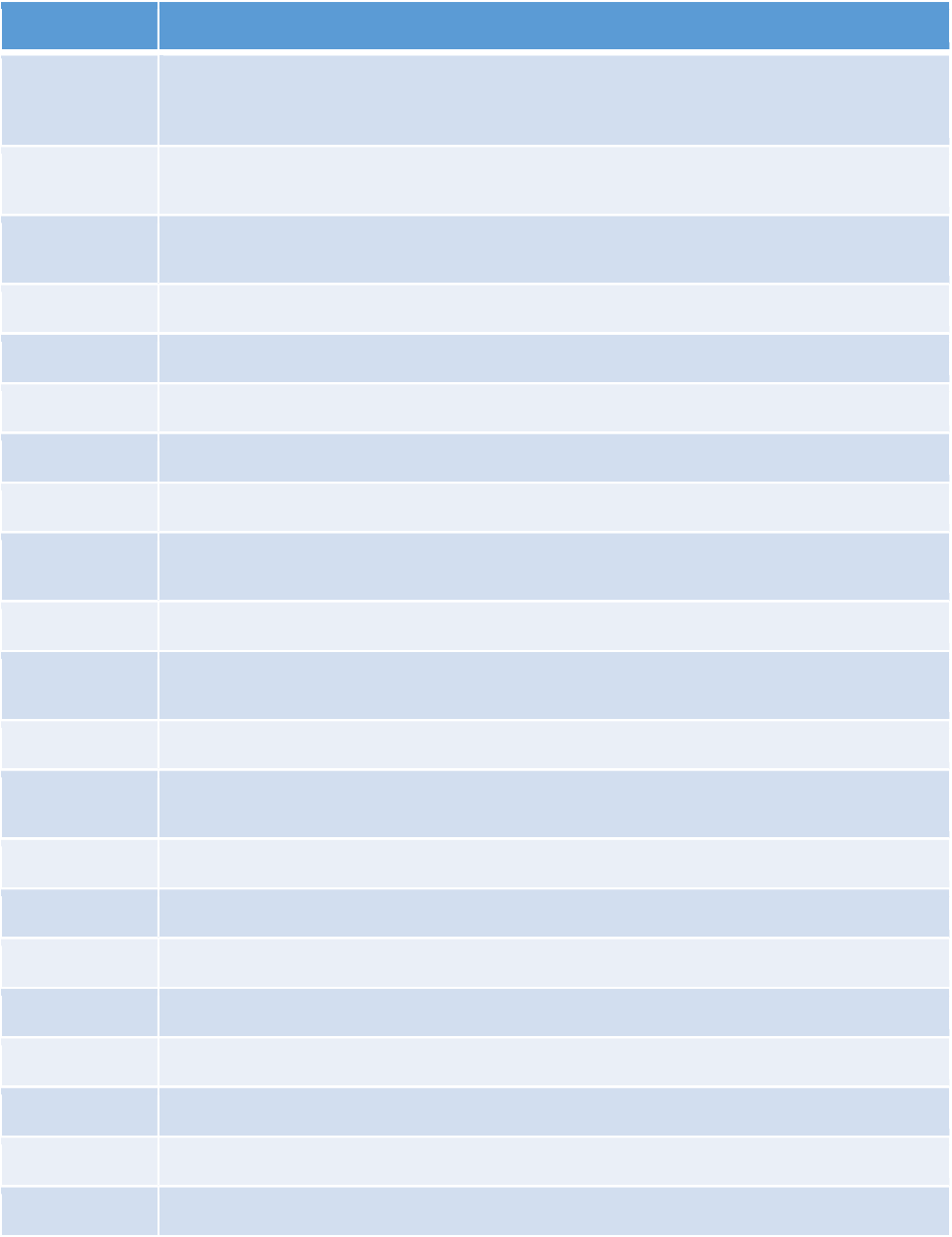

Key Assumptions

Year 1

Year 2

Year 3

Onwards

Machinery Utilization

70%

90%

95%

Line Efficiency

40%

45%

55%

Description

Value

Garment rejection

2%

Embroidered pieces

50%

Electricity cost (Rs./KW

-

Hr)

7.00

Water consumption per person per day (Lts.)

50

Water Cost (Rs/1000 Lts.)

40.0

Monthly Fuel Consumption (Rs. Lakhs.)

0.5

CAD paper, layer paper, numbering stickers, Needles, Oil etc.

(Rs./Machine/Year)

3,000

Repair & Maintenance (Rs./Machine/Year) 1,000

Embroidery (thread & fusing) (Rs./Piece) 0.75

Rental (Rs./sq.ft/month) 11

Provision for contingency (in project cost) 5%

Interest on Term Loan

11.00%

Interest on Working Capital Financing

11.00%

Corporate Tax

17.16%

MAT Rate

17.47%

Annual Changes in Prices

Sales price

2.5%

Salary & Wage

s

3.0%

Shed Rental

2.0%

Fabrics, Trims & all other inputs

2.0%

Working Capital

Norms

Margin Money (as % of working capital)

25%

Raw Material (Months)

1

Work In Process (Months)

0.25

Finished Goods (Months)

0.5

Debtors (Months)

3.0

Creditors

(Months)

2.0

14

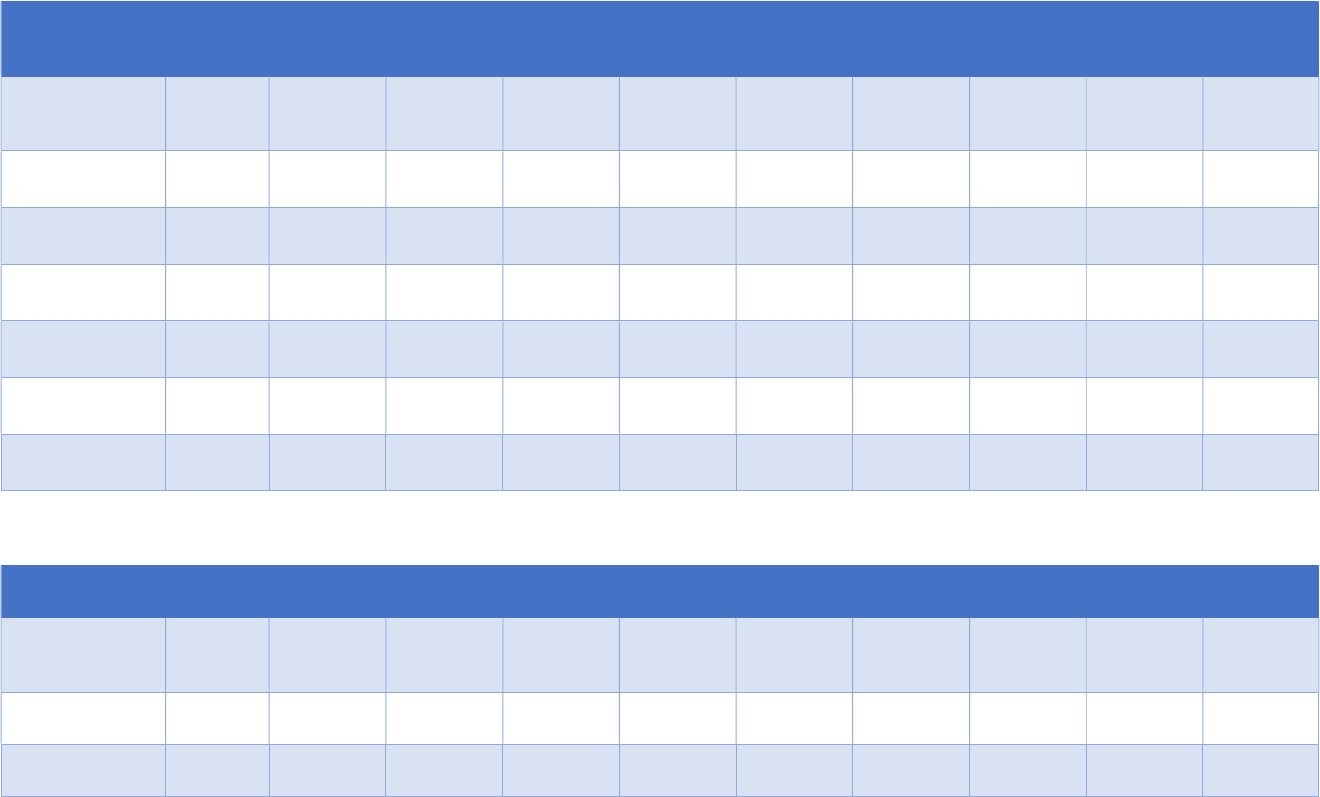

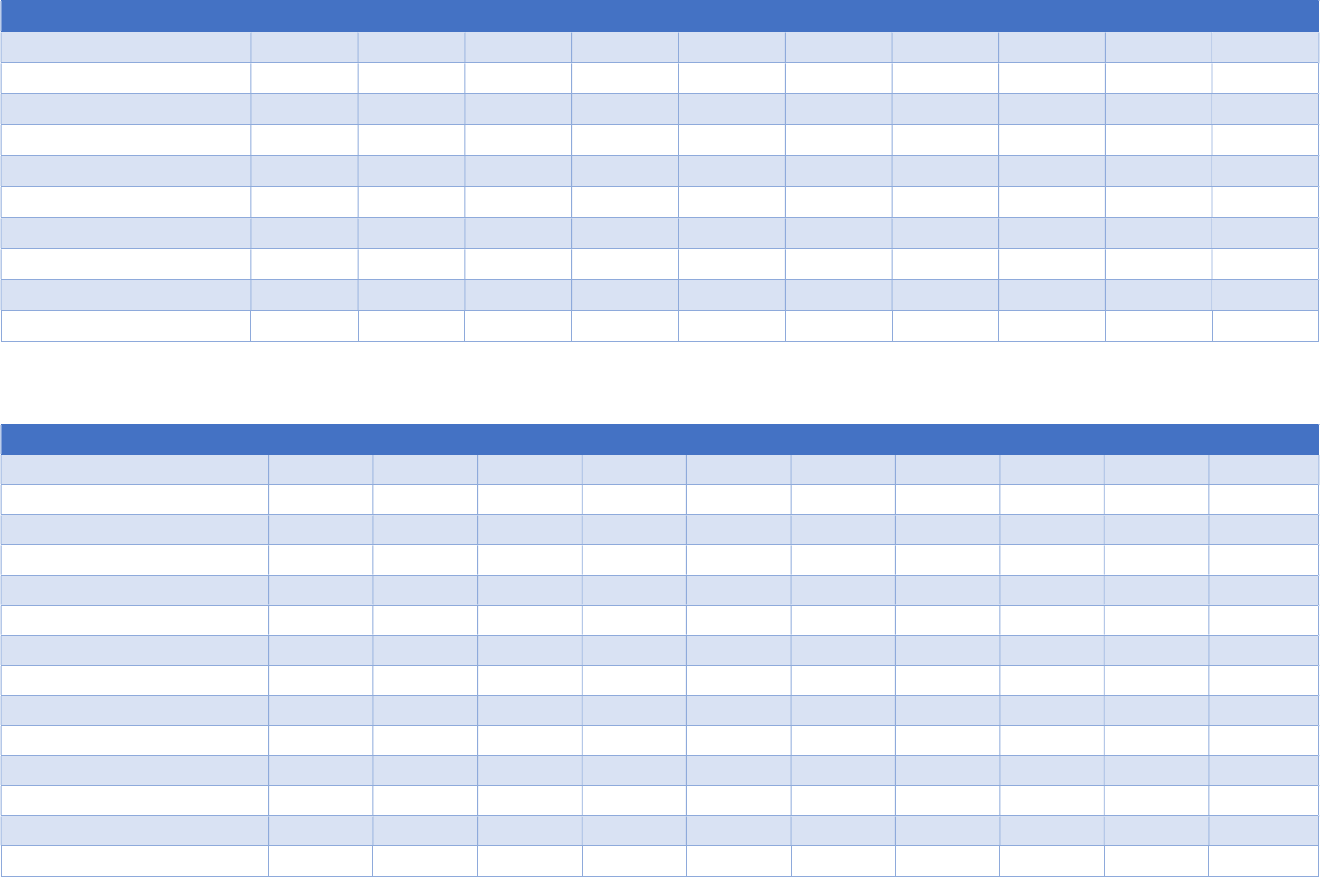

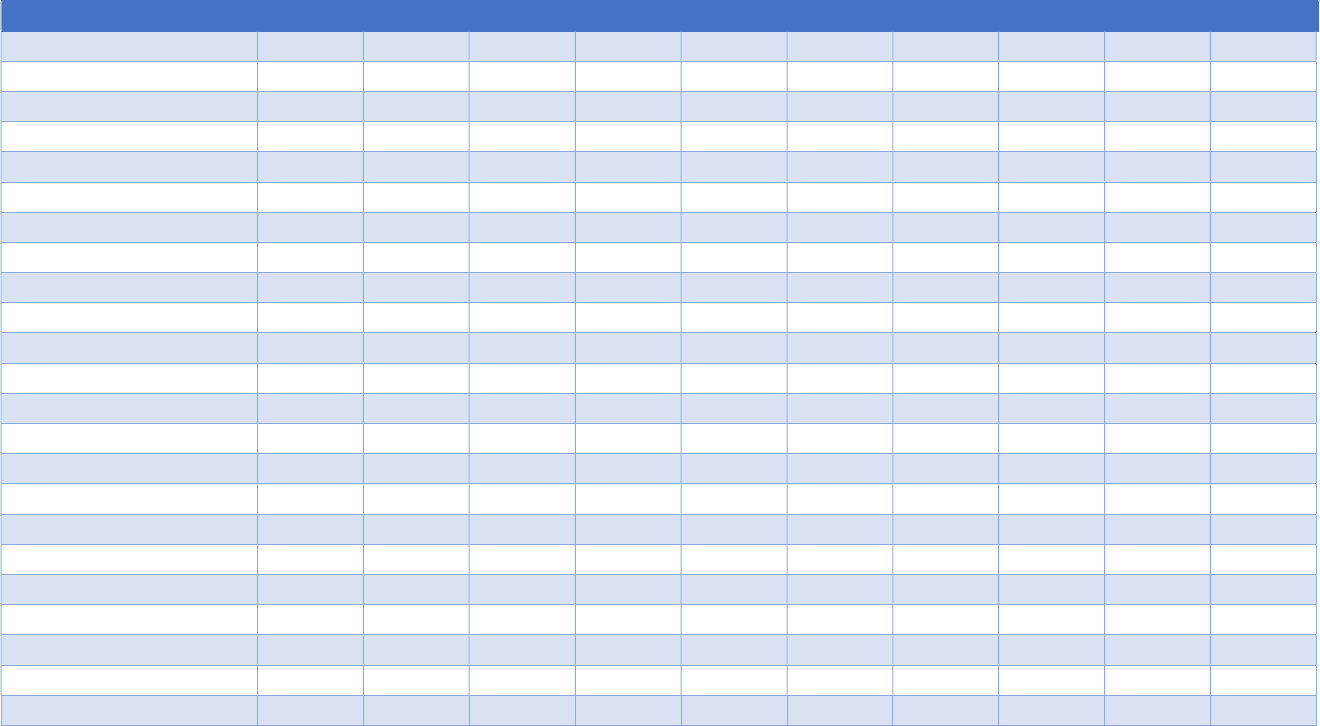

Input costs and Sales Price projections

Costing

(Rs./Piece)

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Fabric

(

270 gsm

pique)

145.00 147.90 150.86 153.88 156.95 160.09 163.29 166.56 169.89 173.29

Trims 13.00 13.26 13.53 13.80 14.07 14.35 14.64 14.93 15.23 15.54

Testing 0.50 0.51 0.52 0.53 0.54 0.55 0.56 0.57 0.59 0.60

Sales Value:

With

Embroidery

245.00 251.13 257.40 263.84 270.43 277.20 284.12 291.23 298.51 305.97

W/o

embroidery

235.00 240.88 246.90 253.07 259.40 265.88 272.53 279.34 286.32 293.48

Avg price 240.00 246.00 252.15 258.45 264.92 271.54 278.33 285.28 292.42 299.73

Input costs

Rs. Crore Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Fabric 270 gsm

pique

5.04 7.43 9.78 9.97 10.17 10.38 10.59 10.80 11.01 11.23

Trims 0.45 0.67 0.88 0.89 0.91 0.93 0.95 0.97 0.99 1.01

Testing 0.02 0.03 0.03 0.03 0.04 0.04 0.04 0.04 0.04 0.04

15

Consumables

Rs. Crore Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Consumables 0.02 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03

Repair and

Maintenance

0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01

Embroidery

Consumables

0.01 0.02 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03

Total 0.04 0.06 0.06 0.07 0.07 0.07 0.07 0.07 0.07 0.07

Production and Sales

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Annual Output

(pcs)

354,462 512,703 661,451 661,451 661,451 661,451 661,451 661,451 661,451 661,451

Less: Rejected

garments (pcs)

7,089 10,254 13,229 13,229 13,229 13,229 13,229 13,229 13,229 13,229

Annual

production

(Lakh pcs)

3.47 5.02 6.48 6.48 6.48 6.48 6.48 6.48 6.48 6.48

Monthly

production

(Lakh pcs)

0.29 0.42 0.54 0.54 0.54 0.54 0.54 0.54 0.54 0.54

Daily

production

(Pieces /

machine)

16.23 18.26 22.32 22.32 22.32 22.32 22.32 22.32 22.32 22.32

Revenue (Rs.

Crore)

8.34 12.36 16.34 16.75 17.17 17.60 18.04 18.49 18.96 19.43

16

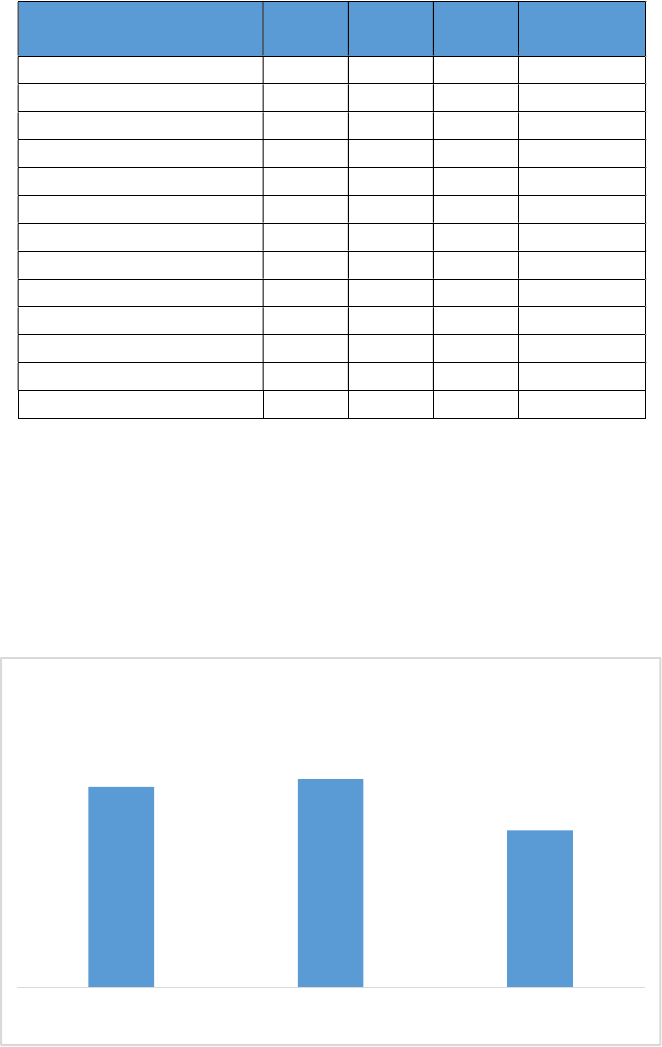

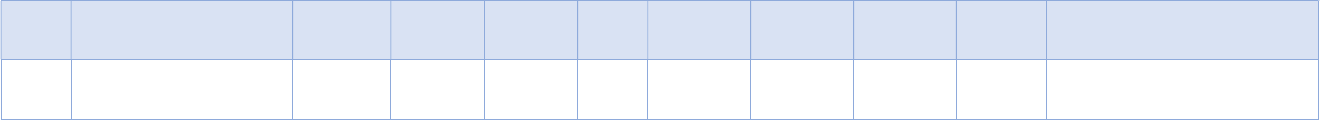

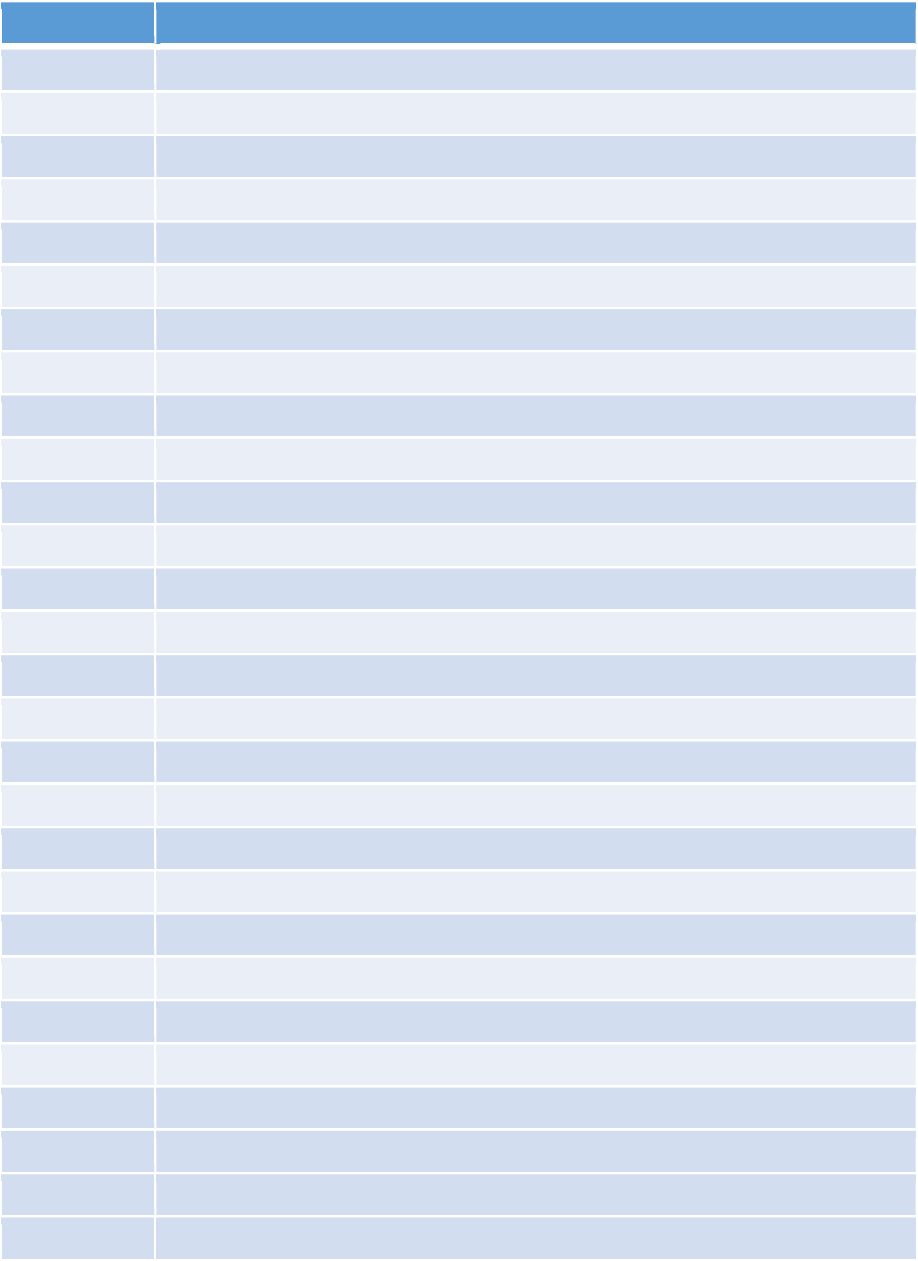

Machinery

Department

Number of Machines

Cost (Rs. Crore)

Sewing

126

1.02

Cutting

9

0.20

CAD

2

0.07

Embroidery

1

0.22

Washing

1

0.10

Finishing

20

0.12

Fabrics and Trims Section Equipment

4

0.04

Total

1298

1.67

Sewing Machines

Total

Machines

Cost/ Machine (Rs. Lakh)

Total Cost (Rs. Lakh)

SNLS

50

0.28

14.05

DNLS

5

1.01

5.06

5TO/L

5

0.60

3.01

4TO/L

25

0.64

15.97

4TO/L CT

5

0.84

4.20

3TF/L FT

5

2.23

11.13

3TF/L

15

1.47

22.12

B/T

3

1.75

5.26

B/A

4

2.41

9.64

B/H

4

2.63

10.51

Total

121

14

100.94

Other Sewing Machine

Inline Sewing Vaccum Table

5

0.26

1.31

Sewing Total

126

102.26

17

Cutting Machines

Total Machines

Cost/ Machine (Rs. Lakh)

Total Cost (Rs. Lakh)

Straight Knife

2

0.73

1.46

Band Knife

1

2.76

2.76

End

Cutter

1

0.25

0.25

Fusing Machine

1

5.48

5.48

5 Digit Numbering Machine

2

0.04

0.09

Lay Table

2

4.96

9.93

CAD

3 Head/4 Head Plotter

1

3.65

3.65

CAD Software and Key

1

3.91

3.91

Total

11

27.51

Embroidery Machines

Total Machines

Cost/ Machine

(Rs. lakh)

Total Cost (Rs. Lakh)

Embroidery Machine

1

21.90

21.90

Finishing Machines

Total Machines

Cost/ Machine (Rs. lakh)

Total Cost (Rs. Lakh)

Vaccum Iron

18

0.25

4.43

Stain Removal Station

1

0.85

0.85

Conveyor Needle Detector

1

6.23

6.23

Fabric

& Trims

Fabric Inspection Machine

1

2.63

2.63

Light Box

1

0.44

0.44

Electronic Weighing for Fabric

1

0.44

0.44

GSM Cutter and Scale

1

0.06

0.06

Total

24

15.08

Miscellaneous Fixed Assets

Utilities Nos. Value (Rs Lakhs)

Racks 7 1.36

Pallets 30 1.11

Table 30 1.99

Trolley 10 0.98

Bins 10 0.14

Center Table 30 1.34

Operator chair 100 0.90

Furniture and Fixture 5.00

IT Infra 5.00

Electrical Works 20.00

Misc. 10.00

Total 47.82

Preliminary and Pre-Operative Expenses

Preliminary & Pre-operative Expenses

Estimated Cost

(Rs. Lakhs)

Company Formation and Legal Expenses

5.00

Up Front Fees of Term Loan

0.90

Insurance

0.90

Raw Material & Training

1.00

Recruitment Expenses

1.00

Salary and Wages during Pre

-

Operative

period

8.40

3 Months Rental Deposit

0.04

Total (Rs. Cr.)

17.24

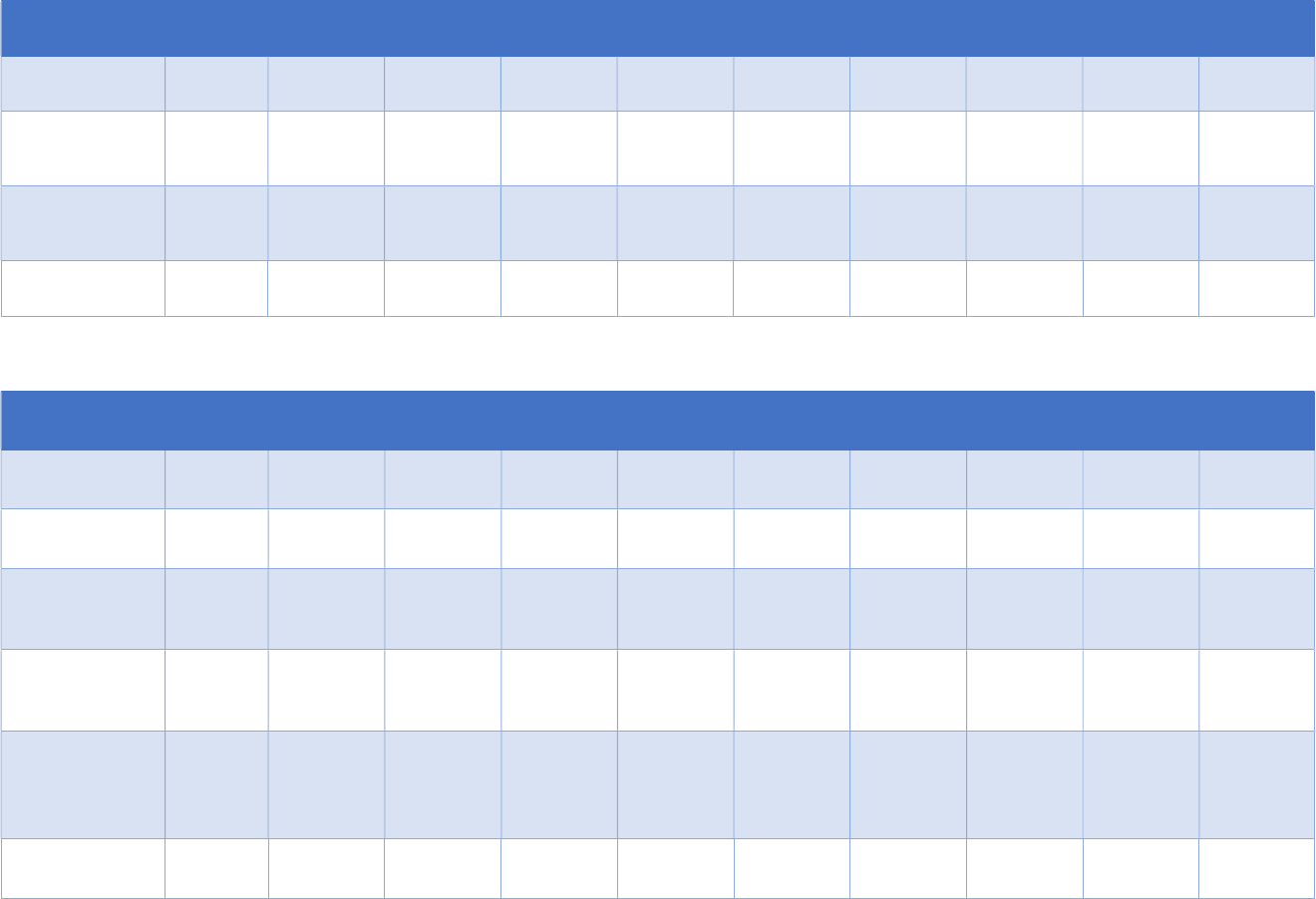

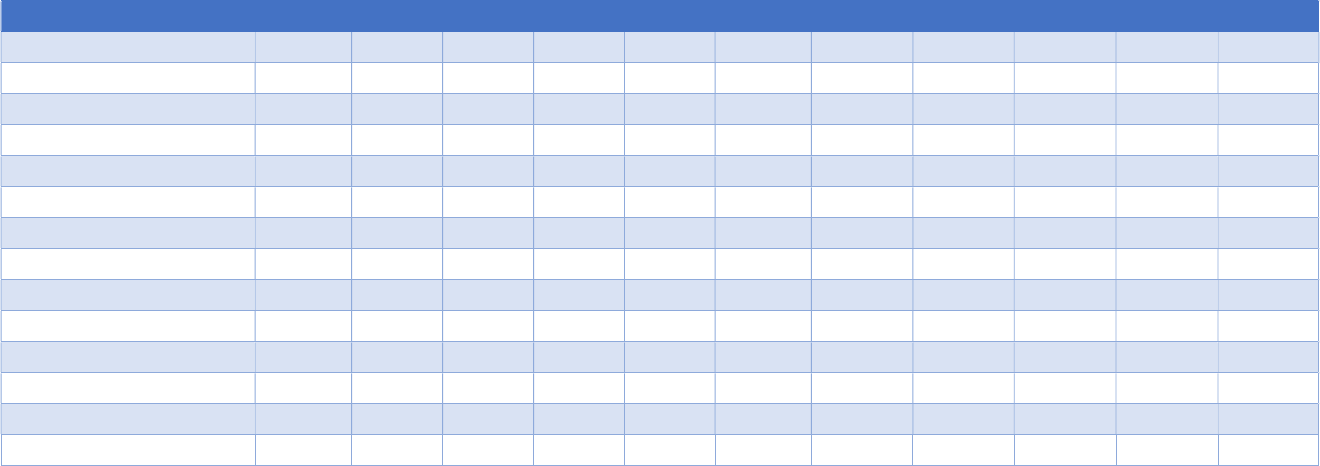

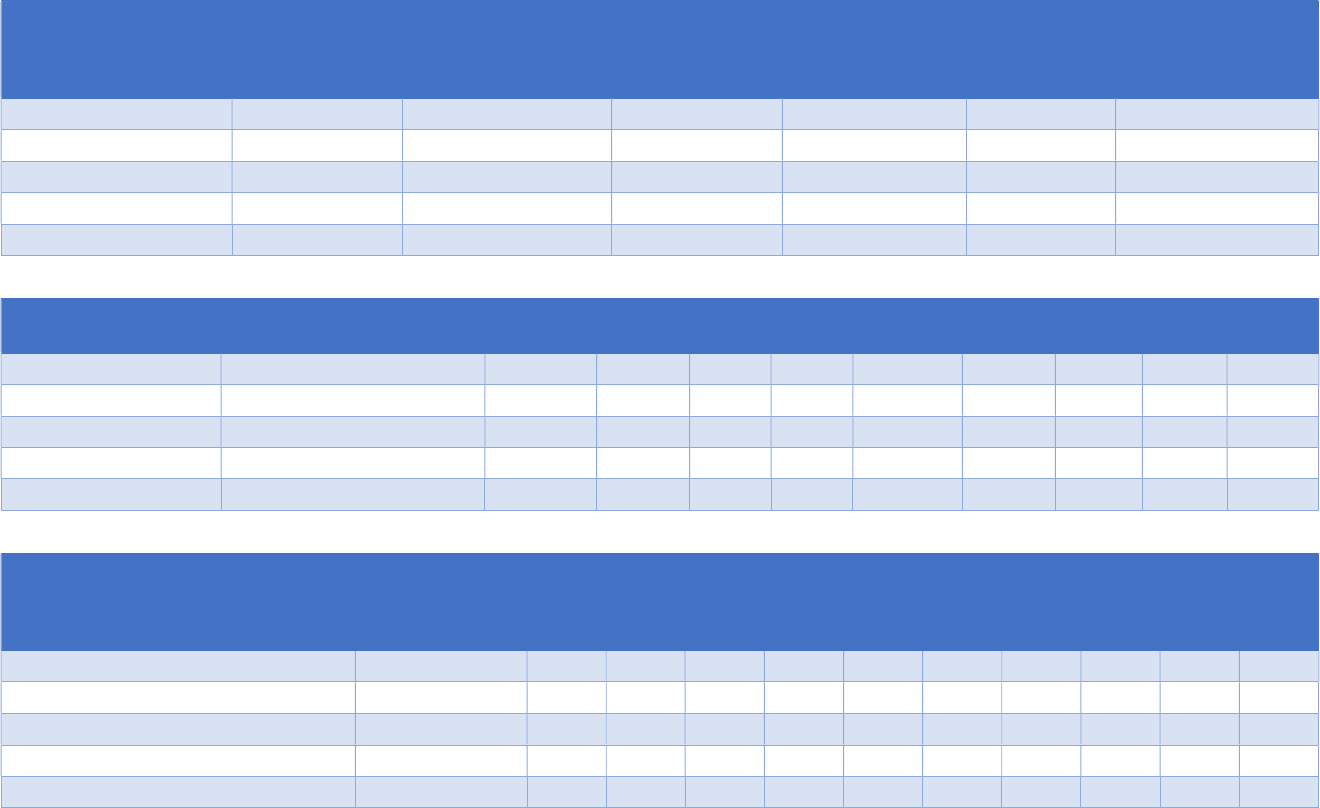

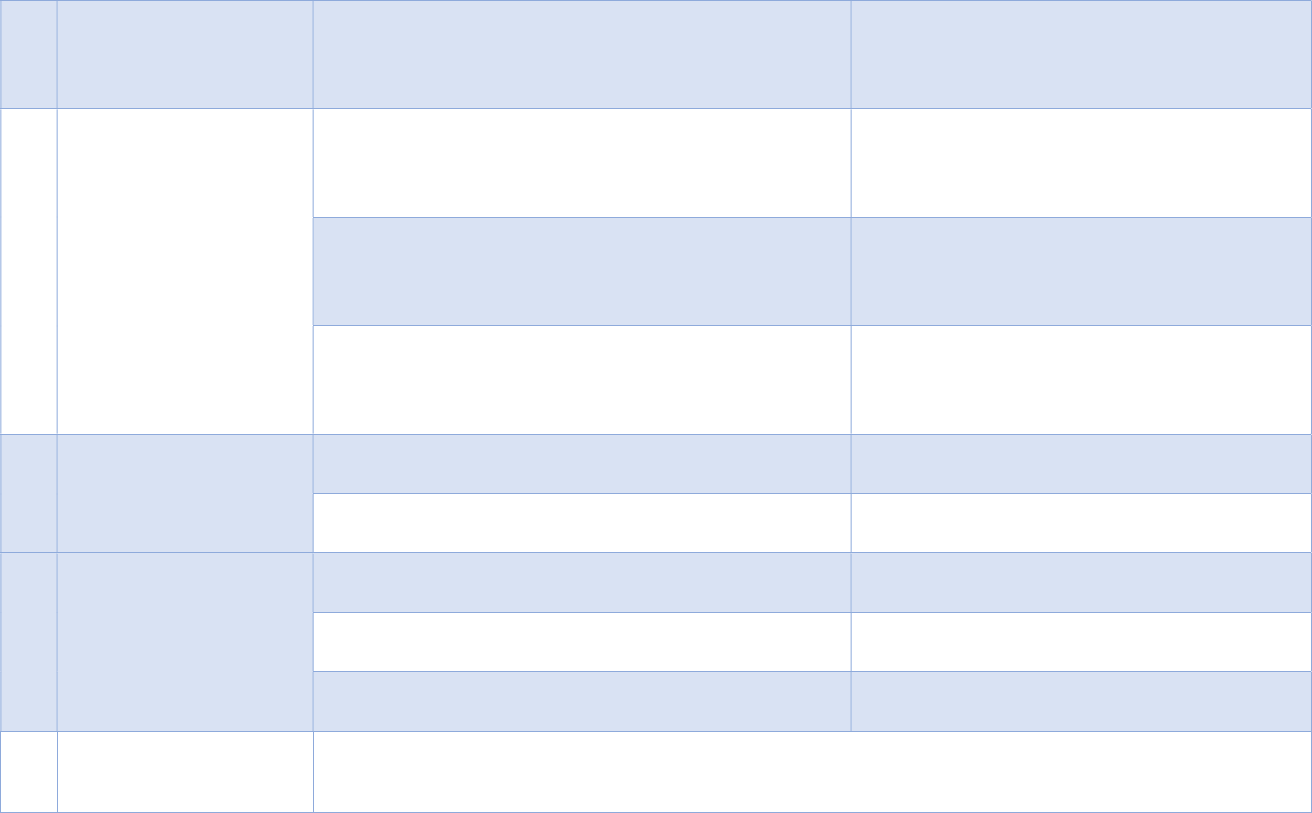

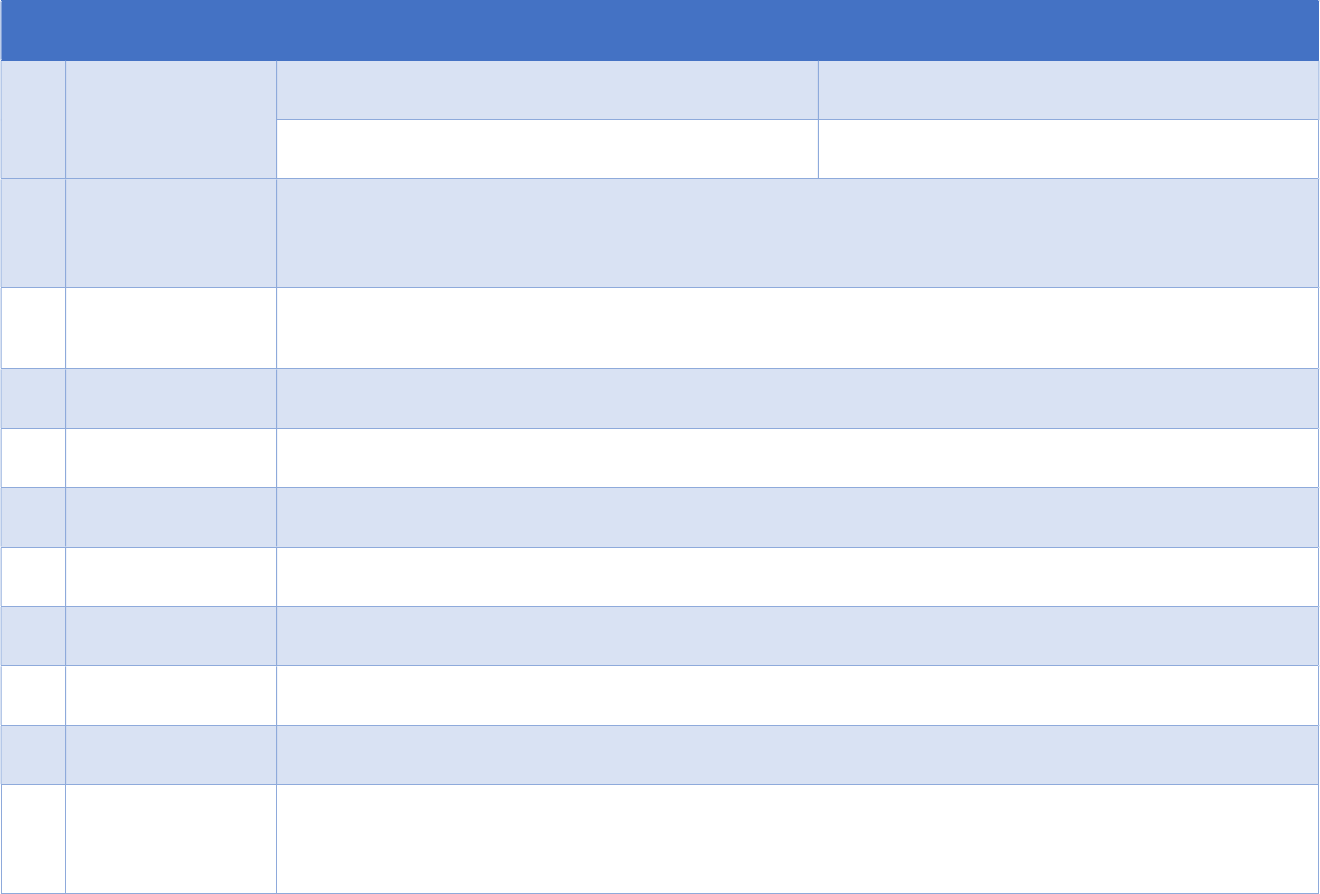

Operating Expenses

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Fabrics 5.04 7.43 9.78 9.97 10.17 10.38 10.59 10.80 11.01 11.23

Trims 0.45 0.67 0.88 0.89 0.91 0.93 0.95 0.97 0.99 1.01

Consumables 0.03 0.05 0.05 0.06 0.06 0.06 0.06 0.06 0.06 0.06

Testing 0.02 0.03 0.03 0.03 0.04 0.04 0.04 0.04 0.04 0.04

Wages & Salaries 2.02 2.67 2.90 2.99 3.08 3.17 3.27 3.36 3.47 3.57

Factory shed rental 0.17 0.18 0.18 0.18 0.19 0.19 0.19 0.20 0.20 0.21

Utilities 0.12 0.14 0.15 0.16 0.16 0.16 0.17 0.17 0.17 0.18

Admin & Staff Expenses 0.05 0.07 0.08 0.08 0.08 0.08 0.08 0.08 0.08 0.08

Repairs & maintenance 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01

Total Expenses 7.91 11.24 14.07 14.38 14.69 15.02 15.35 15.68 16.03 16.38

Working Capital

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Raw Material 0.46 0.68 0.89 0.91 0.93 0.95 0.97 0.99 1.01 1.03

WIP 0.16 0.23 0.29 0.30 0.31 0.31 0.32 0.33 0.33 0.34

Finished Goods 0.35 0.52 0.68 0.70 0.72 0.73 0.75 0.77 0.79 0.81

Debtors 2.08 3.09 4.09 4.19 4.29 4.40 4.51 4.62 4.74 4.86

Creditors 0.92 1.36 1.79 1.82 1.86 1.89 1.93 1.97 2.01 2.05

Current Assets 3.06 4.52 5.95 6.10 6.24 6.39 6.55 6.71 6.87 7.03

Current Liabilities 0.92 1.36 1.79 1.82 1.86 1.89 1.93 1.97 2.01 2.05

Net Working Capital 2.14 3.16 4.17 4.28 4.39 4.50 4.62 4.74 4.86 4.98

Increase in Working Capital 2.14 1.02 1.01 0.11 0.11 0.11 0.12 0.12 0.12 0.13

Margin Money 0.53 0.79 1.04 1.07 1.10 1.12 1.15 1.18 1.21 1.25

Increase in margin money 0.53 0.26 0.25 0.03 0.03 0.03 0.03 0.03 0.03 0.03

Bank Finance 1.60 2.37 3.13 3.21 3.29 3.37 3.46 3.55 3.64 3.74

Increase in Bank Finance 1.60 0.77 0.76 0.08 0.08 0.09 0.09 0.09 0.09 0.09

Interest on Working Capital

0.18 0.26 0.34 0.35 0.36 0.37 0.38 0.39 0.40 0.41

1

Utilities

Power Cost

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year 10

Machine

Utilization

70% 90% 95% 95% 95% 95% 95% 95% 95% 95%

Units Consumed

79,498

102,211

107,890

107,890

107,890

107,890

107,890

107,890

107,890

107,890

Power cost

(Lakhs/annum)

5.56 7.30 7.86 8.01 8.17 8.34 8.51 8.68 8.85 9.03

Water Cost

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year

10

Consumption (L)

1,528,800

2,527,200

2,815,800

2,815,800

2,815,800

2,815,800

2,815,800

2,815,800

2,815,800

2,815,800

Water Cost (Rs.)

61,152

103,110

117,182

119,526

121,916

124,355

126,842

129,379

131,966

134,606

Total

(Rs. Lakhs)

0.61 1.03 1.17 1.19 1.21 1.24 1.26 1.29 1.32 1.34

Fuel Cost Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9

Year

10

Total

(Rs. Lakhs)

6.00 6.12 6.24 6.37 6.49 6.62 6.76 6.89 7.03 7.17

Total Utility Cost Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9

Year

10

Total

(Rs. Crores)

0.12 0.14 0.15 0.16 0.16 0.16 0.17 0.17 0.17 0.18

2

Manpower Planning

Unit

Factory Workers and Staff

200

Average Monthly Wages and Salary

12,000

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Wage & Salary

cost (Rs.

Crores)

2.02 2.67 2.90 2.99 3.08 3.17 3.27 3.36 3.47 3.57

Annual Admin

and staff

expenses

500,000 700,000 800,000 800,000 800,000 800,000 800,000 800,000 800,000 800,000

3

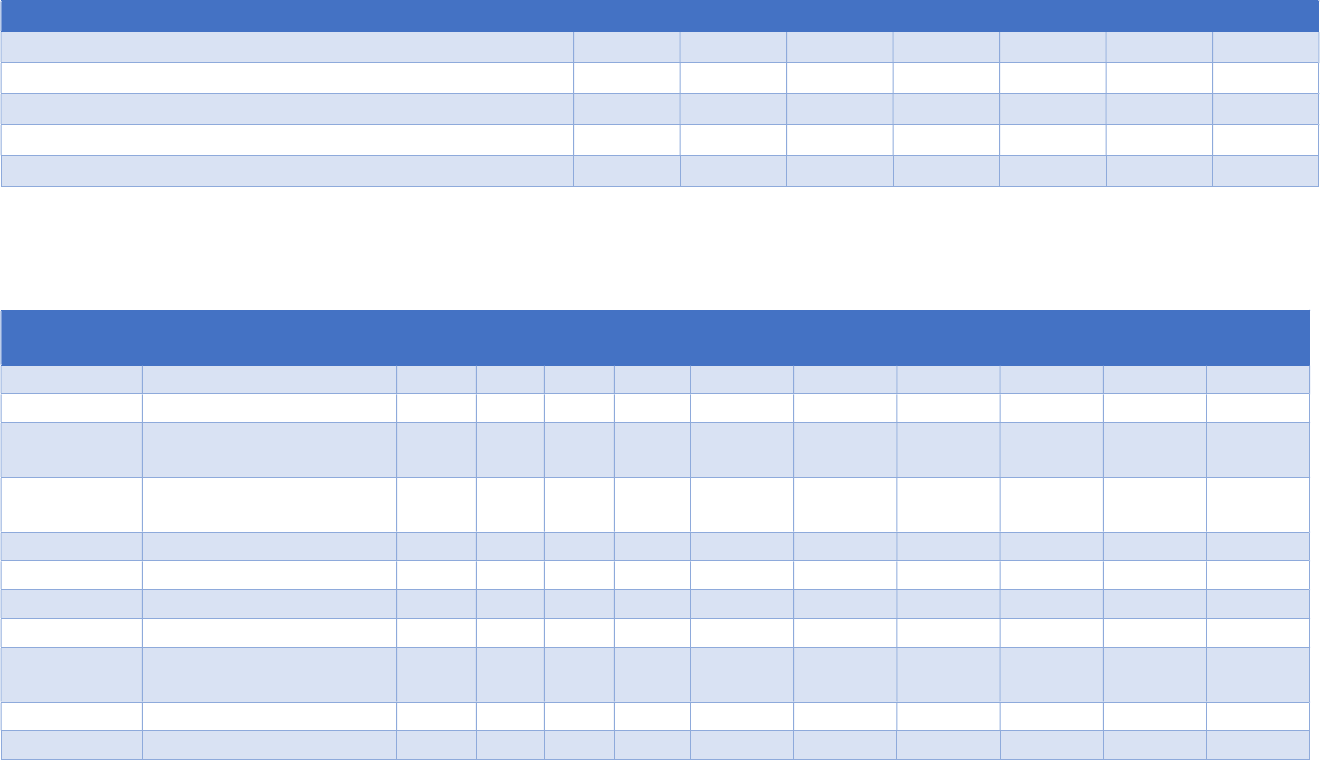

Profit and Loss Statement

P&L - Rs. Crore Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Revenue 8.34 12.36 16.34 16.75 17.17 17.60 18.04 18.49 18.96 19.43

Expenses

Fabrics 5.04 7.43 9.78 9.97 10.17 10.38 10.59 10.80 11.01 11.23

Trims 0.45 0.67 0.88 0.89 0.91 0.93 0.95 0.97 0.99 1.01

Consumables 0.03 0.05 0.05 0.06 0.06 0.06 0.06 0.06 0.06 0.06

Testing 0.02 0.03 0.03 0.03 0.04 0.04 0.04 0.04 0.04 0.04

Wages and Salaries 2.02 2.67 2.90 2.99 3.08 3.17 3.27 3.36 3.47 3.57

Factory Shed Rental 0.17 0.18 0.18 0.18 0.19 0.19 0.19 0.20 0.20 0.21

Utilities 0.12 0.14 0.15 0.16 0.16 0.16 0.17 0.17 0.17 0.18

Admin Staff Salaries 0.05 0.07 0.08 0.08 0.08 0.08 0.08 0.08 0.08 0.08

Repair and Maintenance 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01

Total Expenses 7.91 11.24 14.07 14.38 14.69 15.02 15.35 15.68 16.03 16.38

EBITDA 0.43 1.12 2.28 2.38 2.48 2.59 2.70 2.81 2.93 3.05

EBITDA% 5% 9% 14% 14% 14% 15% 15% 15% 15% 16%

Depreciation 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25

Interest On Term Loan 0.20 0.20 0.18 0.14 0.10 0.06 0.02 - - -

Interest On WC loan 0.18 0.26 0.34 0.35 0.36 0.37 0.38 0.39 0.40 0.41

Total Interest 0.37 0.46 0.52 0.49 0.46 0.43 0.41 0.39 0.40 0.41

PBT (0.19) 0.42 1.50 1.63 1.76 1.90 2.04 2.17 2.27 2.38

PBT % -2% 3% 9% 10% 10% 11% 11% 12% 12% 12%

Tax Payable - 0.07 0.26 0.29 0.31 0.33 0.37 0.39 0.42 0.44

PAT (0.19) 0.34 1.24 1.35 1.46 1.57 1.67 1.77 1.86 1.95

PAT % -2% 3% 8% 8% 8% 9% 9% 10% 10% 10%

4

Balance Sheet

Balance Sheet - Rs Cr. Pre-Op. Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Sources of Funds

Equity 1.18 1.72 1.97 2.23 2.25 2.28 2.31 2.34 2.37 2.40 2.43

Reserves & Surplus (0.19) 0.15 1.39 2.74 4.19 5.76 7.44 9.21 11.06 13.01

Unsecured Loans - - - - - - - - - -

Long term Loan 1.78 1.78 1.42 1.07 0.71 0.36 0.00 - - - -

Short Term Loan 1.60 2.37 3.13 3.21 3.29 3.37 3.46 3.55 3.64 3.74

Total 2.96 4.90 5.92 7.81 8.91 10.12 11.44 13.23 15.13 17.11 19.18

Application of Funds

Capital Expenditure 2.96

Net Block 2.17 1.92 1.67 1.42 1.17 0.92 0.67 0.42 0.17 (0.08)

Current Assets 3.12 4.82 7.39 8.77 10.27 11.88 13.96 16.14 18.41 20.78

Less : Current Liabilities 0.92 1.36 1.79 1.82 1.86 1.89 1.93 1.97 2.01 2.05

Other Assets 0.53 0.53 0.53 0.53 0.53 0.53 0.53 0.53 0.53 0.53

Total 2.96 4.90 5.92 7.81 8.91 10.12 11.44 13.23 15.13 17.11 19.18

5

Cash Flow Statement

Cash Flow – Rs. Cr. Pre-Op. Year 1

Year 2

Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Inflows

Promoters contribution 1.18 0.53 0.26 0.25 0.03 0.03 0.03 0.03 0.03 0.03 0.03

Profit Before Depreciation, Interest & Tax

0.43 1.12 2.28 2.38 2.48 2.59 2.70 2.81 2.93 3.05

Increase in Term Loans 1.78 - - - - - - - - -

Increase in Bank Borrowings 1.60 0.77 0.76 0.08 0.08 0.09 0.09 0.09 0.09 0.09

Total Cash Inflows 2.96 2.57 2.15 3.28 2.48 2.59 2.70 2.81 2.93 3.05 3.17

Outflows

Capital Expenditure 2.96

Increase in Working Capital 2.14 1.02 1.01 0.11 0.11 0.11 0.12 0.12 0.12 0.13

Repayment of Term Loans - - 0.36 0.36 0.36 0.36 0.36 - - - -

Interest 0.37 0.46 0.52 0.49 0.46 0.43 0.41 0.39 0.40 0.41

Tax - 0.07 0.26 0.29 0.31 0.33 0.37 0.39 0.42 0.44

Total Cash Outflows 2.96 2.51 1.91 2.15 1.24 1.24 1.24 0.89 0.90 0.94 0.97

Opening Cash Balance - - 0.06 0.30 1.43 2.67 4.03 5.49 7.42 9.44 11.55

Net Flows - 0.06 0.24 1.13 1.24 1.35 1.46 1.92 2.02 2.11 2.20

Closing Balance - 0.06 0.30 1.43 2.67 4.03 5.49 7.42 9.44 11.55 13.74

6

Break-even Points

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Net Sales 8.34 12.36 16.34 16.75 17.17 17.60 18.04 18.49 18.96 19.43

Variable Cost

Raw Material 0.03 0.05 0.05 0.06 0.06 0.06 0.06 0.06 0.06 0.06

Utilities ( Power, Fuel, and Water )

0.06 0.07 0.08 0.08 0.08 0.08 0.08 0.08 0.09 0.09

Interest on Working Capital 0.18 0.26 0.34 0.35 0.36 0.37 0.38 0.39 0.40 0.41

Total Variable Cost 0.27 0.38 0.48 0.49 0.50 0.51 0.52 0.54 0.55 0.56

Contribution Cost

Contribution 8.07 11.98 15.87 16.27 16.67 17.09 17.52 17.96 18.41 18.87

Fixed Cost

Wages & Salaries 2.02 2.67 2.90 2.99 3.08 3.17 3.27 3.36 3.47 3.57

Rent 0.17 0.18 0.18 0.18 0.19 0.19 0.19 0.20 0.20 0.21

Factory Overheads 0.06 0.07 0.08 0.08 0.08 0.08 0.08 0.08 0.09 0.09

Interest on Term Loan 0.20 0.20 0.18 0.14 0.10 0.06 0.02 - - -

Depreciation 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25

Total 2.69 3.36 3.59 3.64 3.70 3.76 3.82 3.90 4.00 4.11

Net Profit 5.37 8.62 12.28 12.62 12.98 13.33 13.70 14.06 14.40 14.75

Break Even Point (%) 33% 28% 23% 22% 22% 22% 22% 22% 22% 22%

Break Even Sales (Rs. Cr.) 2.79 3.47 3.70 3.75 3.81 3.87 3.93 4.01 4.12 4.24

Cash Break Even Sales (Rs. Cr.) 2.53 3.21 3.44 3.49 3.55 3.61 3.67 3.76 3.86 3.98

Cash Break Even Point 30% 26% 21% 21% 21% 21% 20% 20% 20% 20%

7

Depreciation

Description

Rate of

Depreciation

Cost of Asset Contingency

Add

proportionate

PPOE

Total SLM

Land 0% - - - - -

Factory Building 3% - - - - -

Plant & Equipment 10% 1.67 0.08 0.13 1.88 0.19

Other Fixed Assets 10% 0.48 0.02 0.04 0.54 0.06

Total 2.15 0.11 0.17 2.43 0.25

Depreciation SLM

(Rs. Cr.)

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Depreciation per year 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25

Overall

Gross Value 2.43 2.43 2.43 2.43 2.43 2.43 2.43 2.43 2.43 2.43

Commulative dep 0.25 0.50 0.75 1.00 1.25 1.50 1.76 2.01 2.26 2.51

Net Asset Value 2.17 1.92 1.67 1.42 1.17 0.92 0.67 0.42 0.17 0.08

Depreciation WDV - Phase 1 (Rs. Cr.)

Rate of

Depreciation

Year 1 Year 2

Year 3 Year 4 Year 5

Year 6 Year 7 Year 8 Year 9

Year

10

Land 0.0% - - - - - - - - - -

Factory Building 10.0% - - - - - - - - - -

Plant & Equipment 15.0% 0.28 0.24 0.20 0.17 0.15 0.13 0.11 0.09 0.08 0.07

Other Fixed Assets 15.0% 0.08 0.07 0.06 0.05 0.04 0.04 0.03 0.03 0.02 0.02

Total Depreciation - WDV

0.36 0.31 0.26 0.22 0.19 0.16 0.14 0.12 0.10 0.08

8

Interest Calculation

Total Loan Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

Outstanding amount at the beginning of year

1.78 1.78 1.42 1.07 0.71 0.36

Loan Issued 1.78 - - - - -

Principal Repayment - - 0.36 0.36 0.36 0.36 0.36

Outstanding amount at the end of year 1.78 1.78 1.42

1.07

0.71 0.36 0.00

Interest on loan 0.20 0.20 0.18 0.14 0.10 0.06 0.02

Taxation

Rs. Cr.

Year

1

Year

2

Year

3

Year

4

Year

5

Year

6

Year

7

Year

8

Year

9

Year 10

Taxable Income 0.30 0.36 1.49 1.66 1.83 1.99 2.15 2.30 2.43 2.55

Nil Type of tax to be paid Nil MAT MAT MAT NORMAL

NORMAL

NORMAL

NORMAL

NORMAL

NORMAL

MAT

Tax Payable under

MAT

@21.342%

(0.03) 0.07 0.26 0.29 0.31 0.33 0.36 0.38 0.40 0.42

MAT/Normal

Tax payable as per

normal provisions

(0.05) 0.06 0.26 0.28 0.31 0.34 0.37 0.39 0.42 0.44

Normal Tax payable - 0.07 0.26 0.29 0.31 0.34 0.37 0.39 0.42 0.44

MAT credit amount - 0.01 0.01 0.00 - - - - - -

Cumulative MAT credit - 0.01 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02

Max. MAT - setoff - - - - 0.00 0.01 0.01 0.02 0.02 0.02

Balance MAT Credit at

the Starting Of Year

- - - - 0.02 0.01 0.00 (0.01) (0.03) (0.04)

MAT set-off yearly - - - - 0.00 0.01 0.00 - - -

Net Tax Payable - 0.07 0.26 0.29 0.31 0.33 0.37 0.39 0.42 0.44

9

Payback Period

Payback Period (Years) Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Cash profit 0.06 0.59 1.49 1.60 1.71 1.82 1.92 2.02 2.11 2.20

Cumulative cash profit 0.06 0.65 2.14 3.74 5.45 7.27 9.19 11.21 13.32 15.52

Project cost 2.96

Payback Year 3.5

Internal Rate of Return (IRR)

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

PAT (0.19) 0.34 1.24 1.35 1.46 1.57 1.67 1.77 1.86 1.95

Depreciation & Amortization 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25

Interest 0.37 0.46 0.52 0.49 0.46 0.43 0.41 0.39 0.40 0.41

Total Inflow 0.43 1.05 2.01 2.09 2.17 2.25 2.33 2.41 2.51 2.61

Outflow

Capital Expenditure 2.96 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Change in net working capital

2.14 1.02 1.01 0.11 0.11 0.11 0.12 0.12 0.12 0.13

Total Outflow 5.10 1.02 1.01 0.11 0.11 0.11 0.12 0.12 0.12 0.13

Net Inflow (4.66) 0.03 1.01 1.98 2.06 2.14 2.21 2.29 2.39 2.48

Project IRR (post-tax) 27%

10

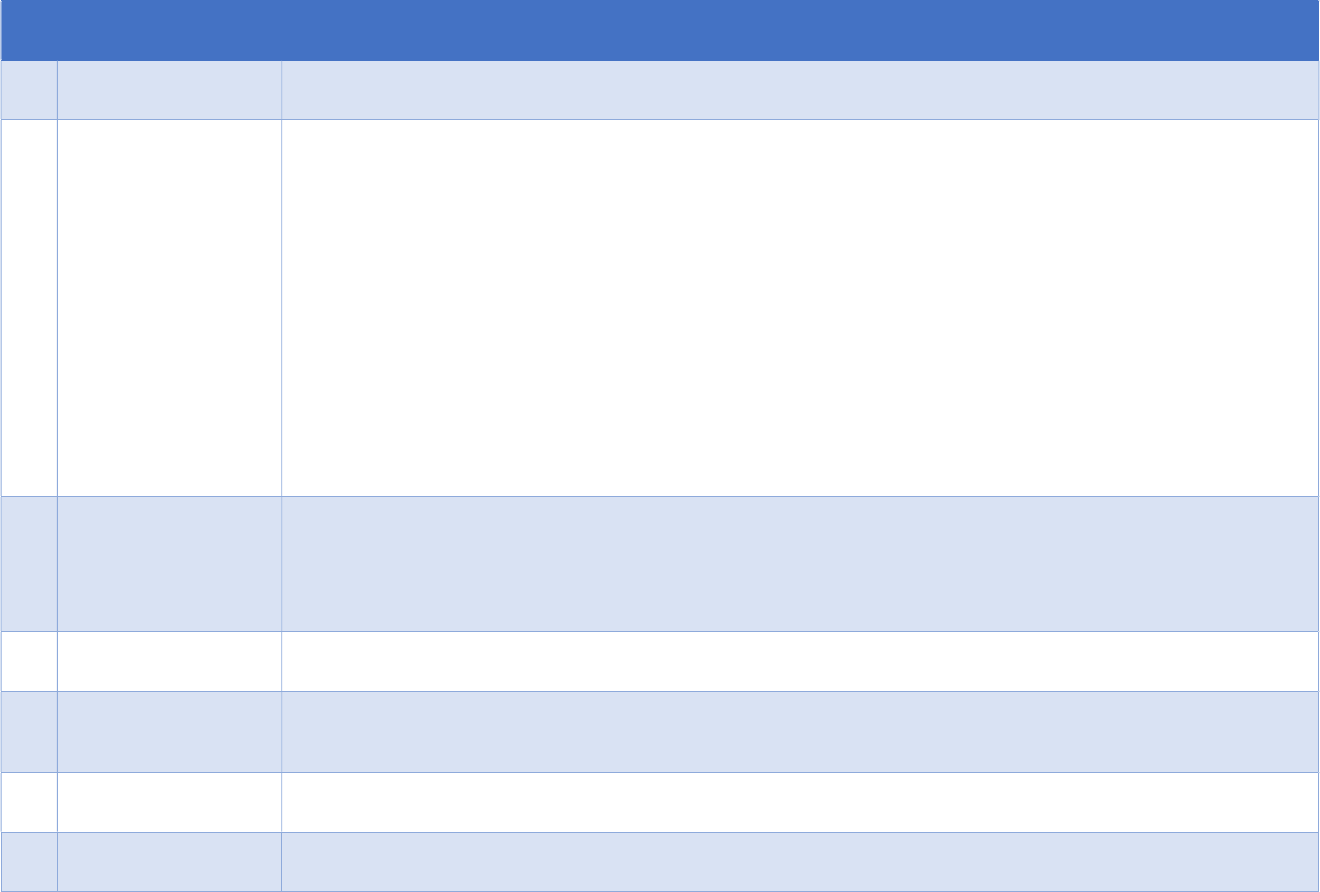

Debt Service Coverage Ratio (DSCR)

DSCR Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

Profit after Tax (0.19) 0.34 1.24 1.35 1.46 1.57 1.67

Add Depreciation 0.25 0.25 0.25 0.25 0.25 0.25 0.25

Add Interest on Term Rupee Loan 0.20 0.20 0.18 0.14 0.10 0.06 0.02

Total Cash In Flow 0.25 0.79 1.67 1.74 1.81 1.88 1.95

Installment for Term Rupee Loan - 0.36 0.36 0.36 0.36 0.36 -

Add Interest on Term Rupee Loan 0.20 0.18 0.14 0.10 0.06 0.02 -

Total Cash Out Flow 0.20 0.54 0.50 0.46 0.42 0.38 -

Annual DSCR 1.30 1.47 3.36 3.80 4.32 4.96 -

Average DSCR 3.20 6-year

Maximum DSCR 4.96

Minimum DSCR 1.30

Financial Ratios

Ratios Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

ROE -16% 20% 63% 60% 65% 69% 73% 76% 78% 81%

ROCE 4% 17% 35% 37% 40% 43% 46% 50% 53% 57%

EBITDA to Capital Employed

8% 18% 32% 33% 34% 35% 36% 37% 37% 38%

11

4. State Government Incentives forGarment Projects

Andhra Pradesh

S.No

Type Investment Bracket/unit eligibility Quantum of Incentives

1

Credit-linked capital

subsidy

(except spinning and

modern ginning)

• Ultra Mega projects ( >500 crores investment or

employing 5,000 people)

• 10% of FCI with a cap of Rs. 50 crores

• Mega projects (>200 crores investment or

employing 2,000 people)

• 20% of FCI with a cap of Rs. 30 crores

• Others • 20% of FCI with a cap of Rs. 15 crores

2

Credit-linked interest

subsidy

Either 12.5% or the

bank

prime lending rate or the rate of interest actually charged, whichever rate is less, will

be taken as the applicable rate of interest; interest subsidy cap @12.5%; admissible for 7 years only inclusive

of 2 years for implementing the project

Sector Interest subsidy

• Spinning and modern ginning • 7.5%

•

Weaving, dyeing and processing, knitting,

garments/ made-ups, machine carpeting, machine

embroidery, technical textiles and other activities

like crimping, texturizing, twisting, winding, sizing,

etc.

• 8%

3

Power cost

reimbursement

• Spinning and modern ginning • @ Rs.1 per unit for a period of 5 years

• Other categories (including technical textiles) • @ Rs. 2 per unit for a period of 5 years

4

Capital and Operational

Assistance for Green

Measures

50% of FCI with a ceiling of Rs. 50 Crores, Reimbursement of 50% of Operational and Maintenances expenses

for first five (5) years from the date of operation of CETP; For establishing external infrastructure facilities,

GoAP will provide financial assistance of up to 50% of expenditure incurred, with maximum limit of 10 crore;

will be provided for establishment CETPs.

12

5 Integrated textile park

Park will have a minimum extent of 500 acres with plug

and play facilities including CETP and marine outfall. It will

be connected to the nearest port through corridors to

facilitate import and exports

Subsidy of 50% of development expenses, up to a

maximum of Rs. 10 Lakhs per Acre. GoAP will also

dovetail the incentives offered by GoI for

development of the park.

6

Employment Based

Incentives for 5 years on

monthly bases

(for domicile worker)

(Spinning and ginning are

excluded)

• Ultra Mega projects

Rs. 3,750 per women and Rs.3,000 for men for 5

years or 100% Net SGST accrued to the state for a

period of 10 years or 100% of the FCI whichever

is earlier

• Mega projects

Rs. 2,500 per women and Rs. 2,000 for men for 5

years or 100% Net SGST accrued to the state for a

period of 7 years or 100% of the FCI whichever is

earlier

• Others

Rs. 1,000 per employee for units

providing

employment of 500 and above for 5 years or

100% Net SGST accrued to the state for a period

of 5 years or 100% of the FCI whichever is earlier

7

Skill development /

training (One time grant)

• Mega and Ultra mega projects 50% of training cost up to Rs.10,000 per trainee

• Others 50% of training cost up to Rs. 7,500 per trainee

8

Capital Subsidy for Green

Measures (ETPs)

• Mega projects 50% of FCI limited to Rs. 30 crores

• Ultra mega projects 50% of FCI limited to Rs. 50 crores

• Others 50% of FCI limited to Rs. 20 crores

9

Land and Infrastructure

Support (Except modern

ginning and spinning)

50% reimbursement of the Land cost limited to 5% of FCI, whichever is less for units established in Andhra

Pradesh Industrial Infrastructure Corporation Industrial Parks/ APIIC.

13

Gujarat

S.No Type Quantum of Assistance

1

Credit-linked interest

subsidy

•

5% per annum subject to a maximum of Rs. 7.5 Cr. per year for 5 years

• Eligible investment-Land, Building and Plant and Machinery; also includes investment in value

addition activities such as washing and garment processing

2 Power subsidy

•

Subsidy @ Rs.1/unit for 5 years from date of commencement of commercial production

• In case of expansion, subsidy will be provided only for the additional facilities

• Subsidy will be available on the electricity purchased from state electricity power distribution

licensee.

3 Payroll assistance

•

For new

garment

units having minimum 75 machines and generating at least 150 domicile jobs,

payroll assistance of 50% of wages will be provided up to Rs. 4000/- for female and Rs. 3200/- for

male worker per month for 5 years

• In case of expansion, above incentives will be available only for additional workers. Minimum

machineries and job generation remain same (75 and 150, respectively)

• Provision of Ramp-up period of 6 months for new applicants

4 Plug and Play Systems

•

GIDC will develop readymade sheds (along with adequate

support infrastructure) for

garment

factories in selected locations and provide them on long term lease or rental basis

• Direct benefit to garment unit of 50% of the project cost including construction of building & shed

excluding land cost up to Rs. 10 crores. Maximum eligible area per machine will be 150 Square feet.

5 Mega garment park

•

Up to 50% of the total cost of the project with a maximum limit of Rs. 10 crore

• 100% stamp duty exemption only once, for developer and first purchaser of individual unit

• Park must accommodate a minimum of 20 garment units with 75 machines each

• Developer needs to hold at least 20% equity participation in project

6 Dormitories

Assistance to GIDC

• GIDC will develop dormitories in selected locations and provide them on rent (minimum lock in 10

years) or long term lease basis

• Dormitories to be operated by leasing entity itself

• GIDC will decide nature of dormitory, rentals etc. on case to case basis

• State government will provide rent assistance of 50% to enterprises

Assistance

to private developers (individual units or parks)

• 50% project cost subject to a maximum of Rs. 5 Crore

• Dormitories to be developed for min 250 workers with a max built up area of 50 sq. ft./ person

14

7

Skill development/

training

Setting up of training

institution

• Assistance up to 85% with a ceiling of Rs. 3 crore of the project

• Eligible investment- Building, equipment and machinery (including installation), electrification,

furniture, etc. excluding land cost

Setting up of training centers

• Assistance of 50% subject to a maximum of Rs. 20 lakhs per center

• Eligible investment- Equipment and machinery, electrification and necessary furniture

Reimbursement of tuition fee to trainees for

garment

production courses

• 50% of total fee charged by institution subject to a limit of up to Rs. 7,500 per trainee (Rs. 10,000/-

for middle level management courses)

15

Haryana

S.No Type Quantum of Assistance

1

Interest subsidy on

term loan for new and

existing units

• MSME in garmenting/ knitting/embroidery/technical

textiles

• 6% or Rs. 10 lakh per year

• MSMEs in ginning, cotton spinning, power loom in B, C,

D category blocks

• 5% or Rs. 10 lakhs for 5 years

not to exceed the amount of net VAT/SGST

paid

2 Power subsidy

• Micro and Small Enterprises in C, D category

• Rs. 2/ unit for 3 years from the date

of release of electricity connection

• Medium and Large units

• Exemption from open excess

charges of 93 paisa/unit

3

Employment

generation subsidy

One time support of Rs. 10,000 for capacity building of persons belonging to the State in B, C, D category

blocks

4 VAT

Investment subsidy with a cap of 100% of Fixed Capital

Investment (FCI) provided for

(for existing units ,expansion should include

at least 50% additional investment in plant

and machinery)

• C, D categories

• 75% of net paid VAT/SGST for first 7

years, 35% for the next 3 years

• B Category

• 50% for first 5 years, 25% for next 3

years

5 Stamp duty

Refund on purchase/lease of land for establishment of

enterprise, after start of production, for 5 years from filing of

EM/IEM

• 100%

• C and D category

• B Category • 80%

16

6

External development

charges (EDC)

50% exemption in B, C, D category blocks

7 Mandi fees 100% exemption in case of ginning enterprises in B, C, D category blocks

8 Electricity duty

100% exemption for 10 years only for new enterprises in B,C, D categories from the date of release of

electricity connection

9 Transfer property tax Exemption for dyes and chemicals purchased from outside the State

10

Environment

compliance

50% financial support, max Rs. 25 lakh on capital cost for setting up new Effluent Treatment Plant, air pollution

control devices to macro and small enterprises

11

Credit-linked interest

subsidy

@5% up to a max of Rs. 5 lakhs per year for 3 years to micro and small units for technology up-gradation

12 Energy audit

Reimbursement of 75% of cost of energy audit, max Rs. 2 lakh and 50% subsidy on cost of capital goods for

conserving energy, max Rs. 20 lakh for MSME (only if there is at least 15% reduction in average monthly

electricity consumption before conducting an audit)

17

Jharkhand

S.No Type Investment Bracket/unit eligibility Quantum of Assistance

1

Capital Investment

Subsidy (CIS)

All

20% of the investments made in P&M, cap of Rs. 50

crore

SC/ST/Women/Handicapped Entrepreneur residents of

Jharkhand

Additional 5%

2 Interest Subsidy

•

Interest subsidy of 7% or 50% of the interest rate, whichever is lower, subject to max. Rs. 1 crore on total

loan availed by new units for 5 years

• Reimbursement of guarantee fee charged under the Credit Guarantee Trust for Micro and Small

Enterprises (CGTMSE) scheme to Micro and Small Enterprises (MSEs)

3 VAT

Incentive of 100% of net VAT payable for 7 years, 40% for next 3 years with a ceiling of 100% of total

fixed capital

investment made, for new units; units qualified to be new by expansion/ modernization/ diversification will also

be entitled for the incentive

4 Stamp duty 100% reimbursement of stamp duty and transfer duty for execution of lease/lease cum sale/ sales deed

5 Power tariff Reimbursement of 50% of power tariff for 7 years

6 Electricity duty 100% exemption for 7 years

7 Mandi fees No Mandi tax will be levied on raw materials

8 Quality certification Assistance of 50% of the expenditure incurred up to a maximum of Rs. 10 lakh

9 Patent registration Assistance of 50% of the expenditure incurred, max Rs. 10 lakh per patent

10 Cluster development Grant of 15% of the grant released by the Government of India

11 Export subsidy

•

For MSE exporters, assistance of 75% of stall charges, max Rs. 2,25,000 per fair/exhibition; 75% of air fare

by economy class, max Rs. 50,000

• For women, assistance of 90% of stall charges, max Rs. 2,70,000 per fair/exhibition; 75% of air fare by

economy class, max. Rs. 60,000 (exporters availing travel support from Central Government shall not be

18

eligible)

Eligible for incentives under Jharkhand Export Policy 2015

12 Dormitory assistance Assistance up to 50% of cost of land, max Rs. 50 lakh (1 acre for 1000 workers)

13 Skill development

One-time support of Rs. 13,000 or actual cost of training per person, for capacity building of persons belonging to

the State

14 Wage subsidy

• Subsidy of Rs. 5,000 per month per worker for 7 years

For SC/ST women, subsidy of Rs. 6000 per month per worker for 7 years

15

ESI/ EPF

reimbursement

Reimbursement to employer up to Rs. 1000 per person per month towards expenditure on ESI/EPF for 5 years

16

Incubation center

support

Support of Rs. 50 lakhs annually for first 5 years (maximum 10 institutions can be granted in the first year); special

incentive of Rs. 10 lakh for incubator for every successful start-up

For establishment of Mega textile/garment park (size more than 75 acres)

For establishment of Mega textile/garment park (size

more than 75 acres)

19

Karnataka

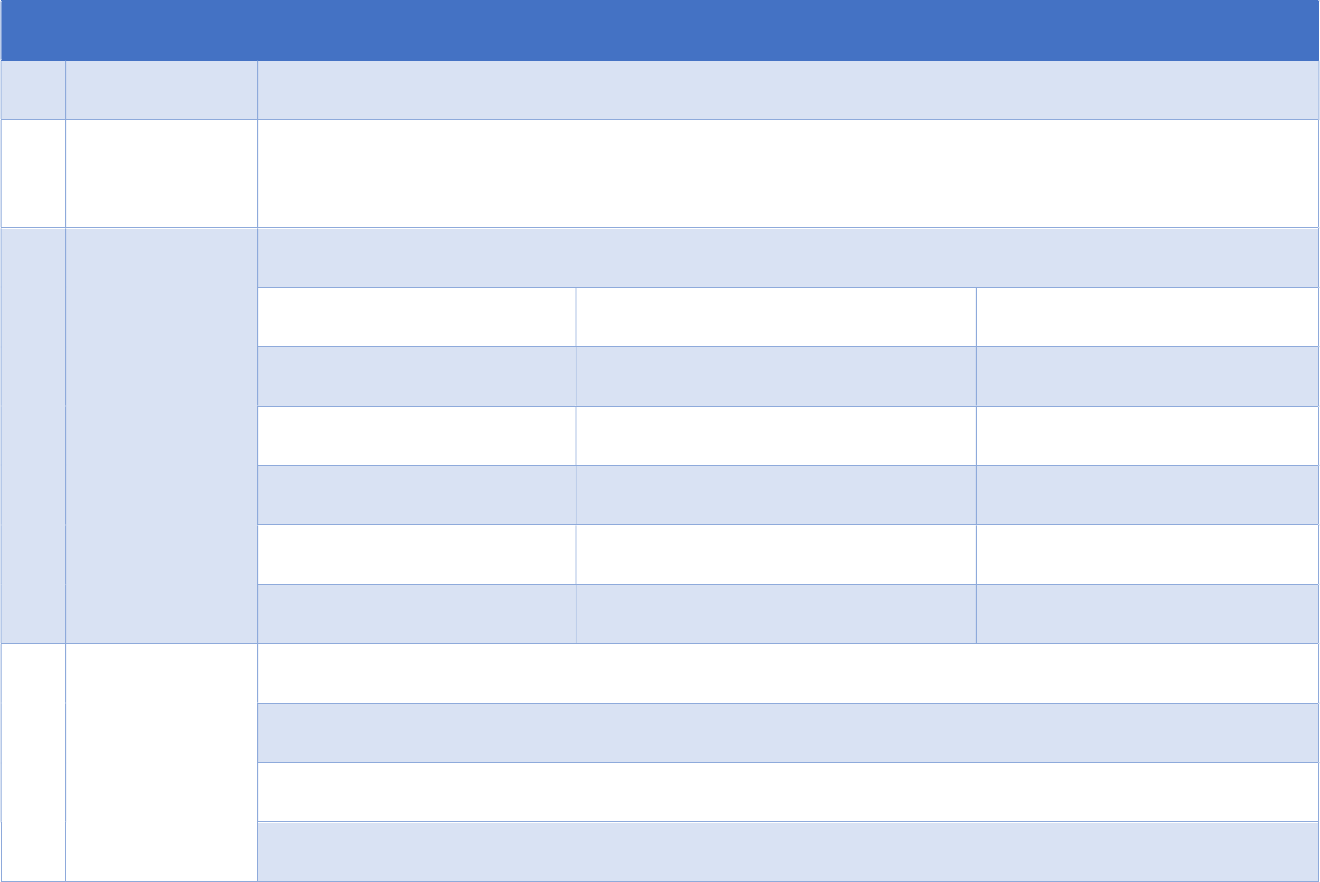

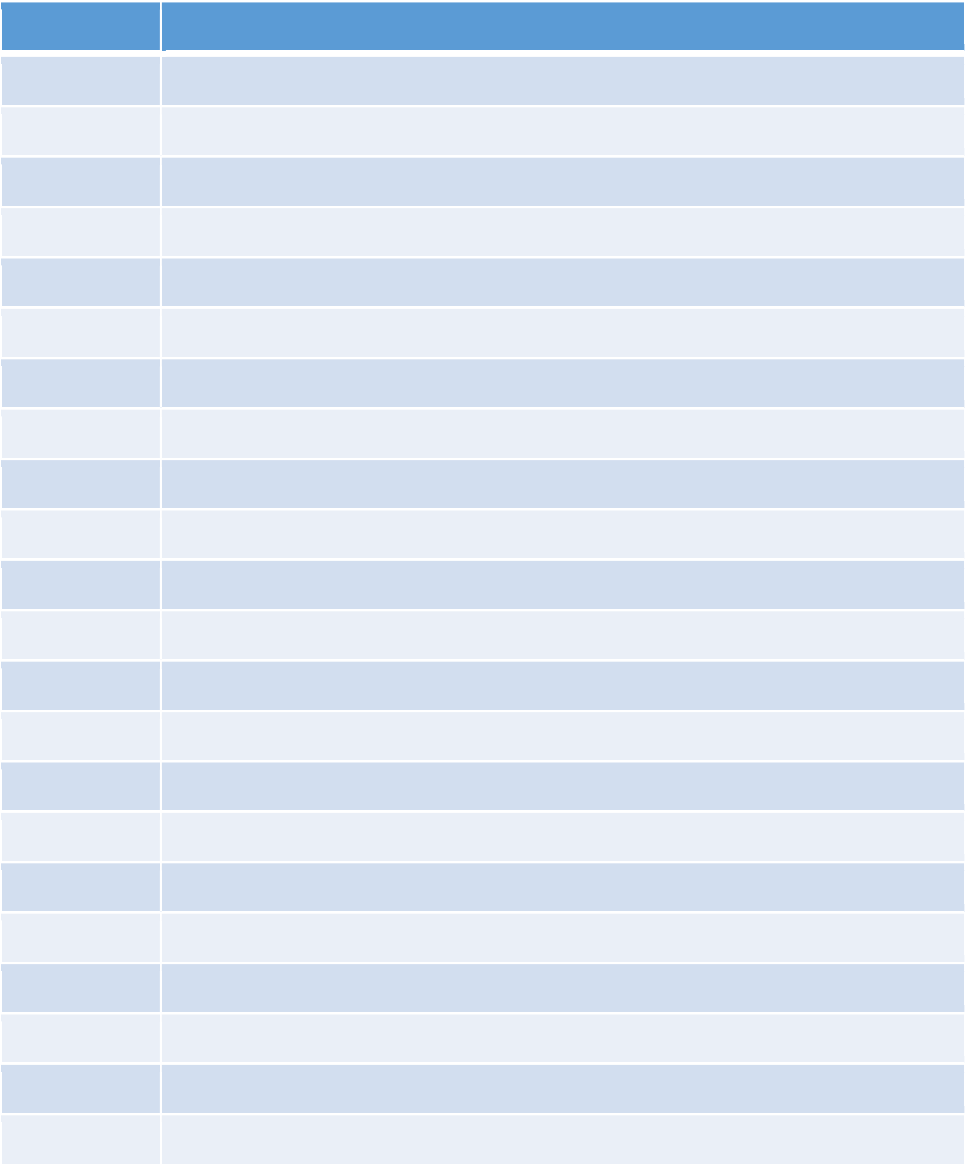

S.No. Type of Subsidy Sector MSMEs Large Units

S.No.

Type of Subsidy

Remarks

Zone 1 Zone 2 Zone 3

Zone

4

Zone 1 Zone 2 Zone 3 Zone 4

1

Credit Linked Capital

Subsidy (% of Fixed

Asset)

25% 20% 15% Nil 20% 15% 10% Nil

Additional 5% subsidy for

SC/ ST / persons with

disabilities/ Minority / Ex-

servicemen / women

2

Interest subsidy on

term loan (for first 5

years)

Nil Nil Nil Nil 5% 5% 5% Nil

3

Power Subsidy (for 5

years)

Only for Micro &

Small enterprises

Rs.1

/unit

Rs.1

/unit

Rs.1

/unit

Nil Nil Nil Nil Nil

4

Wage Subsidy per

worker per month

(for 5 years)

Only for Medium &

Large Enterprises.

Rs.

1,500

Rs.

1,000

Rs.

1,000

Nil Rs. 1,500

Rs. 1,000

Rs. 1,000

Nil

-

For new employment

generation.

-For Karnataka Domicile

workers.

-Min. Employment for

Medium Enterprises: 200

-Min. Employment for

Large Enterprises: 500

5

Stamp Duty

Exemption

100% 100% 100% Nil 100% 100% 100% Nil

6

Concessional

Registration Charges

Rs. 1

per Rs.

1000

Rs. 1

per Rs.

1,000

Rs. 1

per Rs.

1,000

Nil

Rs. 1 per

Rs. 1,000

Rs. 1 per

Rs. 1,000

Rs. 1 per

Rs. 1,000

Nil

7

ESI/ EPF

Reimbursement (for 5

75% 75% 75% Nil Nil Nil Nil Nil

20

years)

8

Training Subsidy (Per

Trainee)

Nil Nil Nil Nil

Rs.

11,000

Rs.

11,000

Rs.

11,000

Rs.

11,000

21

Madhya Pradesh

S.

No

Type Quantum of assistance

1. Interest subsidy 5% for 7 years for P&M

2.

Investment

promotion subsidy

•

Earlier MP state used to provide VAT/CST assistance to large scale industry, after implementation of GST

it is being replaced by “Investment Promotion Assistance”

• Eligibility: Investments in plant & machinery more than 10 crores

• An annual investment promotion assistance for a period of 7 years calculated on the basis of 4

parameters

• Investment in plant and machinery

• Yearly capacity utilization

• Yearly exports share(25% - 75%)

• Yearly average number of employees (100 – 2,500)

• The actual assistance is calculated based on various slabs of the above parameters. The calculation model

is given in attached excel

• As per the stated conditions, the maximum assistance can be up to 72% of investment in plant and

machinery in certain cases

• Maximum assistance is limited to Rs. 150 crores

3.

Employment

generation incentive

5,000/

-

per worker per month for 5 years.

This incentive period will be 10 years from the date of commercial production, however incentives will be

provided only to workers who have been hired till 8

th

year from the date of commercial production.

Conditions for incentive: The company must appoint 50% of workers from MP domicile within 1 year , 75% MP

workers within 3 years and 90% MP workers within 5 years to get the benefits.

4. Training incentives 13000/- per worker for domicile workers for 5 years

5.

Stamp duty and

registration fee

exemption

100% reimbursement for leased land in industrial areas developed by state

6.

Electricity duty

exemption

100% exemption for 7 years

7. Power tariff Fixed power cost of 5/- per unit for 5 years

22

8. Land development fee 50% exemption for leased land in industrial areas developed by state

9.

Environment

compliance related

schemes

Small, Medium, Large &

Mega industries shall be provided a capital subsidy of 50% up to a maximum of Rs. 25

lakh for investment in setting up of waste management systems (such as ETP, STP etc.), pollution control devices,

health and safety standards, water conservation/harvesting etc.

10. Industrial Park 15% of the expenditure on establishment / development of industrial park up to a maximum limit of Rs. 5 crores

*Benefits will be awarded to only those units which are established in

the notified Industrial Area or Industrial

Areas developed by

AKVN/TRIFAC.

** units eligible for this policy will not be eligible for other incentives available in Industrial Policy 2014 (Amended in 2017).

*** Total incentive available is limited to 200% of investment in P&M and building

P&M*: Plant & Machinery excluding land, building, industrial safety equipments, DG Sets, Environment Protection equipments, R&D

equipments, Transformers, Storage Tank, Godown and Fire Fighting equipments.

23

Telangana

S.No Type Quantum of Assistance

1 Capital Assistance

For new units: Units promoted by SC/ST entrepreneurs or PWD shall get an additional capital subsidy of

5% subject to the caps (also increased by 5%)

Category Quantum(for conventional textiles) Quantum (for technical textiles)

A1 25% (cap of Rs. 1 cr) 35% (cap of Rs. 2.5 cr)

A2 25% (cap of Rs. 3 cr) 35% (cap of Rs. 5 cr)

A3 25% (cap of Rs. 5 cr) 35% (cap of Rs. 10 cr)

A4 25% (cap of Rs. 10 cr) 35% (cap of Rs. 20 cr)

A5 25% (cap of Rs. 20 cr) 35% (cap of Rs. 40 cr)

For existing units, 20% of cost of plant and machinery up to Rs. 5 crore

2

Energy, Water and

Environmental Conservation

Infrastructure

•

Assistance of up to 40% of cost of equipment with a ceiling of Rs. 50 lakhs under each category

separately

• CETP: Assistance of 50% of project cost up to Rs. 10 crore at cluster level/industrial parks. For

handloom clusters, assistance up to 70% with a cap of Rs. 2 cr.

• Rebate in local body taxes like property tax, IALA levies, etc.

3 Interest Subsidy

• 75% of the interest rate applicable on loans subject to a cap of 8% p.a. for 8 years (including

moratorium of 2 years) or the period of repayment of the loan

4 Stamp Duty Reimbursement 100% of the stamp duty/transfer duty paid during purchase of land, lease of land/shed/buildings.

5 VAT/CST/SGST concession

Reimbursement is available for tax collected on end product/intermediate product within the entire

value chain to the extent of 100% of VAT/CST/SGST for a period of 7 years or up to the realization of

100% fixed capital investment, whichever is earlier

24

6

Power Tariff Subsidy (for 5

years)

@Rs. 1/unit for ginning and pressing mills

Category Subsidy

A1, A2 Rs. 1.00/unit

A3 Rs. 1.50/unit

A4 Rs. 1.75/unit

A5 Rs. 2.00/unit

Additional Rs. 0.50/unit benefit across all categories for

technical textiles

7 Environment Compliance

Up to 50% subject to max. Rs. 50,000 for each category separately. Available to all existing units with

conservation infrastructure and are into commercial production for a min period of 3 years

8 Acquisition of New Technology

Up to 50% of investment in technology development, subject to a max of Rs. 10 lakh per

process/product

9 Transport Subsidy

For export

-

intensive textile/

garment

units

–

reimbursement of fright charges towards import of raw

materials and export of finished products either by road/rail, from project location to port/dry port

• Year 1 and 2: 75%

• Year 3 and 4: 50%

• Year 5: 25%

Transport subsidy at above rates for 5 years for “Deemed Exports” i.e. supply of goods from within the

State to other units within/outside State provided that the goods are ultimately exported

10

Design, Product Development

and Diversification Assistance

20% of the annual expenditure limited to R

s. 2 lakhs per year. Assistance can be availed twice during

operative period of the scheme (The assistance is not available for processing units with generic

products as output with no scope for design and diversification)

11 Land

In ever new Textile/

Garment

park, anchor client(s) and first movers will be extended rebate of 50% of

the cost, with an upper limit of rebate being Rs. 20 lakh per acre. An additional rebate of 25% with a cap

of Rs. 10 lakhs per acre for technical textiles unit.

25

12 Built-Up Space

Rental subsidy of 25% for first 5 years for the built up spaced created by the Government in textile and

garment parks, to be used mainly by the MSMEs

13 Environmental Infrastructure

•

Where a unit develops its own ETP or waste treatment plant or w

ater recycling plant, capital

subsidy of 50% of the project cost with a cap of Rs. 10 crore.

• For a CETP or ETP, rebate on O&M charges as:

• Year 1 and 2: 75%

• Year 3 and 4: 50%

• Year 5: 25%

14 Other Infrastructure

Support infrastructure like roads, power, water will be provided to standalone units by contributing

50% of cost of infrastructure from IIDF with a ceiling of Rs. 1 crore subject to:

• Location is beyond 10 km from existing Industrial Estates having vacant shed

• Cost is limited to 15% of the eligible fixed capital investment

15

Development of Worker

Housing/Dormitories

Rebate on 60% of the land cost and land conversion charges (upper limit Rs. 30 lakhs per acre)

16

Capacity Building and Skill

Development Support

•

One time support of Rs. 3,000 per employee will be reimbursed incurred in skill towards

training infrastructure in garment design and development:

• Up-gradation and training the local manpower. For units employing more than 1000 persons,

training subsidy will be Rs. 5,000 per person

• Assistance to autonomous institutions: 75% assistance subject to max Rs. 1 crore towards

infrastructure creation

• New/existing center intending to upgrade their facilities: 50% of investment subject to

max. Rs. 20 lakhs per center

17 Fiber to Fabric Incentive

A unit with production of textile fiber to fabric as an integrated family will be eligible for additional 5%

subsidy on items like capital investment and power tariff

18

Returning Migrant’s Incentive

Scheme

Provisi

on of 50% of capital investment limited to Rs. 2 crore or 50% of the required beneficiary group

contribution, required to be borne by weaver group to develop Textile Parks, GoI and MSME Cluster

Development. Only those groups will be eligible that has at least 60% of members as weavers who has

migrated.

26

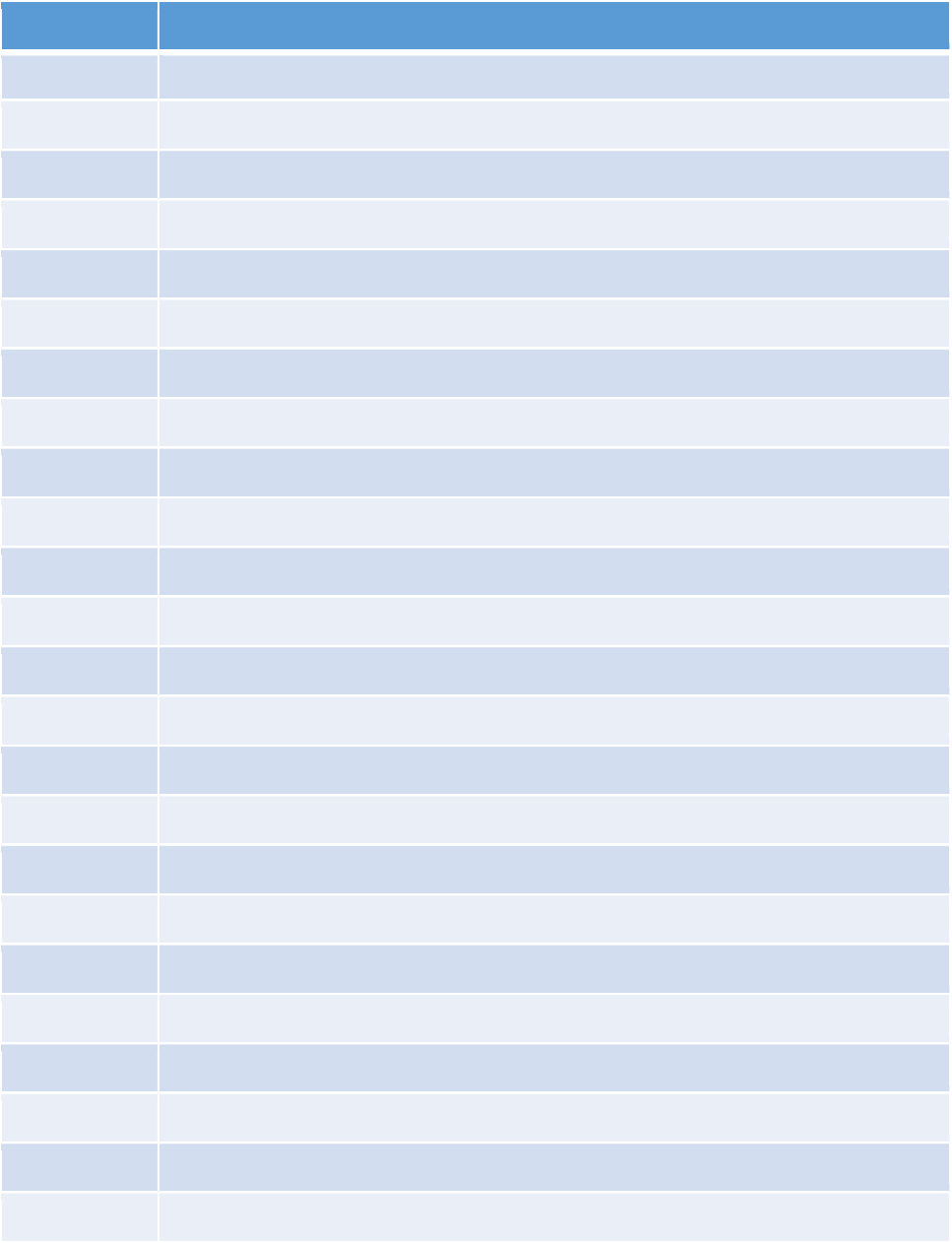

Uttar Pradesh

S.No Subsidy Type Quantum of Assistance

1 Land Cost Subsidy

50% of land cost up to 5% of total project cost (30% of land cost in GB Nagar district)

Subsidy is for land bought from govt. agencies like UPSIDC, SIDA, LIDA, etc.; govt. will ensure functional ETP in area.

2

Stamp Duty

Exemption

•

100% exemption for textile units set up in Bundelkhand, Poorvanchal, Madhyanchal and Paschimancha

(75% exemption for GB Nagar district)

• 100% exemption for the land purchased for developing infrastructure facilities*

• 100% of exemption for the sericulture chaaki, koya production, threading units

3 Capital Subsidy

25% of plant & machinery as per the following cap:

Investment (Rs. cr.) Or Minimum Employment Subsidy cap (Rs. crores)

<= 10 50 2

>10 but <=50 200 10

>50 but <=100 300 20

>100 but <=200 500 40

>200 1000 100

4 Interest Subsidy

7% for 7 years for TUFS eligible machinery up to Rs. 1.5 crores per annum per unit (Rs. 75 lakhs per annum per unit

for GB Nagar district)

5% for 5 years for infrastructure development up to Rs. 1 crore per unit

5% for 5 years for quality development up to Rs. 1 crore per lab/ tool room

2.5% additional subsidy to SC/ ST/ Women/ specially enabled entrepreneurs holding more than 75% equity in the

company (Total additional interest subsidy is capped at 7.5% and total interest subsidy can not be more than

27

payable interest)

5

SGST

Reimbursement

•

90% reimbursement for Textile units in MSME

• Textile units not in MSME:

• 90% reimbursement in poorvanchal and Bundelkhand

• 75% reimbursement in Madhyanchal and Pashchimanchal

• 60% reimbursement in GB Nagar district

Up to annual upper limit of 25% of FCI (Land, building, construction and P&M) or actual tax deposited whichever is

less for a period of 10 years

Facility of interest-free loan equal to the sum of VAT & CST or amount deposited to the extent of State’s share

under GST, under the previous textile policy, will continue to the eligible units as before.

6 Electricity Duty 100% exemption for 10 years

7 EPF Subsidy

50% reimbursement of employer’s EPF contribution for 5 years for units not covered under “Employees Provident

Fund Scheme Reforms / Pradhan Mantri Rojgar Protsahan Yojana” (Units employing > 100 workers)

60% reimbursement of employer’s EPF contribution for 5 years for units not covered under “Employees Provident

Fund Scheme Reforms / Pradhan Mantri Rojgar Protsahan Yojana” (Units employing > 200 workers)

28

Garmenting units that get E.P.F. reimbursement for 3 years under the “Employees Provident Fund Scheme Reforms

/ Pradhan Mantri Rojgar Protsahan Yojana”, will be given benefit by the State Govt. for 2 more years.

8 Others

•

Mandi fee exemption: Purchase of raw materials will be exempted for a period of 5 years for all textile

units.

• Freight subsidy for garment exporters:

• 75% for first 2 years

• 50% for next 2 years

• 25% in the 5

th

year

9

Training cost

subsidy

Difference of actual training cost and central government subsidy up to 25% of project cost

5. Annexure

HSN Codes of Garments

HSN Codes Description

61 Knitted garment

6101 Men orBoys overcoats, etc.Knit or crochet

610120 Overcoats, capes, cloaks, anoraks, etc. Of Cotton

610130 Overcoats, car-coats, etc. Of man-made fibres

610190 Overcoats, etc. Of other textile materials

6102 Womenorgirls overcoats, etc., Knit or Crochet

610210 Overcoat, etc. Wool/Fine animal hair

610220 Overcoat, Car-coat,Capes, etc. Of Cotton

610230 Overcoat,etc. Of Manmade fibres

610290 Overcoat, etc. Of other textile materials

6103 Mens or boys Suits, ensemble, etc., KNIT OR CROCH

610310 Suits

610311 Men’s, boys suits, of wool, fine animal hair, knit, Suits :-- Of wool or fine animal hair

610312 Men’s, boys suits, synthetic fibres, knit, Suits :-- Of synthetic fibres

610319 Men’s, boys suits, of materials nes, knit, Suits :-- Of other textile materials

610322 Ensemblesof Cotton

610323 Ensemblesof Synthetic fibres

610329 Ensemblesofothertextile materials

610331 Jacketsand Blazers of Wool/Fine animal hair

610332 Jacketsand Blazers of Cotton

610333 Jacketsand Blazers of Synthetic Fibres

610339 Jacketsand Blazers ofother textile material

1

HSN Codes Description

610341 Trousers,Shorts, etc. Of Wool/Fine animal hair

610342 Trousers,Shorts, etc. Of Cotton

610343 Trousers,Shorts, etc. Of Synthetic Fibres

610349 Trousers,Shorts, etc. Of other textile materials

6104 Women’sor Girls Suits, ensemble, etc., Knit or Crochet

610413 Suitsof Synthetic Fibres

610419 Suitsofother textile material

610422 Ensembles of cotton

610423 Ensembles of synthetic fibres

610429 Ensembles of other textile materials

610431 Jackets of wool or fine animal hair

610432 Jackets of cotton

610433 Jackets of synthetic fibres

610439 Jackets of other textile materials

610441 Dresses of wool or fine animal hair

610442 Dresses of cotton

610443 Dresses of synthetic fibres

610444 Dresses of artificial fibres

610449 Dresses of other textile materials

610451 Skirts and divided skirts of wool or fine animal hair

610452 Skirts and divided skirts of cotton

610453 Skirts and divided skirts of synthtc fibres

610459 Skrts and divided skrts of other txtl matrls

610461 Trousers,bib and brace overalls,breeches and shorts of wool/fne animal hair

2

HSN Codes Description

610462 Trsrs,bibs,brc ovrlls,brchs,shrts of cotn

610463 Trousers,bib and brace overalls,breeches and shorts of synthetic fibres

610469 Trousers,bib and brace overalls,breeches and shorts of other textile materials

6105 Mens or boys shirts, knitted or crocheted

610510 Mens/boys shirts of cotton

610520 Mens/boys shirts of man-made fibres

610590 Shirts of othr textile material

6106 Womens or girls blouses & shirts, knit or croch

610610 Blouse etc of cotton

610620 Blouse etc of man-made fibres

610690 Blouses etc of othr textile materials

6107 Mens or boys underpants, pgs, etc, knit or croch

610711 Underpants and briefs of cotton

610712 Underpants and briefs of manmade fbrs

610719 Undrpnts and briefs of othr textile matrls

610721 Nightshirts and pyjamas of cotton

610722 Nightshirts and pyjamas of manmade fibres

610729 Nightshirts and pyjamas of othr txtl matrls

610791 Bathrobs dressing gown etc.of cotton

610799 Bathrobs etc.of other textile materials

6108 Womens or girls slips, pjs, etc, knit or crochet

610811 Slips and petticoats of man-made fibres

610819 Slips and petticoats of other txtl matrls

610821 Briefs and panties of cotton

3

HSN Codes Description

610822 Briefs and panties of man-made fibres

610829 Briefs and panties of other textle matrls

610831 Nightdresses and pyjamas of cotton

610832 Nightdresses and pyjamas of man-made fibres

610839 Nightdresses and pyjamas of othr txtl matrls

610891 Negliges,bathrobes, etc. of cotton

610892 Negliges,bathrobes, etc. of man-made fibres

610899 Negliges, bathrobes, etc. of othr txtl matrls

6109 T-shirts, singlets, tank tops etc., knit or crochet

610910 T-shirts etc of cotton

610990 T-shirt etc of other textile materials

6110 Sweaters, pullovers, vests etc, knit or crochet

611011 Jerseys, pullovers, cardigans etc of wool

611012 Jerseys etc of kashmiri goats

611019

Jerseys, pullovers, cardigans, waistcoats and similar articles; knitted or crocheted, of

fine animal hair other than that of Kashmir (cashmere) goats

611020 Jerseys etc of cotton

611030 Jerseys etc of man-made fibres

611090 Jersey etc of other txtl matrls

6111 Babies garments & accessories, knit or crocheted

611120 Babies garments etc of cotton

611130 Babies garments etc of synthic fbrs

611190 Babies grmnts etc of othr txtl matrls

6112 Track suits, ski-suits & swimwear, knit or crochet

611211 Track suits of cotton

4

HSN Codes Description

611212 Track suits of synthetic fibres

611219 Track suits of othr txtl matrls

611220 Ski suits

611231 Mens/boys swimwear of synthtc fbrs

611239 Mens/boys swimwear of othr txtl matrls

611241 Womens/girls swimwear of synthtc fbrs

611249 Womens/girls swmwear of othr txtl matrls

6113 Garments, knit etc, coated etc rubber, plastic etc

611300 Grmnts,made up of knttd/crchtd fabrics of hdng no. 5903 5906 or 5907

6114 Garments nesoi, knitted or crocheted

611420 Other garments of cotton

611430 Other garments of man-made fibres

611490 Othr grmnts of othr textile materials

6115 Pantyhose, socks & other hosiery, knit or crochet

611510 Graduated compression hosiery for example, (stockings for varicose veins)

611511

Panty hose etc., synthetic fibre yarn <67 dtex/sy, knit, Panty hose and tights :

-

Panty

hose and tights :-- Of synthetic fibres, measuring per single yarn less than 67 decitex

611512

Panty hose etc., synthetic fibre yarn >67

dtex/sy, knit, Panty hose and tights :

-

Panty

hose and tights :-- Of synthetic fibres, measuring per single yarn 67 decitex or more

611519

Panty hose etc of materials nes, knit, Panty hose and tights :

--

Of other textile

materials

611520

Womens full, kn

eelength hosiery, yarn <67 dtex/sy,knit, Women's full

-

length or knee

-

length hosiery, measuring per single yarn less than 67 decitex

611521 Of synthetic fibres, measuring per single yarn less than 67 decitex

611522 Of synthetic fibres, measuring per single yarn 67 decitex or more

611529 Of other textile materials:

611530 Other womens full-length or knee-length hosiery, measuring per single yarn less than

5

HSN Codes Description

67 decitex

611591 Hosiery nes, of wool or fine animal hair, knit, Other :-- Of wool or fine animal hair

611592 Hosiery nes, of cotton, knit, Other :-- Of cotton

611593 Hosiery nes, synthetic fibres, knit, Of synthetic fibres

611594 Of wool or fine animal hair

611595 Of cotton

611596

Hosiery and footwear; without applied soles, of

synthetic fibres, knitted or crocheted