PUBLIC PUBLIC PUBLIC PUBLIC

HSBC Open Banking

TPP Implementation Guide (V3.1.11)

Last Updated: 28-08-2024

PUBLIC PUBLIC PUBLIC PUBLIC

Table of Contents

1. INTRODUCTION......................................................................................................................................................... 8

2. KEY CHANGES AND ANNOUNCEMENTS..................................................................................................................... 9

3. SUMMARY OF HSBC API FUNCTIONALITY PER CHANNEL ........................................................................................ 10

4. USEFUL INFORMATION ........................................................................................................................................... 12

4.1. CUSTOMER UI JOURNEYS ................................................................................................................................................ 12

4.2. TPP REGISTRATION ....................................................................................................................................................... 12

4.2.1. Software Statement .............................................................................................................................................. 12

4.2.2. Onward Provisioning – TPP / Agent name display options ................................................................................... 14

4.2.3. Implemented Endpoints ........................................................................................................................................ 15

4.2.4. Supported token_endpoint_auth_method ............................................................................................................ 16

4.2.5. MTLS when token_endpoint_auth_method is tls_client_auth .............................................................................. 17

4.3. AUTHENTICATION JOURNEY ............................................................................................................................................. 18

4.4. CONSENT EXPIRY DATE ................................................................................................................................................... 18

4.5. AUTHORISATION CODE IN OAUTH AUTHORISATION FRAMEWORK ........................................................................................... 19

4.6. MESSAGE SIGNING - X-JWS-SIGNATURE ............................................................................................................................. 20

4.7. CONSENT OBJECT STATUSES ............................................................................................................................................ 20

4.8. OBWAC / EIDAS CERTIFICATES ...................................................................................................................................... 20

4.8.1. Test Certificate ...................................................................................................................................................... 20

4.8.2. Certificate Requirements ....................................................................................................................................... 21

4.8.3. Certificate Refresh / Replacement ......................................................................................................................... 21

4.9. BUSINESS BANKING ENTITLEMENTS ................................................................................................................................... 21

4.10. UK IP ADDRESS WHITELISTING AND GRATING USER ACCESS FOR HSBCNET USERS ...................................................................... 22

5. ACCOUNTS AND TRANSACTIONS SUMMARY .......................................................................................................... 24

5.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 24

5.1.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 24

5.1.2. HSBC Business Banking .......................................................................................................................................... 25

5.1.3. HSBC Kinetic .......................................................................................................................................................... 26

5.1.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 26

5.2. IN-SCOPE PRODUCTS ...................................................................................................................................................... 27

5.2.1. HSBC Personal ....................................................................................................................................................... 27

5.2.2. first direct .............................................................................................................................................................. 27

5.2.3. M&S Bank .............................................................................................................................................................. 28

5.2.4. HSBC Business ....................................................................................................................................................... 28

5.2.5. HSBC Kinetic .......................................................................................................................................................... 28

5.2.6. HSBC Corporate UK (HSBCnet UK) * ...................................................................................................................... 29

5.2.7. HSBC Innovation Banking (HSBCnet UK) ............................................................................................................... 29

6. ACCOUNT REQUESTS API ........................................................................................................................................ 30

6.1. OVERVIEW ................................................................................................................................................................... 30

6.2. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 30

6.2.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 30

6.2.2. HSBC Business ....................................................................................................................................................... 31

6.2.3. HSBC Kinetic .......................................................................................................................................................... 31

6.2.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 31

6.3. KEY INFORMATION ABOUT ACCOUNT IDENTIFICATION........................................................................................................... 32

6.4. CREDIT CARD PRODUCT BEHAVIOUR (REPLACEMENT CARDS) ................................................................................................. 32

6.5. CURRENT ACCOUNT SWITCHING RESPONSES (HSBC RETAIL AND BUSINESS BRANDS) ................................................................. 33

7. BALANCES API ......................................................................................................................................................... 34

7.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 34

7.1.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 34

3

PUBLIC

7.1.2. HSBC Business ....................................................................................................................................................... 34

7.1.3. HSBC Kinetic .......................................................................................................................................................... 34

7.1.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 34

7.2. BALANCE TYPE .............................................................................................................................................................. 35

7.2.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 35

7.2.2. HSBC Business ....................................................................................................................................................... 35

7.2.3. HSBC Kinetic .......................................................................................................................................................... 36

7.2.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 36

8. TRANSACTIONS API ................................................................................................................................................. 37

8.1. OVERVIEW ................................................................................................................................................................... 37

8.1.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 37

8.1.2. HSBC Business ....................................................................................................................................................... 37

8.1.3. HSBC Kinetic .......................................................................................................................................................... 37

8.1.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 38

8.2. TRANSACTION HISTORY .................................................................................................................................................. 38

8.3. LIFESPAN OF NEXT LINKS ................................................................................................................................................. 39

8.4. TRUNCATION ................................................................................................................................................................ 39

8.5. TRANSACTION ORDERING ................................................................................................................................................ 41

8.6. PAGINATION ................................................................................................................................................................. 41

8.7. DATE FILTERING ............................................................................................................................................................ 41

8.8. TIME FILTERING ............................................................................................................................................................ 41

8.9. BOOKED AND PENDING TRANSACTIONS ............................................................................................................................. 41

8.10. RESPONSE FIELDS .......................................................................................................................................................... 42

8.10.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 42

8.10.2. HSBC Business ....................................................................................................................................................... 43

8.10.3. HSBC Kinetic .......................................................................................................................................................... 44

8.10.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 45

8.11. MUTABILITY FLAG ......................................................................................................................................................... 45

8.12. RESTRICTED DATA FOR LASTING CONSENTS (ALSO KNOWN AS ARTICLE 10A ACCESS) .................................................................. 46

9. BENEFICIARIES API .................................................................................................................................................. 47

9.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 47

9.1.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 47

9.1.2. HSBC Business ....................................................................................................................................................... 47

9.1.3. HSBC Kinetic .......................................................................................................................................................... 47

9.1.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 48

10. DIRECT DEBITS API .................................................................................................................................................. 50

10.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 50

10.1.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 50

10.1.2. HSBC Business ....................................................................................................................................................... 50

10.1.3. HSBC Kinetic .......................................................................................................................................................... 50

10.1.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 50

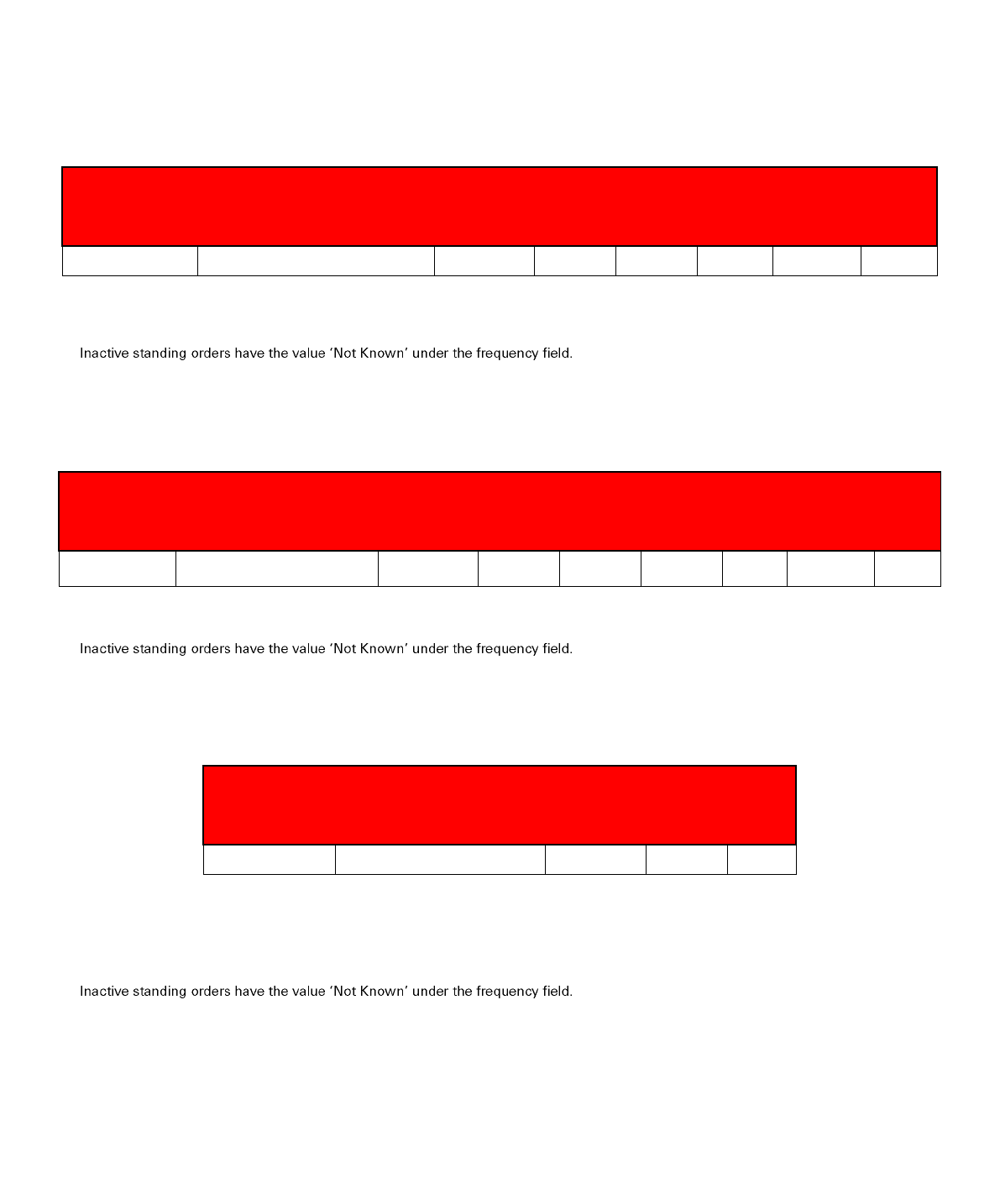

11. STANDING ORDERS API ........................................................................................................................................... 51

11.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 51

11.1.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 51

11.1.2. HSBC Business ....................................................................................................................................................... 51

11.1.3. HSBC Kinetic .......................................................................................................................................................... 51

11.1.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet (Not Implemented) .............................................. 52

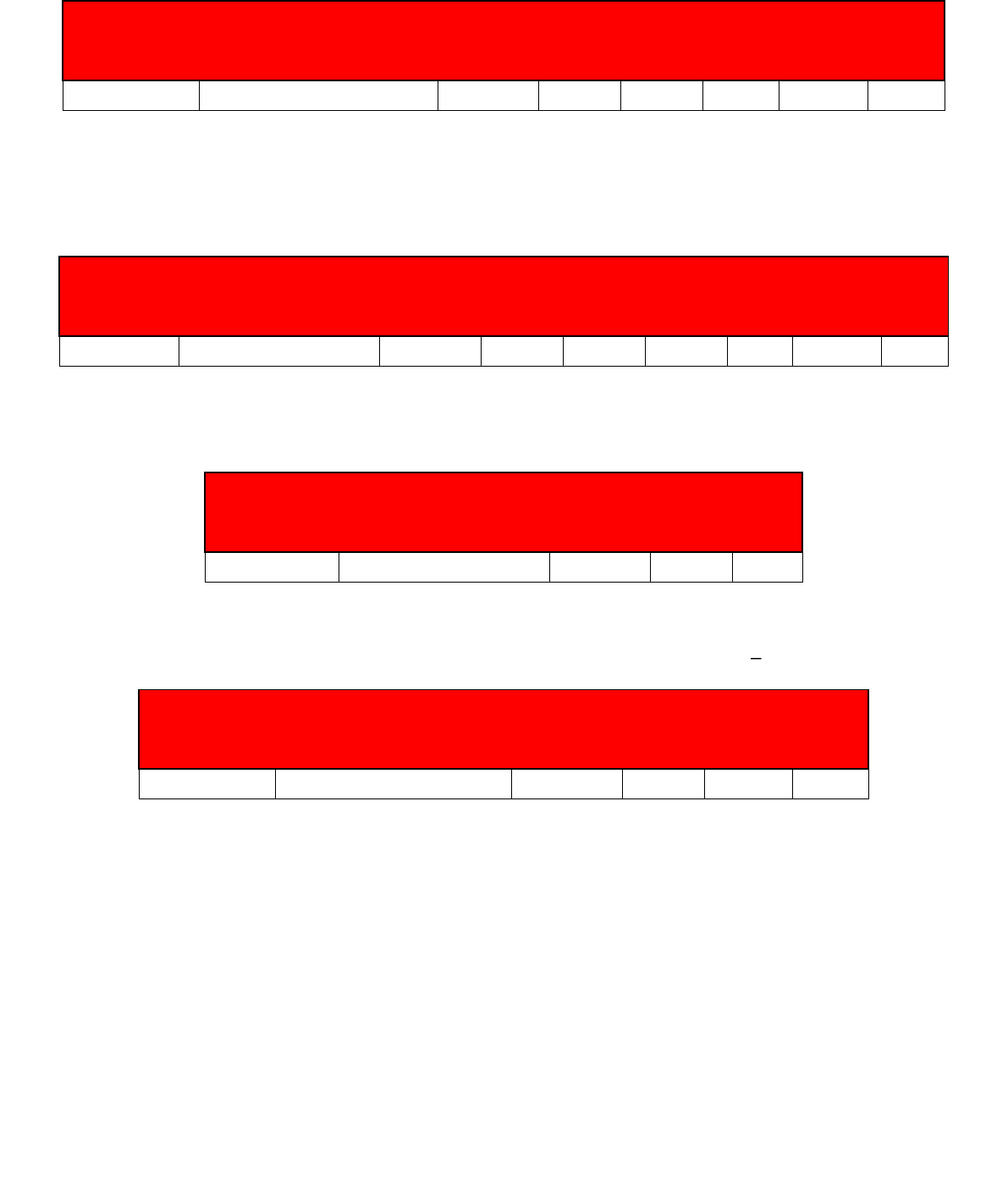

12. PRODUCTS API ........................................................................................................................................................ 52

12.1. OVERVIEW ................................................................................................................................................................... 52

12.2. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 53

12.2.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 53

12.2.2. HSBC Business ....................................................................................................................................................... 53

4

PUBLIC

12.2.3. HSBC Kinetic .......................................................................................................................................................... 53

12.2.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 53

13. PARTY API ............................................................................................................................................................... 54

13.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 54

13.1.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 54

13.1.2. HSBC Business ....................................................................................................................................................... 54

13.1.3. HSBC Kinetic .......................................................................................................................................................... 54

13.1.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 54

13.2. PERMISSIONS ................................................................................................................................................................ 55

13.3. DATA .......................................................................................................................................................................... 55

14. SCHEDULED PAYMENTS API .................................................................................................................................... 56

14.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 56

14.1.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 56

14.1.2. HSBC Business ....................................................................................................................................................... 56

14.1.3. HSBC Kinetic .......................................................................................................................................................... 56

14.1.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 56

15. OFFERS API ............................................................................................................................................................. 57

15.1. OVERVIEW ................................................................................................................................................................... 57

15.2. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 57

15.2.1. HSBC Personal, M&S Bank ..................................................................................................................................... 57

15.3. OFFERS TYPE ................................................................................................................................................................ 57

15.4. RESPONSE FIELDS........................................................................................................................................................... 58

15.4.1. HSBC Personal, M&S Bank ..................................................................................................................................... 58

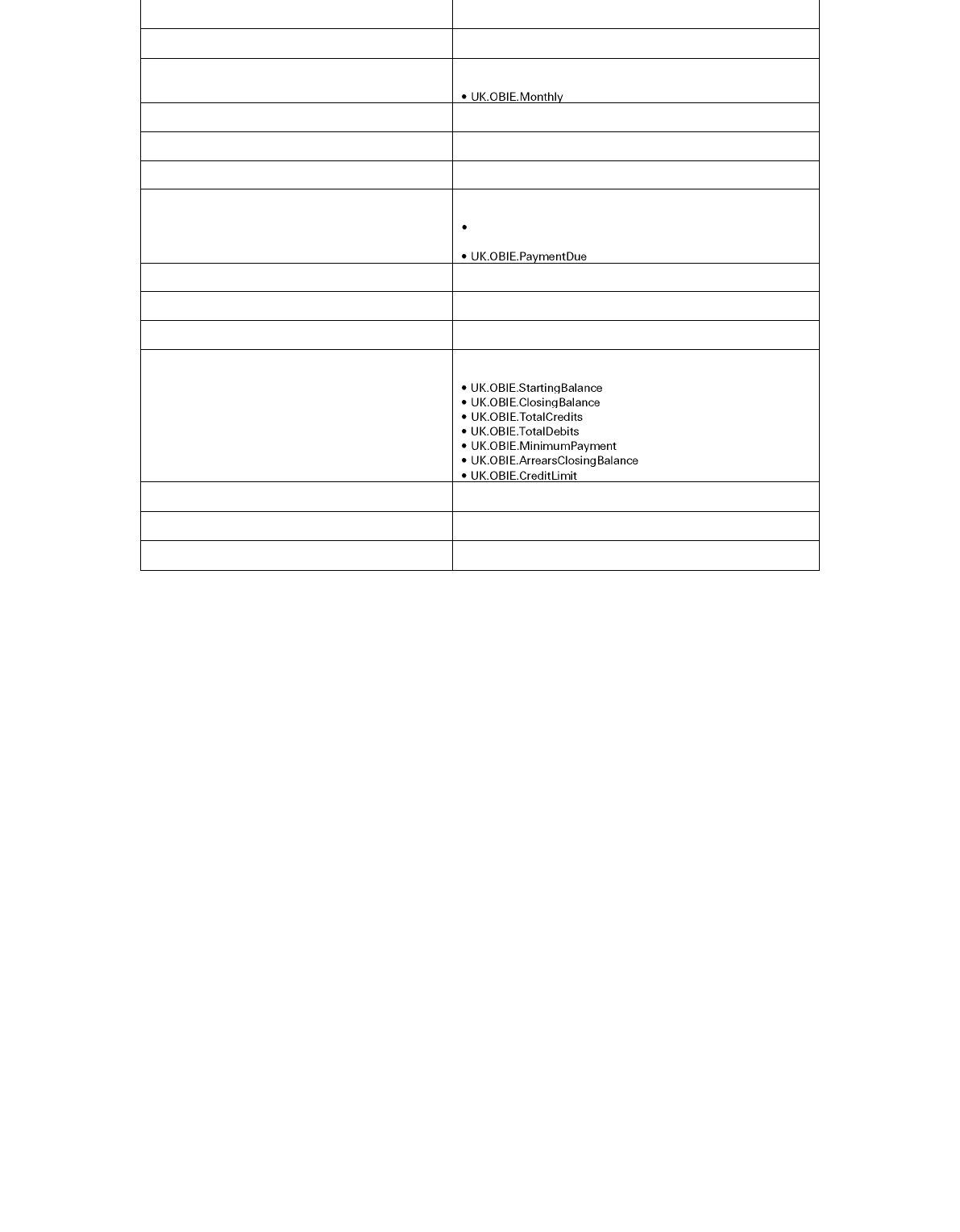

16. STATEMENTS API .................................................................................................................................................... 59

16.1. OVERVIEW ................................................................................................................................................................... 59

16.2. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 60

16.2.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 60

16.2.2. HSBC Business ....................................................................................................................................................... 60

16.2.3. HSBC Kinetic .......................................................................................................................................................... 60

16.3. RESPONSE FIELDS........................................................................................................................................................... 61

16.3.1. HSBC Personal, first direct, M&S Bank .................................................................................................................. 61

16.3.2. HSBC Business, Kinetic ........................................................................................................................................... 62

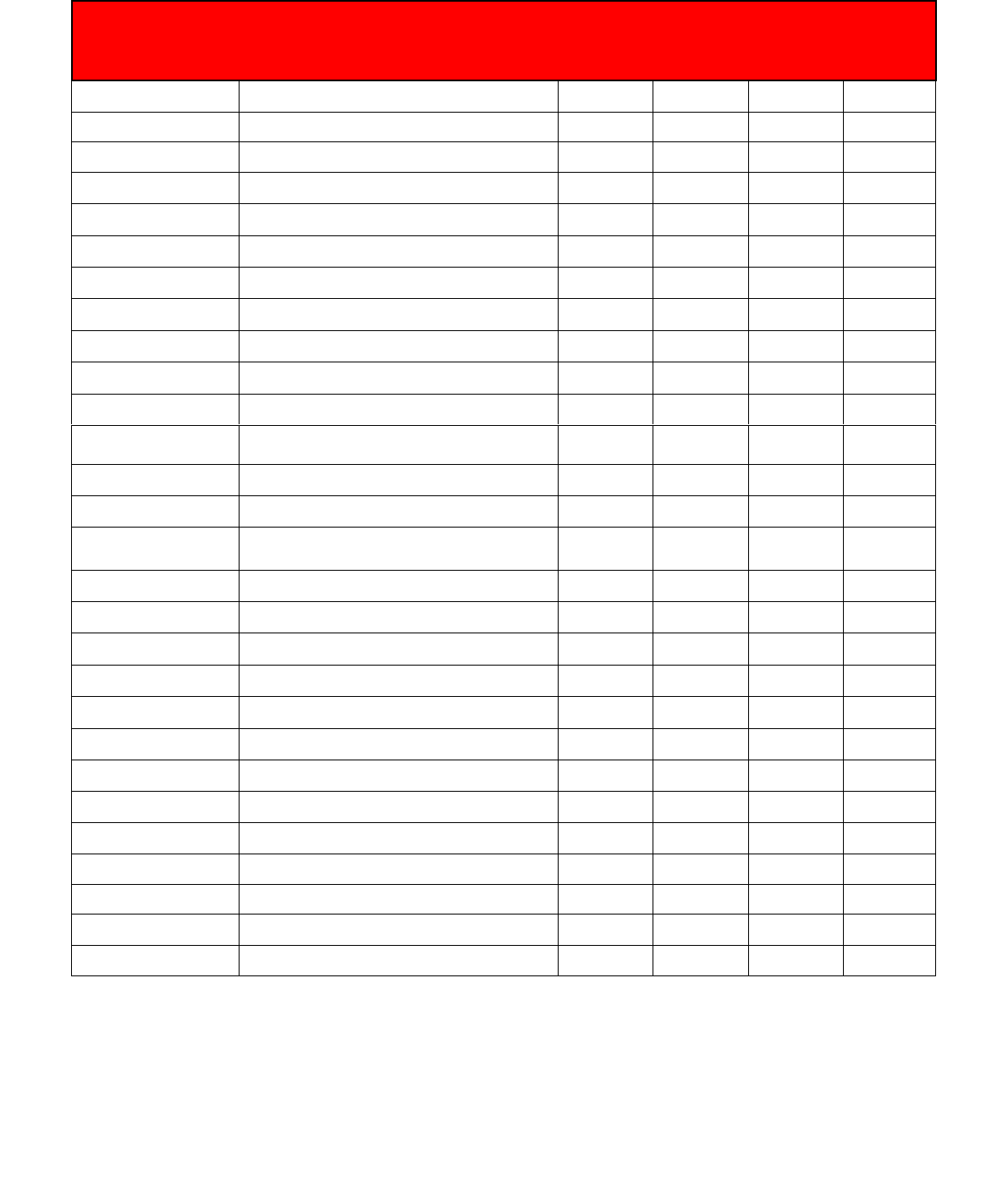

17. PAYMENT INITIATION SUMMARY ........................................................................................................................... 65

17.1. PAYMENT LIMITS ........................................................................................................................................................... 65

17.1.1. HSBC Personal ....................................................................................................................................................... 65

17.1.2. first direct .............................................................................................................................................................. 65

17.1.3. HSBC Business ....................................................................................................................................................... 65

17.1.4. HSBC Kinetic .......................................................................................................................................................... 65

17.1.5. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 65

17.2. HSBC BUSINESS – KEY PIS INFORMATION ......................................................................................................................... 66

17.3. FASTER PAYMENTS ........................................................................................................................................................ 66

17.4. PAYMENTS REFUNDS ...................................................................................................................................................... 66

17.5. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 67

17.5.1. HSBC Personal, first direct ..................................................................................................................................... 67

17.5.2. HSBC Business ....................................................................................................................................................... 68

17.5.3. HSBC Kinetic .......................................................................................................................................................... 69

17.5.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 70

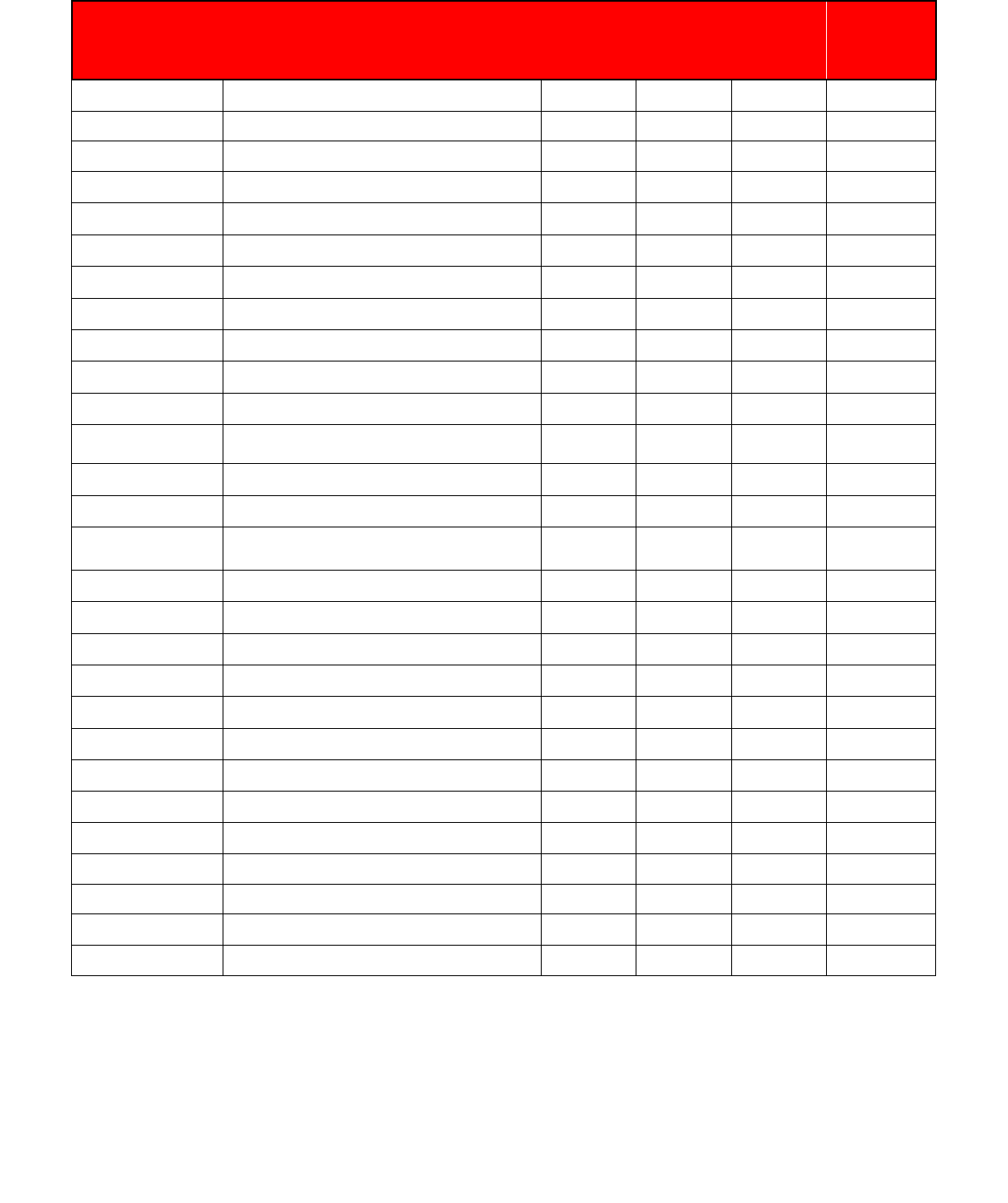

18. DOMESTIC PAYMENTS ............................................................................................................................................ 71

18.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 71

18.1.1. HSBC Personal, first direct ..................................................................................................................................... 71

18.1.2. HSBC Business ....................................................................................................................................................... 71

5

PUBLIC

18.1.3. HSBC Kinetic .......................................................................................................................................................... 71

18.1.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 72

18.2. REQUEST FIELDS ............................................................................................................................................................ 72

18.2.1. HSBC Personal, first direct ..................................................................................................................................... 72

18.2.2. HSBC Business ....................................................................................................................................................... 72

18.2.3. HSBC Kinetic .......................................................................................................................................................... 73

18.2.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 74

18.3. FEES FOR CHAPS PAYMENTS .......................................................................................................................................... 75

18.4. CUT-OFF TIME FOR CHAPS PAYMENTS ............................................................................................................................. 75

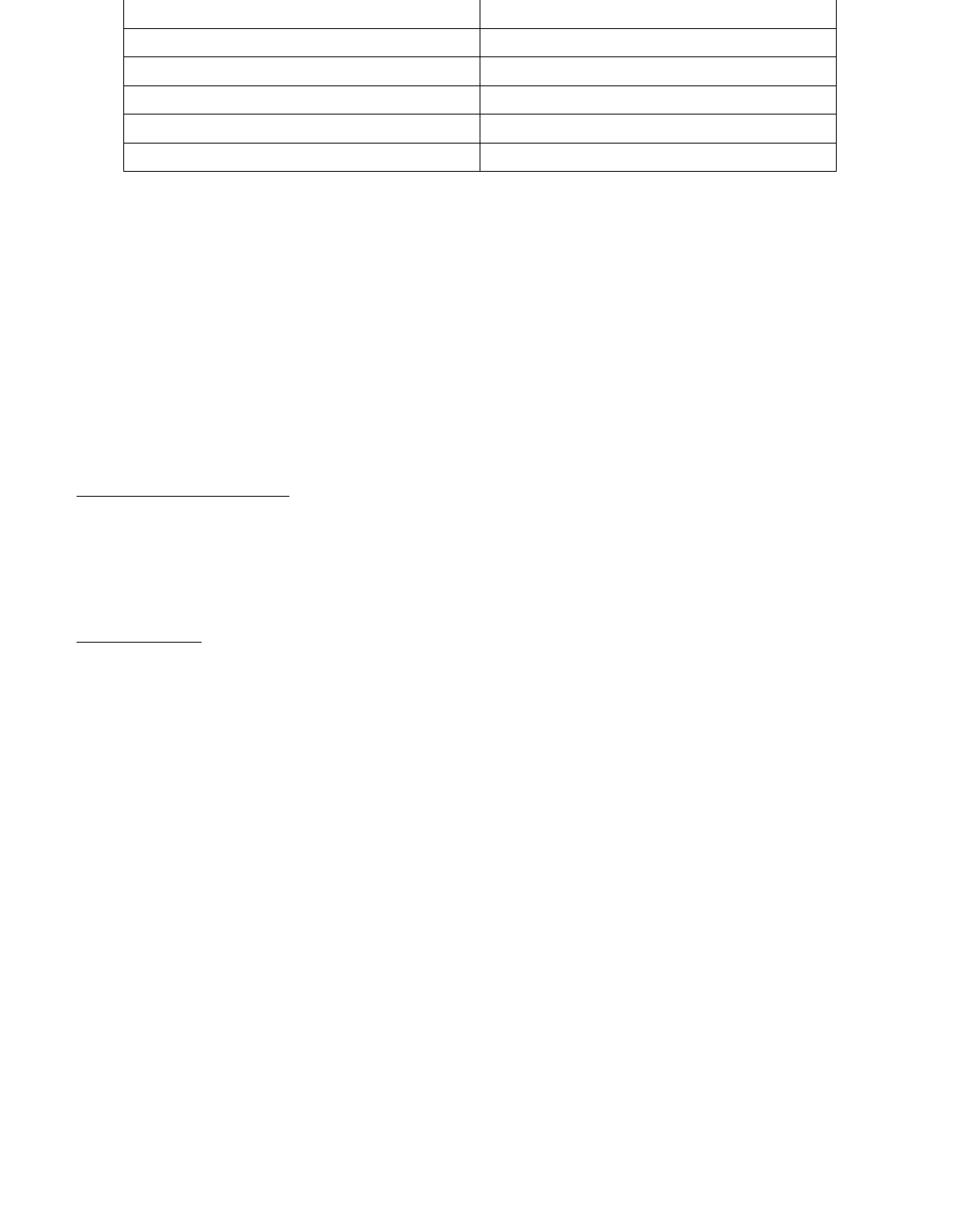

18.5. PAYMENT STATUS ......................................................................................................................................................... 76

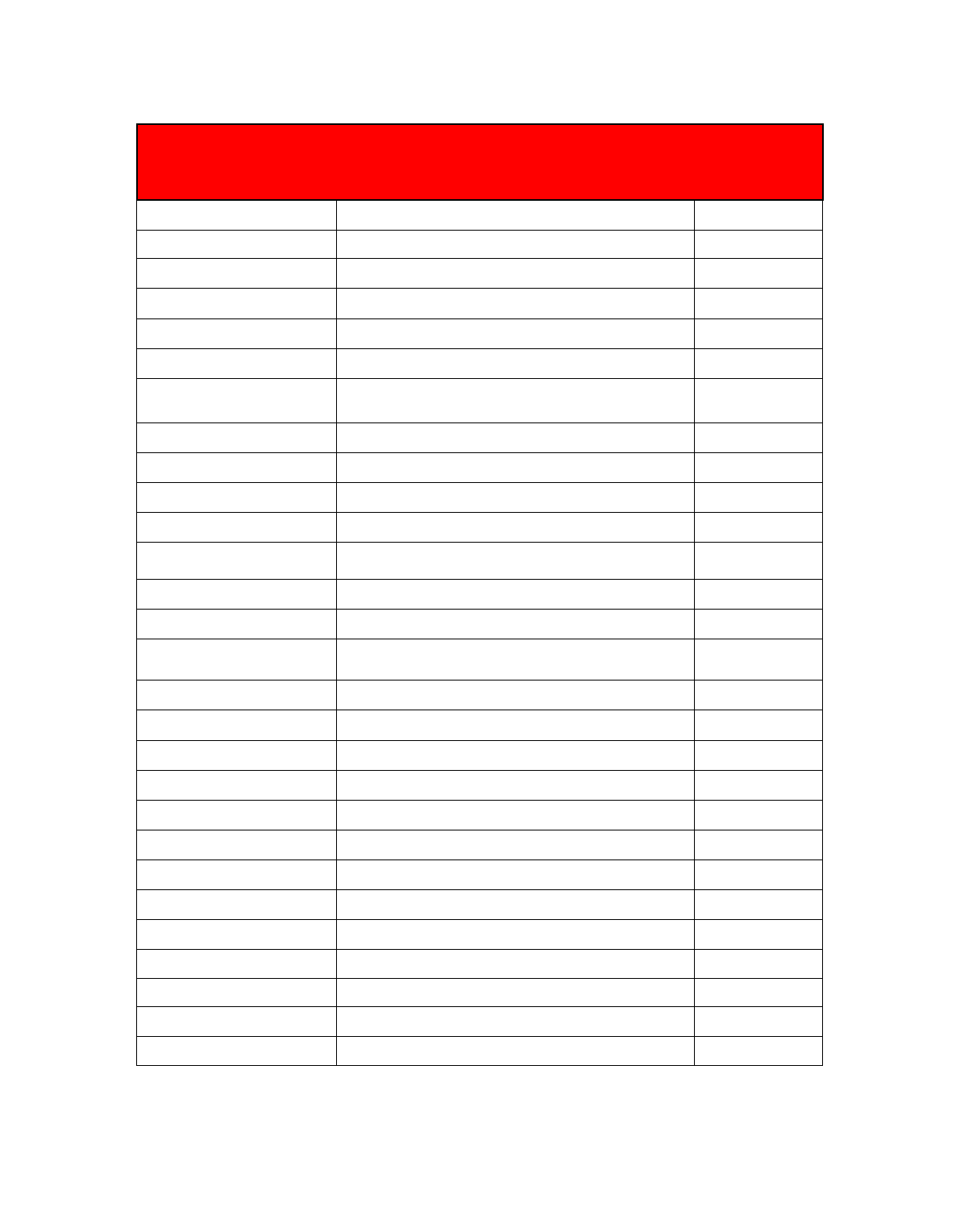

19. DOMESTIC SCHEDULED PAYMENTS ......................................................................................................................... 77

19.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 77

19.1.1. HSBC Personal, first direct ..................................................................................................................................... 77

19.1.2. HSBC Business ....................................................................................................................................................... 77

19.1.3. HSBC Kinetic .......................................................................................................................................................... 77

19.1.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 78

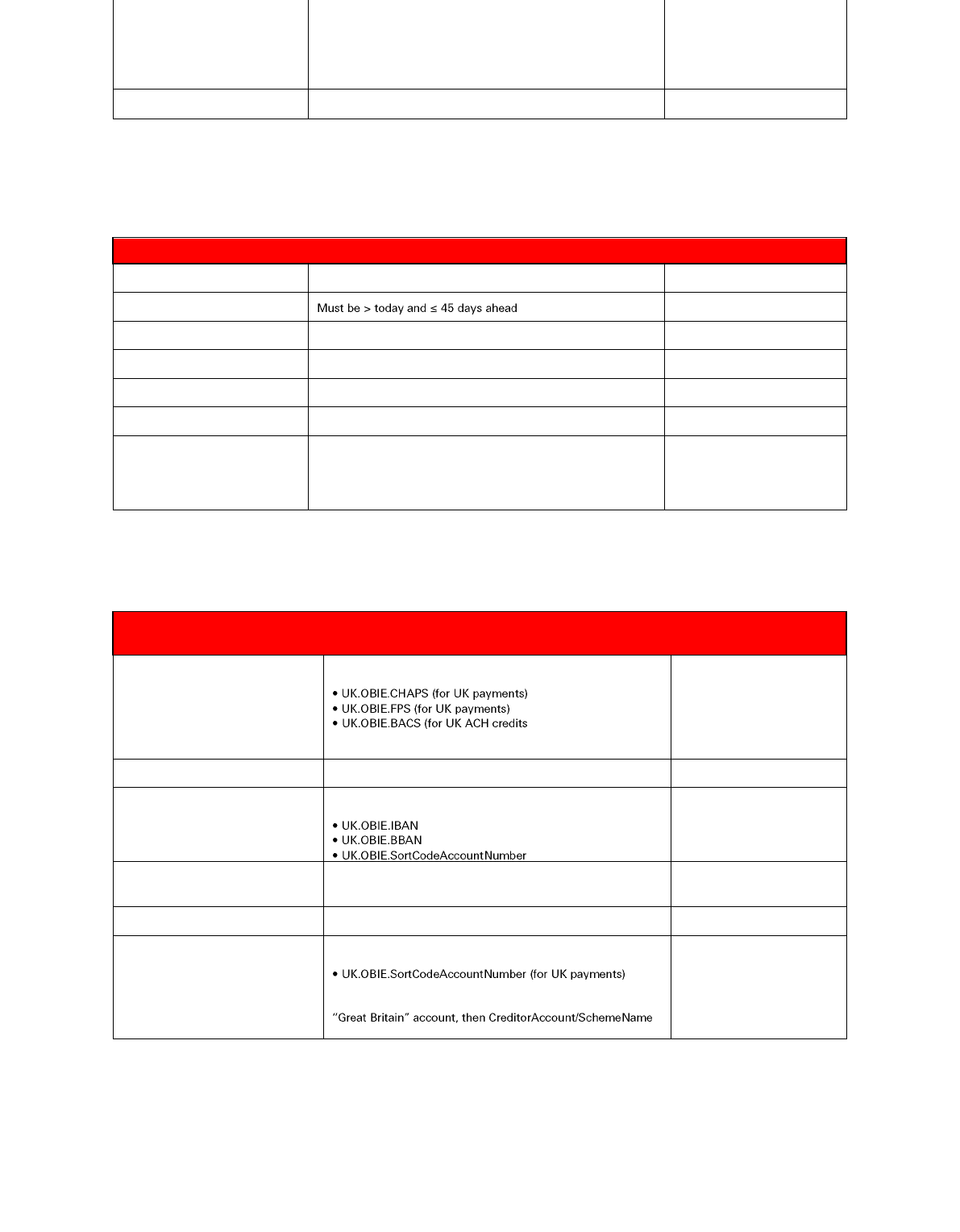

19.2. REQUEST FIELDS ............................................................................................................................................................ 78

19.2.1. HSBC Personal, first direct ..................................................................................................................................... 78

19.2.2. HSBC Business ....................................................................................................................................................... 78

19.2.3. HSBC Kinetic .......................................................................................................................................................... 79

19.2.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 79

19.3. PAYMENT STATUS ......................................................................................................................................................... 81

20. DOMESTIC STANDING ORDERS ............................................................................................................................... 82

20.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 82

20.1.1. HSBC Personal, first direct ..................................................................................................................................... 82

20.1.2. HSBC Business ....................................................................................................................................................... 82

20.1.3. HSBC Kinetic .......................................................................................................................................................... 82

20.1.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 82

20.2. REQUEST FIELDS ............................................................................................................................................................ 83

20.2.1. HSBC Personal, Business, Kinetic ........................................................................................................................... 83

20.2.2. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ............................................................................. 84

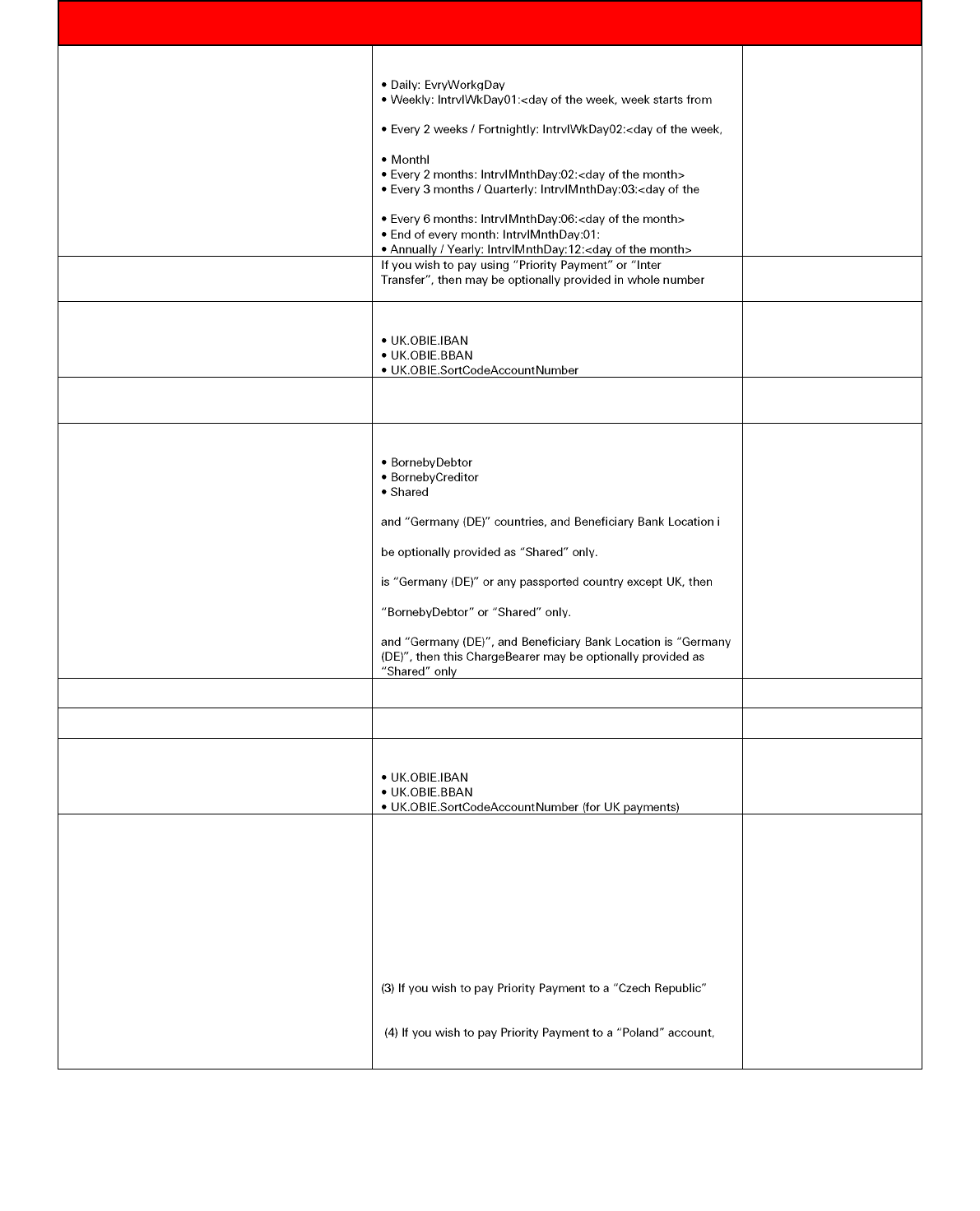

20.3. PERMITTED FREQUENCY VALUES ...................................................................................................................................... 85

20.3.1. HSBC Personal, Business and Kinetic ..................................................................................................................... 85

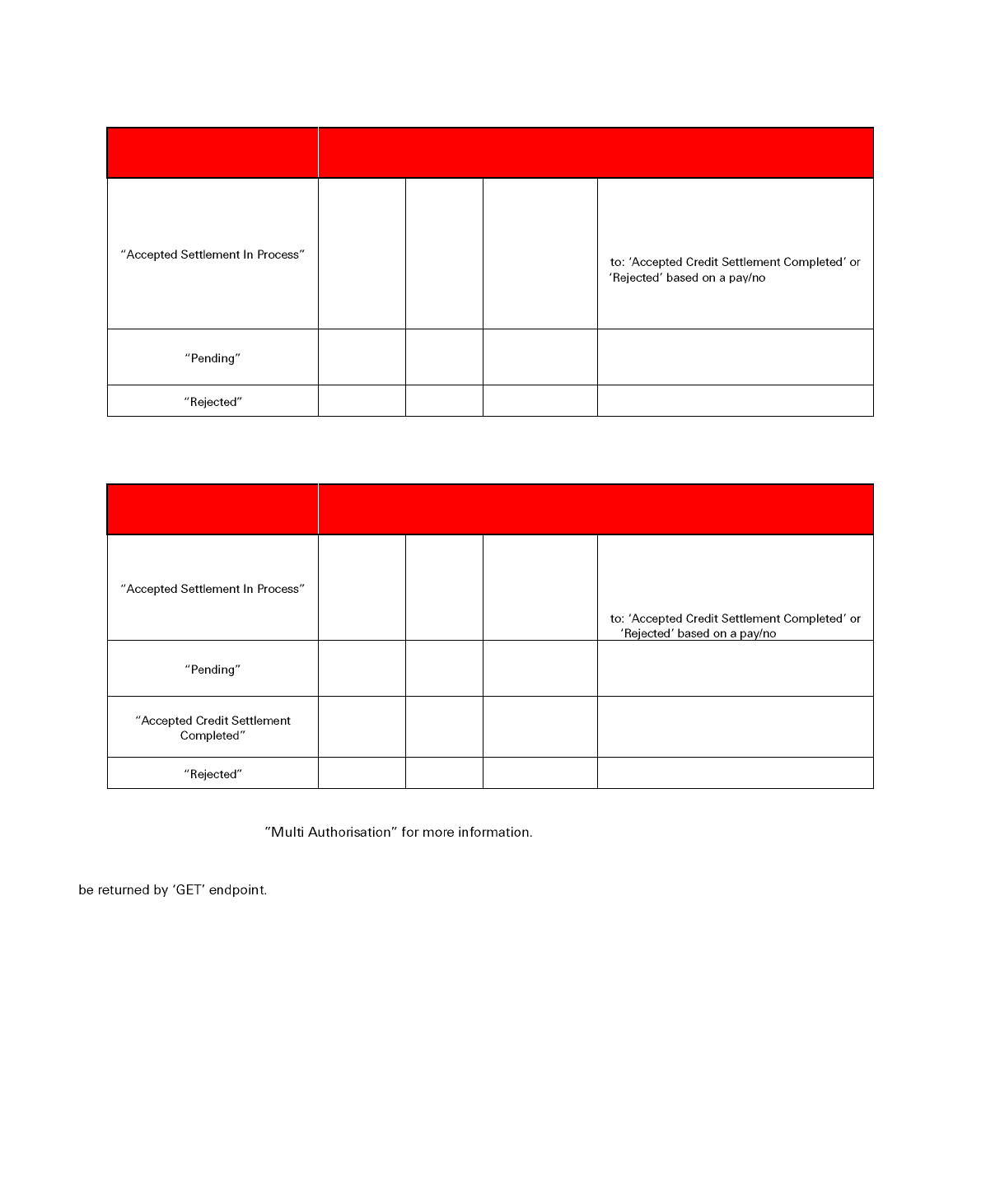

20.4. PAYMENT STATUS ......................................................................................................................................................... 87

21. INTERNATIONAL PAYMENTS ................................................................................................................................... 88

21.1. IMPLEMENTED ENDPOINTS .............................................................................................................................................. 88

21.1.1. HSBC Personal, first direct ..................................................................................................................................... 88

21.1.2. HSBC Business ....................................................................................................................................................... 88

21.1.3. HSBC Kinetic .......................................................................................................................................................... 88

21.1.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 89

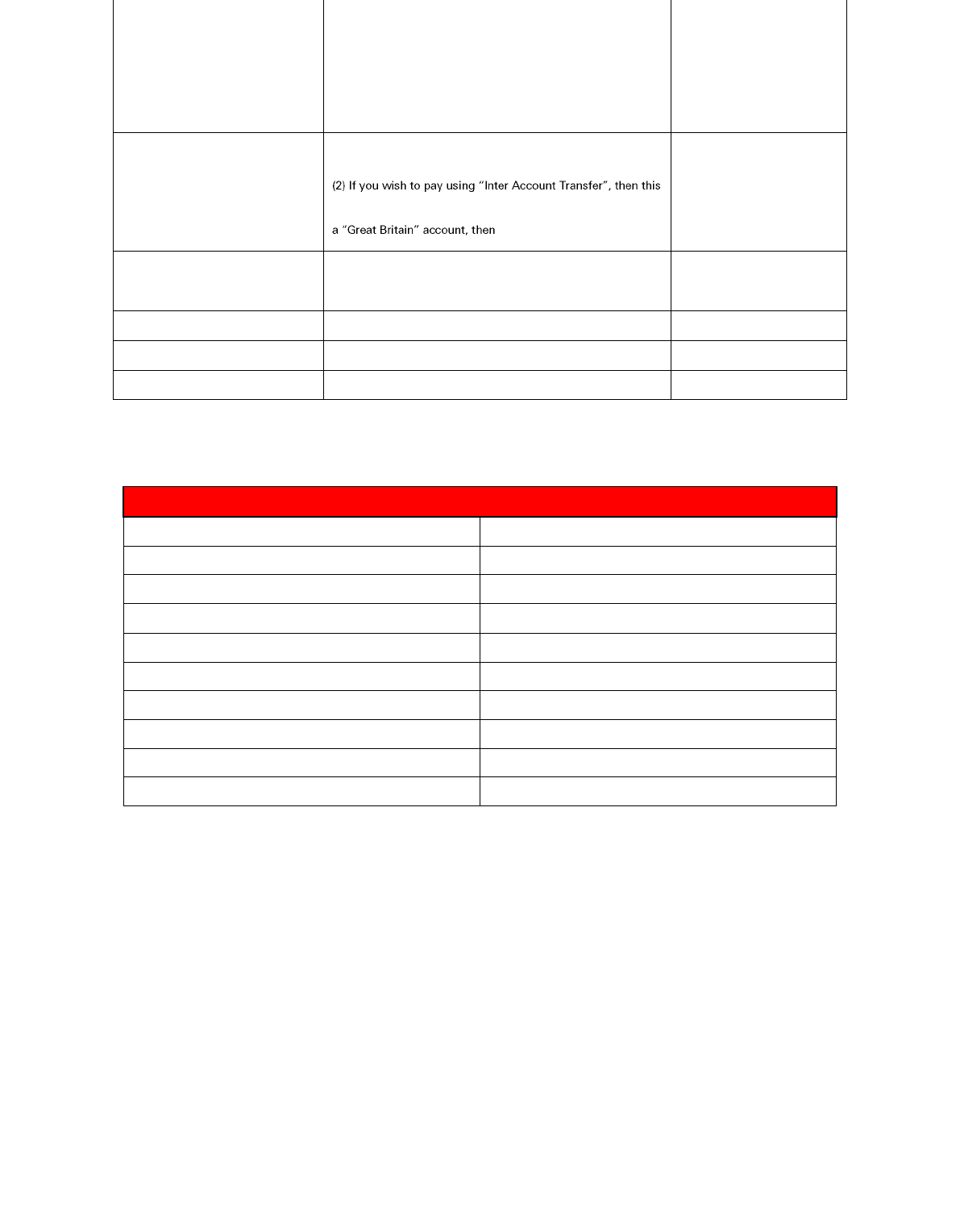

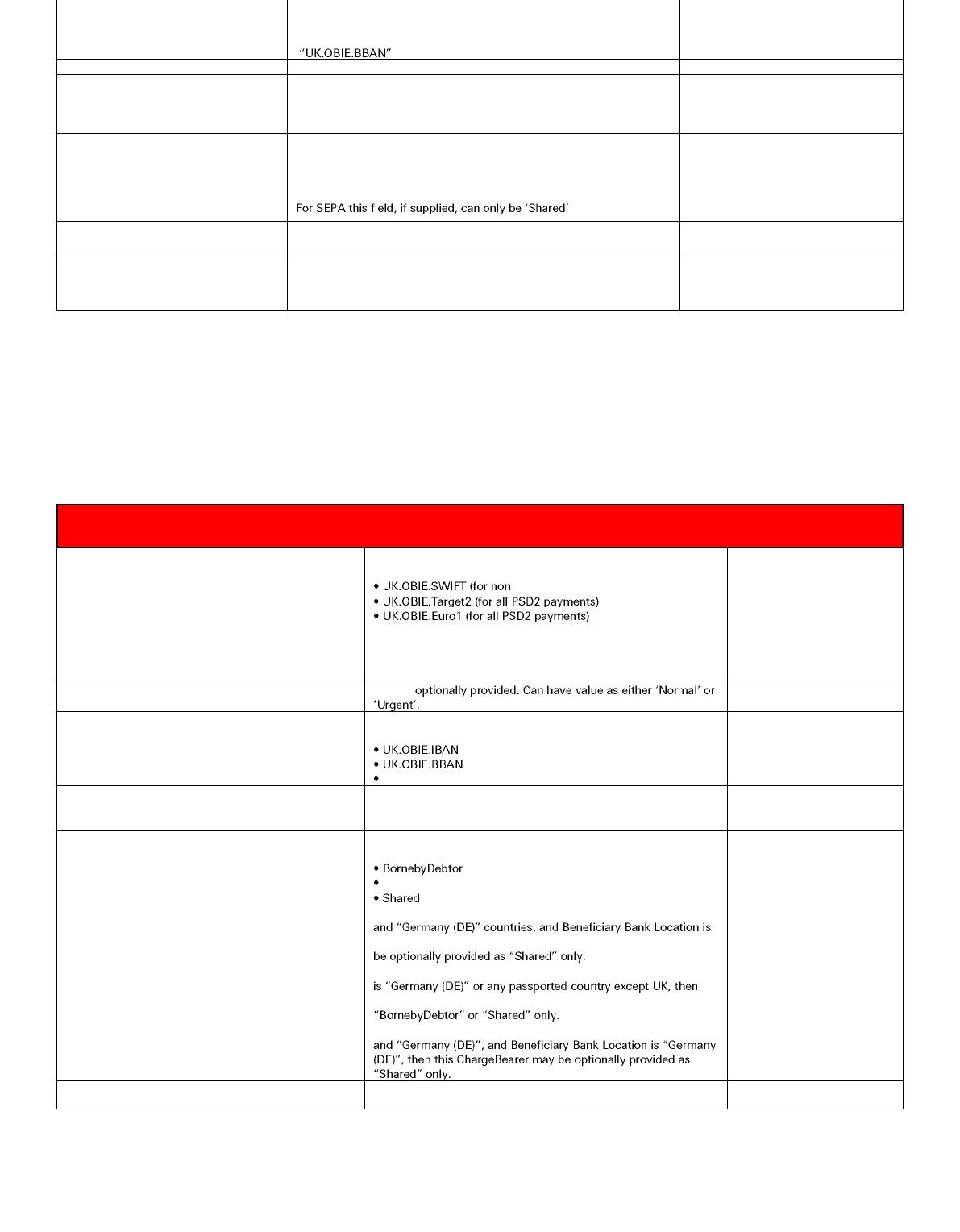

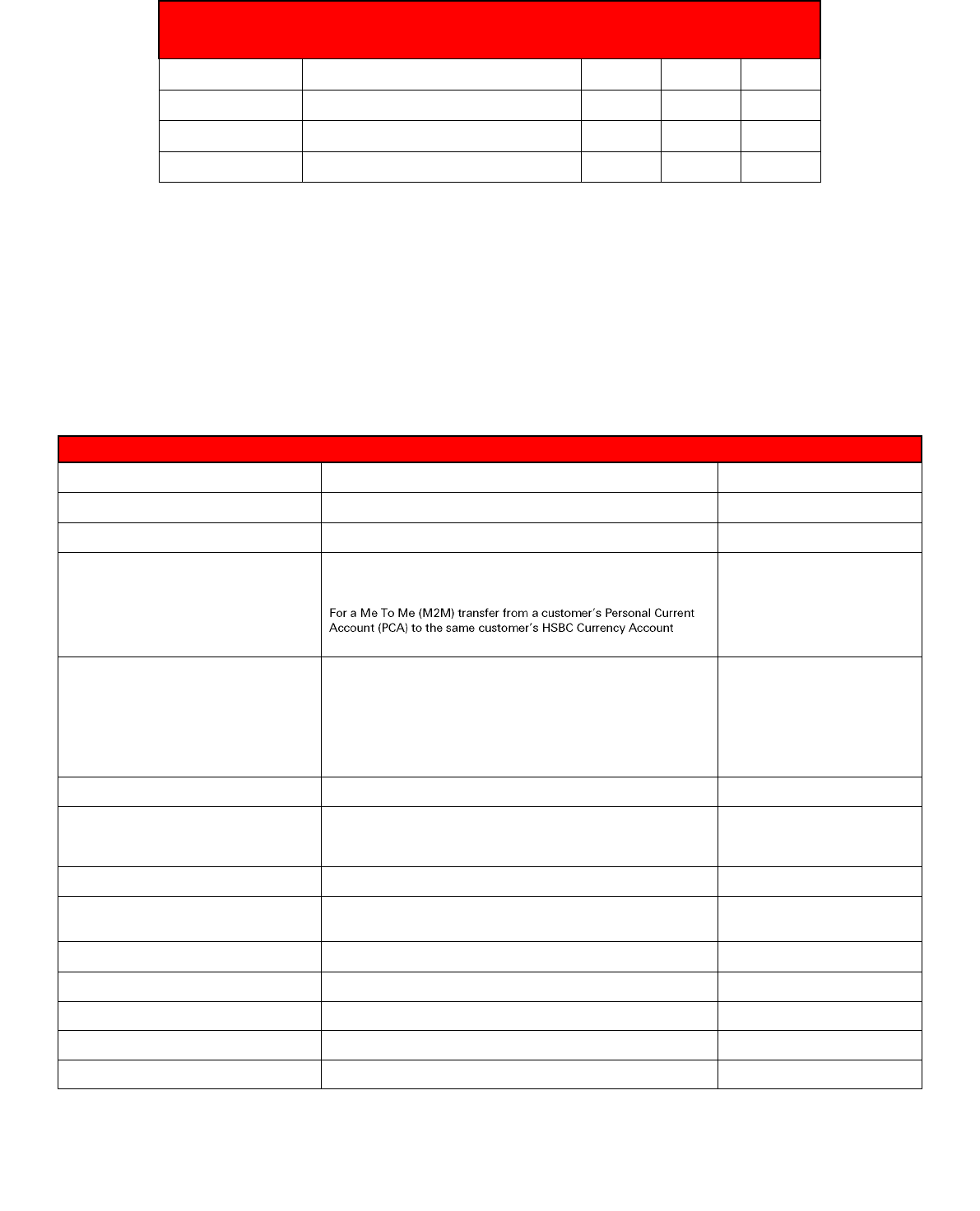

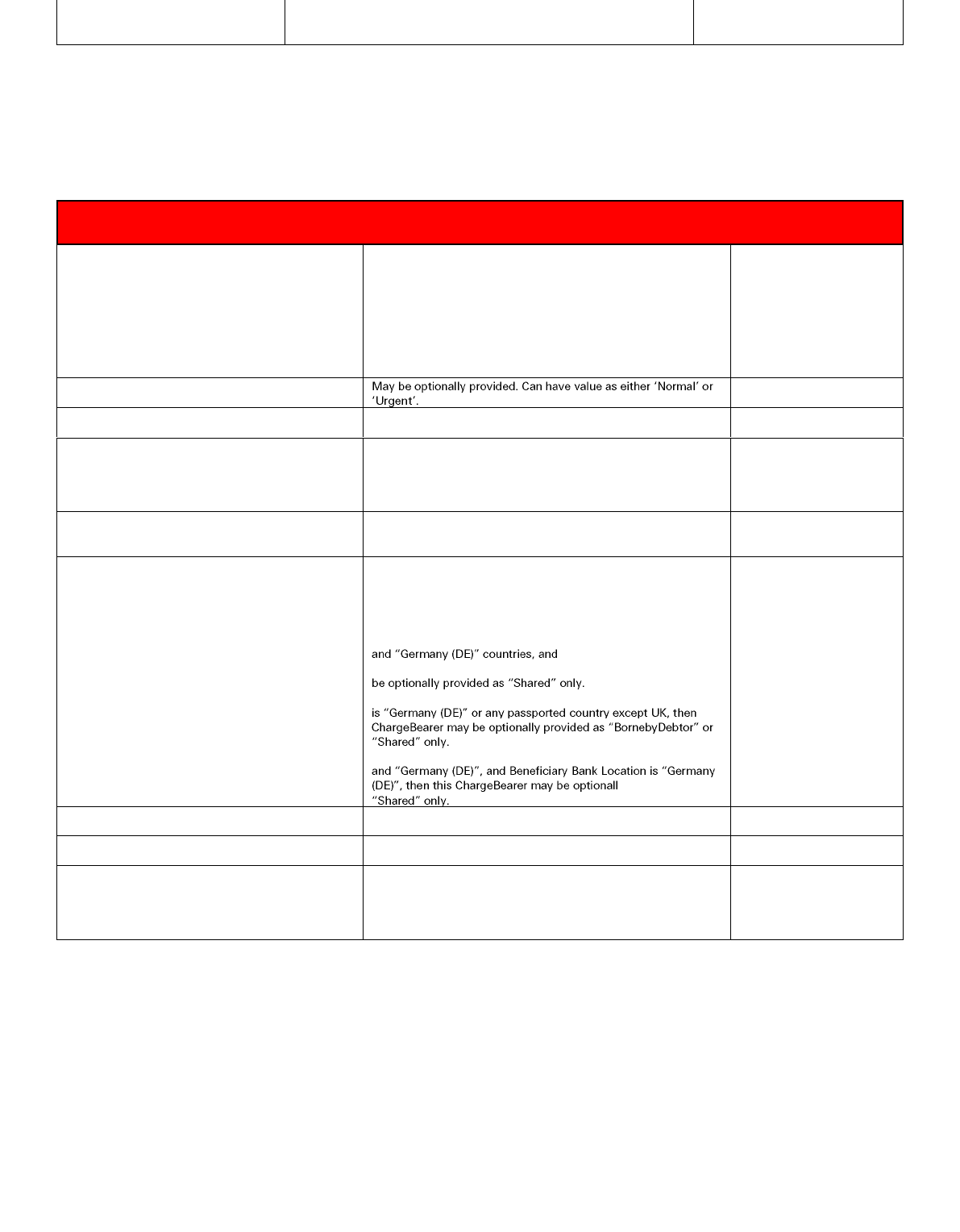

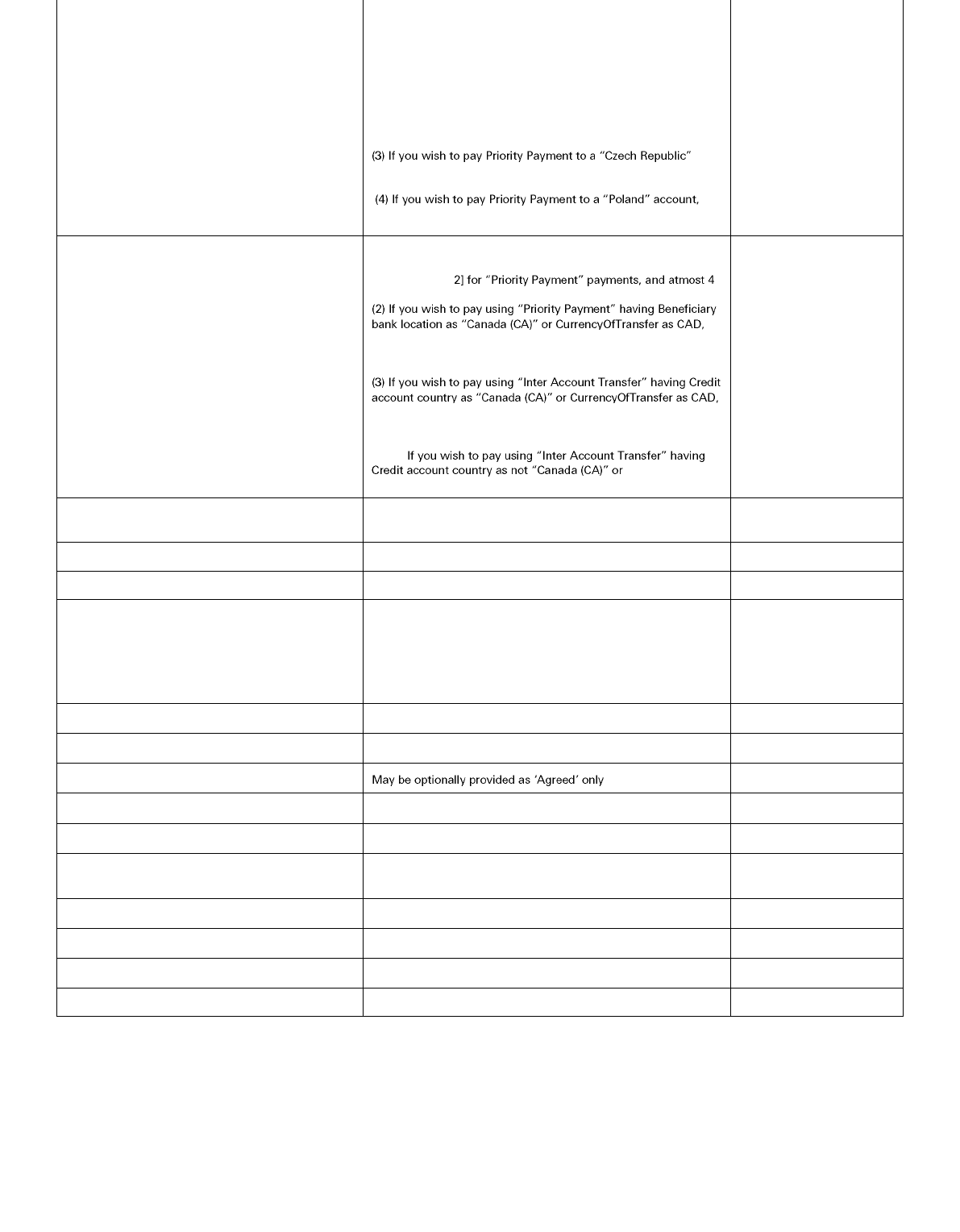

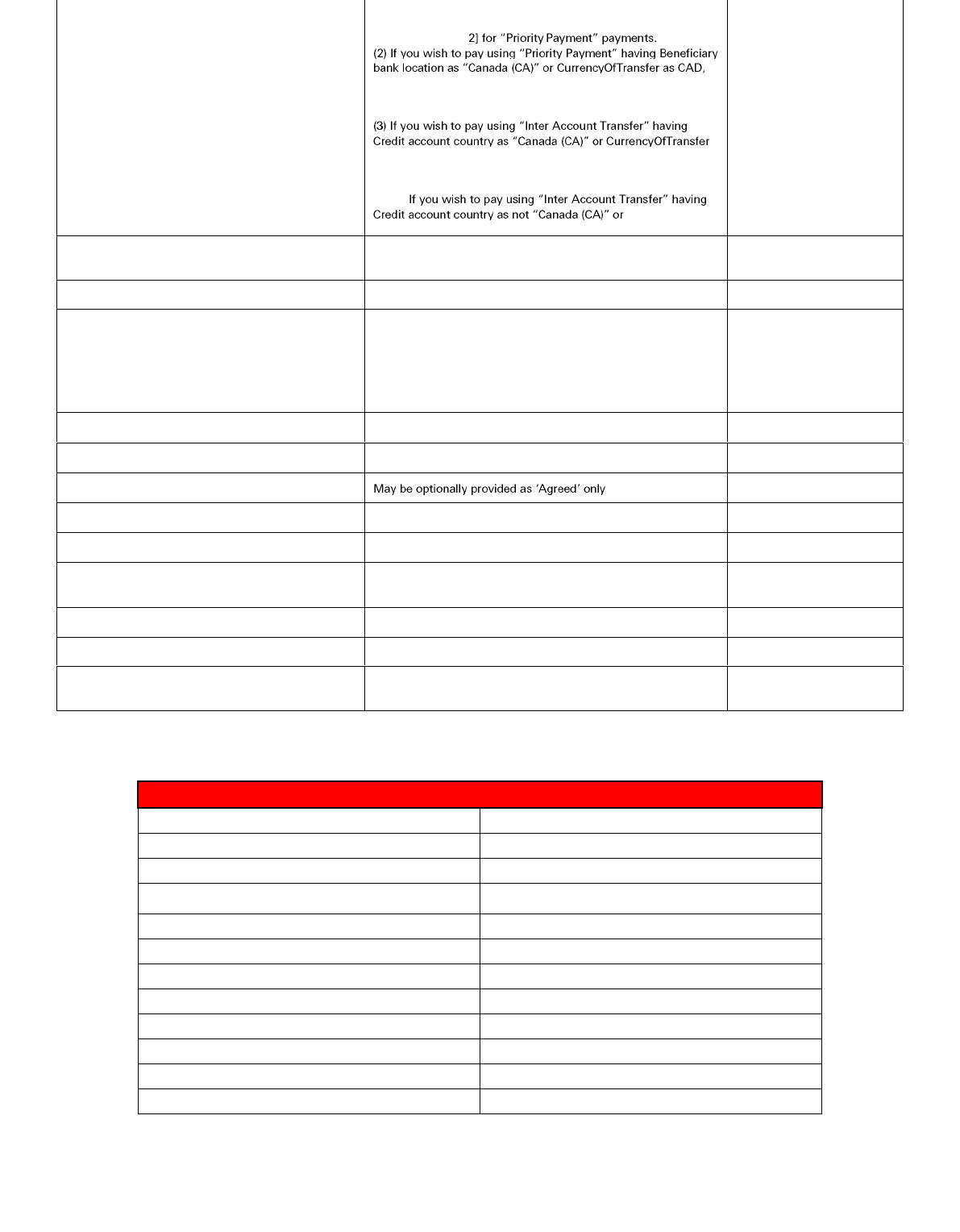

21.2. REQUEST FIELDS ............................................................................................................................................................ 89

21.2.1. HSBC Personal, first direct ..................................................................................................................................... 89

21.2.2. HSBC Business ....................................................................................................................................................... 90

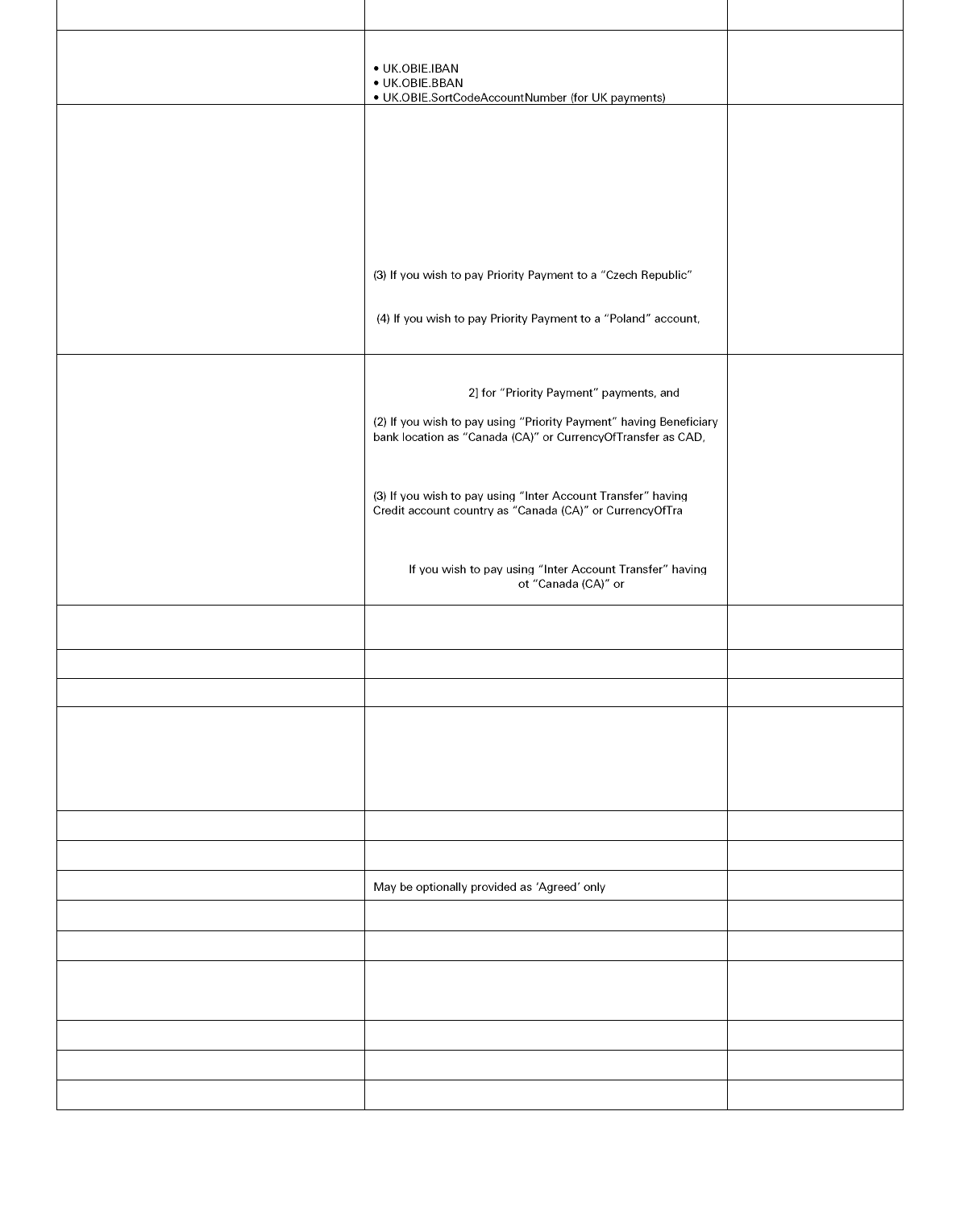

21.2.3. HSBC Kinetic .......................................................................................................................................................... 92

21.2.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 93

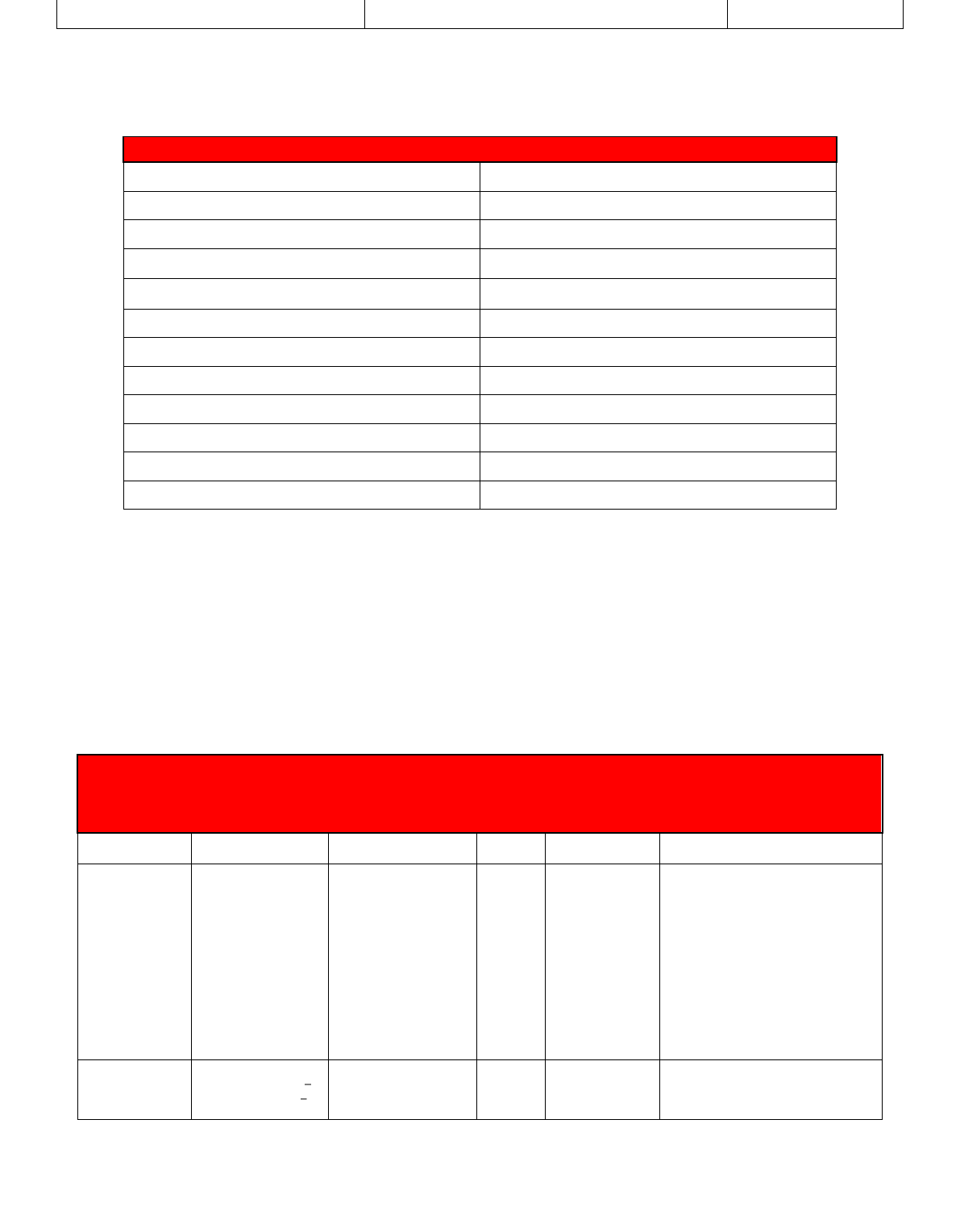

21.3. CREDITORAGENT AND CREDITORACCOUNT ......................................................................................................................... 95

21.3.1. HSBC Personal, first direct ..................................................................................................................................... 95

21.3.2. HSBC Business ....................................................................................................................................................... 96

21.3.3. HSBC Kinetic .......................................................................................................................................................... 96

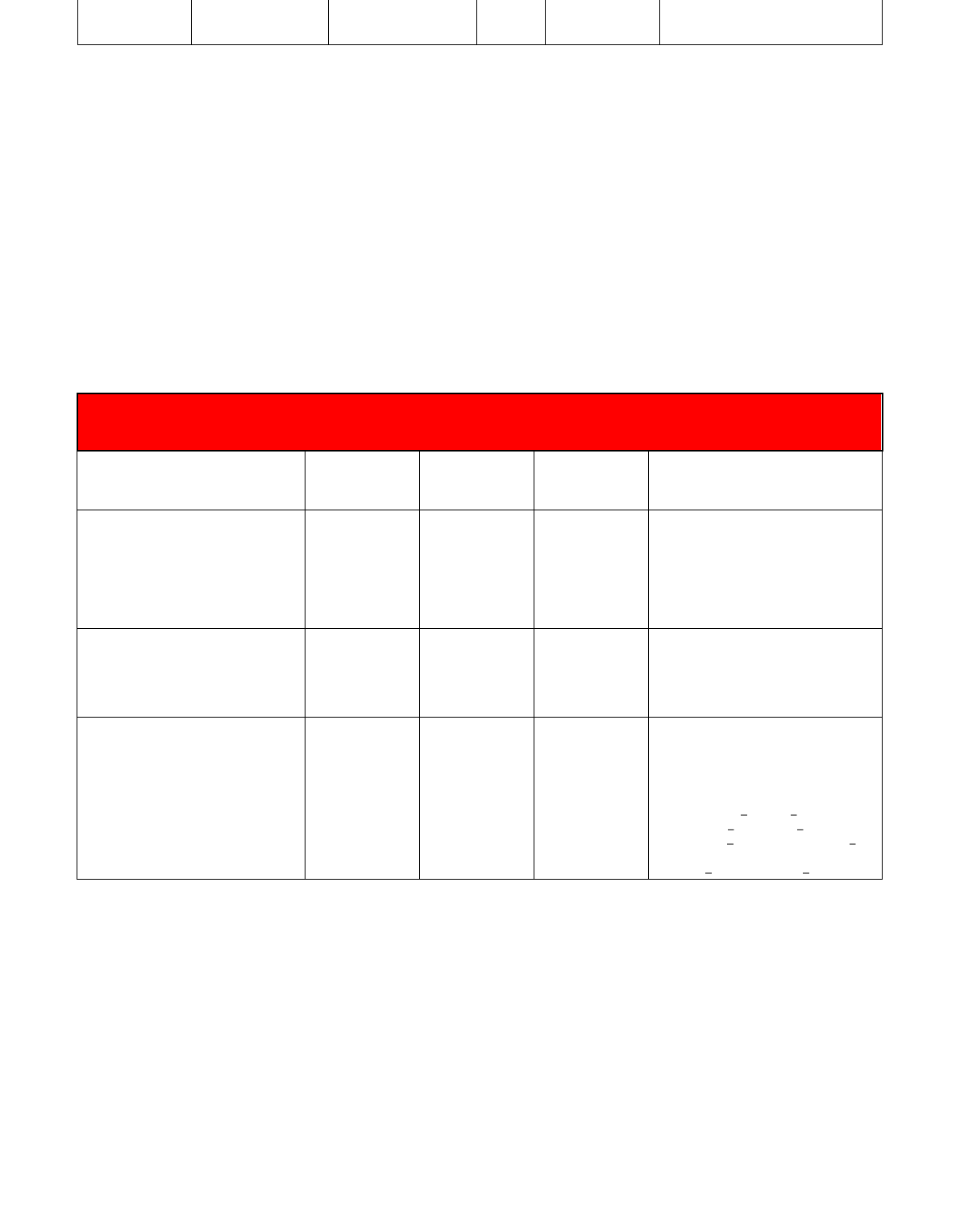

21.4. CREDITOR/POSTALADDRESS ............................................................................................................................................ 97

21.4.1. HSBC Business, HSBC Kinetic ................................................................................................................................. 98

21.5. CREDITORAGENT/POSTALADDRESS................................................................................................................................... 98

21.5.1. HSBC Personal, first direct ..................................................................................................................................... 98

21.6. PAYMENT COUNTRY – CREDITORAGENT/POSTALADDRESS/COUNTRY ..................................................................................... 98

6

PUBLIC

21.6.1. HSBC Personal, first direct ..................................................................................................................................... 99

21.6.2. HSBC Business, HSBC Kinetic ................................................................................................................................. 99

21.6.3. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet .............................................................................. 99

21.7. OPTIONAL FIELDS ........................................................................................................................................................... 99

21.7.1. HSBC Personal, first direct ..................................................................................................................................... 99

21.7.2. HSBC Business, HSBC Kinetic ............................................................................................................................... 100

21.7.3. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet ............................................................................ 102

21.8. FX RATE VALIDITY ....................................................................................................................................................... 105

21.8.1. HSBC Personal, first direct ................................................................................................................................... 105

21.8.2. HSBC Business, HSBC Kinetic ............................................................................................................................... 105

21.8.3. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet ............................................................................ 105

21.9. PAYMENT STATUS ....................................................................................................................................................... 106

21.9.1. HSBC Personal, first direct ................................................................................................................................... 106

21.9.2. HSBC Business, HSBC Kinetic ............................................................................................................................... 106

21.9.3. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet ............................................................................ 106

22. INTERNATIONAL SCHEDULED PAYMENTS ............................................................................................................. 108

22.1. IMPLEMENTED ENDPOINTS ............................................................................................................................................ 108

22.1.1. HSBC Personal, first direct ................................................................................................................................... 108

22.1.2. HSBC Business ..................................................................................................................................................... 108

22.1.3. HSBC Kinetic (Not Implemented) ......................................................................................................................... 108

22.1.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet ............................................................................ 109

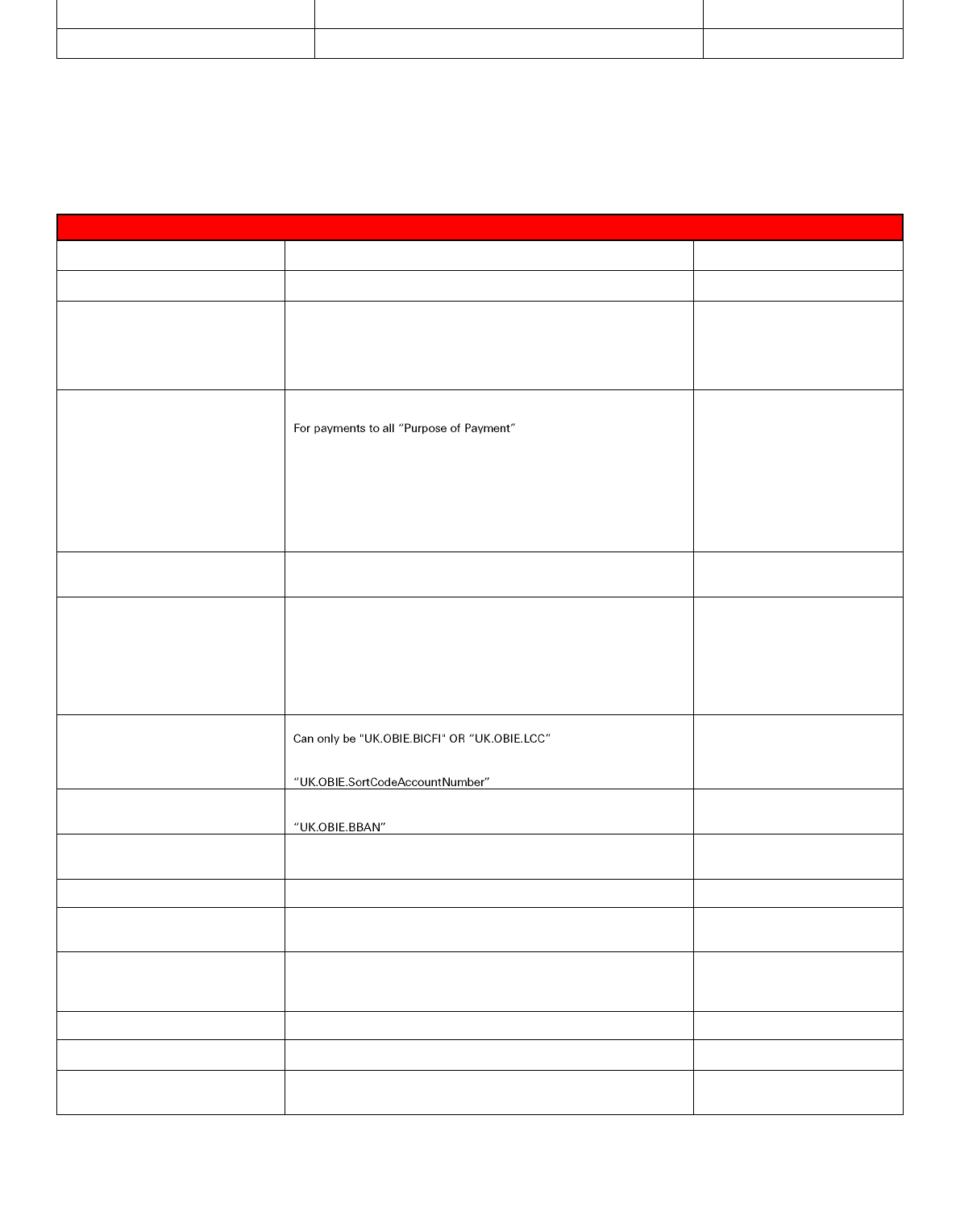

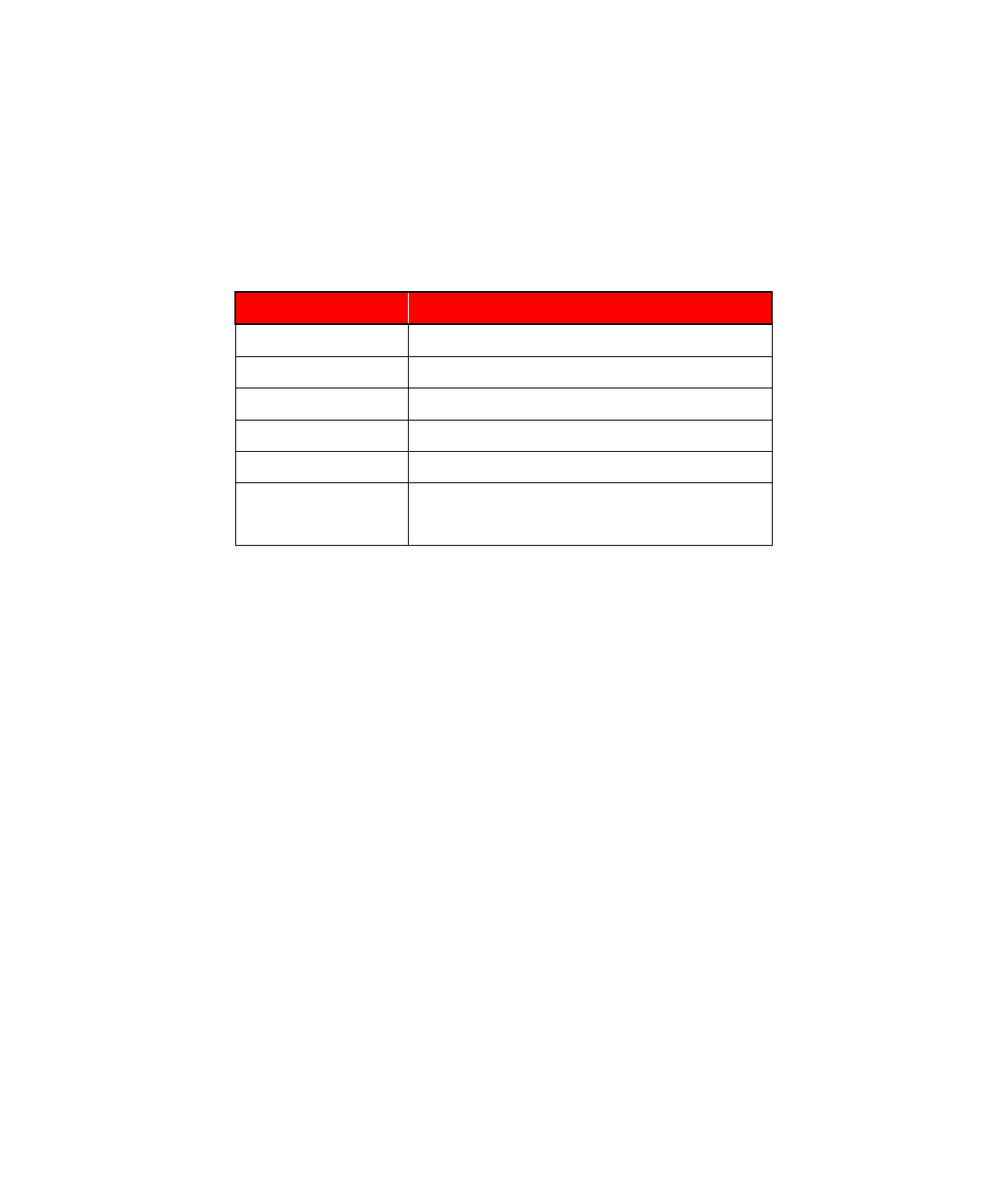

22.2. REQUEST FIELDS .......................................................................................................................................................... 109

22.2.1. HSBC Personal, first direct ................................................................................................................................... 109

22.2.2. HSBC Business ..................................................................................................................................................... 110

22.2.3. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet ............................................................................ 111

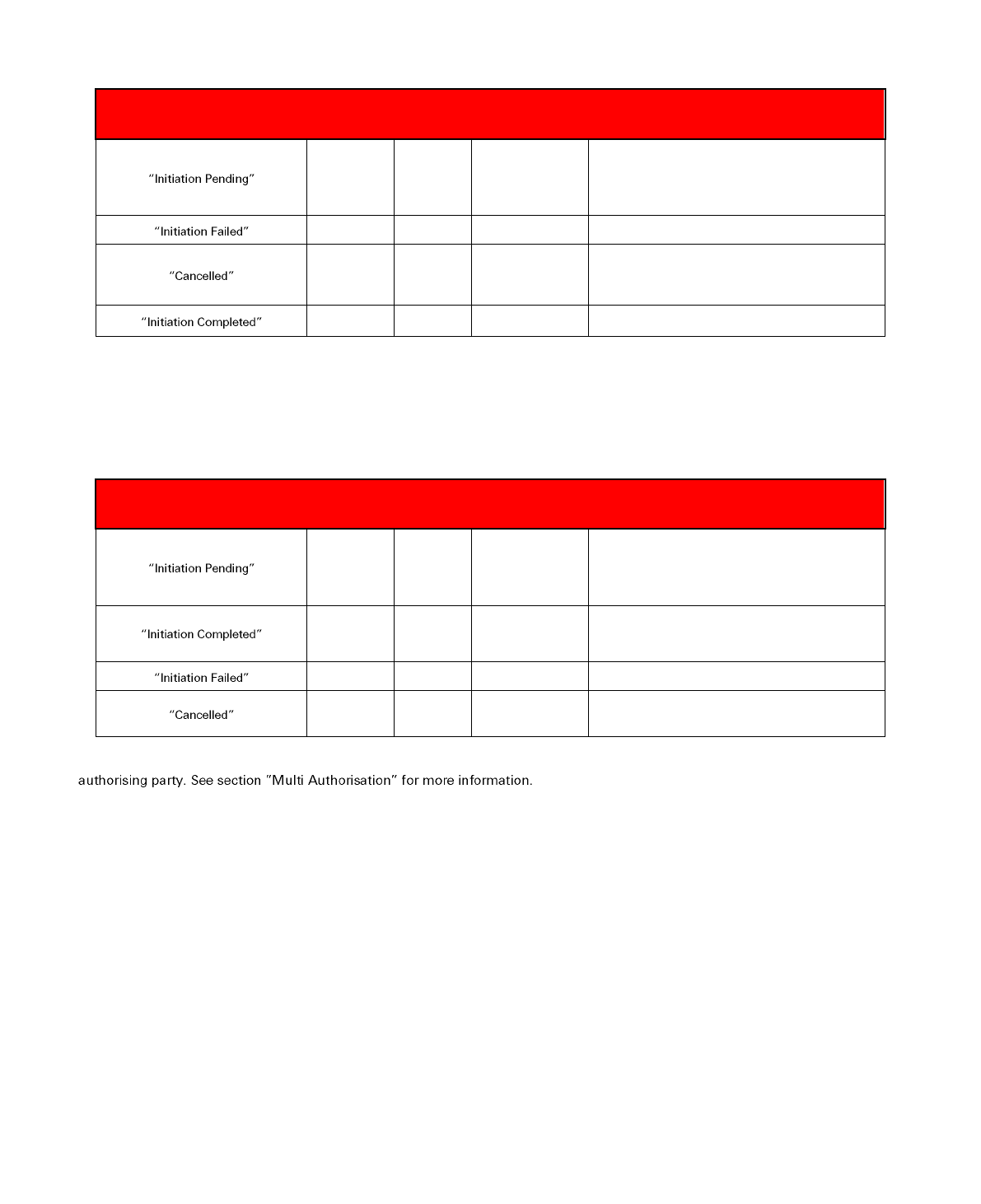

22.3. PAYMENT STATUS ....................................................................................................................................................... 113

22.3.1. HSBC Personal, first direct ................................................................................................................................... 113

22.3.2. HSBC Business ..................................................................................................................................................... 113

22.3.3. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet ............................................................................ 114

23. INTERNATIONAL STANDING ORDERS .................................................................................................................... 115

23.1. IMPLEMENTED ENDPOINTS ............................................................................................................................................ 115

23.1.1. HSBC Personal, first direct ................................................................................................................................... 115

23.1.2. HSBC Business (Not Implemented) ...................................................................................................................... 115

23.1.3. HSBC Kinetic (Not Implemented) ......................................................................................................................... 115

23.1.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ........................................................................... 116

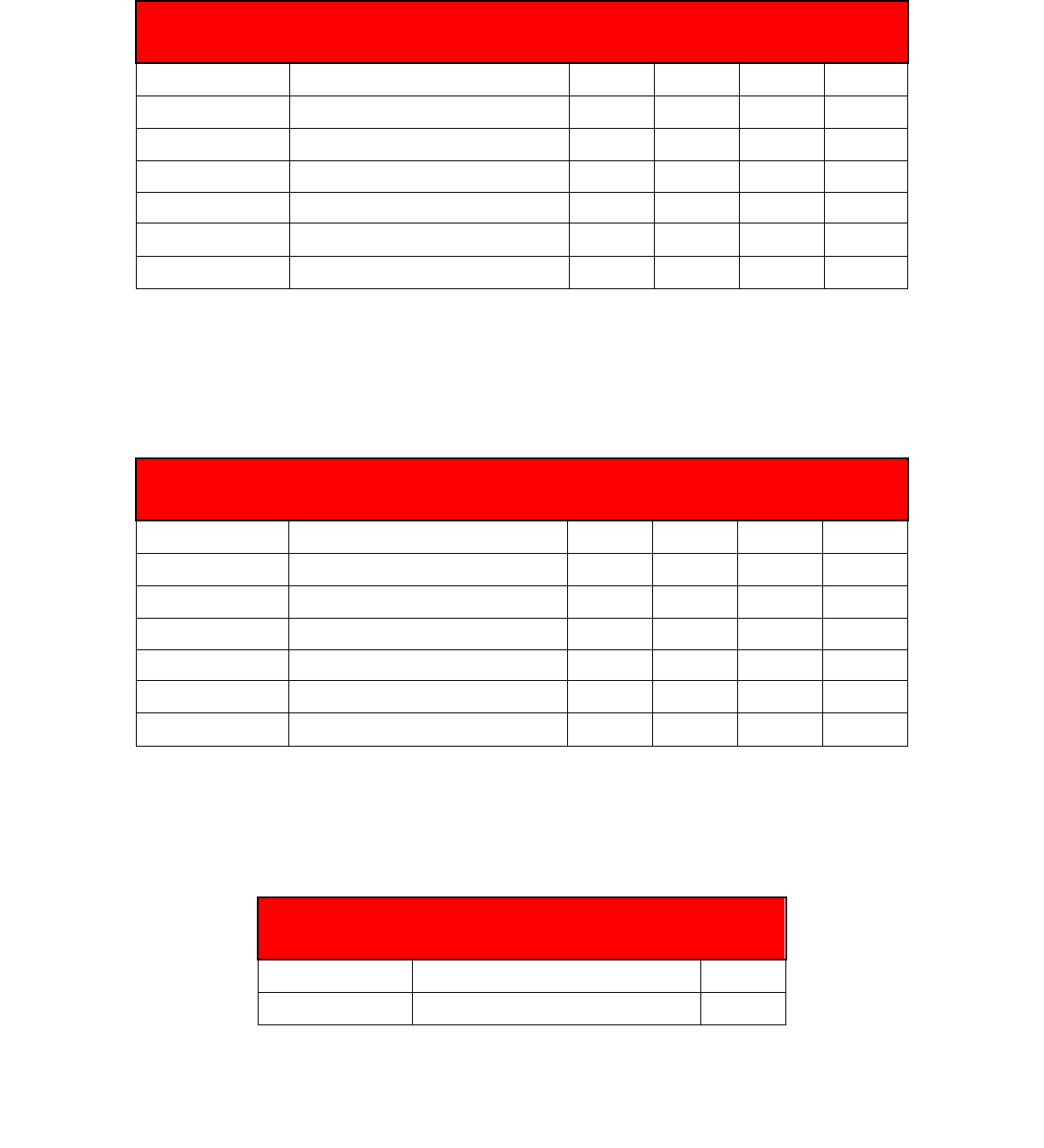

23.2. REQUEST FIELDS .......................................................................................................................................................... 116

23.2.1. HSBC Personal, first direct ................................................................................................................................... 116

23.2.2. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet ............................................................................ 118

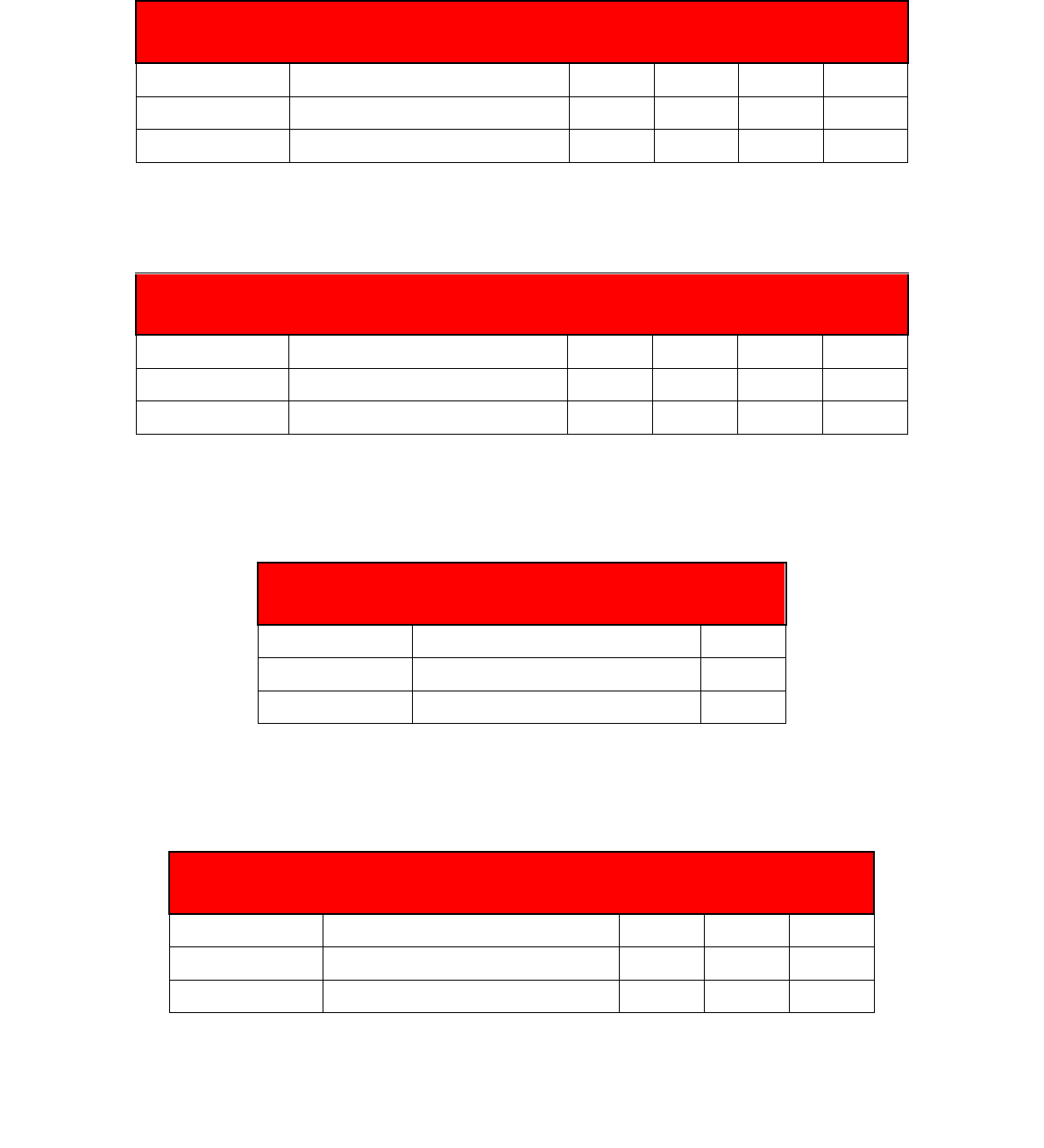

23.3. PERMITTED FREQUENCY VALUES .................................................................................................................................... 120

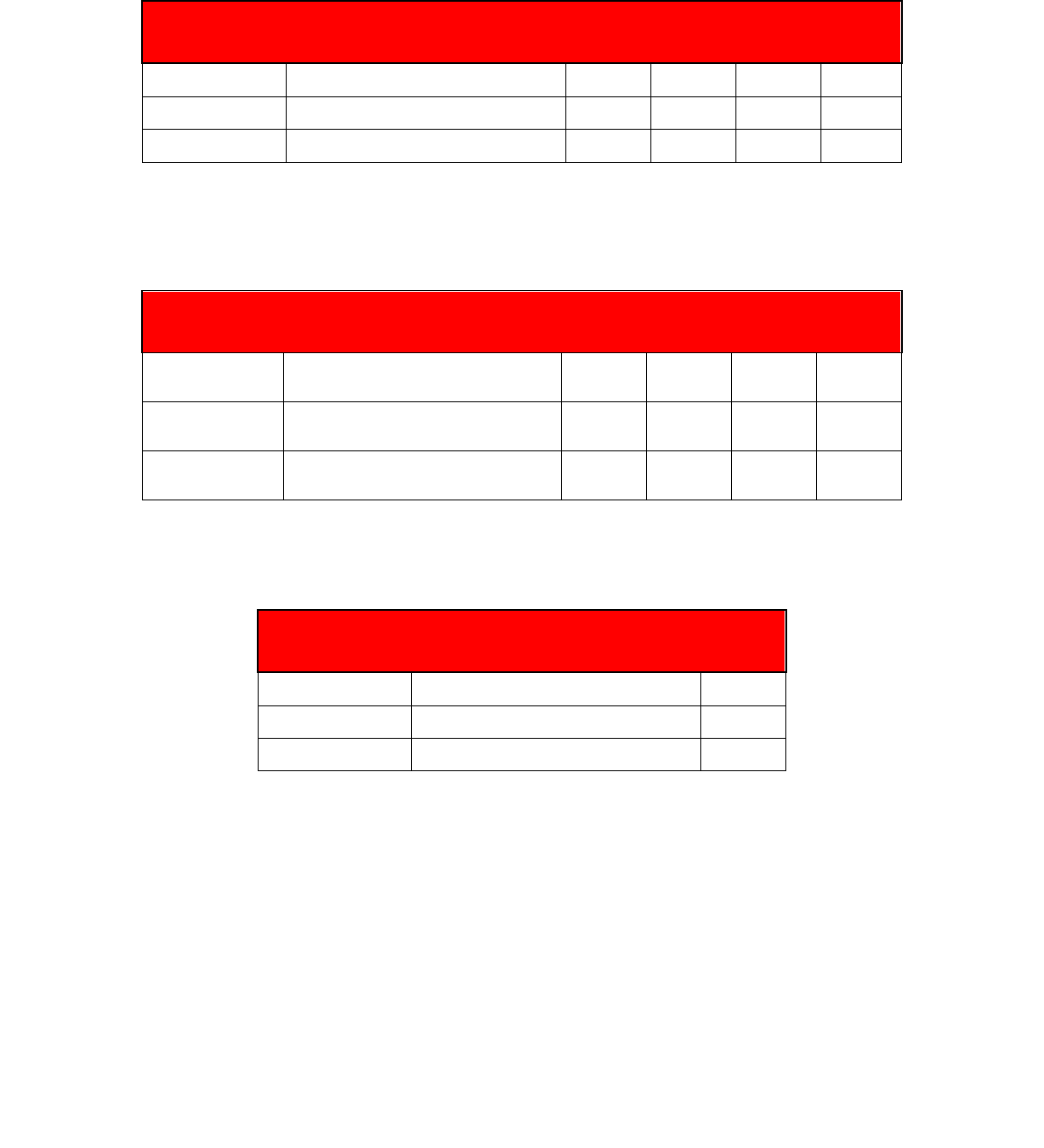

23.4. PAYMENT STATUS ....................................................................................................................................................... 120

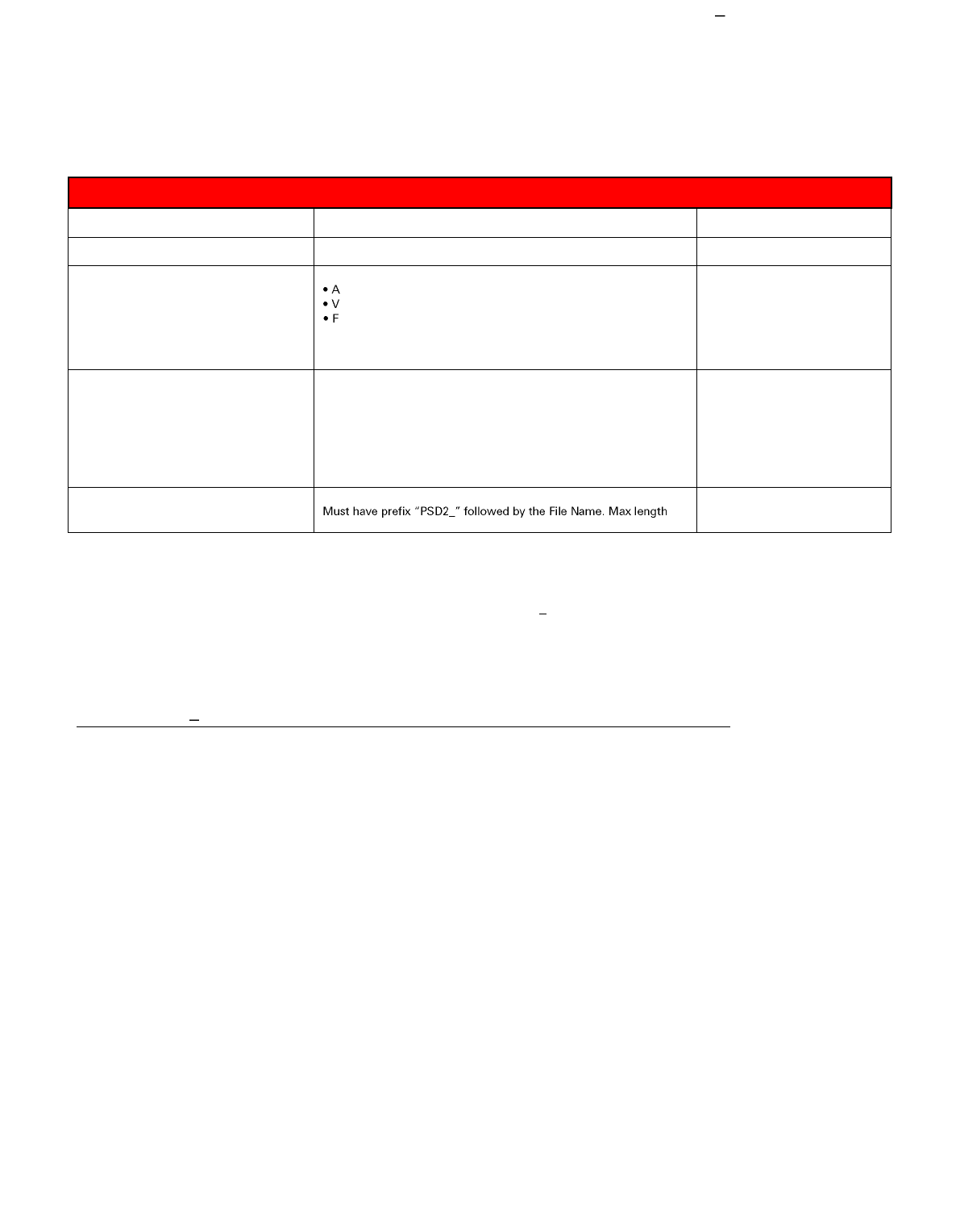

24. FILE PAYMENTS ..................................................................................................................................................... 121

24.1. IMPLEMENTED ENDPOINTS ............................................................................................................................................ 121

24.1.1. HSBC Personal (Not implemented) ...................................................................................................................... 121

24.1.2. HSBC Business ..................................................................................................................................................... 121

24.1.3. HSBC Kinetic (Not Implemented) ......................................................................................................................... 121

24.1.4. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ........................................................................... 122

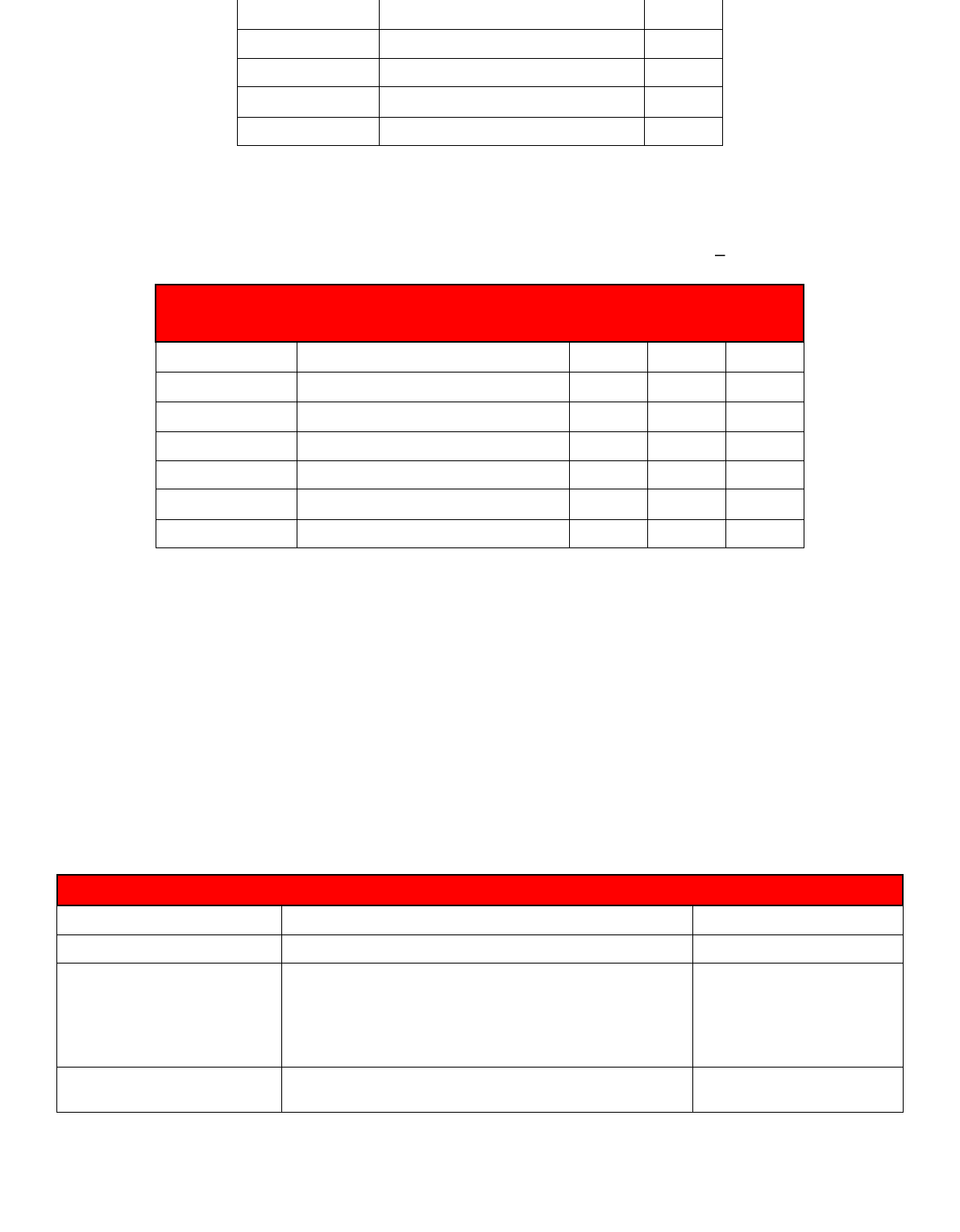

24.2. REQUEST FIELDS AND EXAMPLE FILE................................................................................................................................ 122

24.2.1. HSBC Business ..................................................................................................................................................... 122

24.2.2. HSBC Corporate UK and HSBC Innovation Banking – HSBCnet ........................................................................... 127

24.3. PAYMENT STATUS ....................................................................................................................................................... 130

24.3.1. HSBC Business ..................................................................................................................................................... 130

24.3.2. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet UK ....................................................................... 131

25. MAJOR BENEFICIARIES .......................................................................................................................................... 132

7

PUBLIC

25.1. PAYING A MAJOR BENEFICIARY ...................................................................................................................................... 132

25.1.1. HSBC Personal, first direct ................................................................................................................................... 132

25.1.2. HSBC Business ..................................................................................................................................................... 132

25.1.3. HSBC Kinetic ........................................................................................................................................................ 132

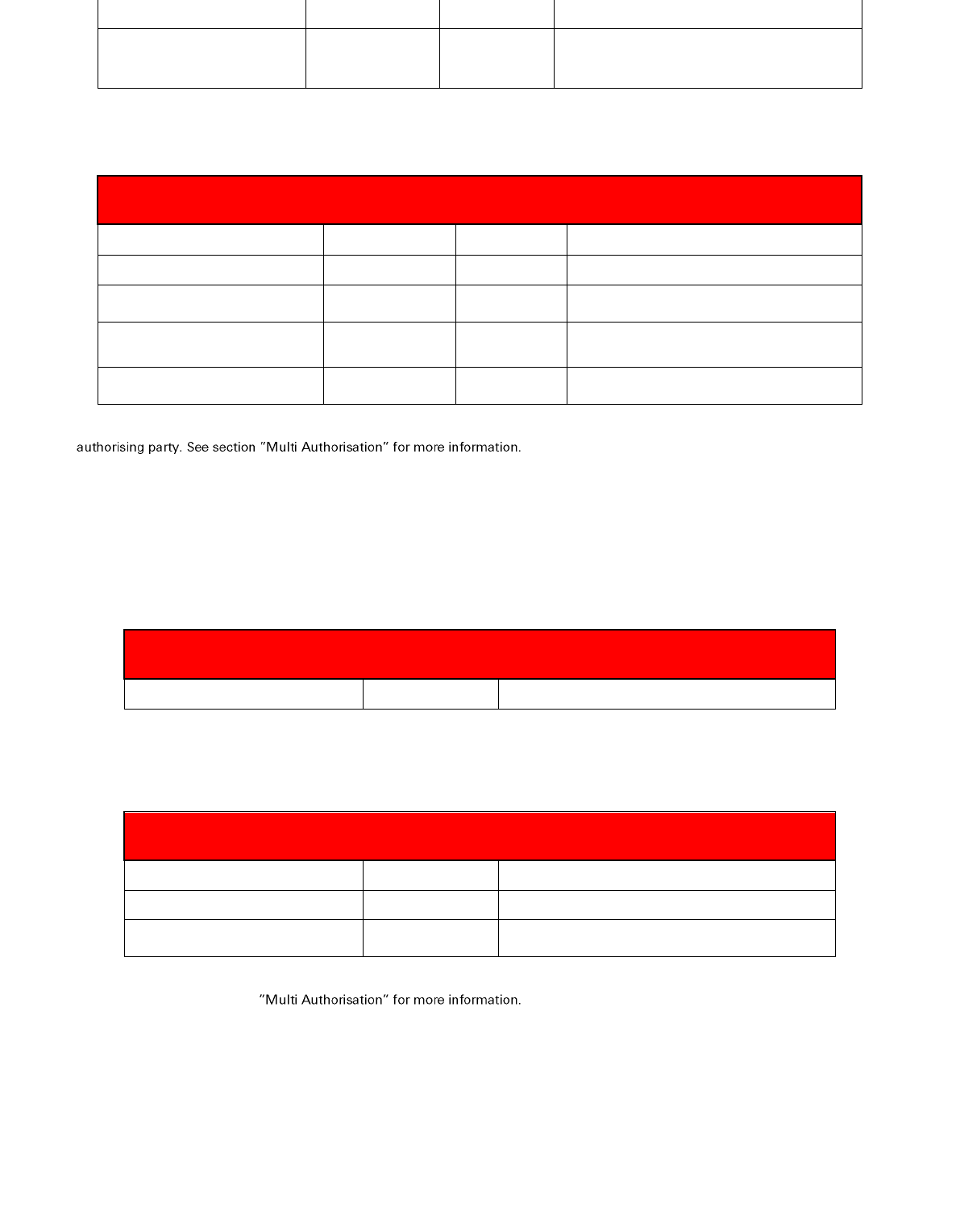

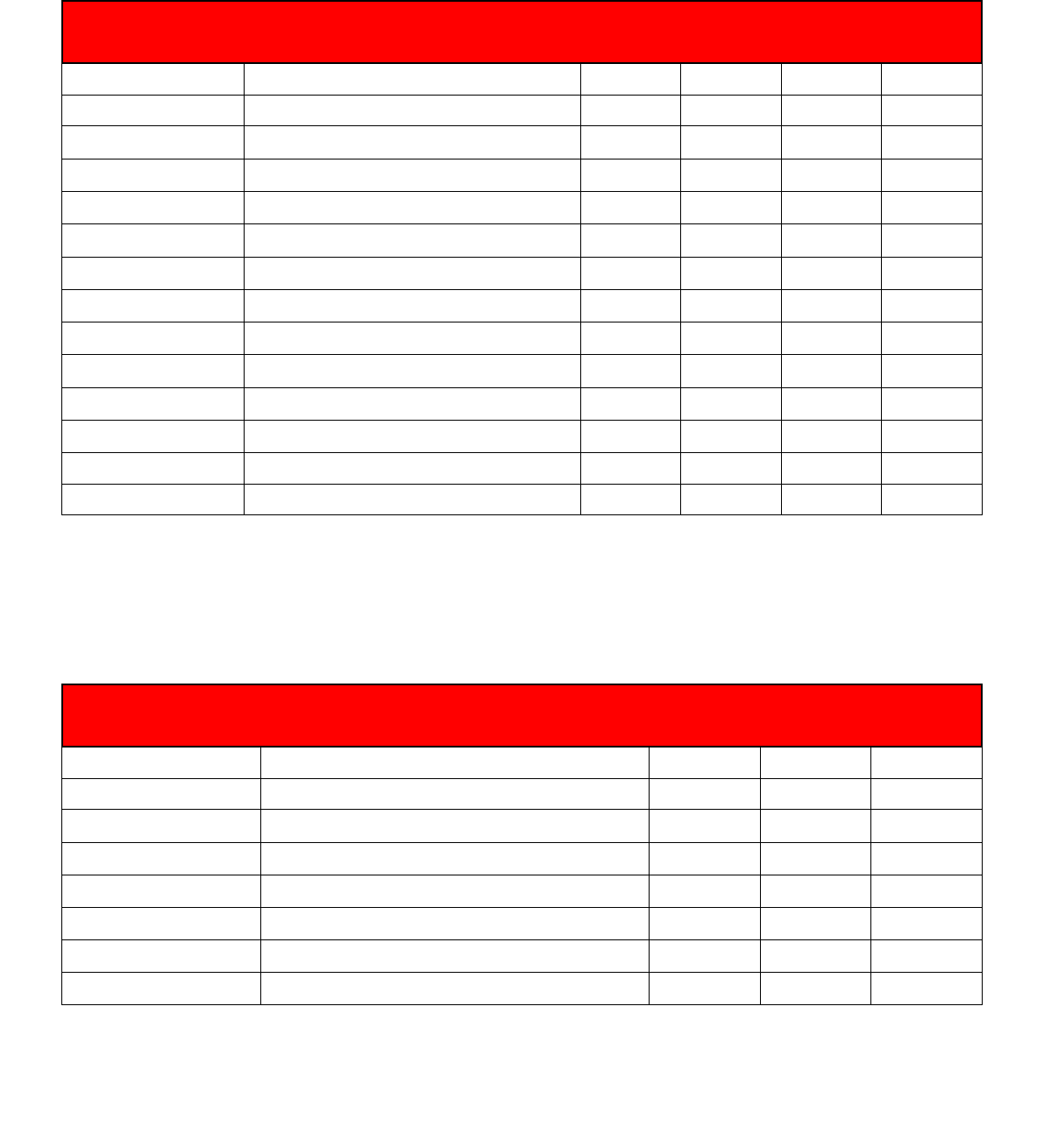

26. MULTI-AUTHORISATION ....................................................................................................................................... 133

26.1. IMPLEMENTED ENDPOINTS ............................................................................................................................................ 133

26.1.1. HSBC Business ..................................................................................................................................................... 133

26.1.2. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet ............................................................................ 133

26.2. TPP AUTHORISATION TYPE ........................................................................................................................................... 134

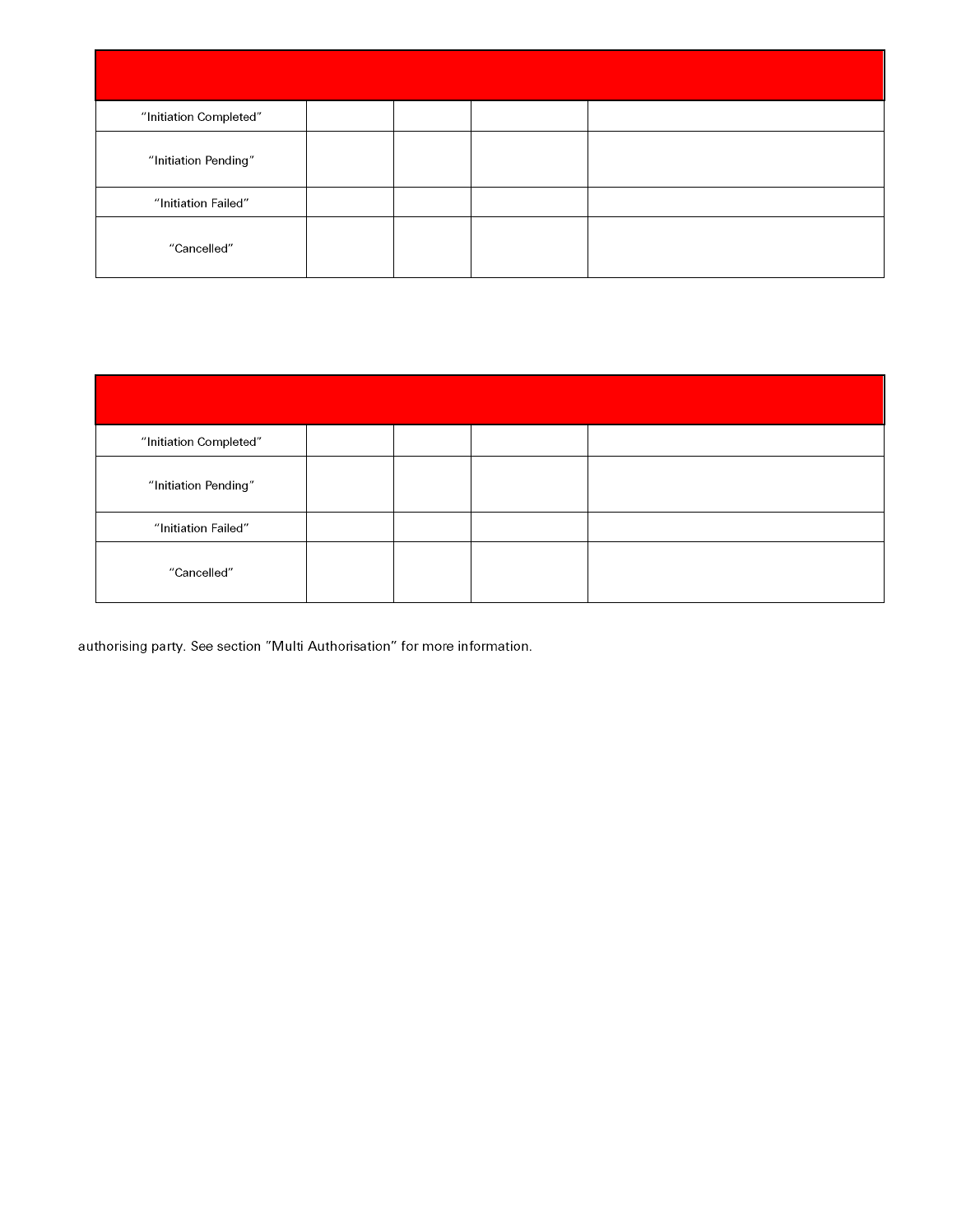

26.3. HSBC BUSINESS MULTI-AUTHORISATION ........................................................................................................................ 134

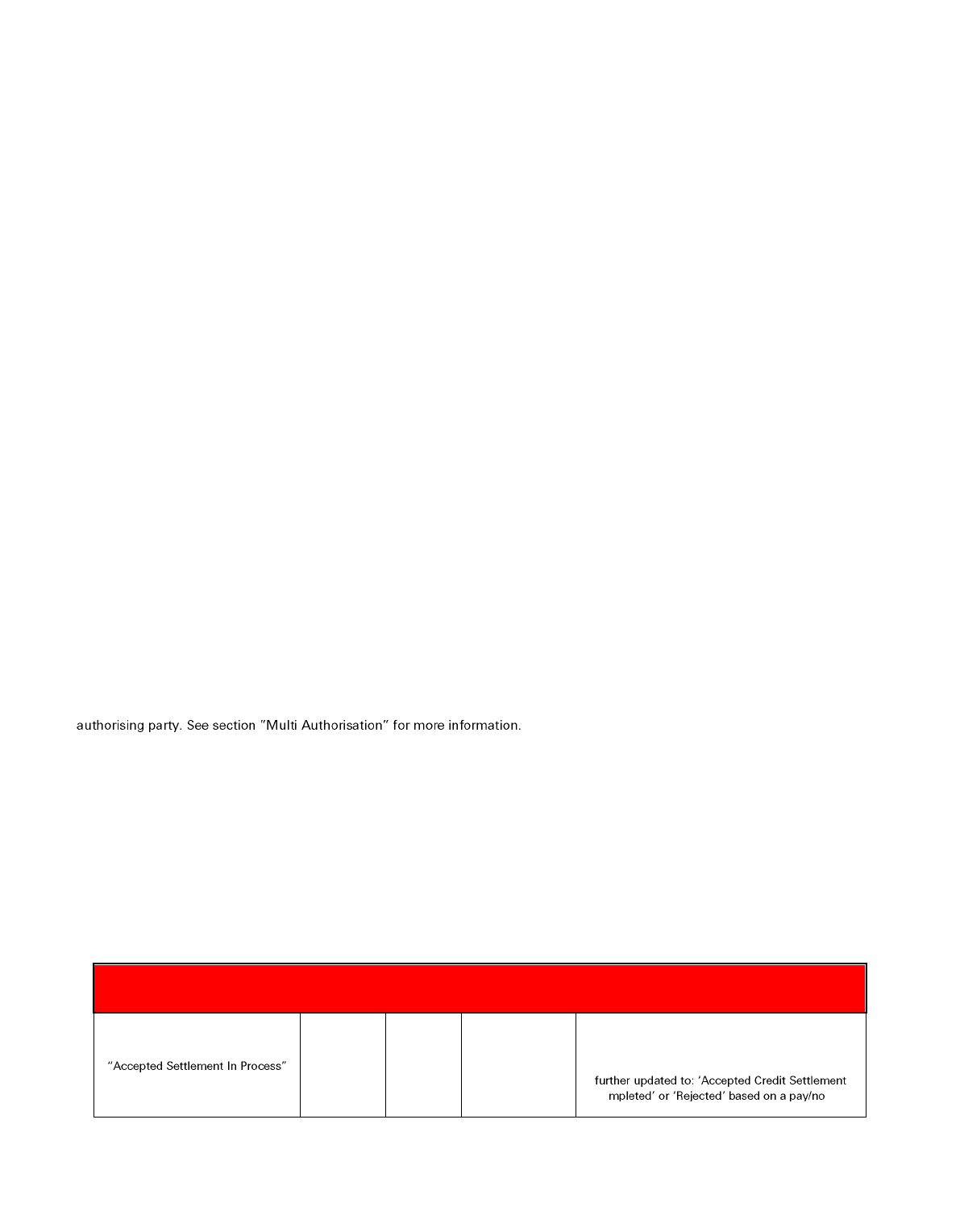

26.4. MULTI-AUTHORISATION OBJECT STATUS ......................................................................................................................... 135

26.5. REFUND ACCOUNT DETAILS FOR MULTI-AUTHORISATION PAYMENTS .................................................................................... 135

27. CONFIRMATION OF FUNDS SUMMARY ................................................................................................................. 137

27.1. IMPLEMENTED ENDPOINTS ............................................................................................................................................ 137

27.1.1. HSBC Personal, first direct, M&S Bank ................................................................................................................ 137

27.1.2. HSBC Business ..................................................................................................................................................... 137

27.1.3. HSBC Kinetic ........................................................................................................................................................ 138

27.1.4. HSBC Corporate UK and HSBC Innovation Banking - HSBCnet ............................................................................ 138

27.2. REQUEST FIELDS .......................................................................................................................................................... 138

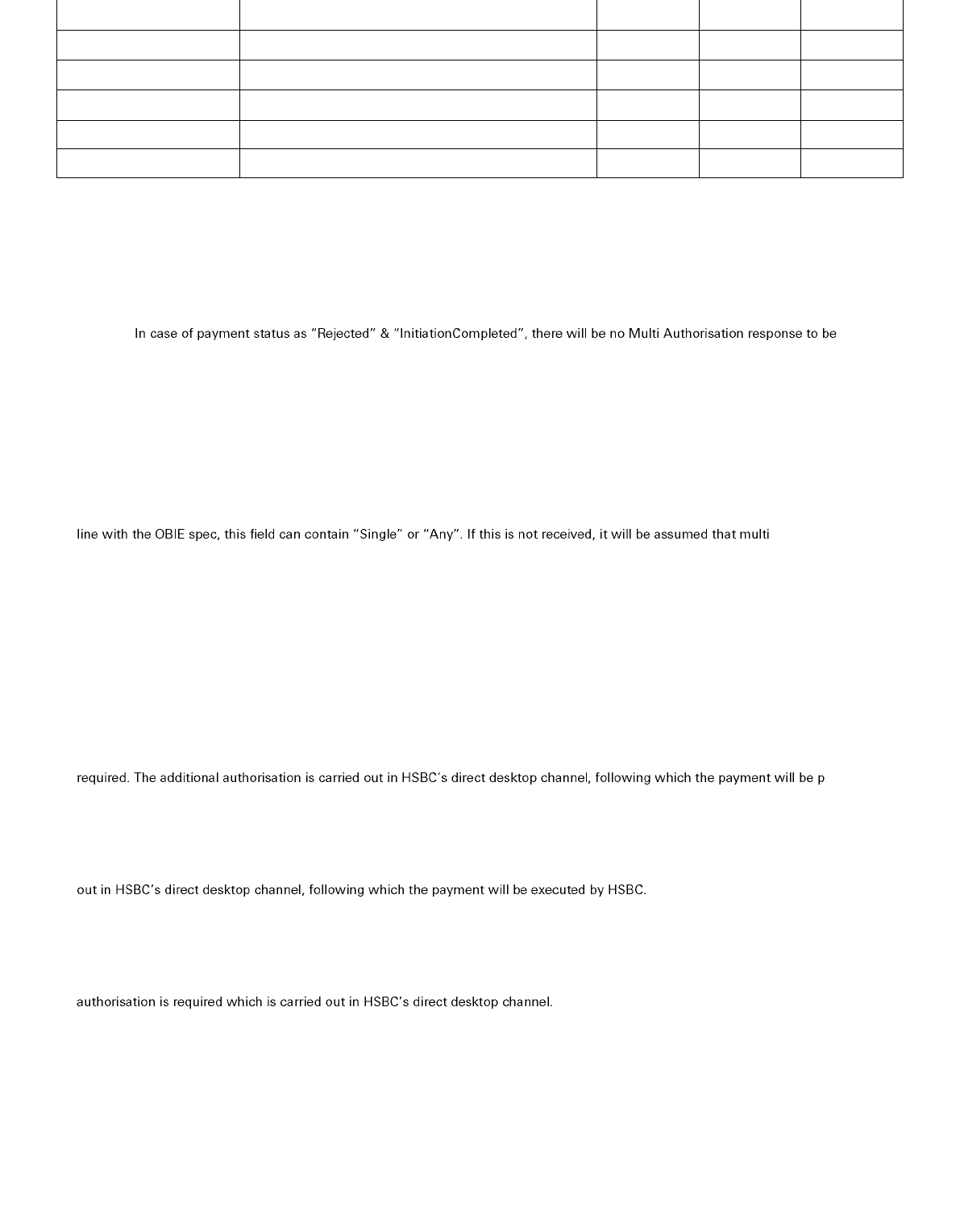

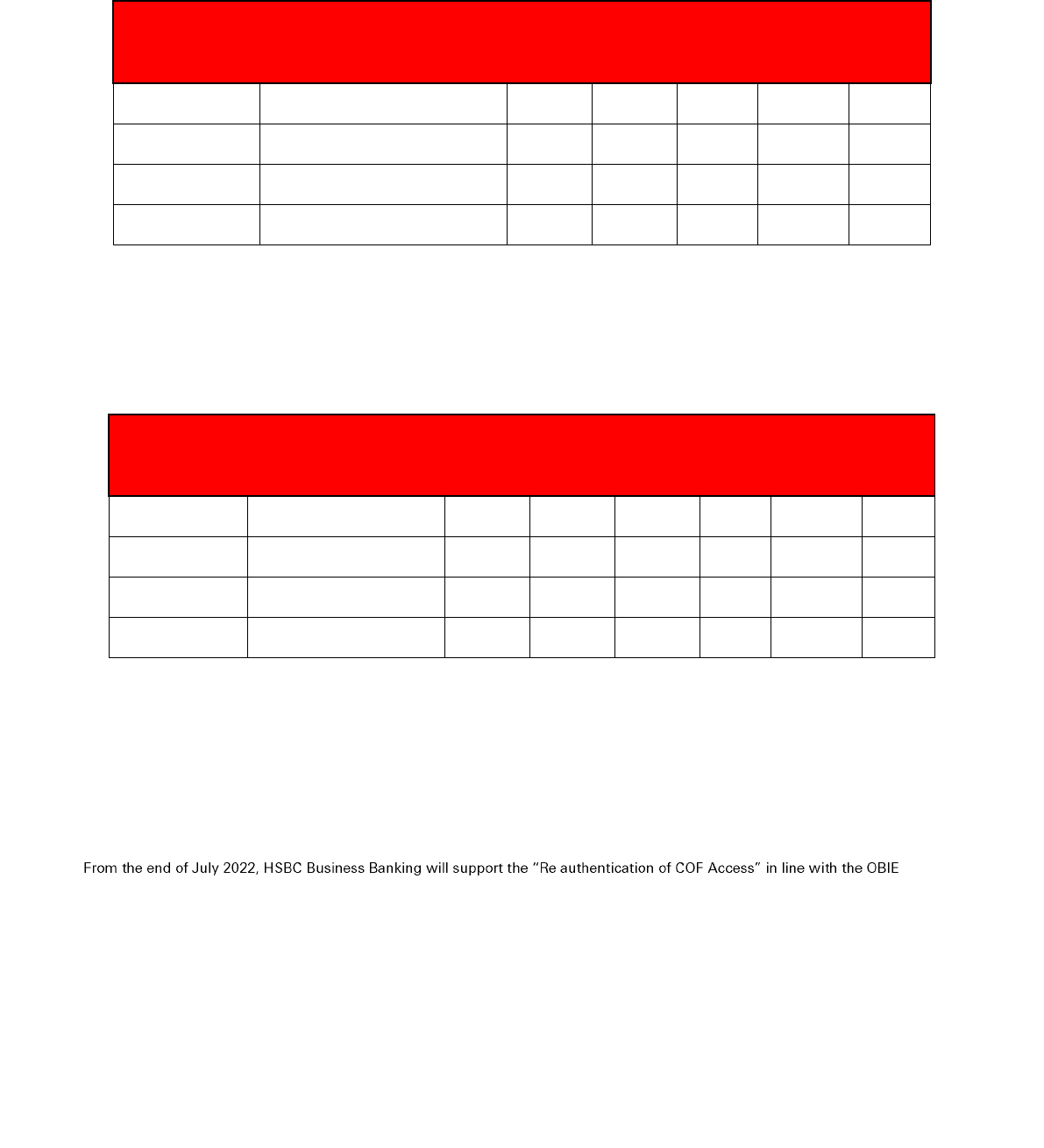

28. VARIABLE RECURRING PAYMENTS - SWEEPING .................................................................................................... 139

28.1. KEY INFORMATION....................................................................................................................................................... 139

28.2. PAYMENT REFUNDS ..................................................................................................................................................... 139

28.3. IMPLEMENTED ENDPOINTS ............................................................................................................................................ 139

28.3.1. HSBC Personal, first direct ................................................................................................................................... 139

28.3.2. HSBC Business ..................................................................................................................................................... 140

28.3.3. HSBC Kinetic ........................................................................................................................................................ 140

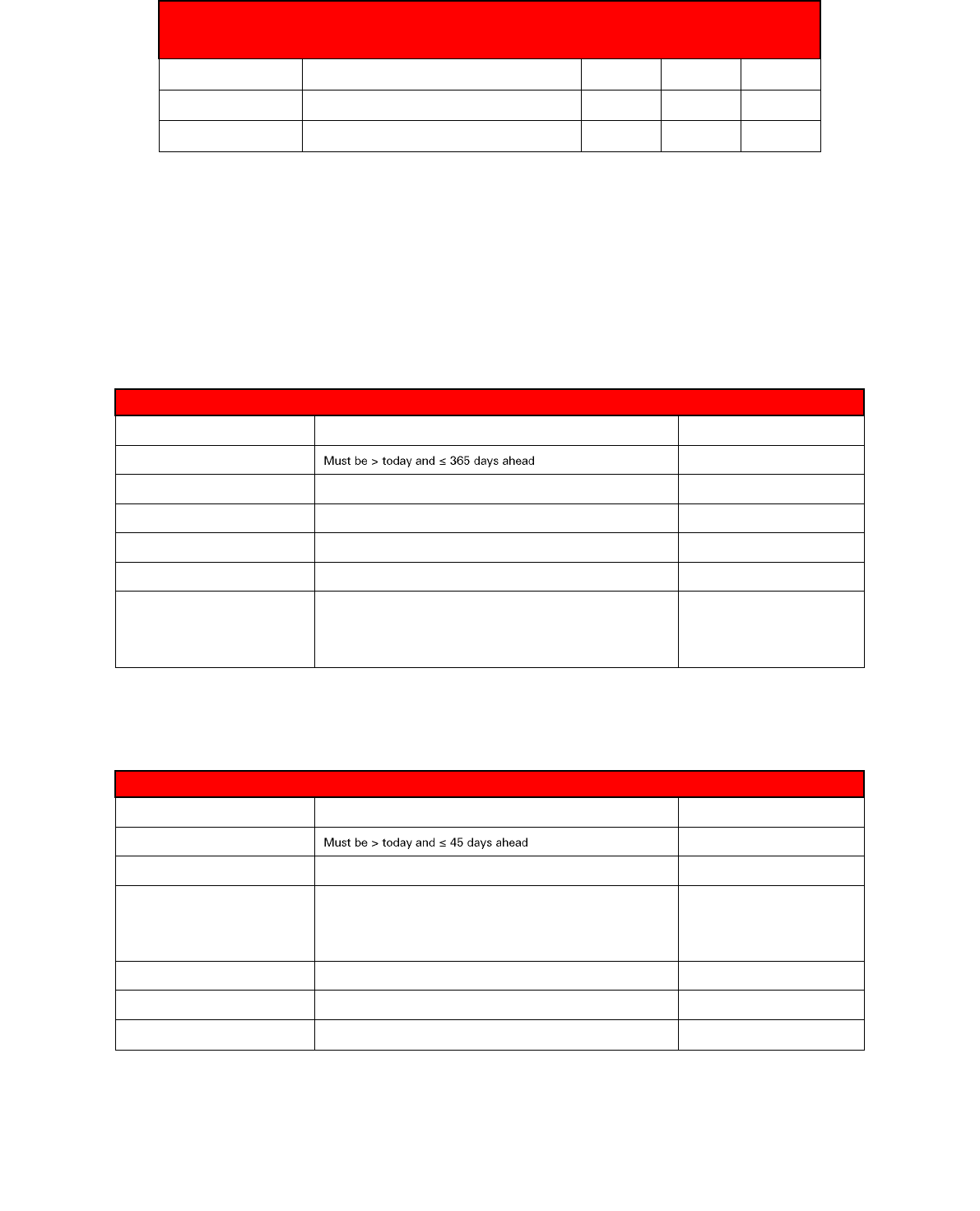

28.4. REQUEST FIELDS .......................................................................................................................................................... 141

28.4.1. HSBC Personal, first direct ................................................................................................................................... 141

28.4.2. HSBC Business ..................................................................................................................................................... 142

28.5. PAYMENT LIMITS ......................................................................................................................................................... 143

28.5.1. HSBC Personal, first direct ................................................................................................................................... 143

28.5.2. HSBC Business ..................................................................................................................................................... 143

28.5.3. HSBC Kinetic ........................................................................................................................................................ 143

28.6. FEES FOR CHAPS PAYMENTS ........................................................................................................................................ 143

28.7. CUT-OFF TIME FOR CHAPS PAYMENTS ........................................................................................................................... 143

28.8. PAYMENT STATUS ....................................................................................................................................................... 144

28.9. ADDITIONAL NOTES ..................................................................................................................................................... 145

29. TWO-WAY NOTICE OF REVOCATION ..................................................................................................................... 145

29.1. IMPLEMENTED ENDPOINTS ............................................................................................................................................ 146

29.1.1. HSBC Personal, first direct, M&S Bank ................................................................................................................ 146

29.1.2. HSBC Business ..................................................................................................................................................... 146

29.1.3. HSBC Kinetic ........................................................................................................................................................ 146

29.2. REQUEST FIELDS .......................................................................................................................................................... 146

30. ERROR CODES ....................................................................................................................................................... 148

30.1. COMMON, AUTHORISATION AND TOKEN ERRORS .............................................................................................................. 148

30.2. ACCOUNT INFORMATION SERVICE (AIS) ERRORS ............................................................................................................... 148

30.3. PAYMENT INITIATION SERVICE (PIS) ERRORS .................................................................................................................... 148

30.4. CARD BASED PAYMENT INSTRUMENT ISSUER (CBPII) ERRORS ............................................................................................. 149

30.5. EVENT NOTIFICATION ERRORS ....................................................................................................................................... 149

31. DISCLAIMER .......................................................................................................................................................... 150

8

PUBLIC

1. Introduction

HSBC has made all reasonable efforts to apply the OBIE standard to its UK Open Banking implementation. Therefore, developers

should start with OBIE published documentation.

This Implementation Guide covers items HSBC wishes to provide further detail on. We welcome feedback to make this as useful as

possible. Our implementation guide is designed to assist you, as a TPP with registration, on-boarding and completion of both AIS and

PIS standard journeys.

If you have any suggestions or feedback on our Implementation Guide, then please reach out to our Third Party Provider Engagement

team by clicking

here

or completing our Online Form.

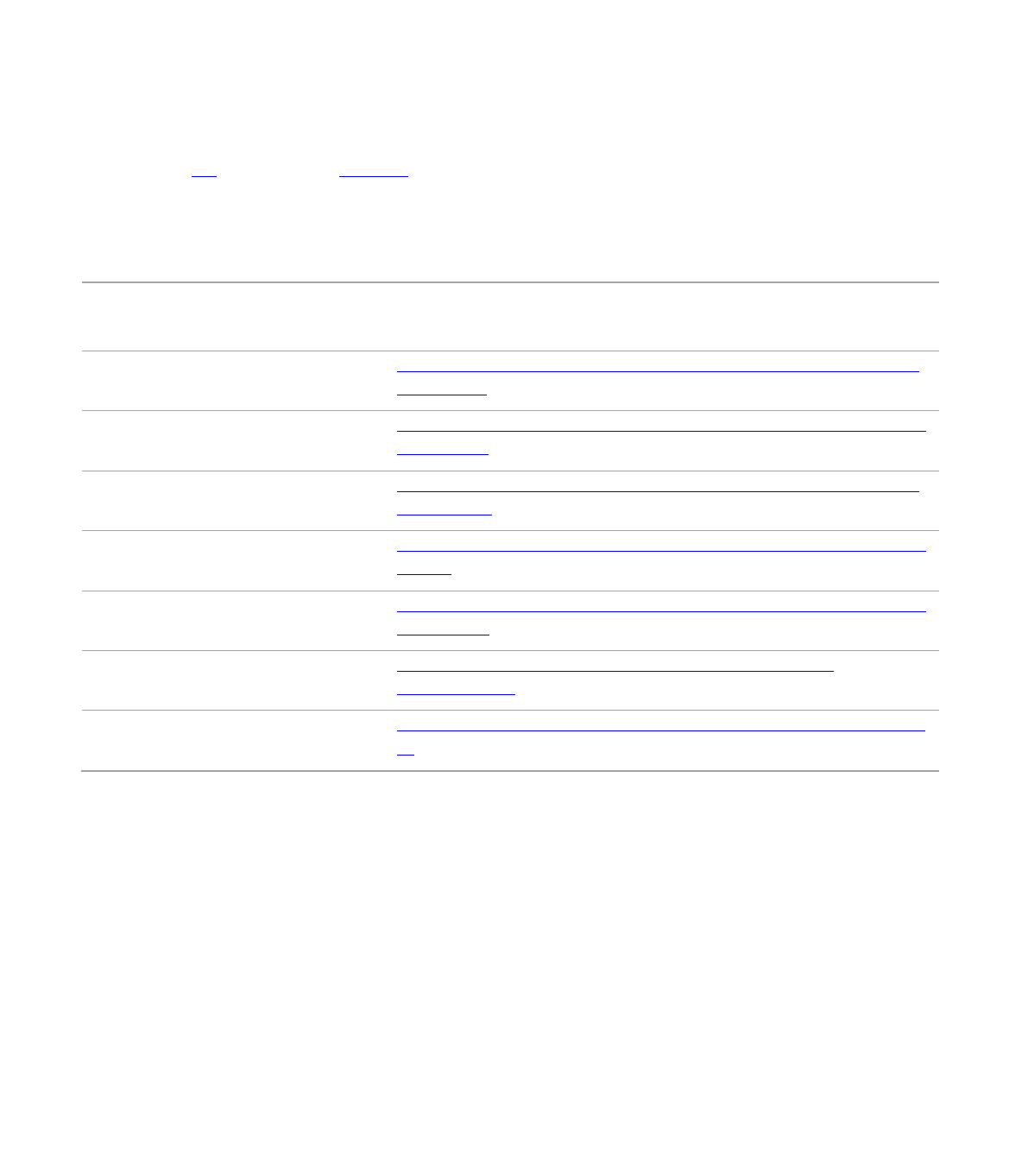

You can access the HSBC Transparency Calendars via the following links:

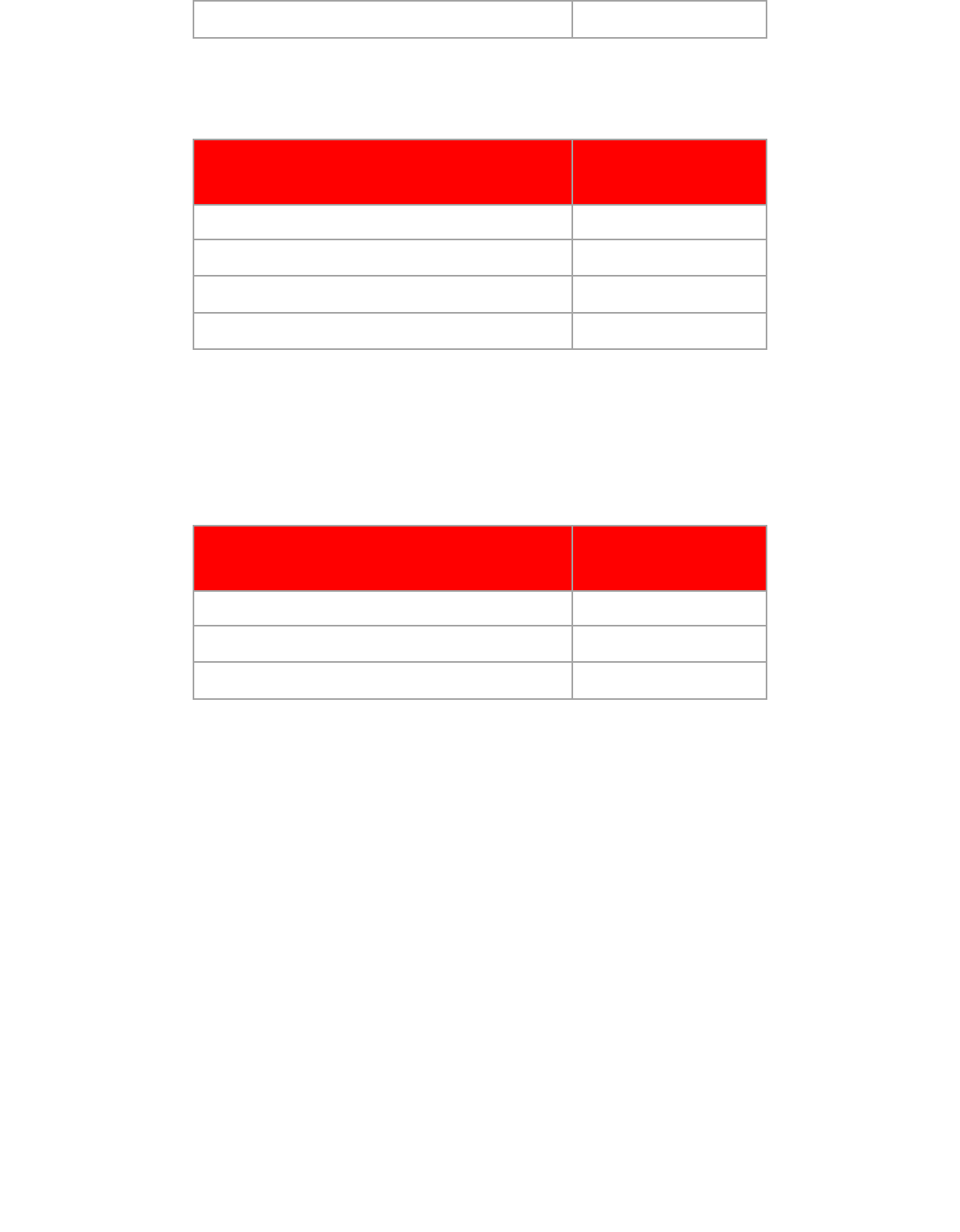

Banking Area

Page Link

HSBC Personal

https://openbanking.atlassian.net/wiki/spaces/AD/pages/108266712/Implementation+Guide+

HSBC+Personal

HSBC Business

https://openbanking.atlassian.net/wiki/spaces/AD/pages/1059489023/Implementation+Guide+

HSBC+Business

Marks and Spencer

https://openbanking.atlassian.net/wiki/spaces/AD/pages/914326499/Implementation+Guide+

Marks+Spencers

first direct

https://openbanking.atlassian.net/wiki/spaces/AD/pages/915047304/Implementation+Guide+fi

rst+direct

HSBC Kinetic

https://openbanking.atlassian.net/wiki/spaces/AD/pages/1387201093/Implementation+Guide+

HSBC+-+Kinetic

HSBC Corporate UK (HSBCnet UK)

https://openbanking.atlassian.net/wiki/spaces/AD/pages/1171816486/HSBC+-

+Corporate+Banking

HSBC Innovation Banking

(HSBCnet UK)

https://openbanking.atlassian.net/wiki/spaces/AD/pages/2707390465/HSBC+Innovation+Bank

ing

9

PUBLIC

2. Key Changes and Announcements

Key Changes:

➢ Discover the newly added information about payment limits in the Payment Initiation Summary (section 17)

➢ Errata corrections

Announcements:

➢ The decommissioning of the MCIs for HSBC Personal, first direct, M&S Bank, HSBC Business, HSBC Kinetic, and HSBCnet

UK, which was communicated on 31st May 2024, will be implemented on or after 31st August 2024.

10

PUBLIC

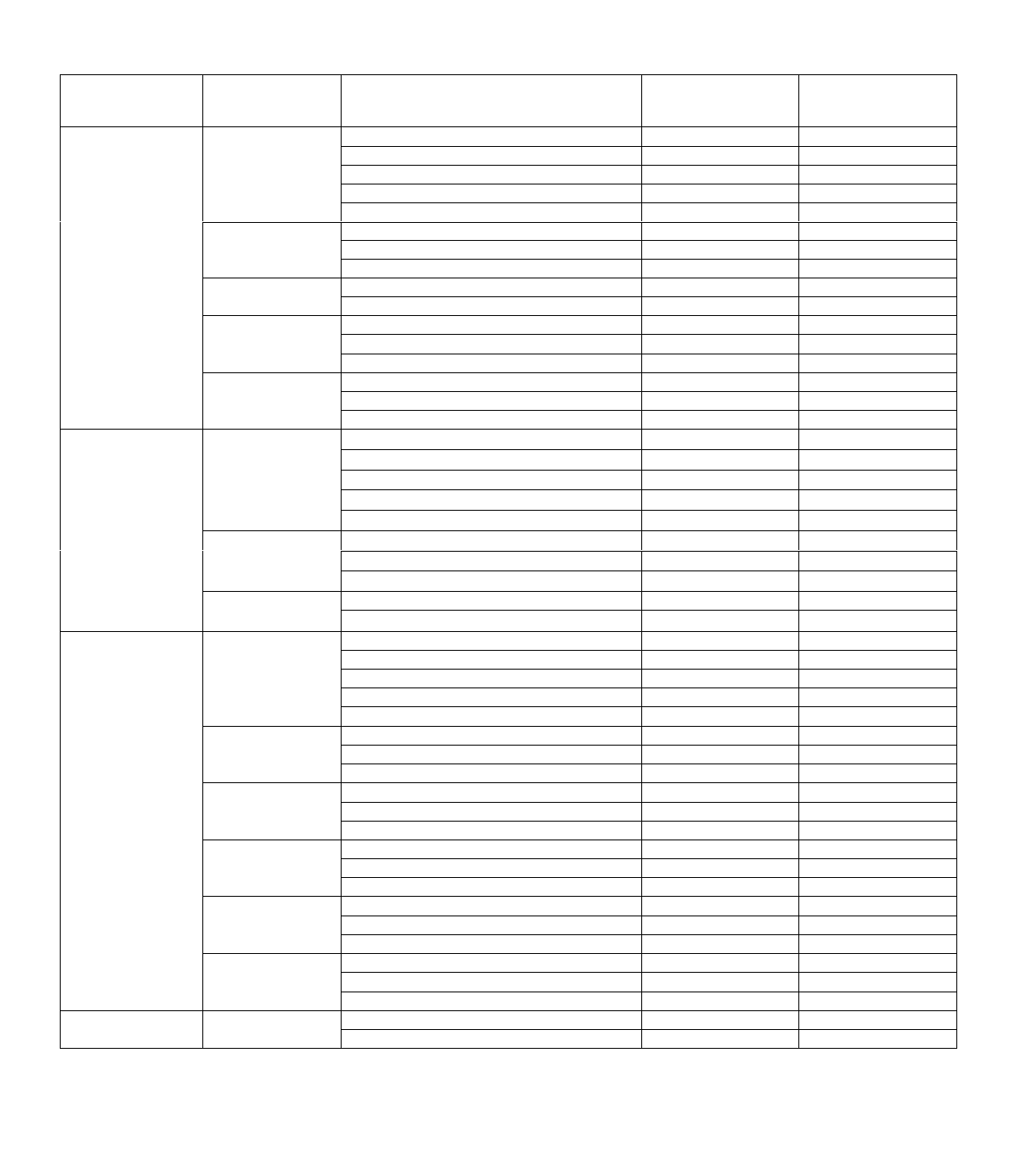

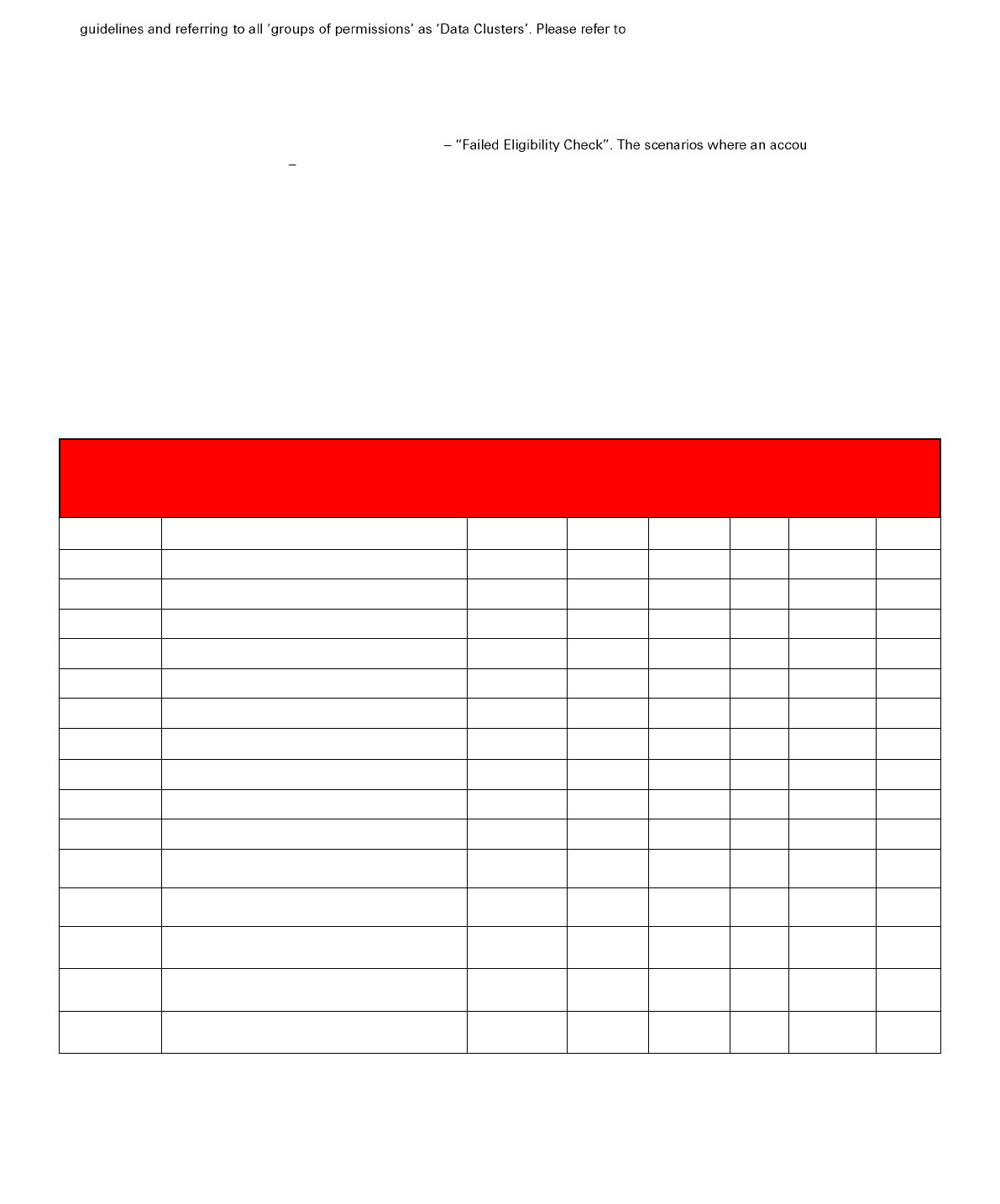

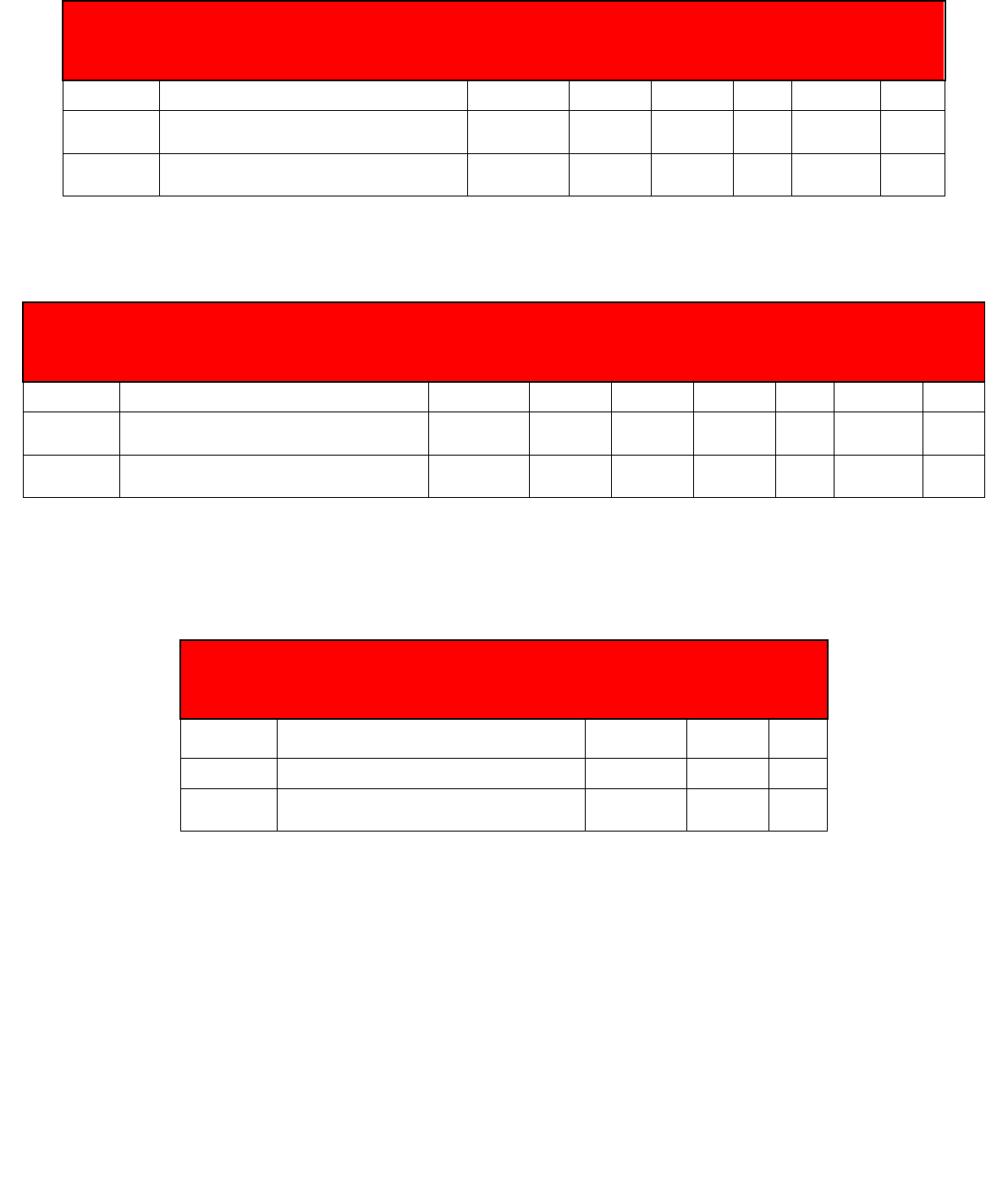

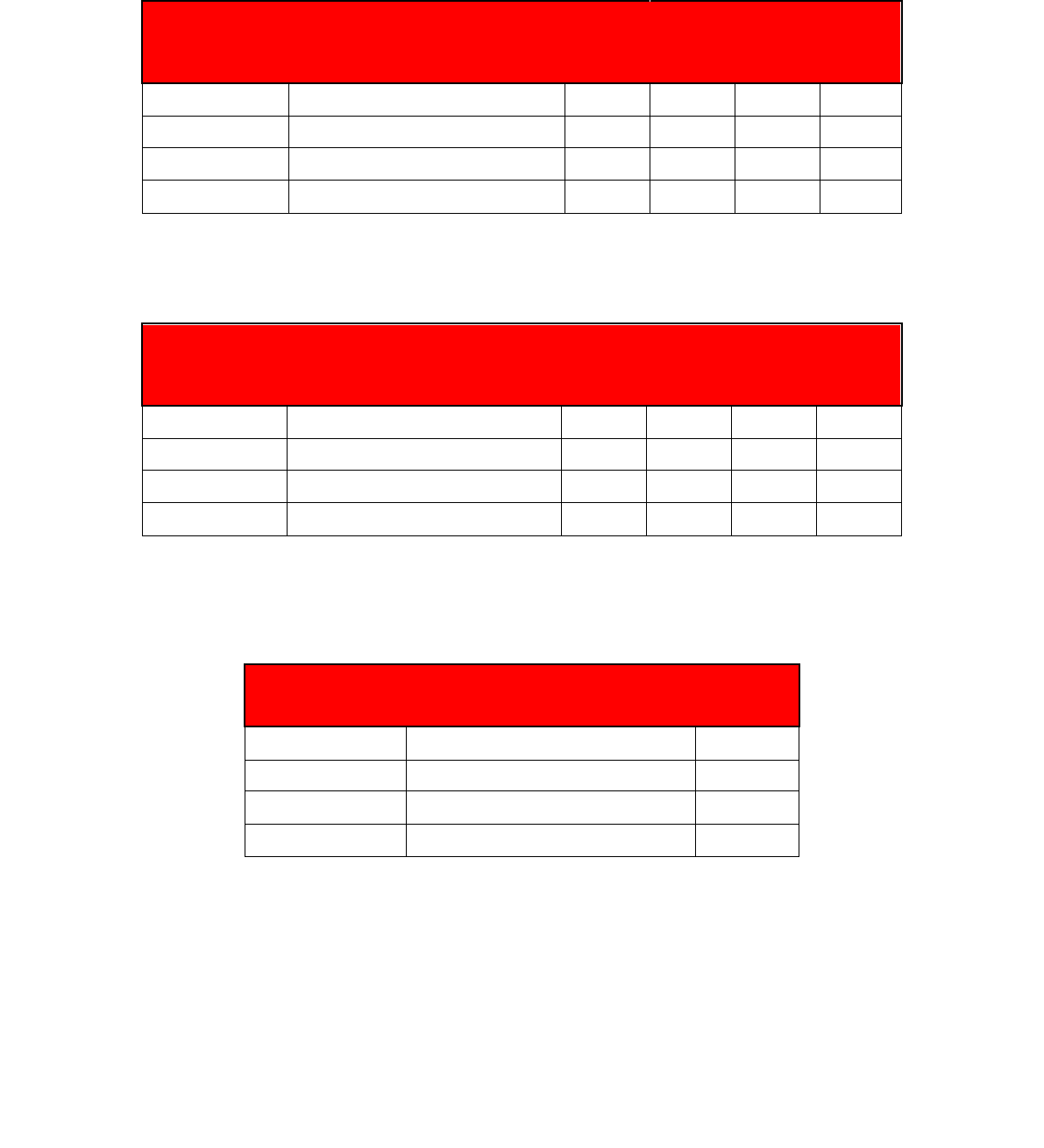

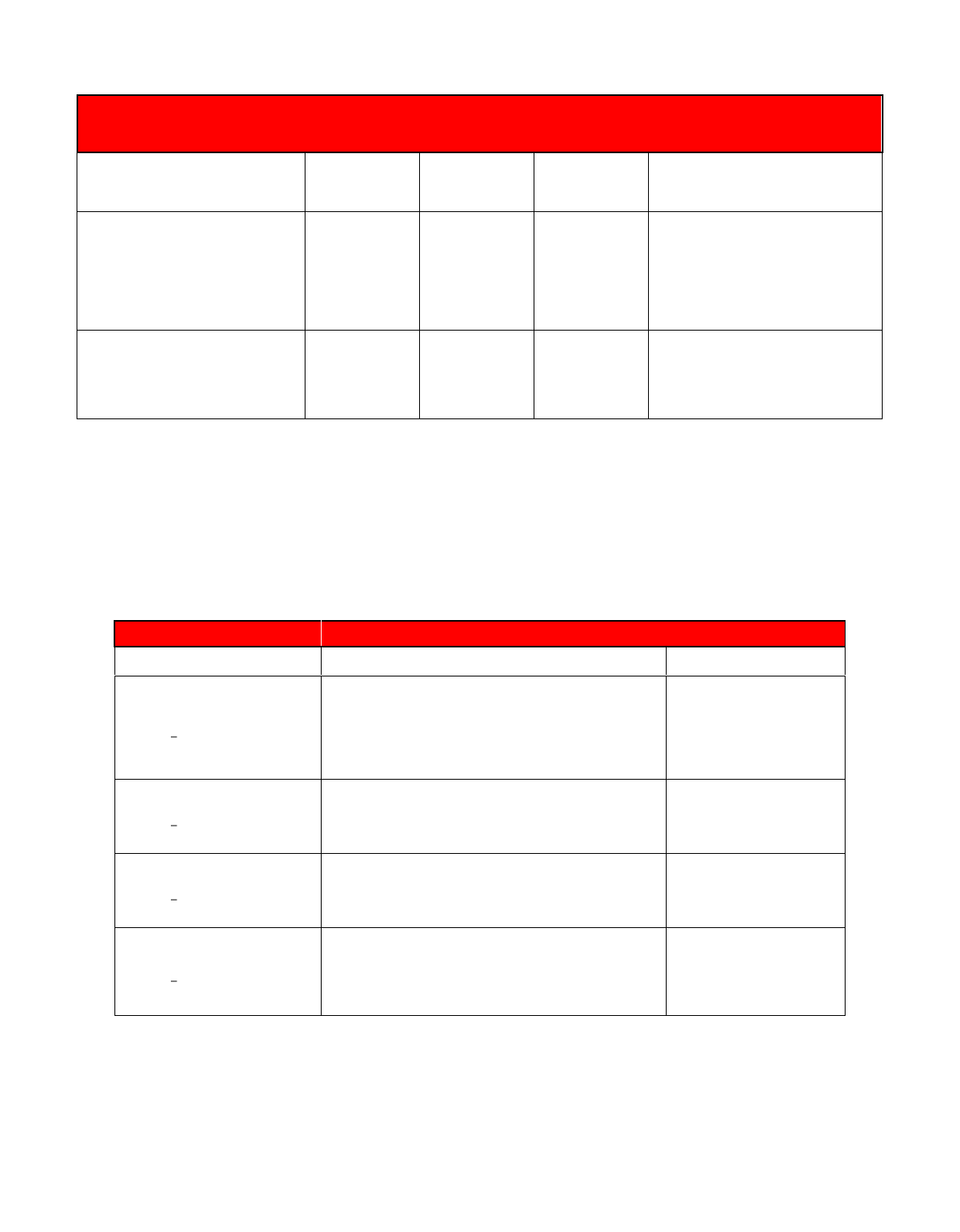

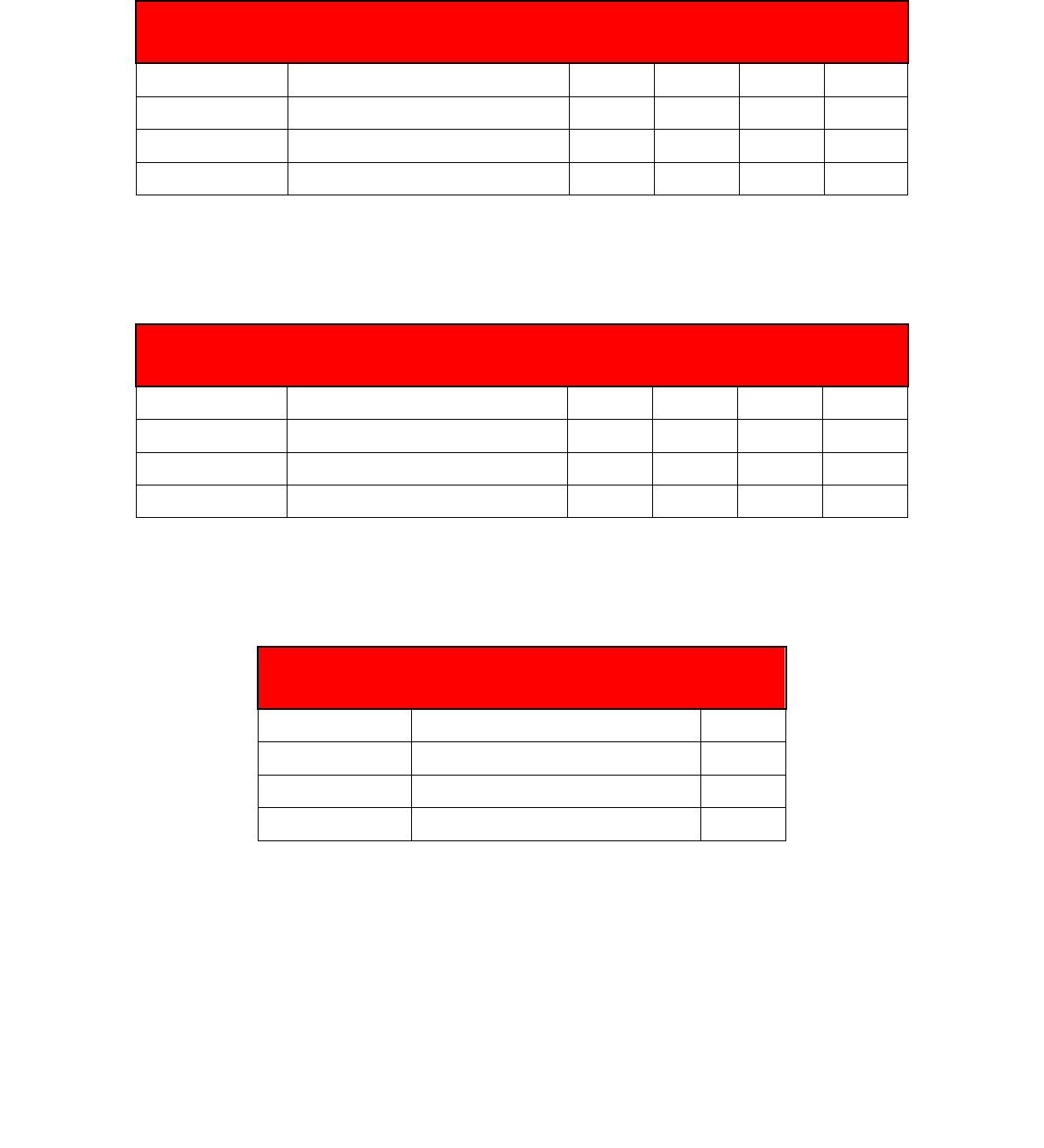

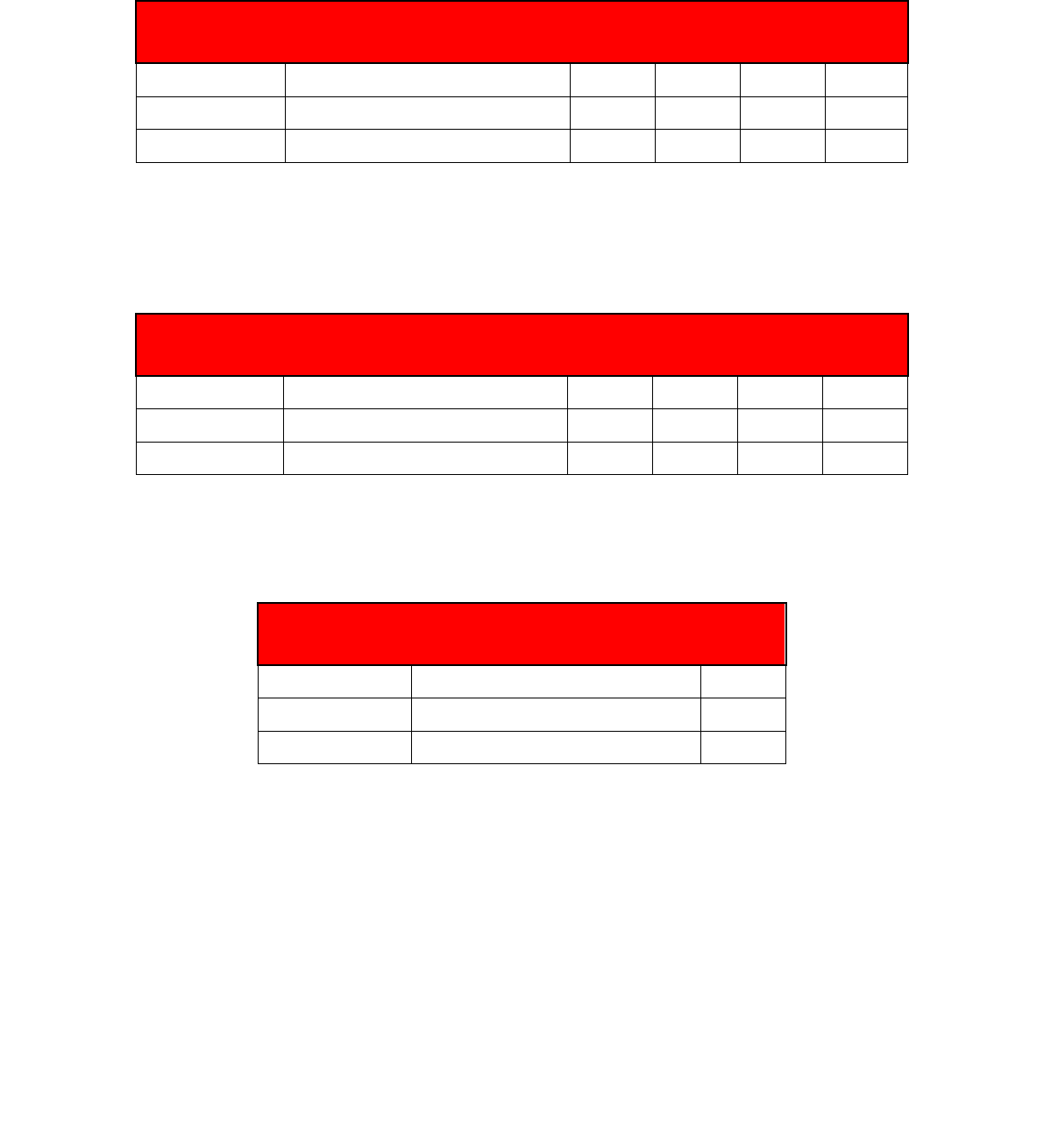

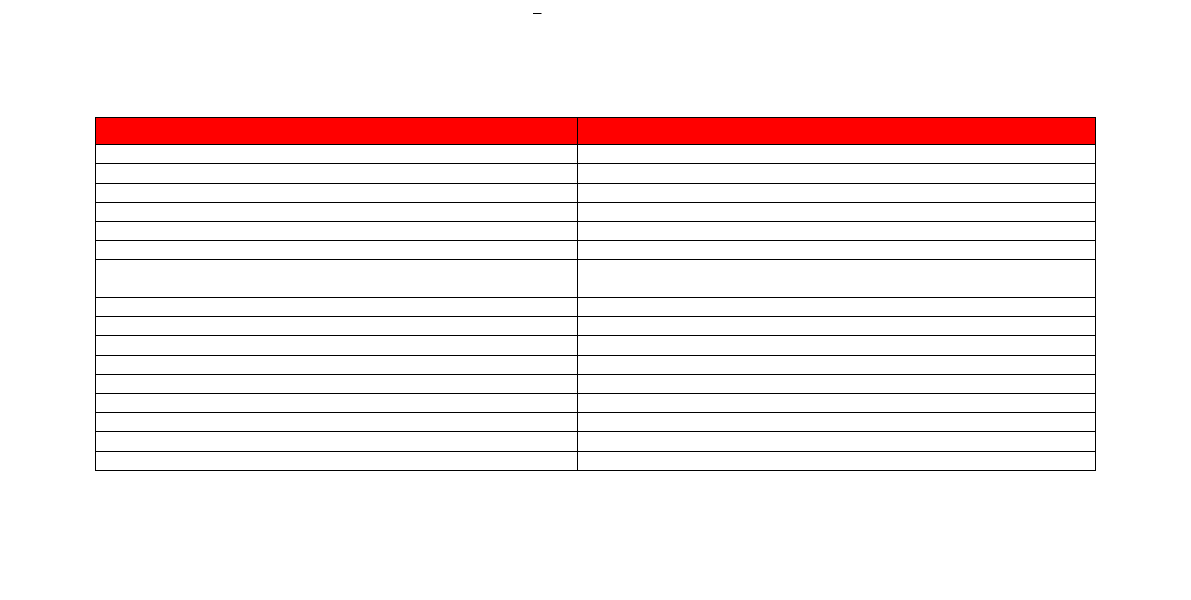

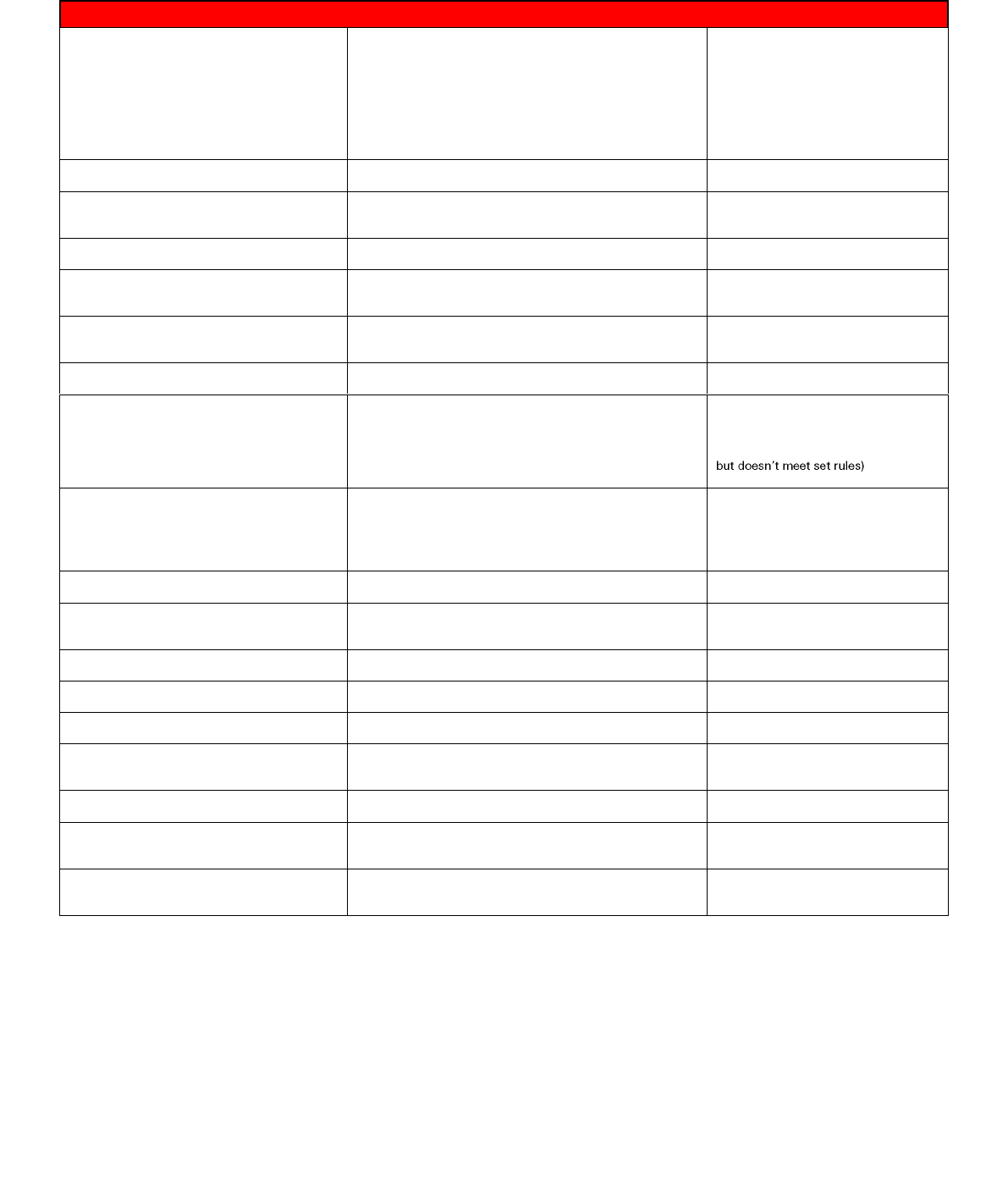

3. Summary of HSBC API Functionality Per

Channel

HSBC continues to make improvements and introduce new functionality to its Open Banking API channel. Below summarises the

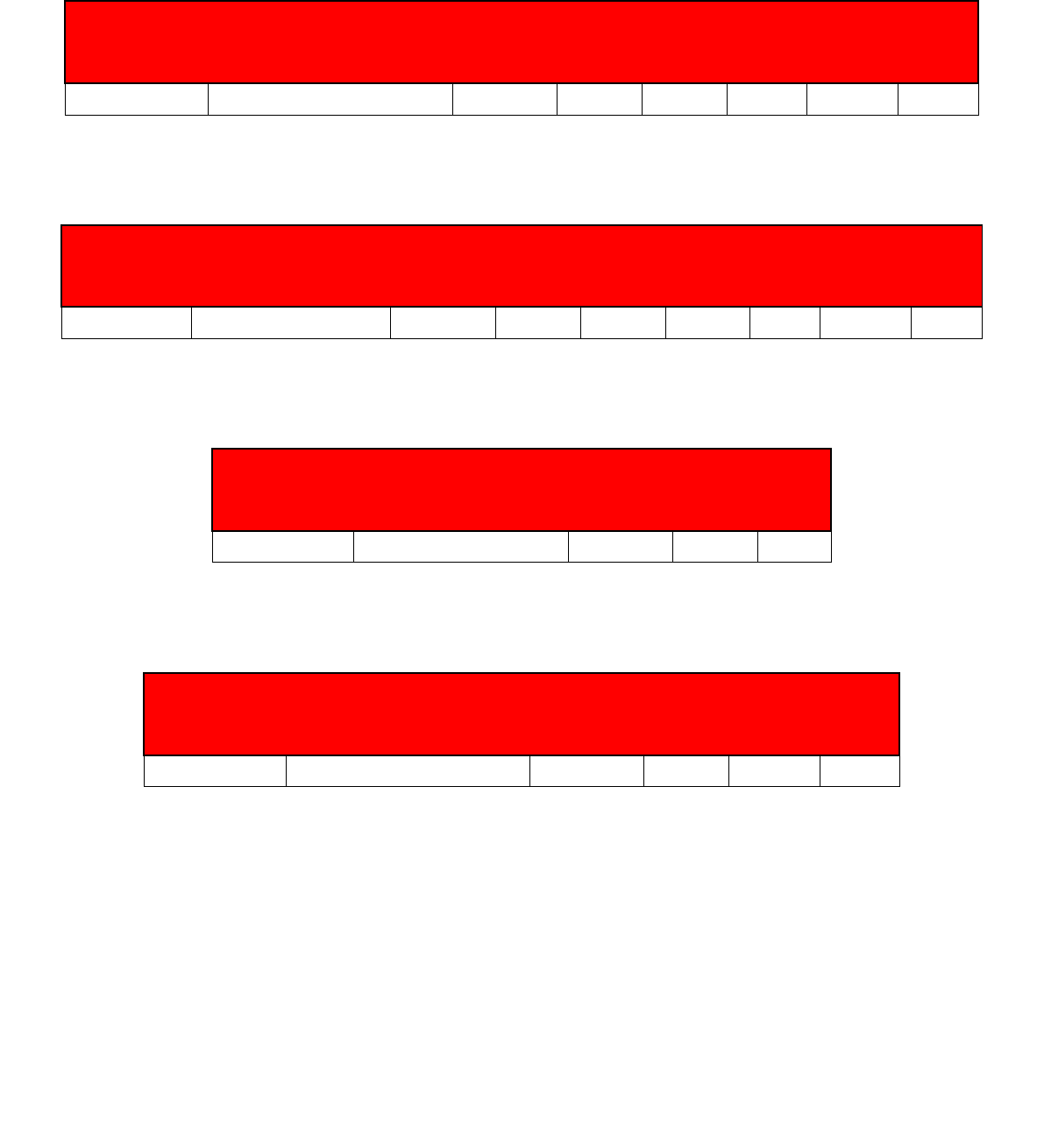

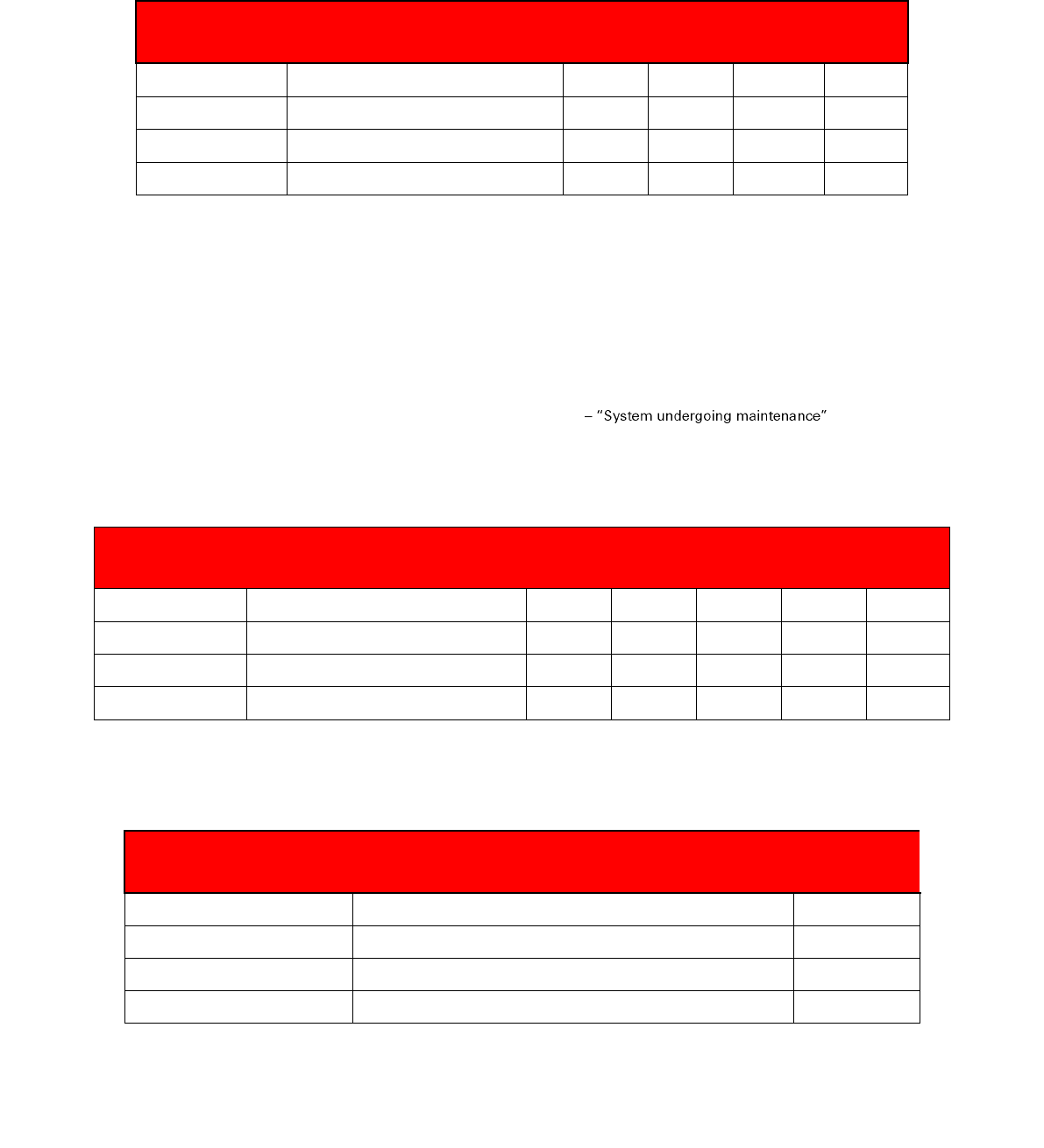

current per-brand position of live API functionality, and what can be expected to be live-to-market later in 2024.

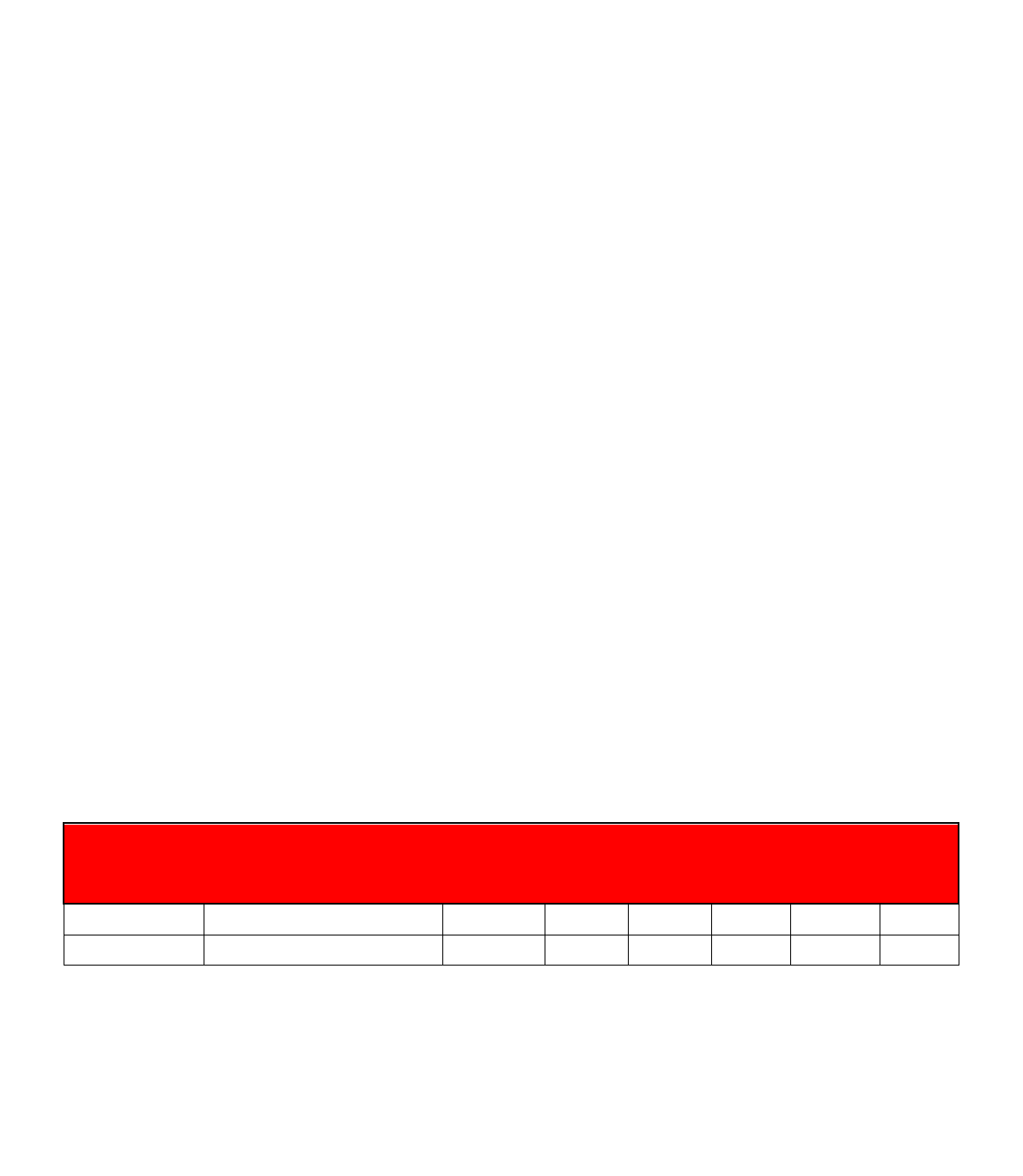

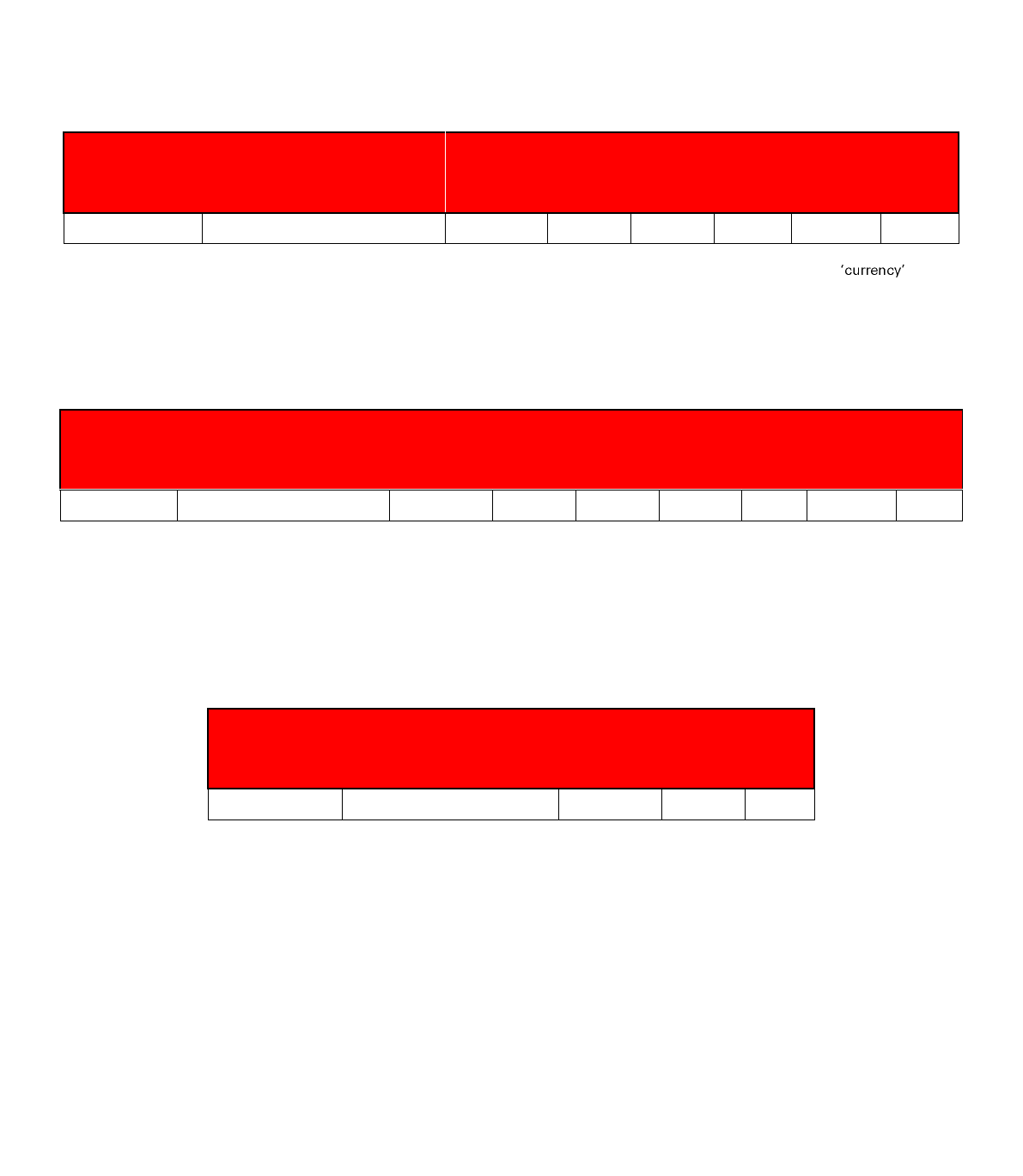

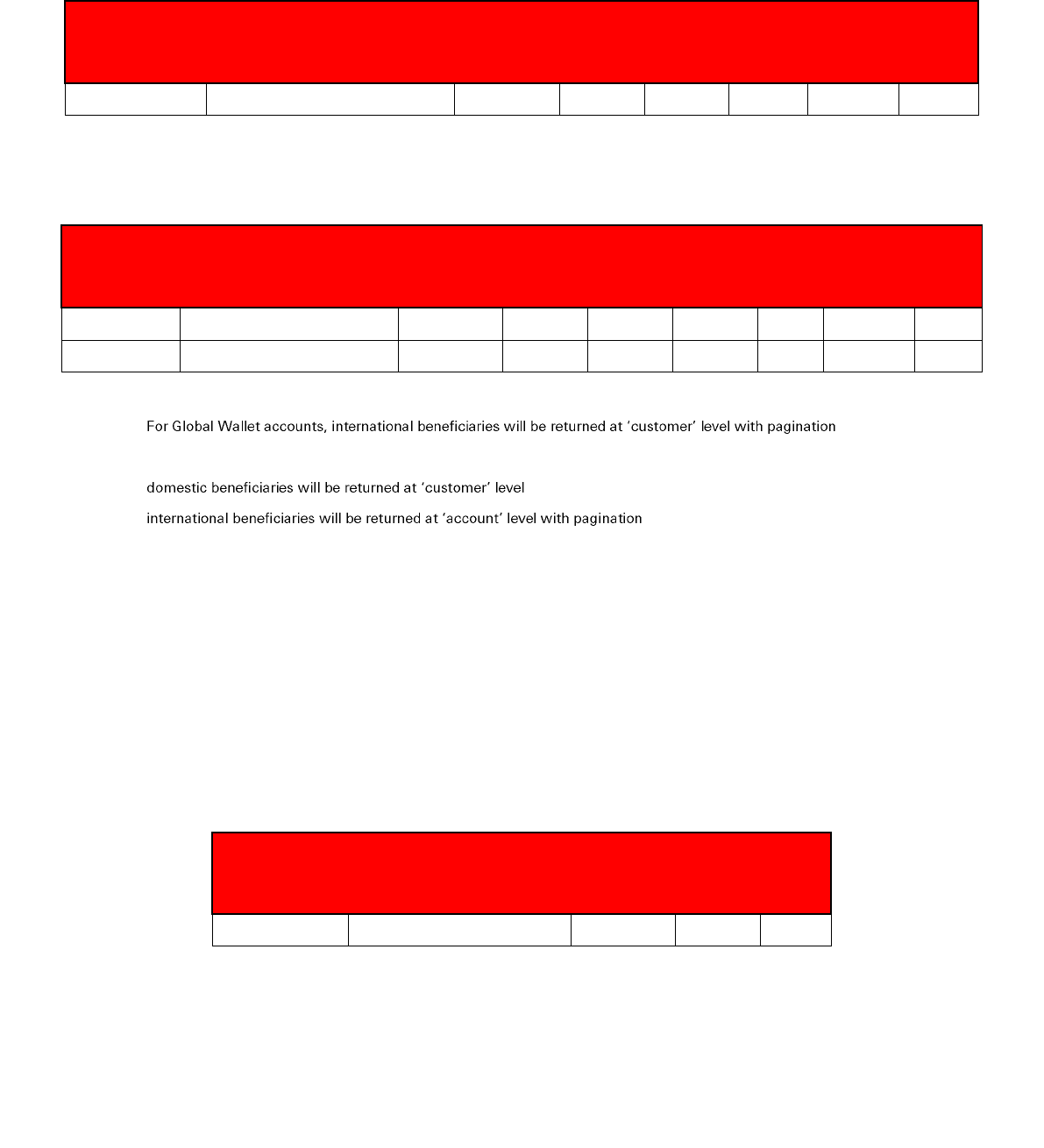

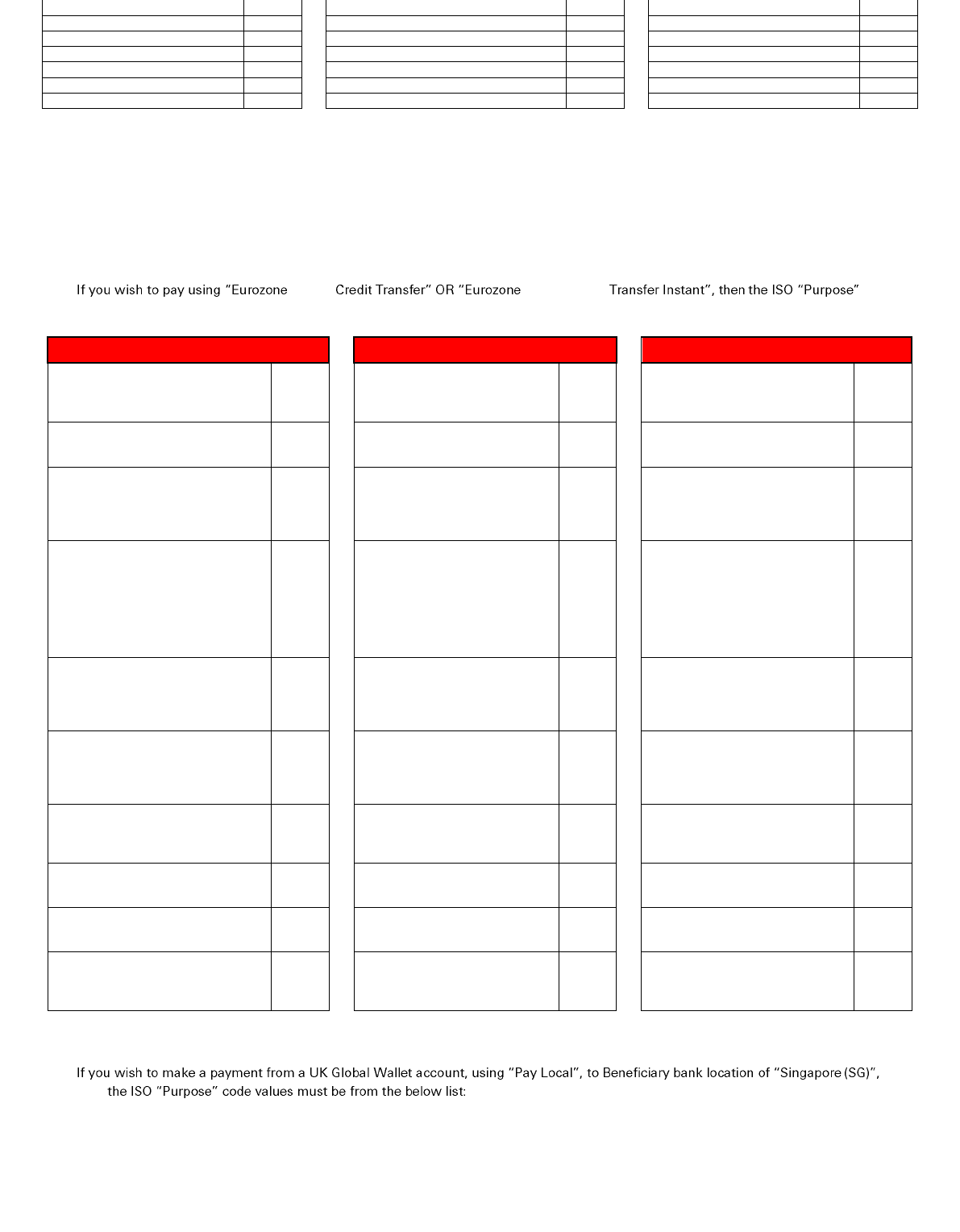

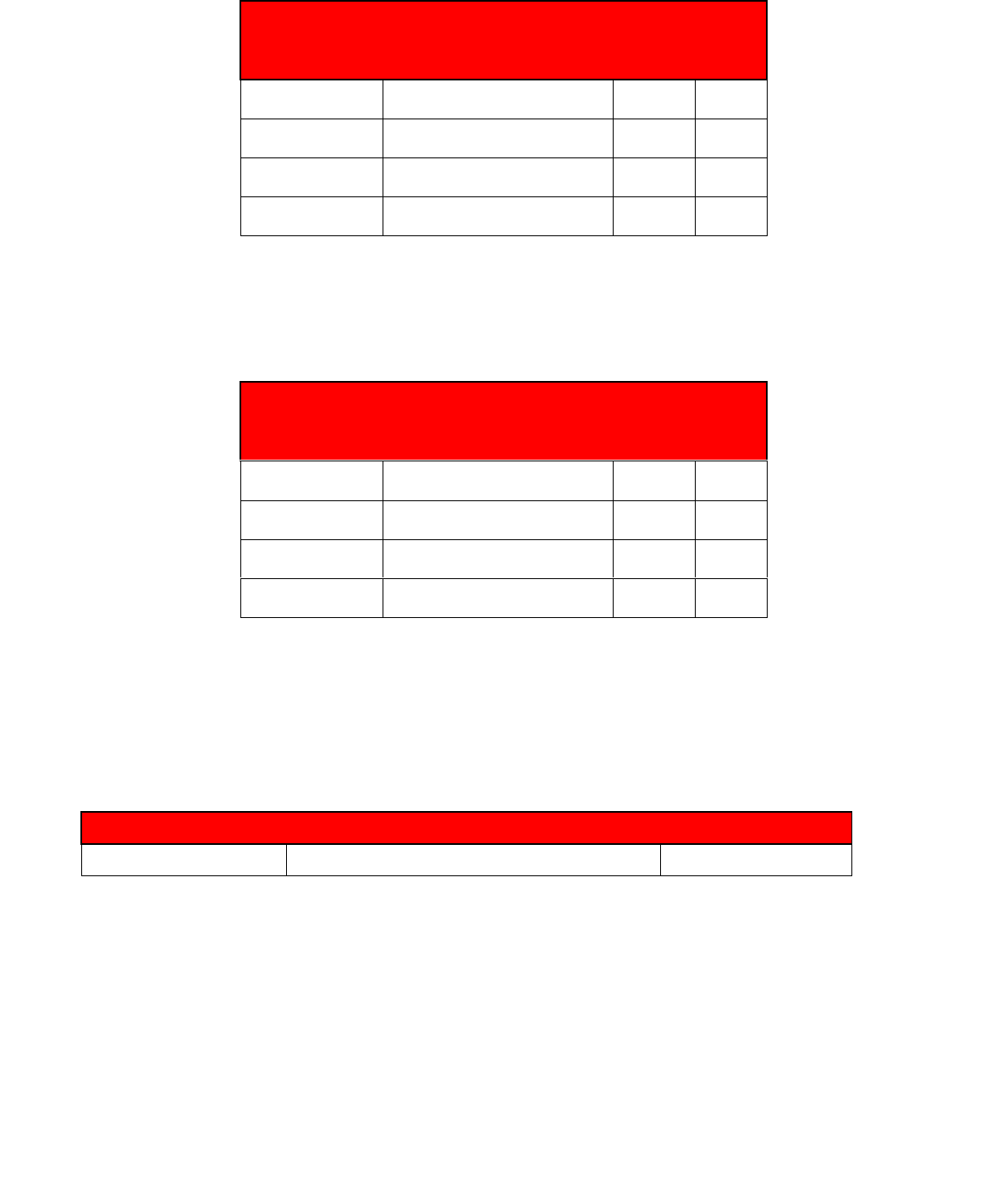

Brand

Product

Feature

Date (browser)

Date

(app-2-app)

HSBC Personal

Current Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (SIP, FDP, SO)

Live

Live

International Payments

Live

Live

Complex Payments (BACS, CHAPS)

n/a

n/a

Savings Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (Domestic Payments Only)

Live

Live

Credit Cards*

AIS

Live

Live

Confirmation of Funds

Live

Live

Global Money

AIS

Live

Live

PIS (Domestic Payments Only)

Live

Live

Confirmation of Funds

Live

Live

Multi-Currency

Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (International Payments Only)

Live

Live

first direct

Current Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (SIP, FDP, SO)

Live

Live

International Payments

Live

Live

Complex Payments (BACS, CHAPS)

n/a

n/a

Savings Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (Domestic Payments Only)

Live

Live

Credit Cards*

AIS

Live

Live

Confirmation of Funds

Live

Live

HSBC

Business

Business

Current Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (SIP, FDP, SO)

Live

Live

International Payments

Live

Live

Complex Payments (BACS, CHAPS)

Live

Live

Savings Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (Internal Transfers Only)

Live

Live

Deposit Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS

Live

Live

Credit Cards*

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS

n/a

n/a

Multi-Currency

Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (International Payments Only)

Live

Live

Global Wallet

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (International Payments Only)

Live

Live

M&S Bank

Credit Cards*

AIS

Live

Live

Confirmation of Funds

Live

Live

11

PUBLIC

* For Credit Card APIs, please note the following:

- The maximum transaction history accessible with SCA is 18 months billed and 1 month unbilled; for statements it is 18 months billed only (Transactions of up

to 72 months will be shared through Credit Cards Statements endpoint in 2024)

cal license will not be covered.

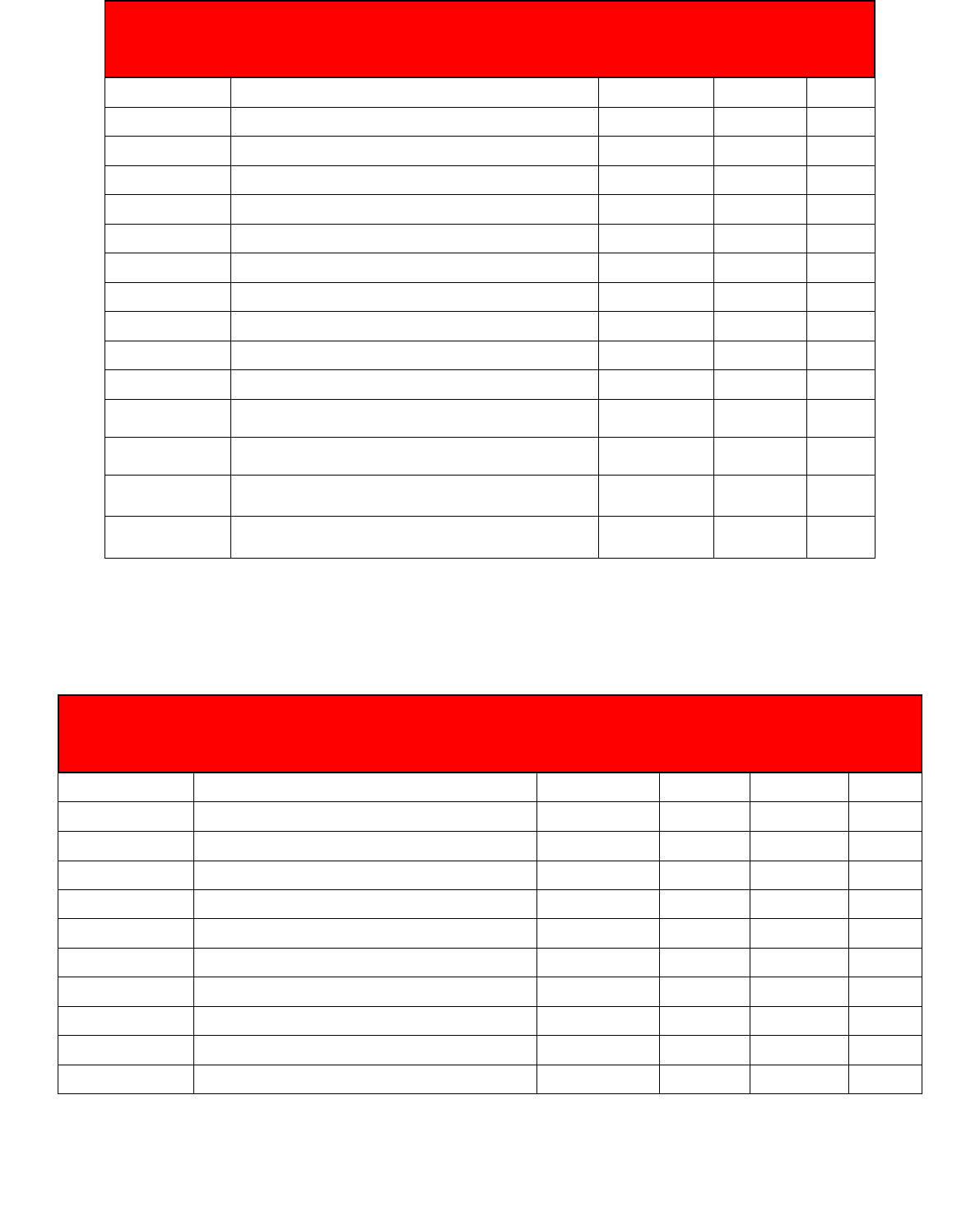

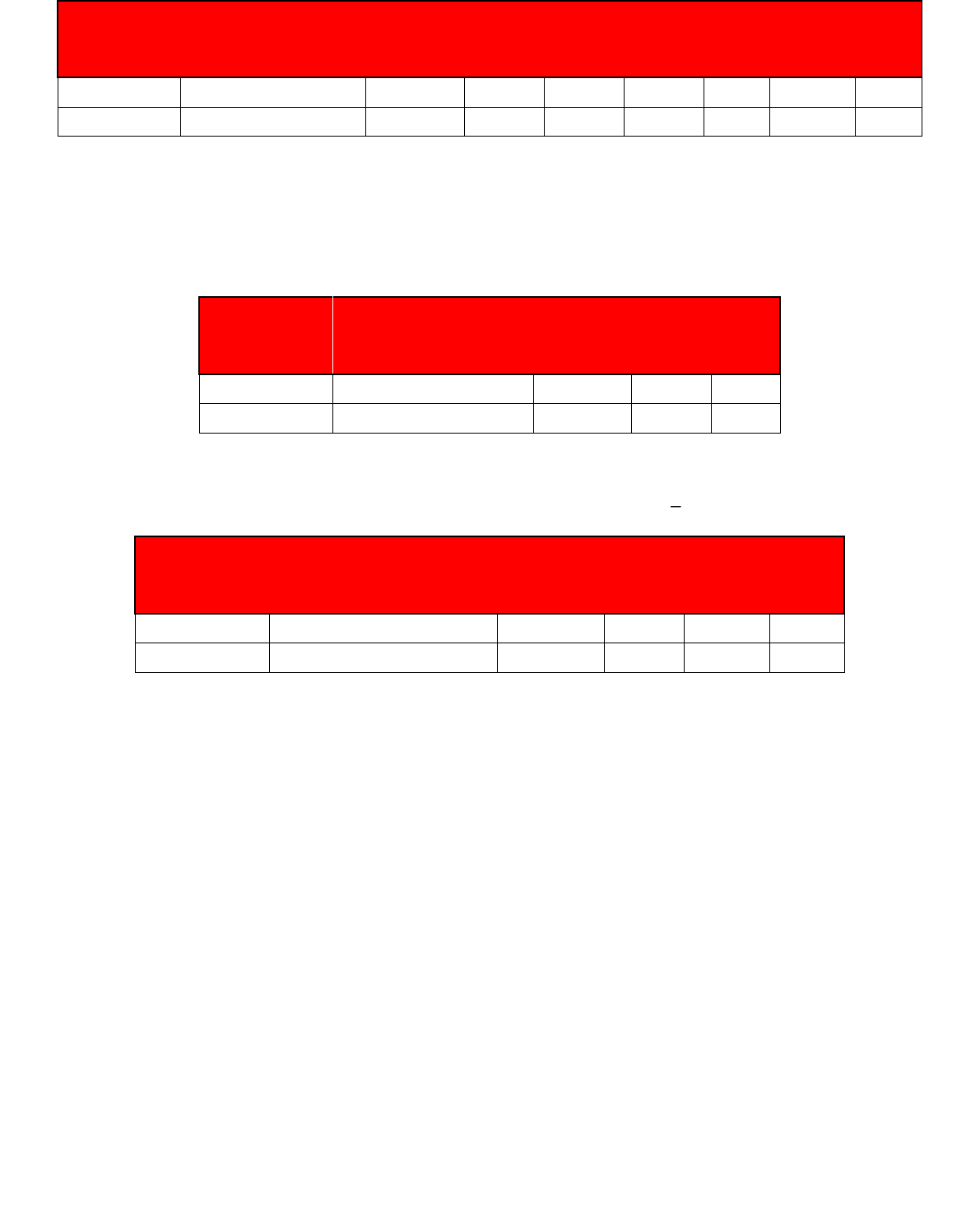

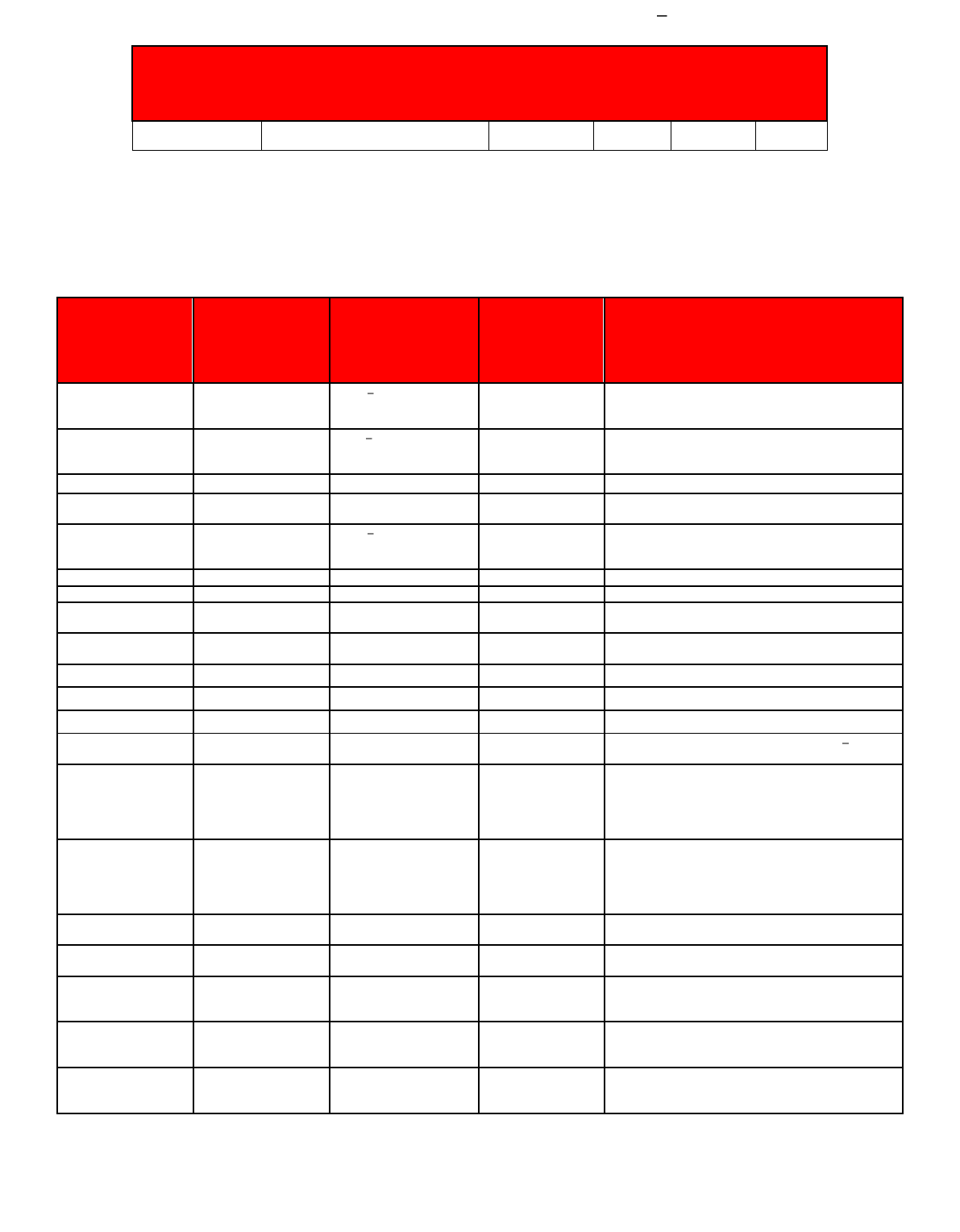

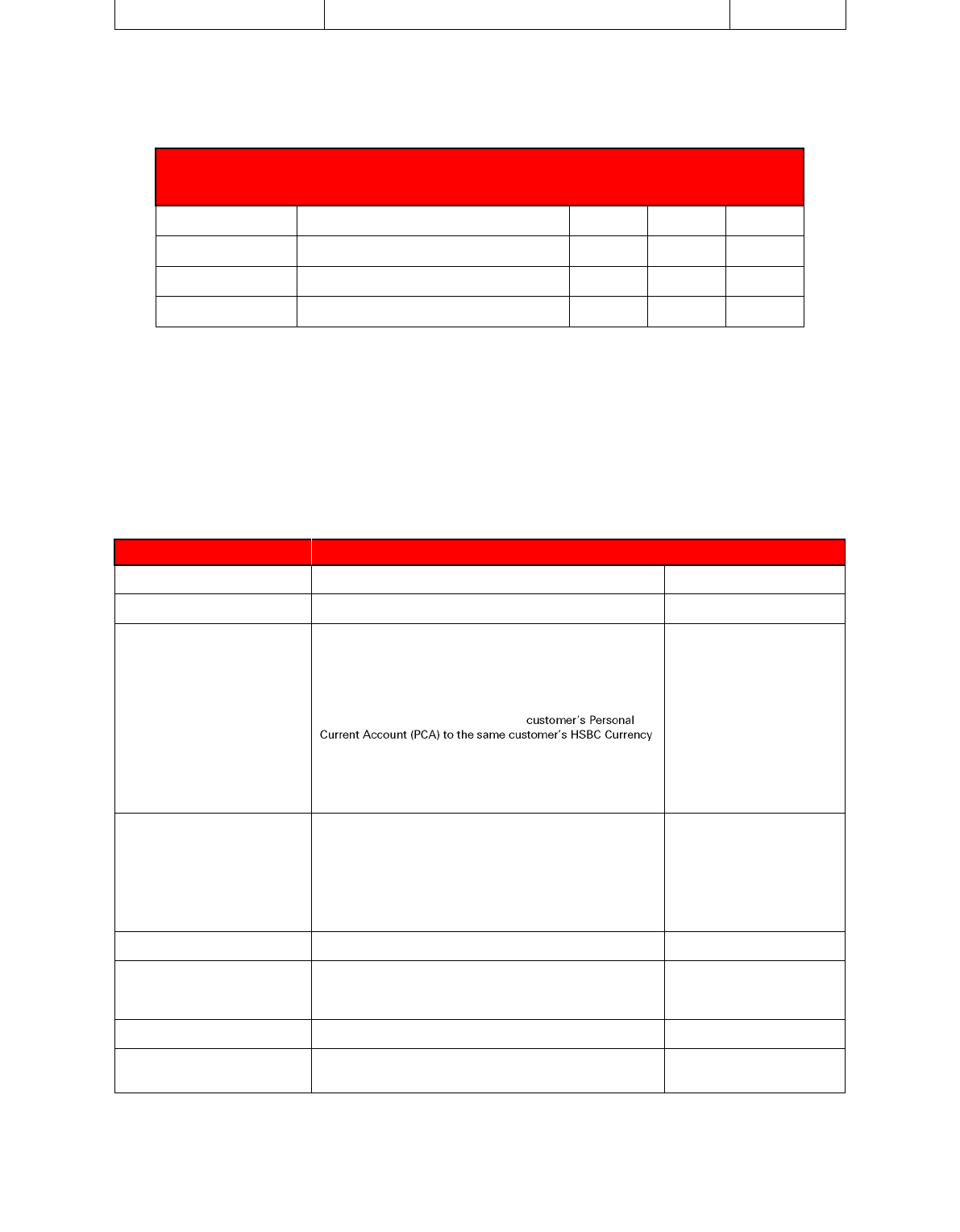

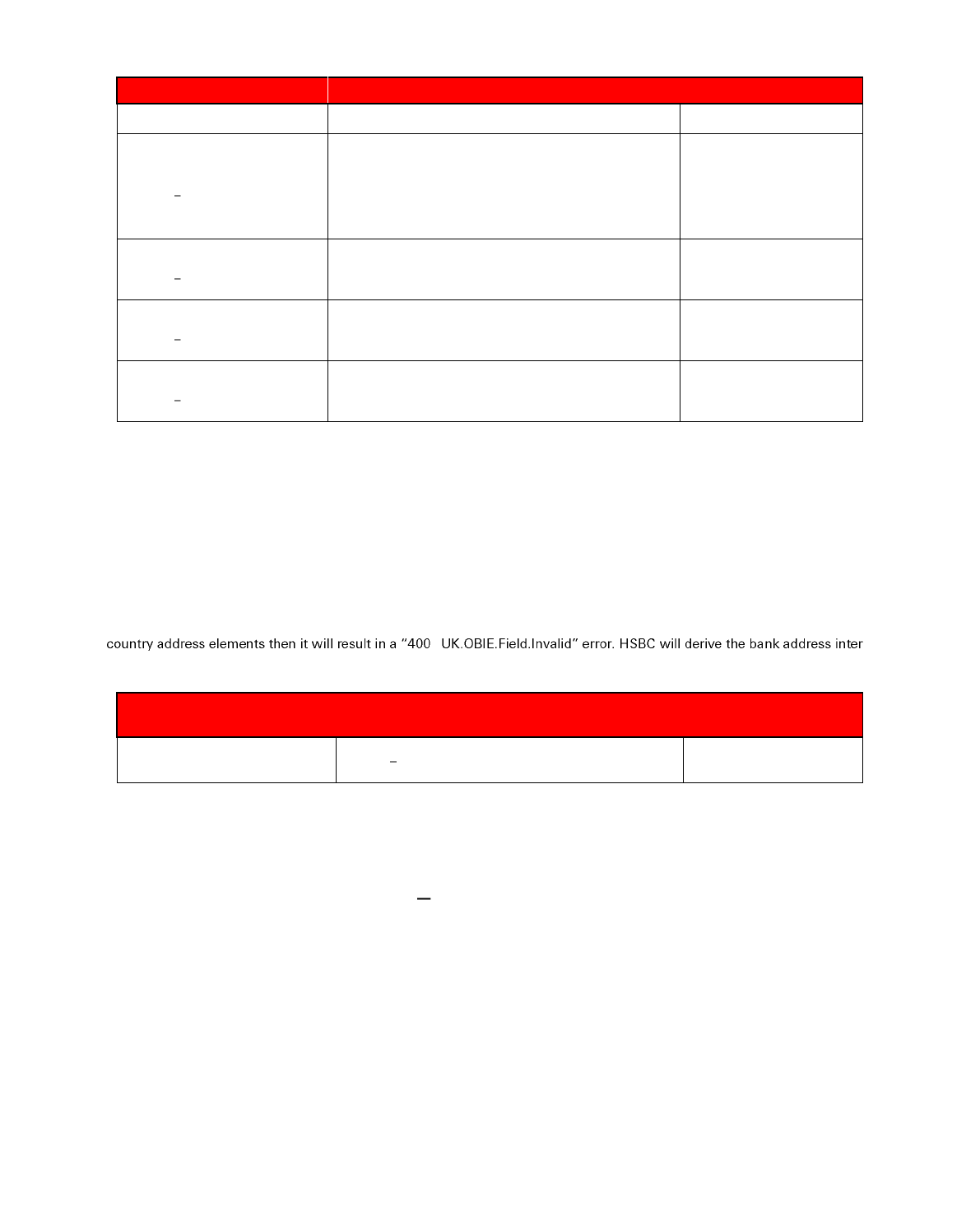

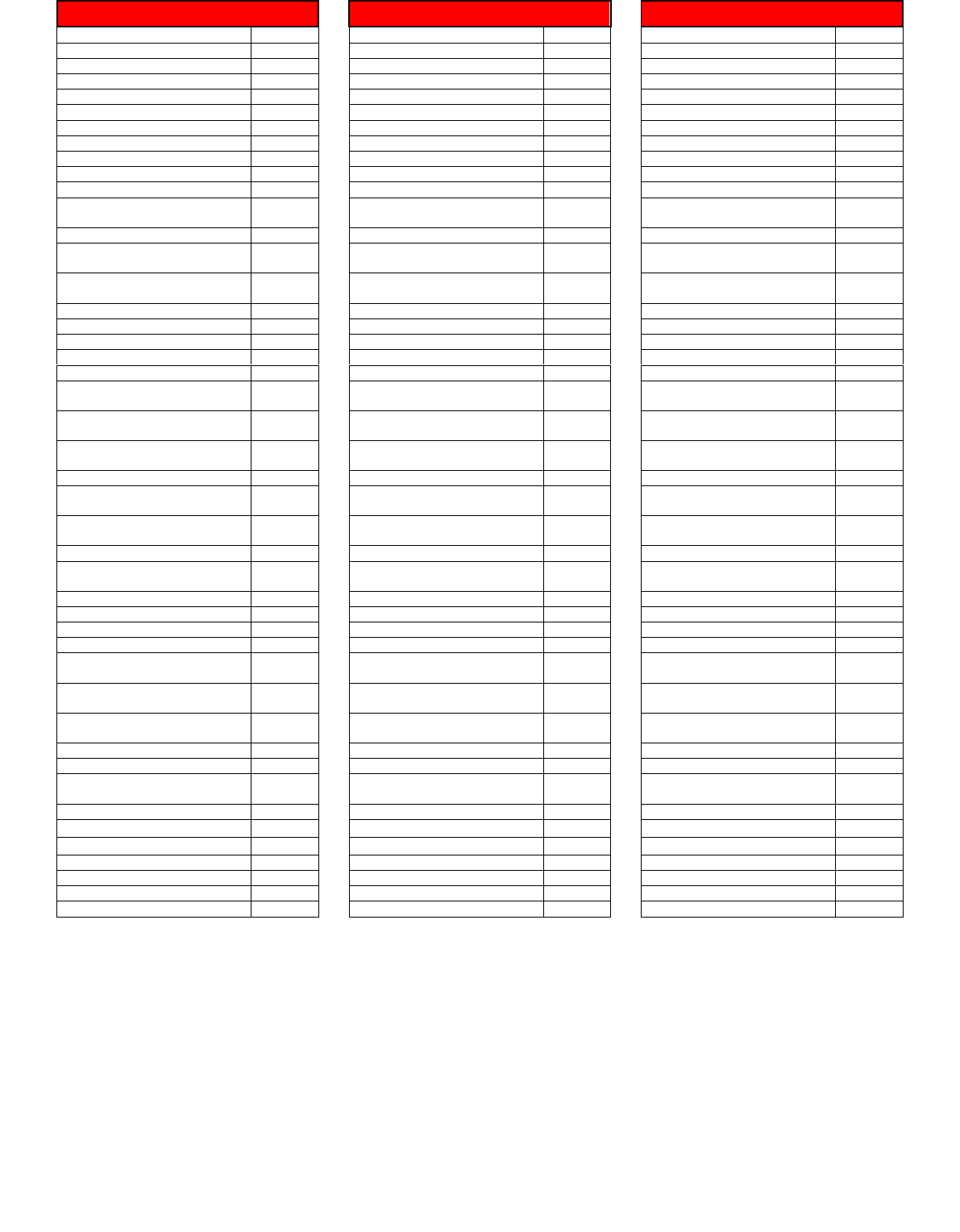

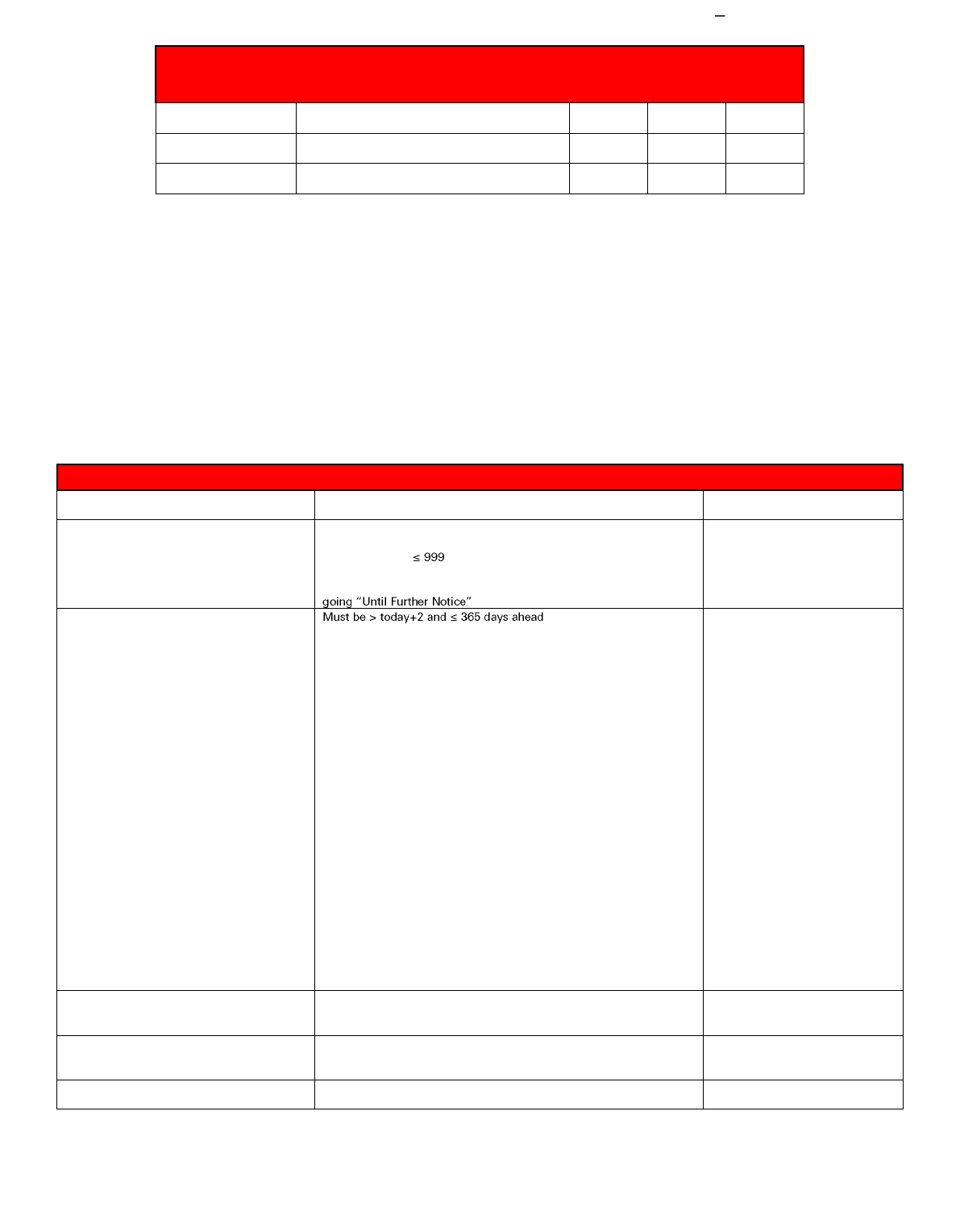

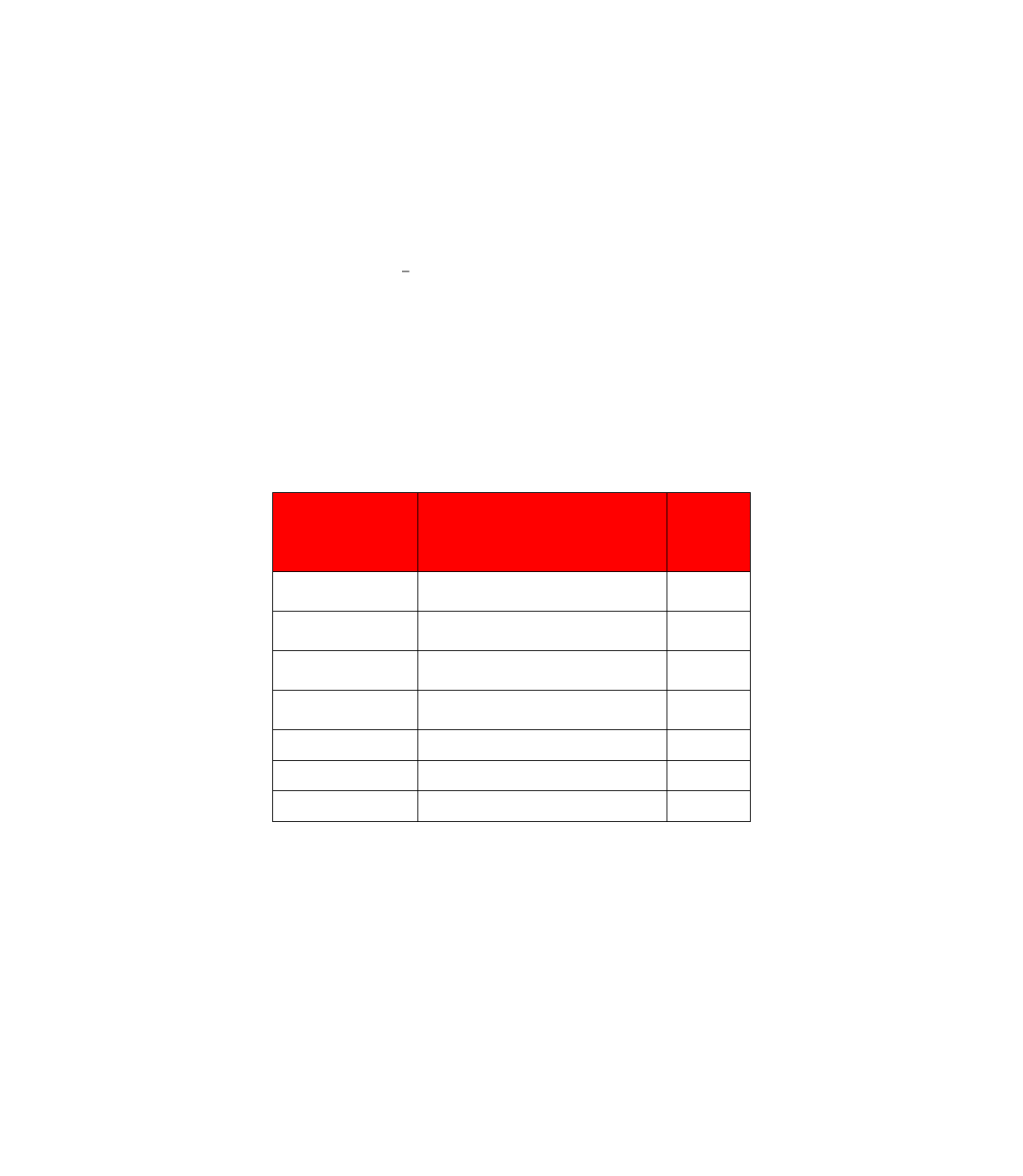

HSBC Kinetic

Business

Current Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (SIP, FDP, SO)

Live

Live

International Payments

n/a

n/a

Complex Payments (BACS, CHAPS)

n/a

n/a

Credit Cards*

AIS

Live

Live

Confirmation of Funds

Live

Live

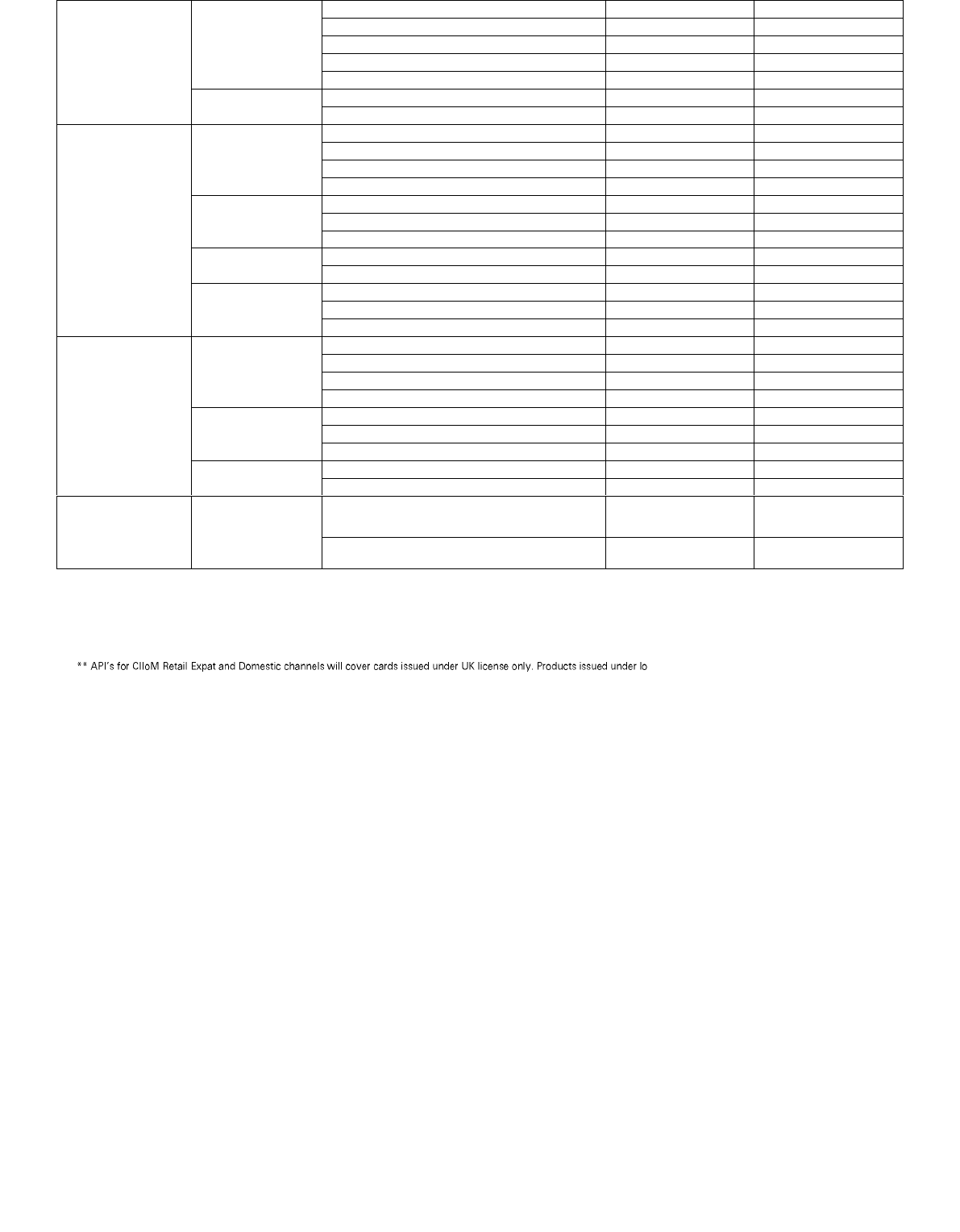

HSBC

Corporate UK

(HSBCnet UK)

Business

Current Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (Domestic payments)

Live

Live

Complex Payments (BACS, CHAPS)

Live

Live

Multi-Currency

Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (International Payments Only)

Live

Live

Credit Cards

AIS

Live

Live

Confirmation of Funds

Live

Live

Global Wallet

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (International Payments Only)

Live

Live

HSBC

Innovation

Banking

(HSBCnet UK)

Business

Current Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (Domestic payments)

Live

Live

Complex Payments (BACS, CHAPS)

Live

Live

Multi-Currency

Accounts

AIS

Live

Live

Confirmation of Funds

Live

Live

PIS (International Payments Only)

Live

Live

Credit Cards

AIS

Live

Live

Confirmation of Funds

Live

Live

HSBC Channel

Islands and

Isle of Man

Credit Cards**

AIS

tbc

tbc

Confirmation of Funds

tbc

tbc

12

PUBLIC

4. Useful Information

4.1. Customer UI Journeys

For AISP journeys, our solution can determine whether the PSU is about to authorise a new consent or refresh an existing one. As a

result, only the core information is displayed during the AISP refresh flow user journey.

PISP flows are enriched with similar features, to enable us to spot a payment request to a trusted beneficiary, or to apply SCA

exemptions if applicable.

The above is supported by a responsive design which provides a smooth user experience on desktop and a mobile browser.

For further technical information please visit the Open Banking Security Profile

4.2. TPP Registration

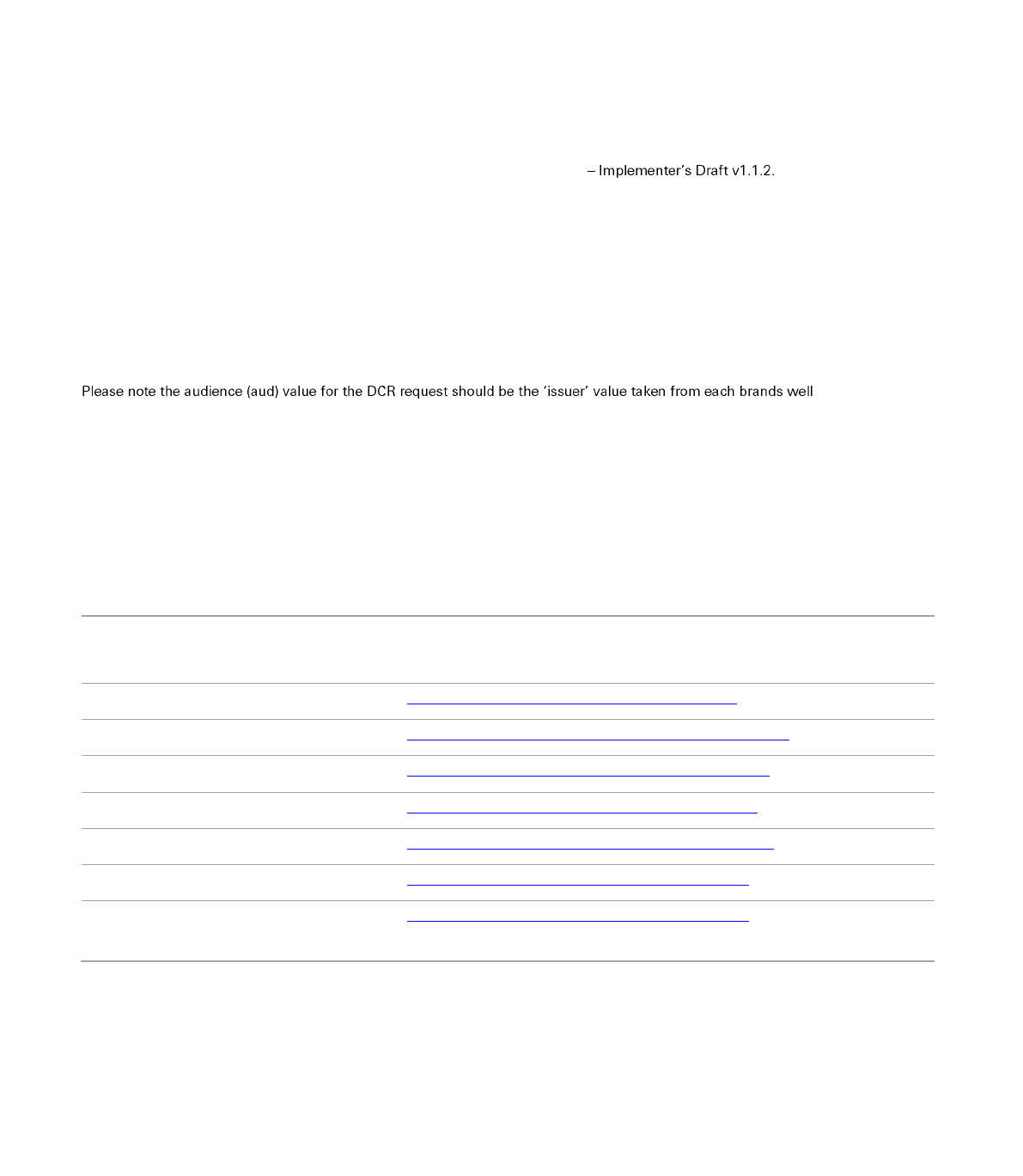

For TPP registration HSBC supports 3.2 of Dynamic Client Registration in line with specifications - Dynamic Client Registration v3.2.

Please note in version 3.2 of Dynamic Client Registration content-type should be application/jose.

-known

configuration.

Please note the JWT expiry parameter (exp) in the request body should be set to a maximum of 30 mins.

4.2.1. Software Statement

TPPs need to check the address of HSBC's registration endpoint using our well-known endpoints:

Banking Area

Well-known Endpoint

HSBC Personal

https://api.ob.hsbc.co.uk/.well-known/openid-configuration

HSBC Business

https://api.ob.business.hsbc.co.uk/.well-known/openid-configuration

Marks and Spencer

https://api.ob.mandsbank.com/.well-known/openid-configuration

first direct

https://api.ob.firstdirect.com/.well-known/openid-configuration

HSBC Kinetic

https://api.ob.hsbckinetic.co.uk/.well-known/openid-configuration

HSBC Corporate UK (HSBCnet UK)

https://api.ob.hsbcnet.com/.well-known/openid-configuration

HSBC Innovation Banking

(HSBCnet UK)

https://api.ob.hsbcnet.com/.well-known/openid-configuration

TPPs need to register with their National Competent Authority (NCA) and to obtain the appropriate certificate based on jurisdiction.

13

PUBLIC

Software Statements:

For holders of OBWAC / OBSEAL certificates, TPPs will be issued with a software statement from the OBIE Directory - see here for

more information.

TPPs using eIDAS certificates can generate a self-signed software statement (self-signed SSA) - see here for further information. A

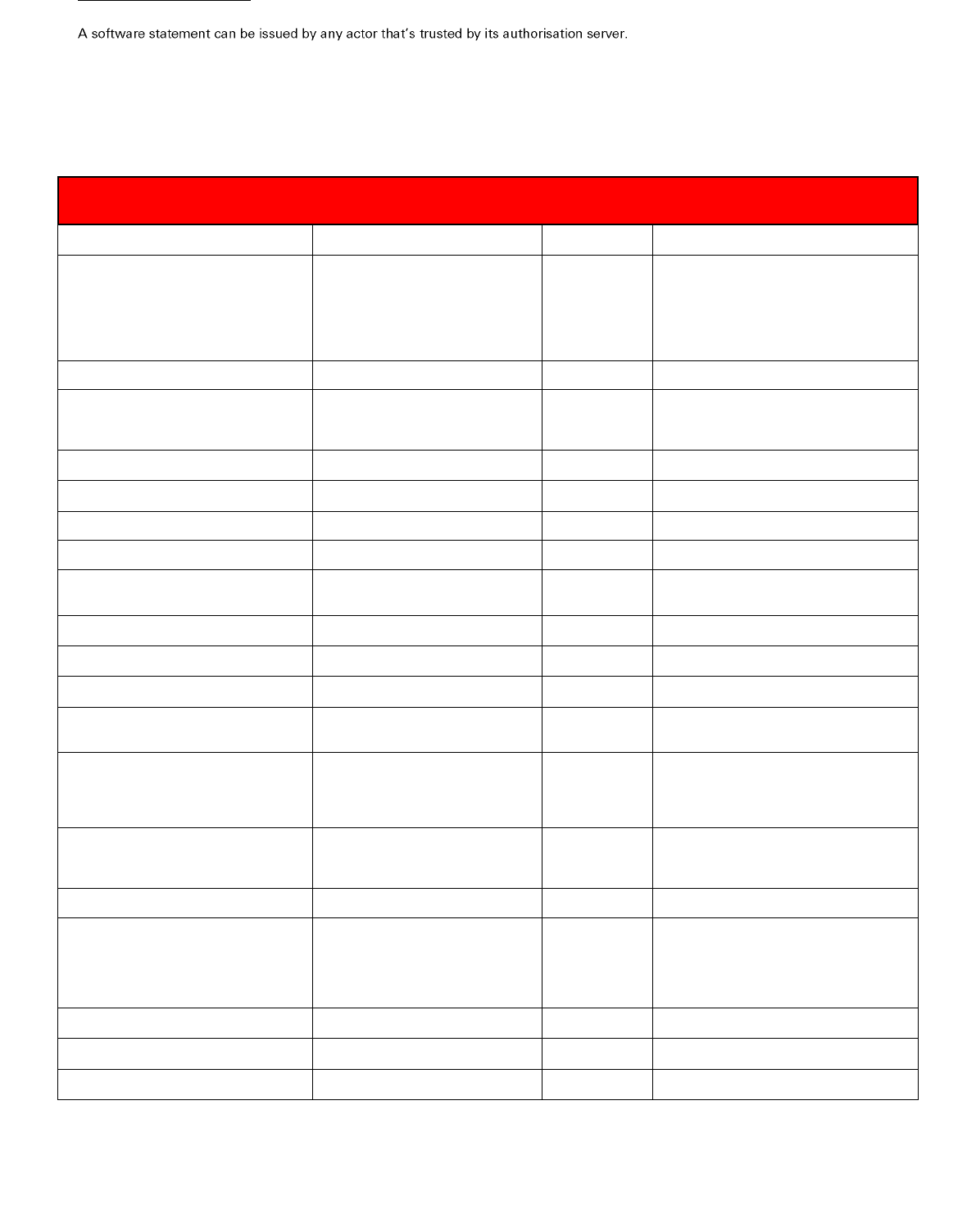

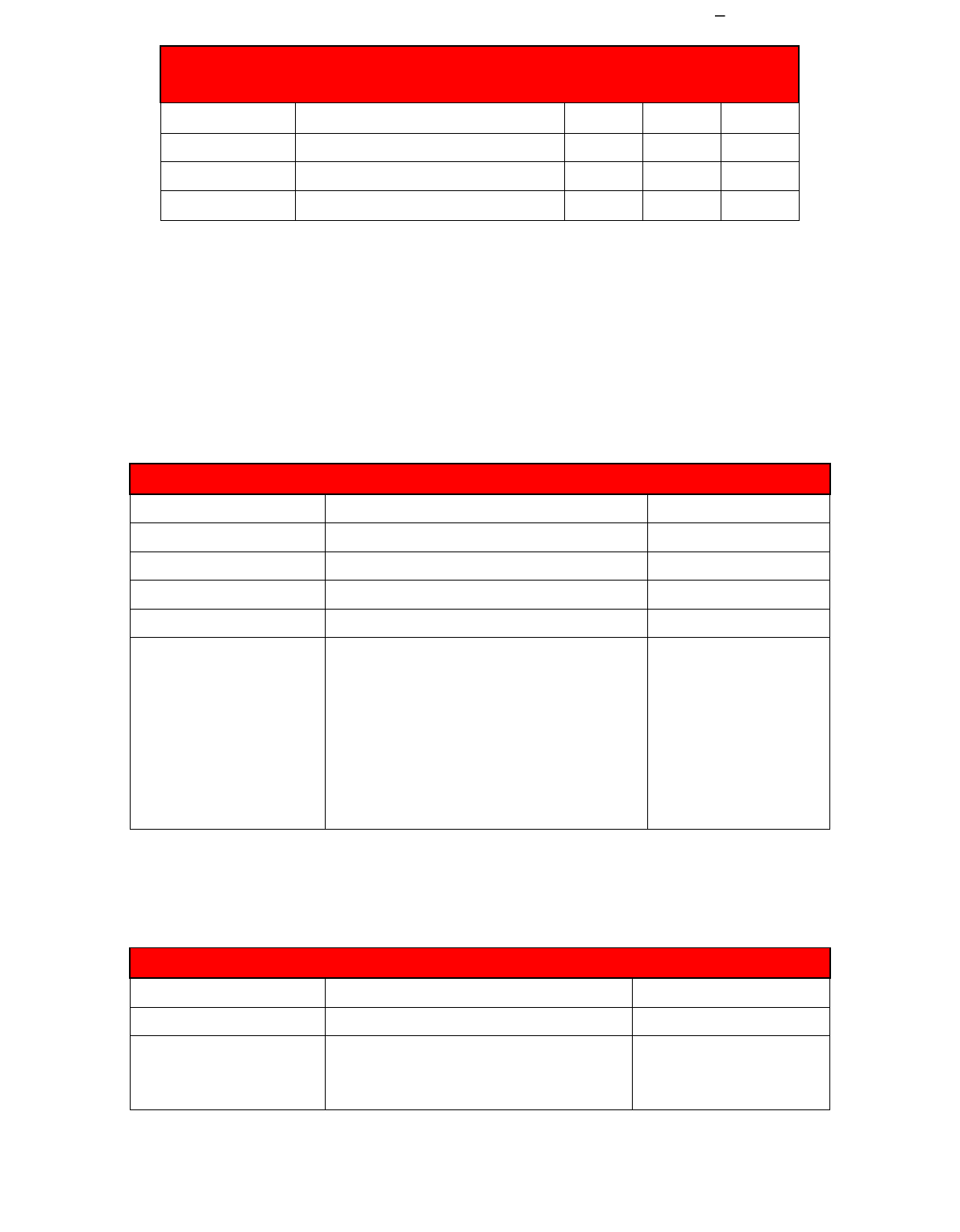

complete list of all fields required for a self-signed SSA is provided below in the tables:

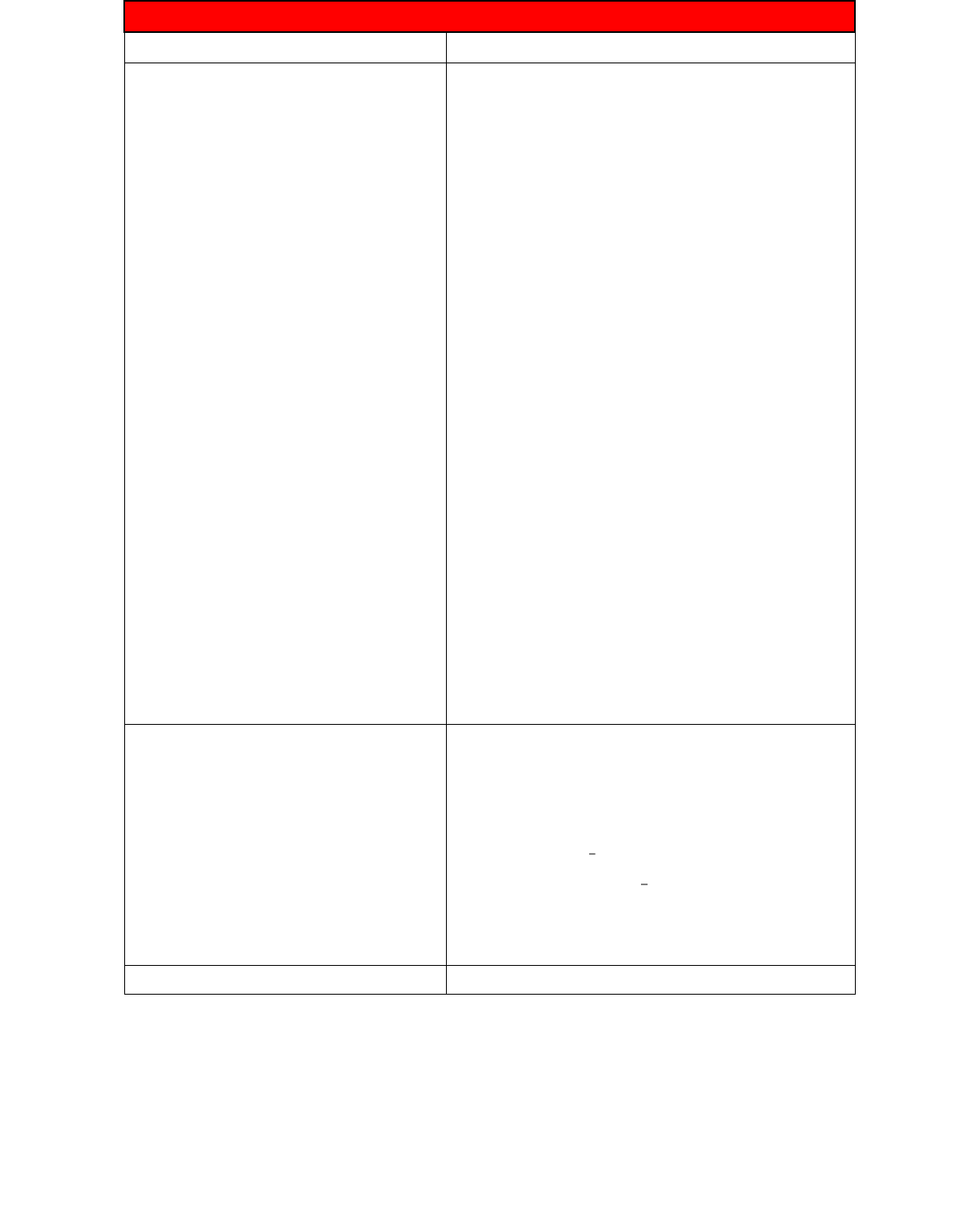

Metadata

Description

Optional or

Mandatory

Source Specification

`software_id`

Unique Identifier for TPP Client

Software

M

[RFC7591]

^[0-9a-zA-Z]{1,22}$

`iss`

SSA Issuer

M

[RFC7519]

^[0-9a-zA-Z]{1,22}$

Identifier for the TPP. This value must be

unique for each TPP registered by the issuer

of the SSA

For SSAs issued by the OB Directory, this

must be the software_id

`iat`

Time SSA issued

M

[RFC7519]

`jti`

JWT ID

M

[RFC7519]

^[0-9A-F]{8}-[0-9A-F]{4}-4[0-9A-F]{3}-

[89AB][0-9A-F]{3}-[0-9A-F]{12}$`

Max-36 length

`software_client_id`

The Client ID Registered at OB used to

access OB resources

M

Base62 GUID (22 chars) Max 36

`software_client_description`

Human-readable detailed description of

the client

O

Max256Text

`software_client_name`

Human-readable Software Name

O

Max40Text

`software_client_uri`

The website or resource root uri

O

Max256Text

`software_version`

The version number of the software

should a TPP choose to register and /

or maintain it

O

decimal

`software_environment`

Requested additional field to avoid

certificate check

O

Max256Text

`software_jwks_endpoint`

Contains all active signing and network

certs for the software

M

Max256Text

`software_jwks_revoked_endpoint`

Contains all revoked signing and

network certs for the software

O

Max256Text

`software_logo_uri`

Link to the TPP logo. Note, ASPSPs are

not obliged to display images hosted

by third parties

O

Max256Text

`software_mode`

ASPSP Requested additional field to

indicate that this software is `Test` or

`Live` the default is `Live`. Impact and

support for `Test` software is up to the

ASPSP.

O

Max40Text

`software_on_behalf_of_org`

A reference to fourth party

organsiation resource on the OB

Directory if the registering TPP is

acting on behalf of another.

O

Max40Text

`software_policy_uri`

A link to the software's policy page

O

Max256Text

`software_redirect_uris`

Registered client callback endpoints as

registered with Open Banking

M

A string array of Max256Text items

Pattern applied

(?:\\[([0-9a-fA-F:]+)\\]|(?:(?:[a-zA-Z0-9%-

._~!$&'()*+,;=]+(?::[a-zA-Z0-9%-

._~!$&'()*+,;=]*)?@)?([\\p{Alnum}\\-

\\.]*)))(?::(\\d*))?(.*)?

`software_roles`

A multi value list of PSD2 roles that

this software is authorized to perform.

M

A string array of Max256Text items

`software_tos_uri`

A link to the software's terms of

service page

O

Max256Text

`organisation_competent_authority_claims`

Authorisations granted to the

organsiation by an NCA

CodeList {`AISP`, `PISP`, `CBPII`, `ASPSP`}

14

PUBLIC

`org_status`

Included to cater for voluntary

withdrawal from OB scenarios

`Active`, `Revoked`, or `Withdrawn`

`org_id`

The Unique TPP or ASPSP ID held by

OpenBanking.

M

HSBC Implementation support Max 18 char

`org_name`

Legal Entity Identifier or other known

organisation name

O

Max140Text

`org_contacts`

JSON array of objects containing a

triplet of name, email, and phone

number

O

Each item Max256Text

`org_jwks_endpoint`

Contains all active signing and network

certs for the organisation

O

Max256Text

`org_jwks_revoked_endpoint`

Contains all revoked signing and

network certs for the organisation

O

Max256Text

`typ`

MUST be set to `JWT`

M

`alg`

MUST be set to `PS256`

M

`kid`

The kid will be kept the same as the

`x5t` parameter. (X.509 Certificate

SHA-1 Thumbprint) of the signing

certificate.

M

Software statements are checked by the ASPSP on TPP registration / request for access.

Digital Signatures:

QSEALs or OBSEALS will also be required by TPPs to enable a digital signature feature. Use of a digital signature to sign payloads is

mandatory.

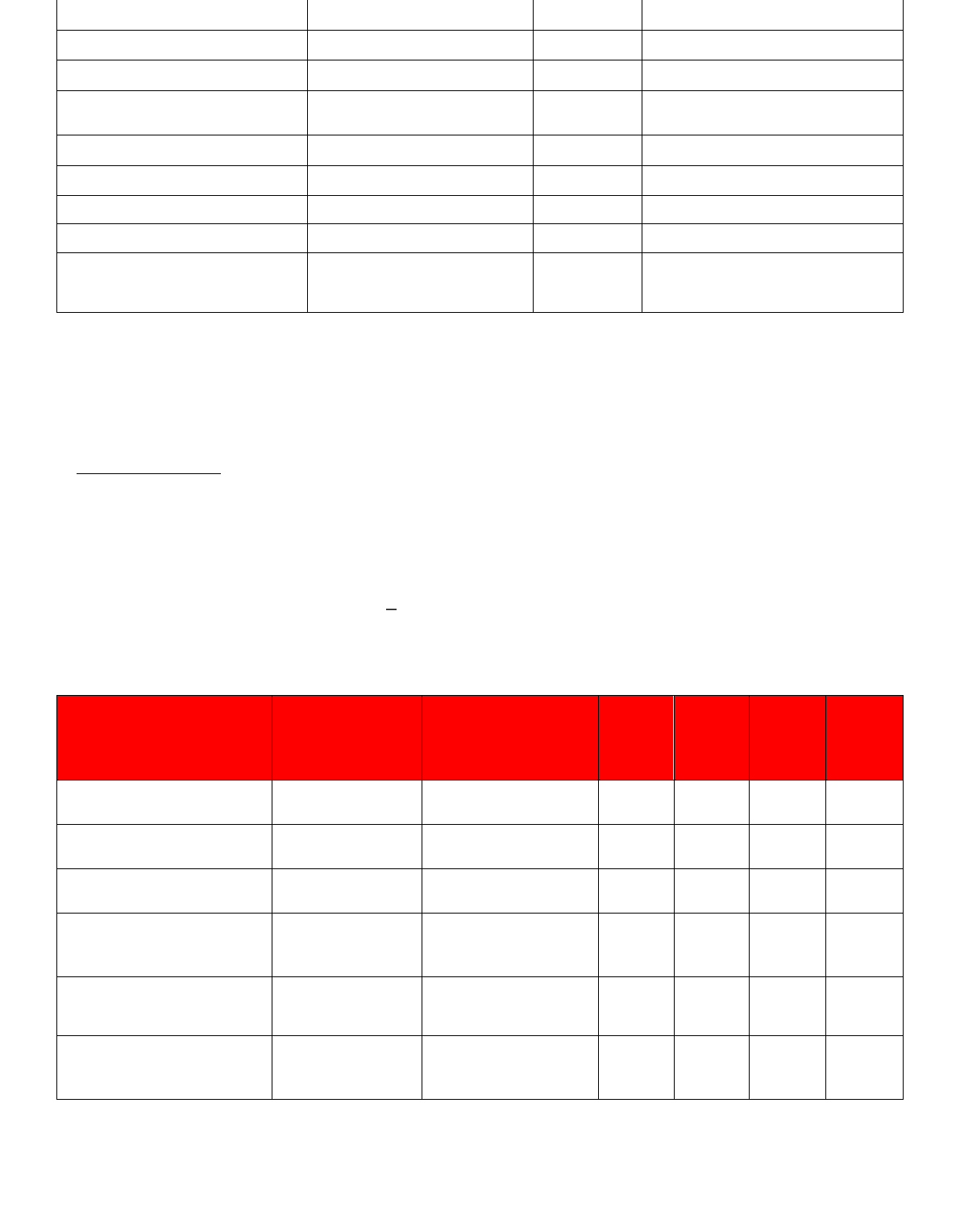

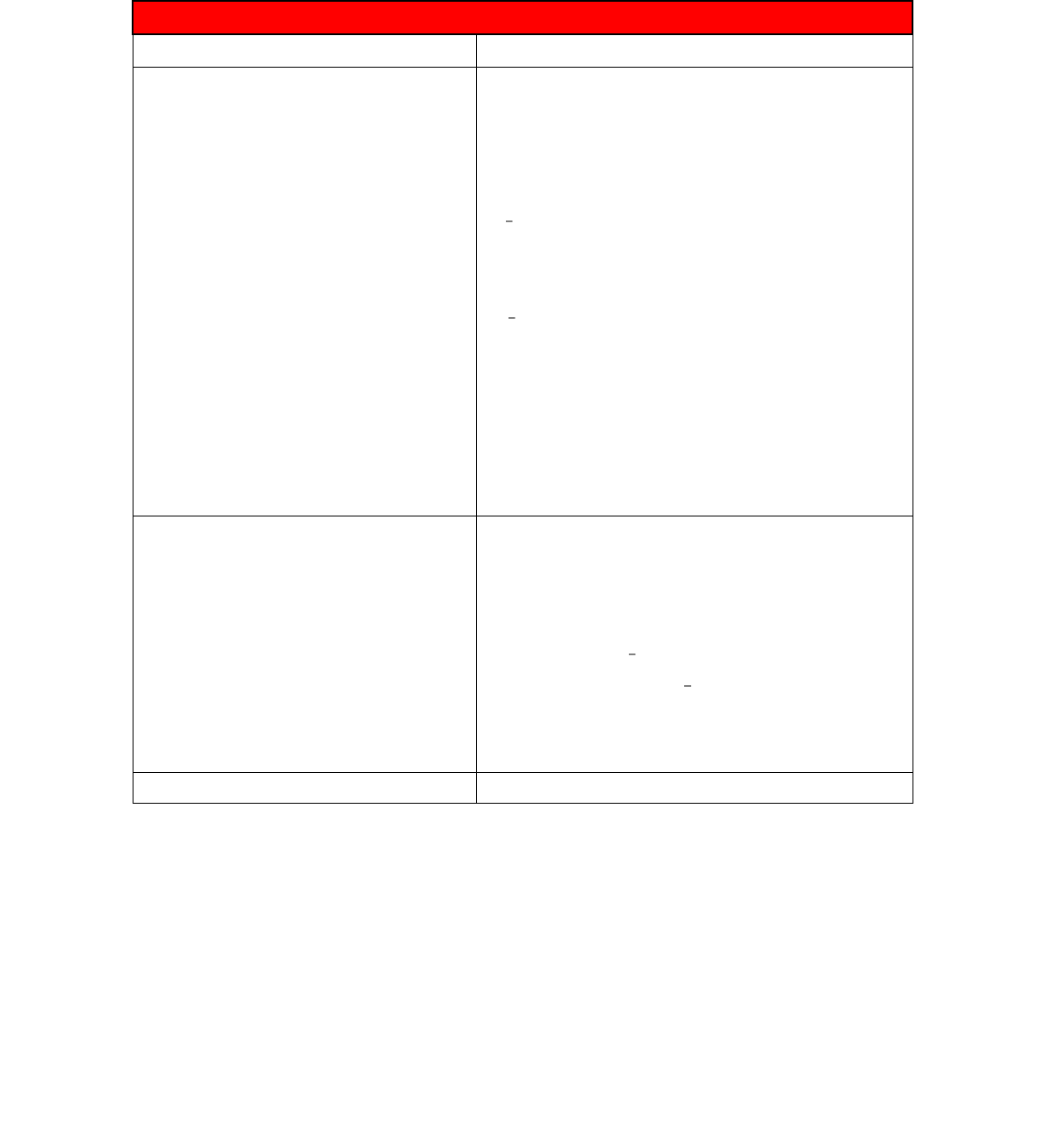

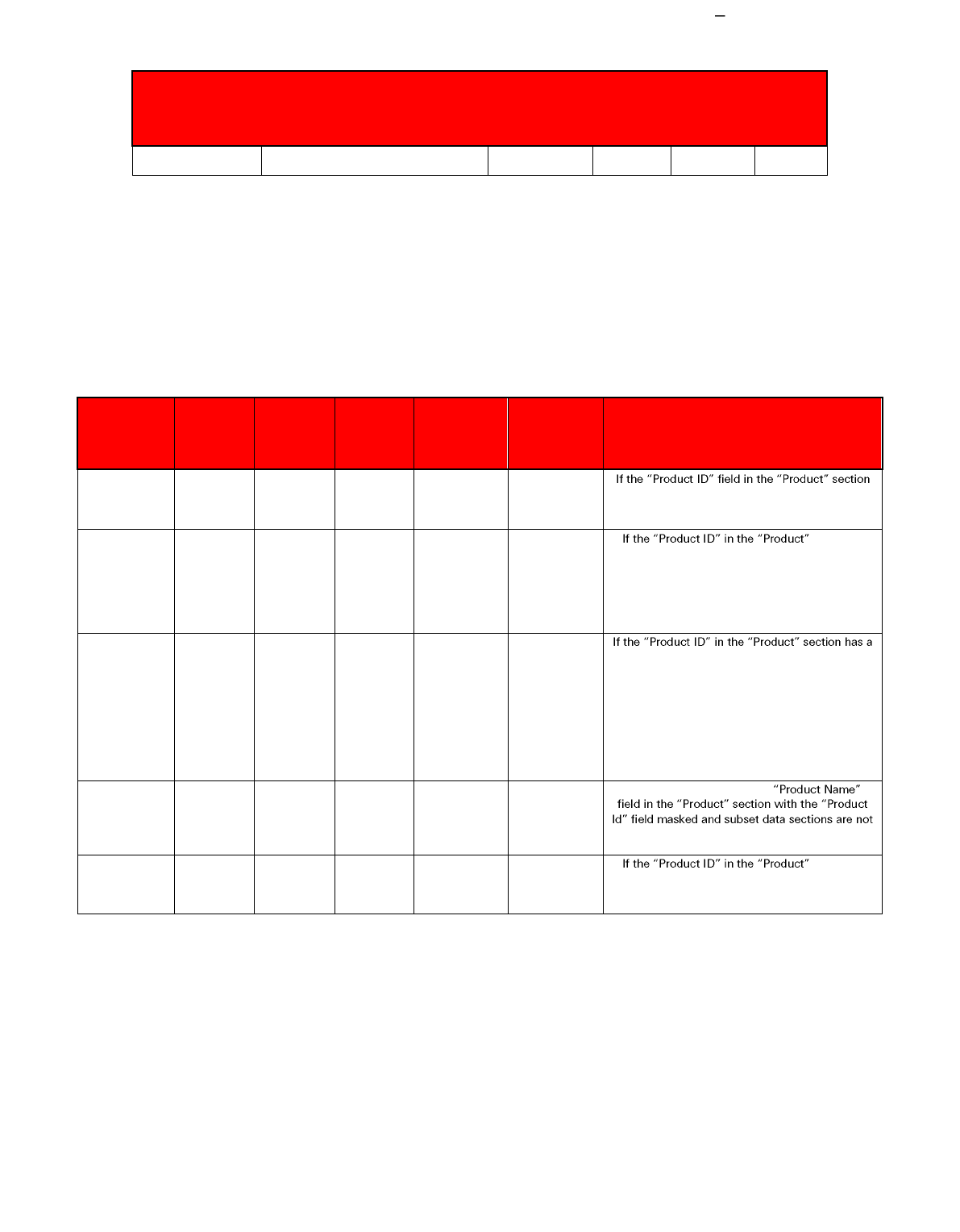

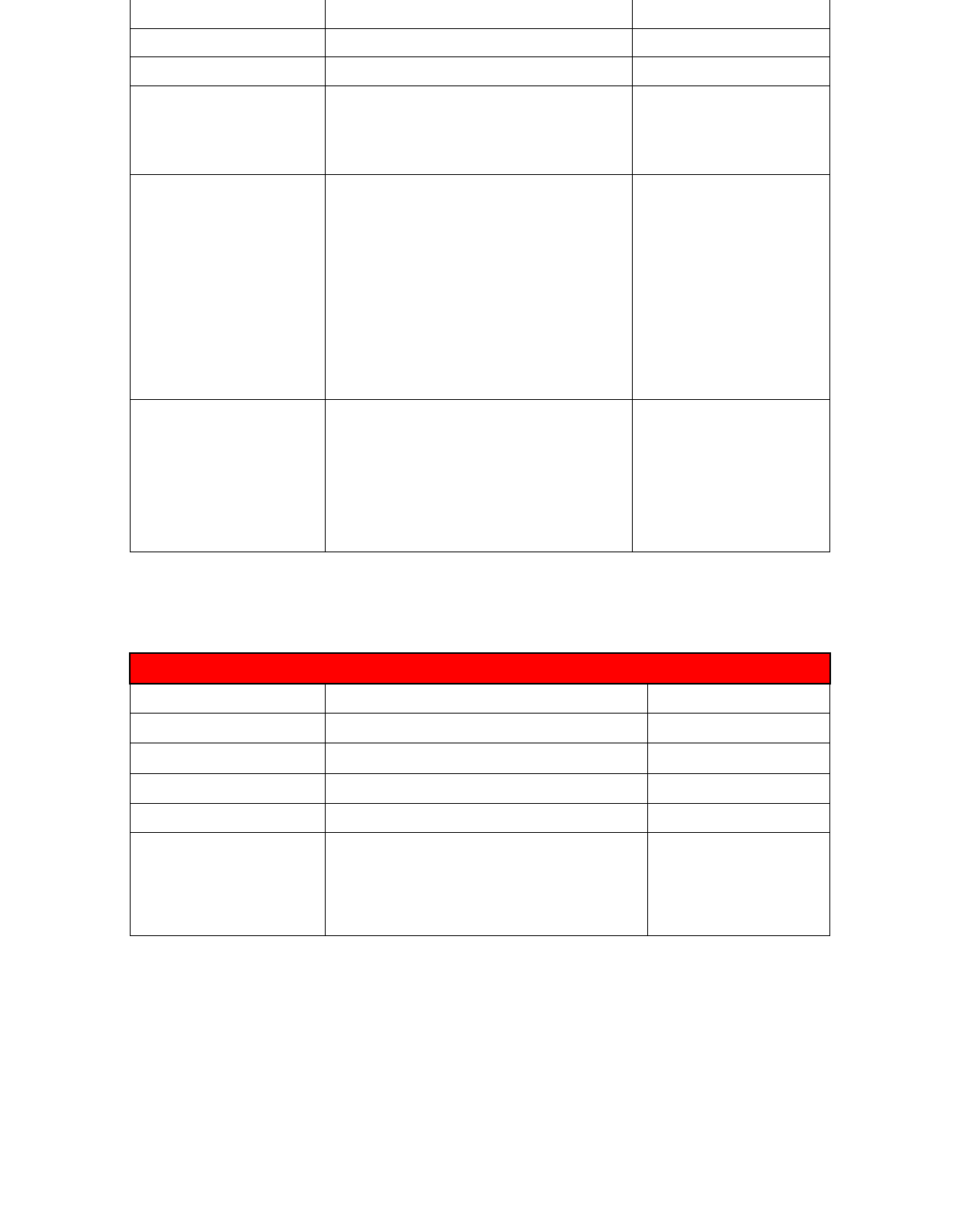

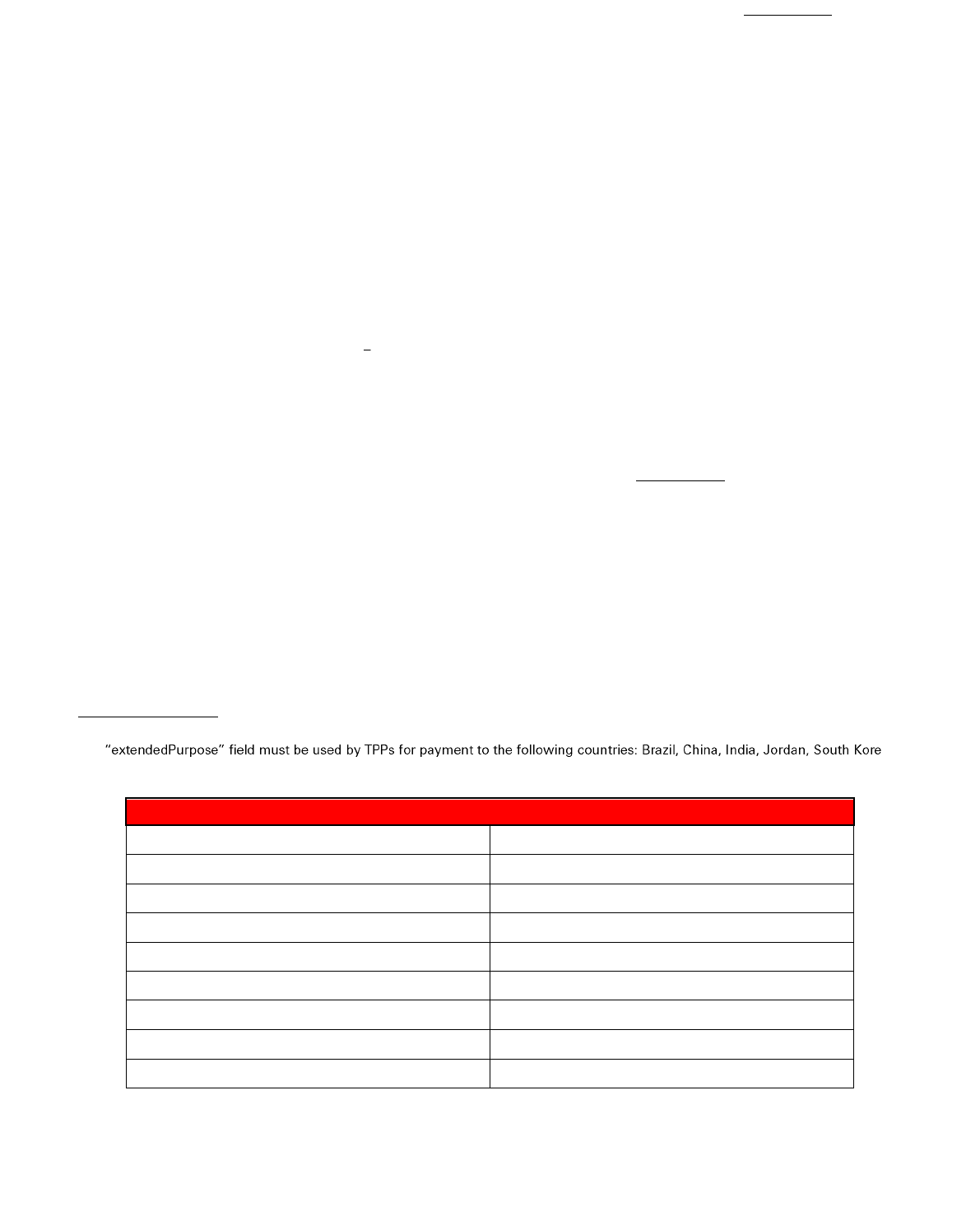

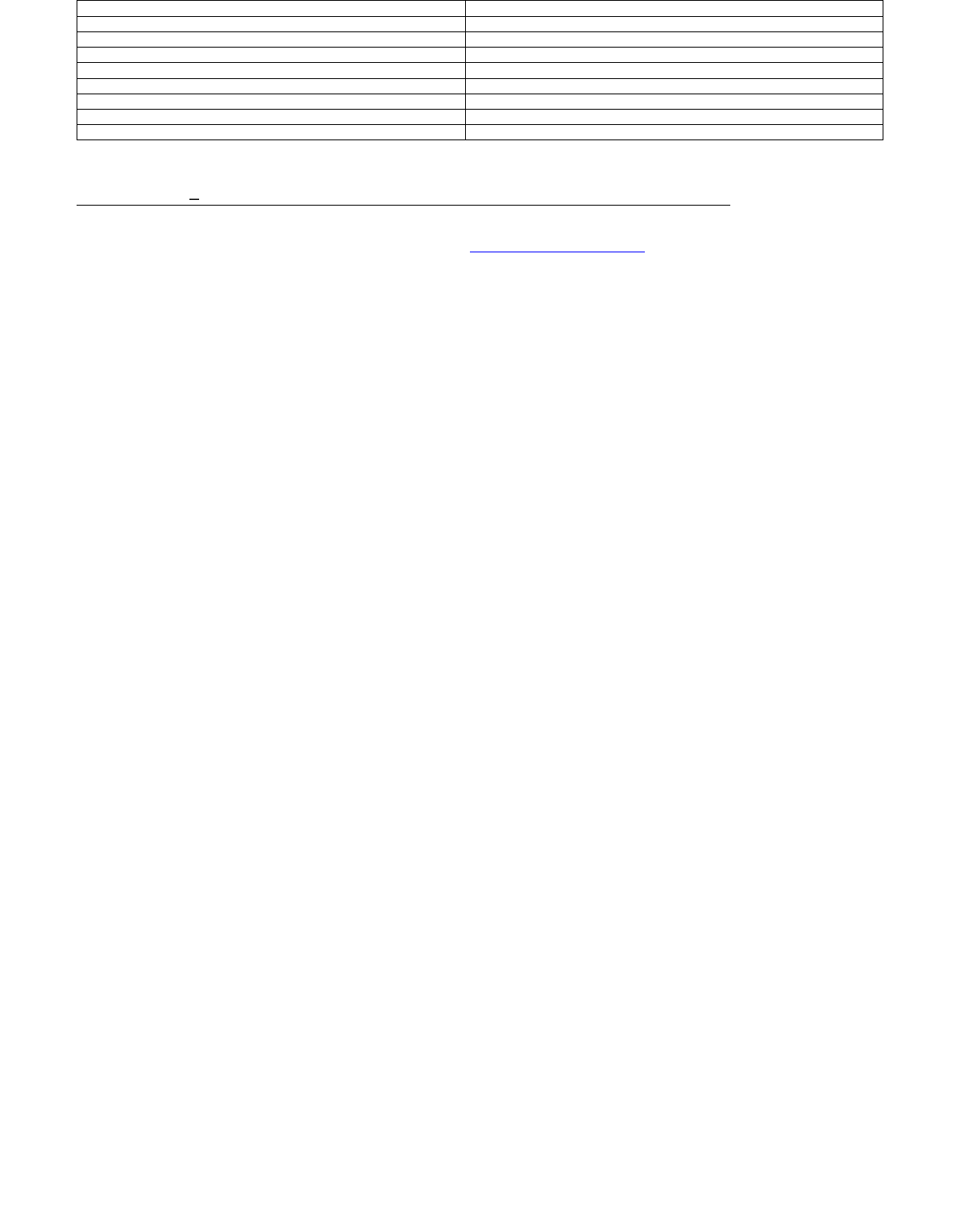

4.2.2. Onward Provisioning TPP / Agent name display options

Please note that TPPs must ensure that they have registered using the appropriate fields so that the correct information is displayed

to customers.

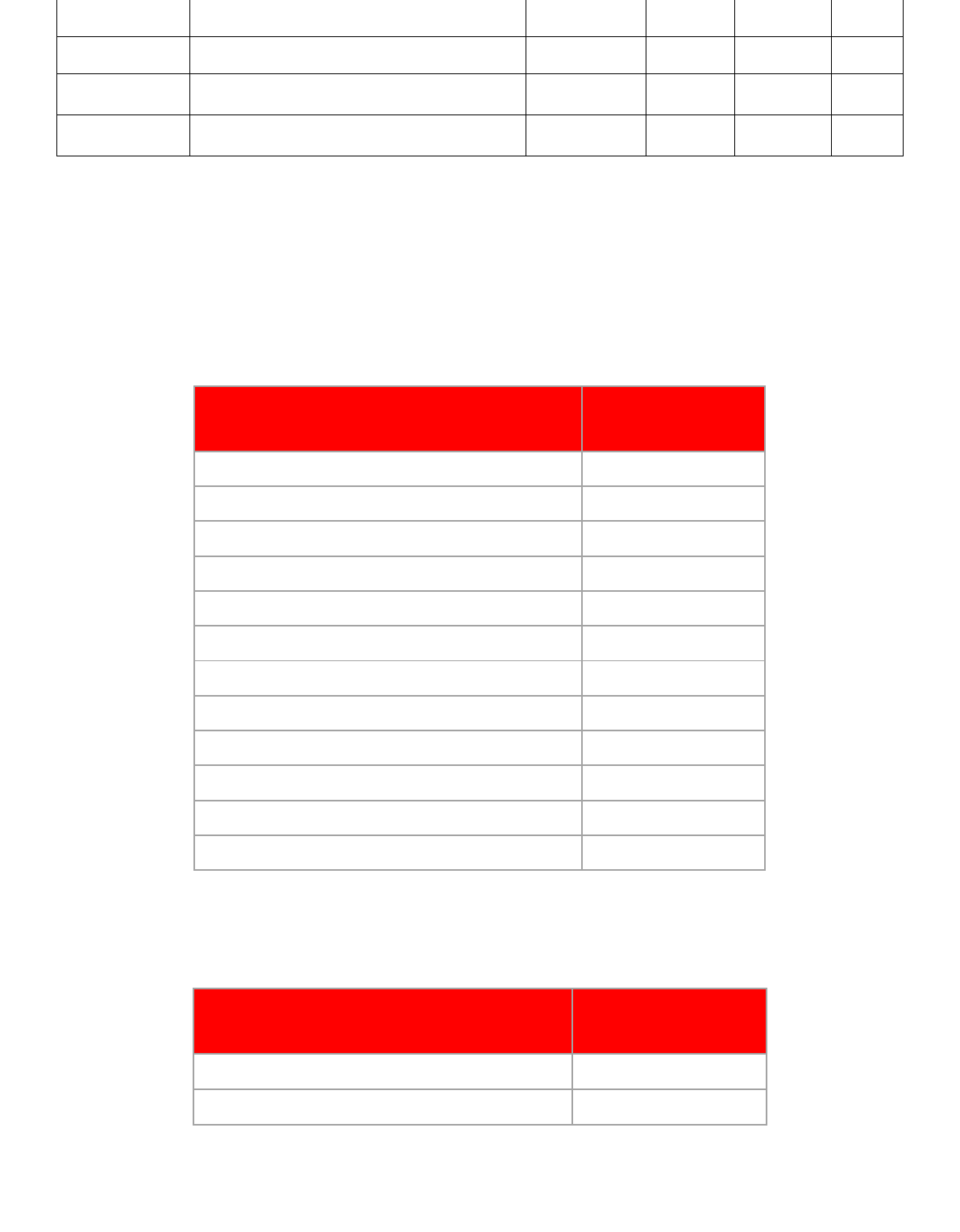

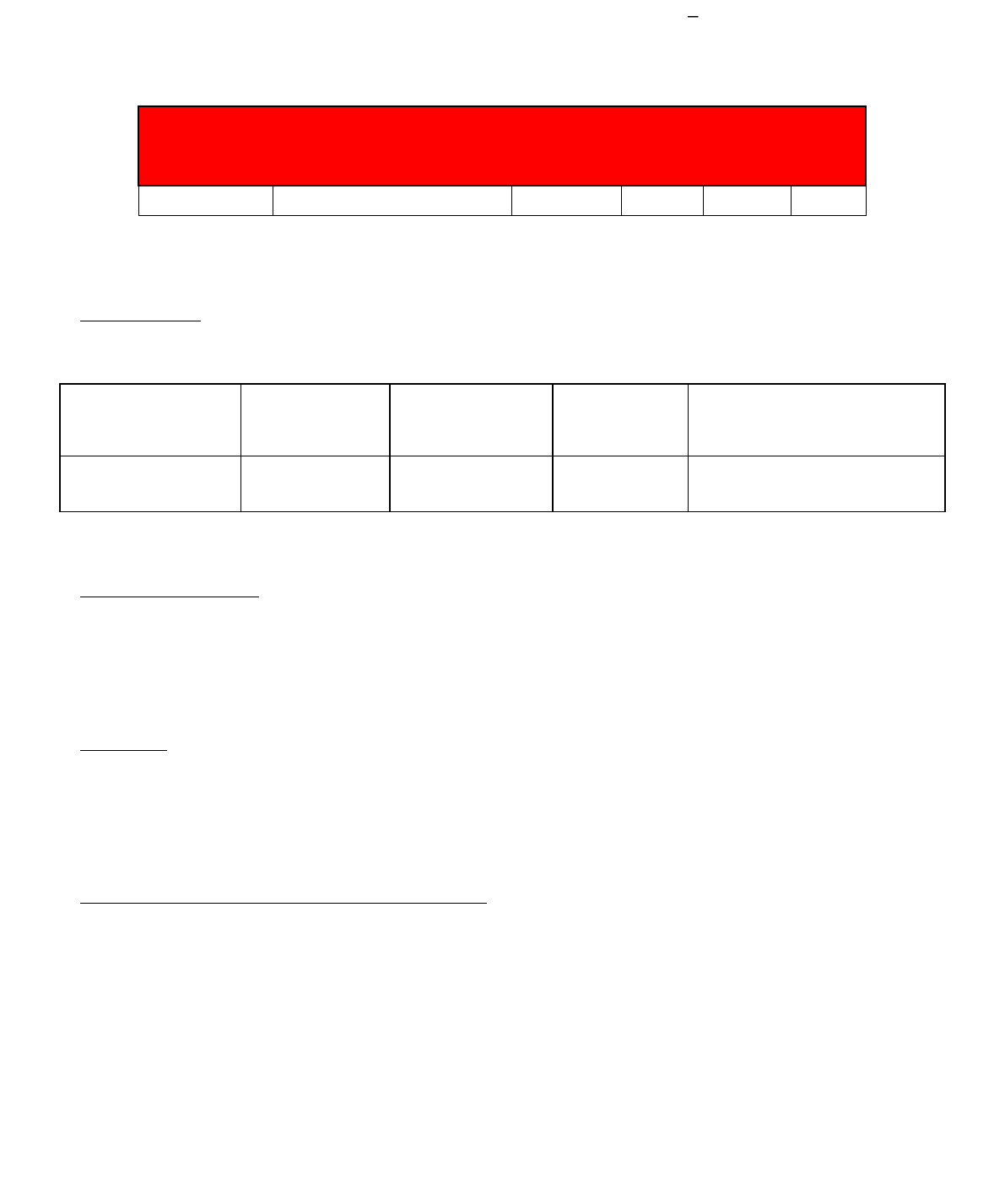

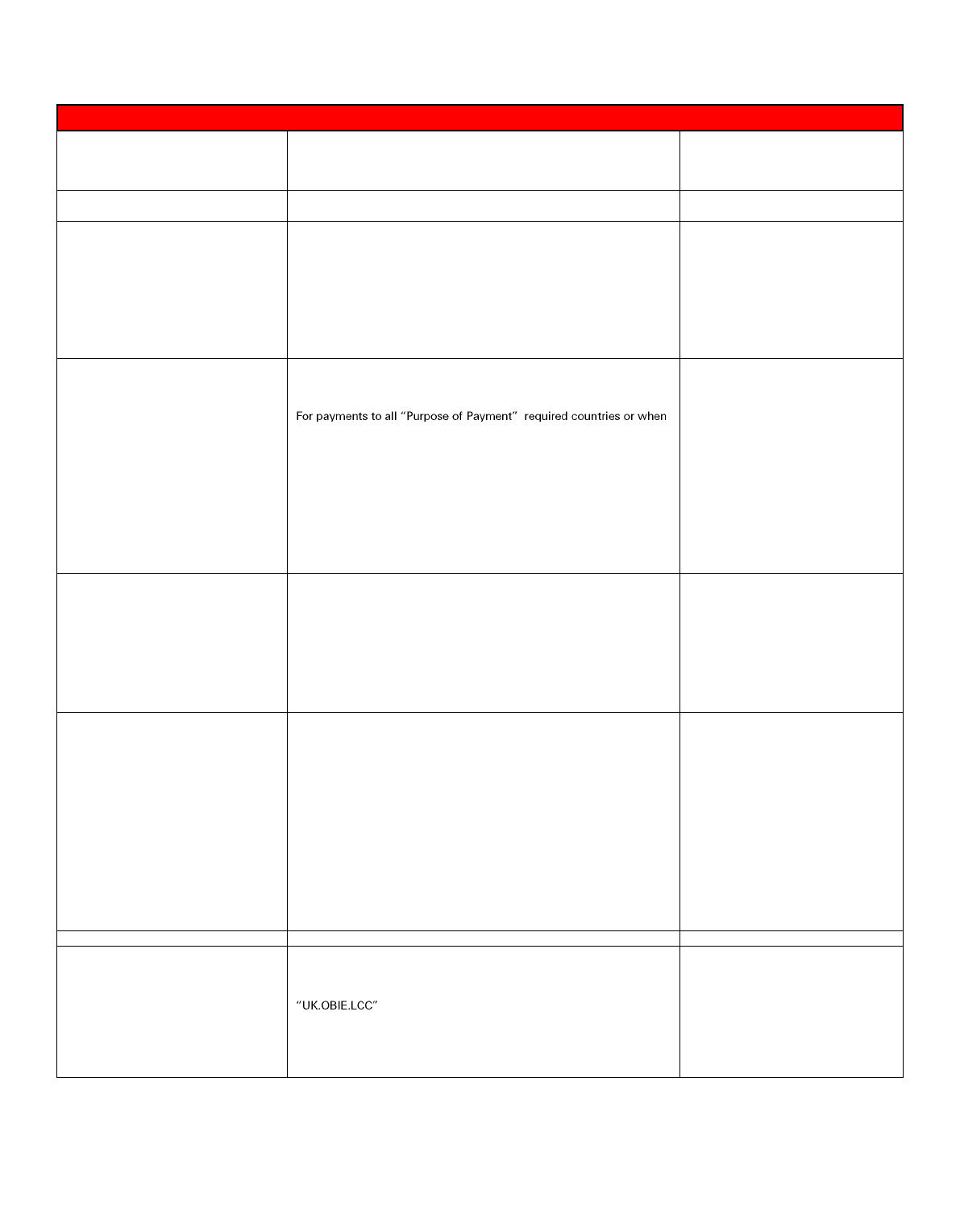

Options

Display

Display Rule

Client

Name

Org

Name

On

Behalf

Of'

Name

What

Will

display

When <org name> & <Client Name> are

available & both are same & <Software on

behalf name> not available

All (single name and key

point)

Use <Client Name> as TPP name

ABC

Company

Ltd

ABC

Company

Ltd

N/A

ABC

Company

Ltd

When <org name> & <Client Name> are

available & both are different & <Software

on behalf name> not available

All (single name and key

point)

Use <Client Name> as TPP name

ABC Trades

ABC

Company

Ltd

N/A

ABC Trades

When <org name> & <Client Name> are

available & both are same & <Software on

behalf name> is available & is same as well

All (single name and key

point)

Use <Client Name> as TPP name

ABC

Company

Ltd

ABC

Company

Ltd

ABC

Company

Ltd

ABC

Company

Ltd

When <org name> & <Client Name> are

available & both are different & <Software

on behalf name> is available & is same as

the <org name>

Both names to be displayed

*

<Agent> on behalf of <TPP>

Use <SoftwareOnBehalf> as Agent

Use <Client Name> as TPP

ABC Trades

ABC

Company

Ltd

ABC

Company

Ltd

ABC

Company

Ltd on behalf

of ABC

Trades

When <org name> & <Client Name> are

available & both are different & <Software

on behalf name> is available & is same as

the <Client name>

All (single name and key

point)

Use <Client Name> as TPP name

ABC Trades

ABC

Company

Ltd

ABC Trades

ABC Trades

When <org name> & <Client Name> are

available & both are same & <Software on

behalf name> is available & is different

from both

Both names to be displayed*

<Agent> on behalf of <TPP>

Use <SoftwareOnBehalf> as Agent

Use <Client Name> as TPP

ABC

Company

Ltd

ABC

Company

Ltd

OBO Ltd

OBO Ltd on

behalf of

ABC

Company

Ltd

15

PUBLIC

When <org name> & <Client Name> are

available & both are different & <Software

on behalf name> is available & is different

from both

Both names to be displayed

*

<Agent> on behalf of <TPP>

Use <SoftwareOnBehalf> as Agent

Use <Client Name> as TPP

ABC Trades

ABC

Company

Ltd

OBO Ltd

OBO Ltd on

behalf of

ABC Trades

* Both names will always be displayed at the consent set-up step, however, for simplicity, single name may be displayed in some

non-key steps within the journey.

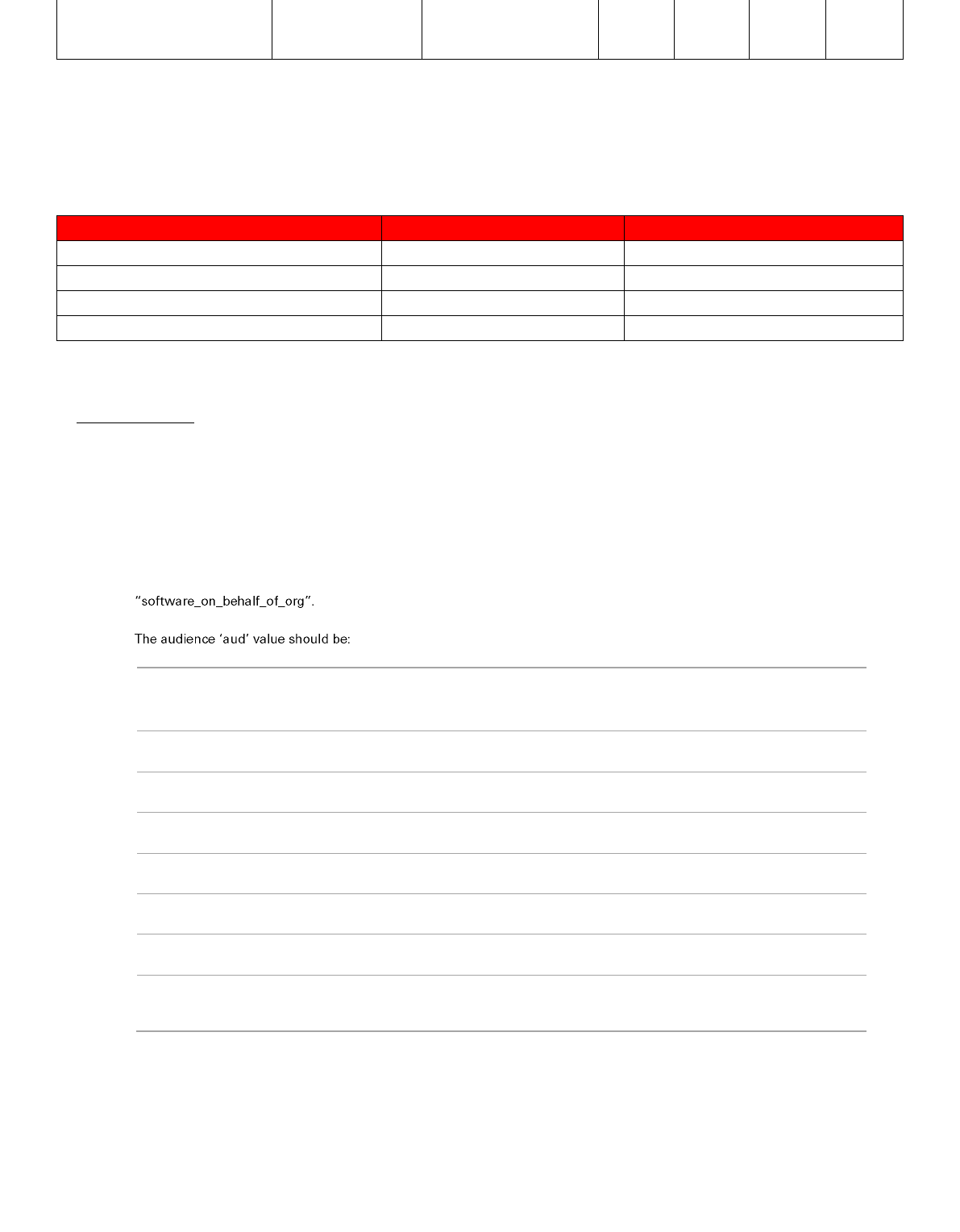

4.2.3. Implemented Endpoints

Endpoints

Mandatory

Implemented

POST /register

Conditional

Y

GET /register/{ClientId}

Optional

Y

PUT /register/{ClientId}

Optional

Y

DELETE /register/{ClientId}

Optional

N

POST /register:

➢ TPPs must include a complete ClientName and OrganisationName during the registration process.

➢ Both names should be:

▪ Semantically and syntactically correct

▪ Adhere to data integrity rules including correct capitalisation, consistent use of abbreviations and spacing

➢ If an agent is acting on behalf of the TPP, the agent name (Trading name of the Agent Company) must be provided within

➢

Banking Area

Well-known Endpoint

HSBC Personal

https://api.ob.hsbc.co.uk

HSBC Business

https://api.ob.business.hsbc.co.uk

Marks and Spencer

https://api.ob.mandsbank.com

first direct

https://api.ob.firstdirect.com

HSBC Kinetic

https://api.ob.hsbckinetic.co.uk

HSBC Corporate UK (HSBCnet UK)

https://api.ob.hsbcnet.com

HSBC Innovation Banking

(HSBCnet UK)

https://api.ob.hsbcnet.com

16

PUBLIC

GET /register:

➢ r

should have Bearer token as access_token retrieved from /token with client_credentials grant_type.

PUT /register:

➢ TPPs may use this endpoint to update existing registration details. Relevant checks will be performed to ensure the updates

are valid/allowed. An error message will be returned in instance of failures.

➢ The request should contain the response received from the GET /register

should have Bearer token as access_token retrieved from /token with client_credentials grant_type.

➢ It is important to note that the entire GET /register payload is expected in PUT /register payload as well. Any value that does

not need an update during registration is still expected to be sent in the request.

➢ Also with respect to scope update, it is expected that all scope for which registration is required is sent. For example, even if

TPP is registered with accounts scope, and expects payments to be updated as part of PUT /register, the value in the

payload expected is accounts payments. This scope in PUT /register will be considered as a complete replace instead of

append to the existing value.

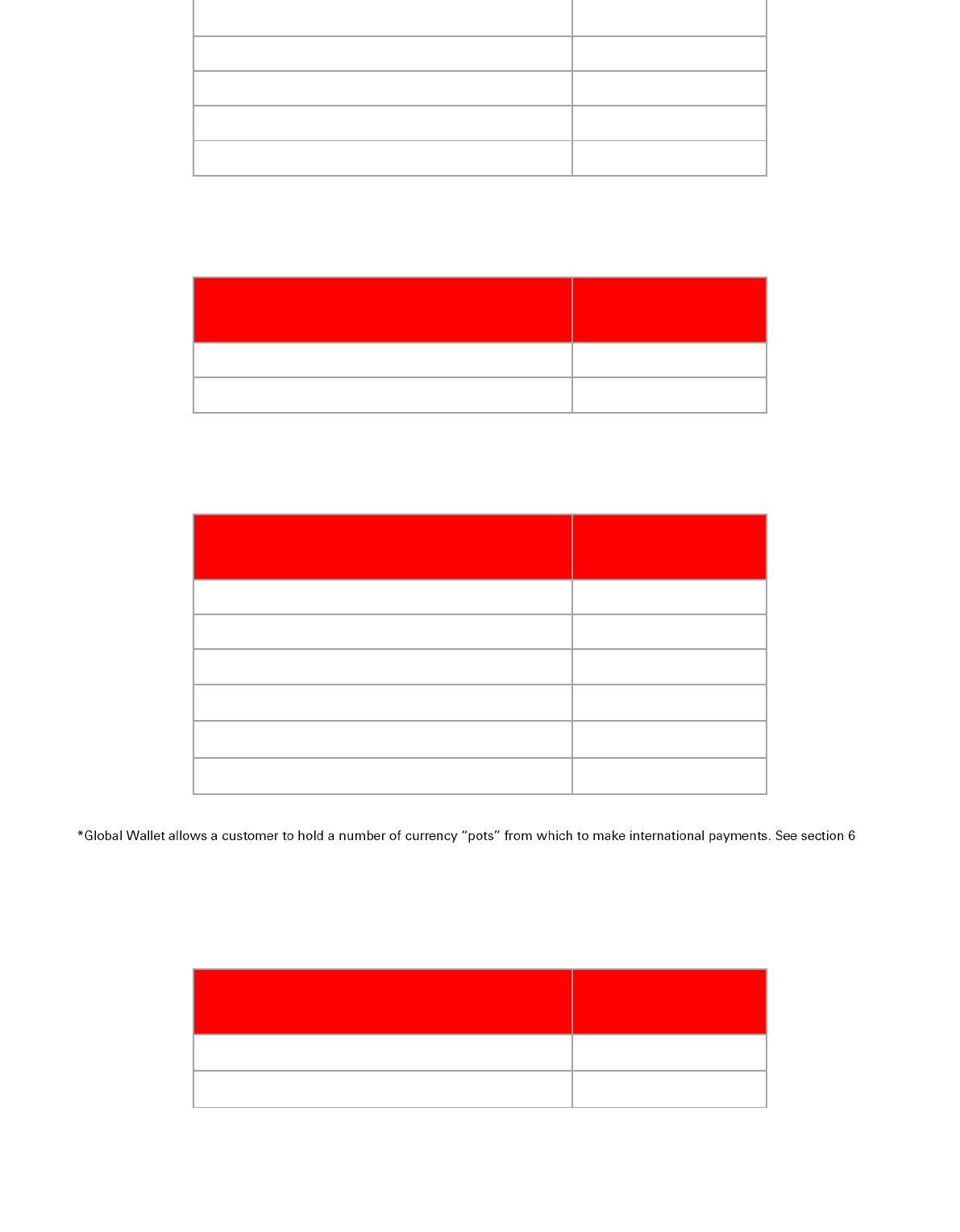

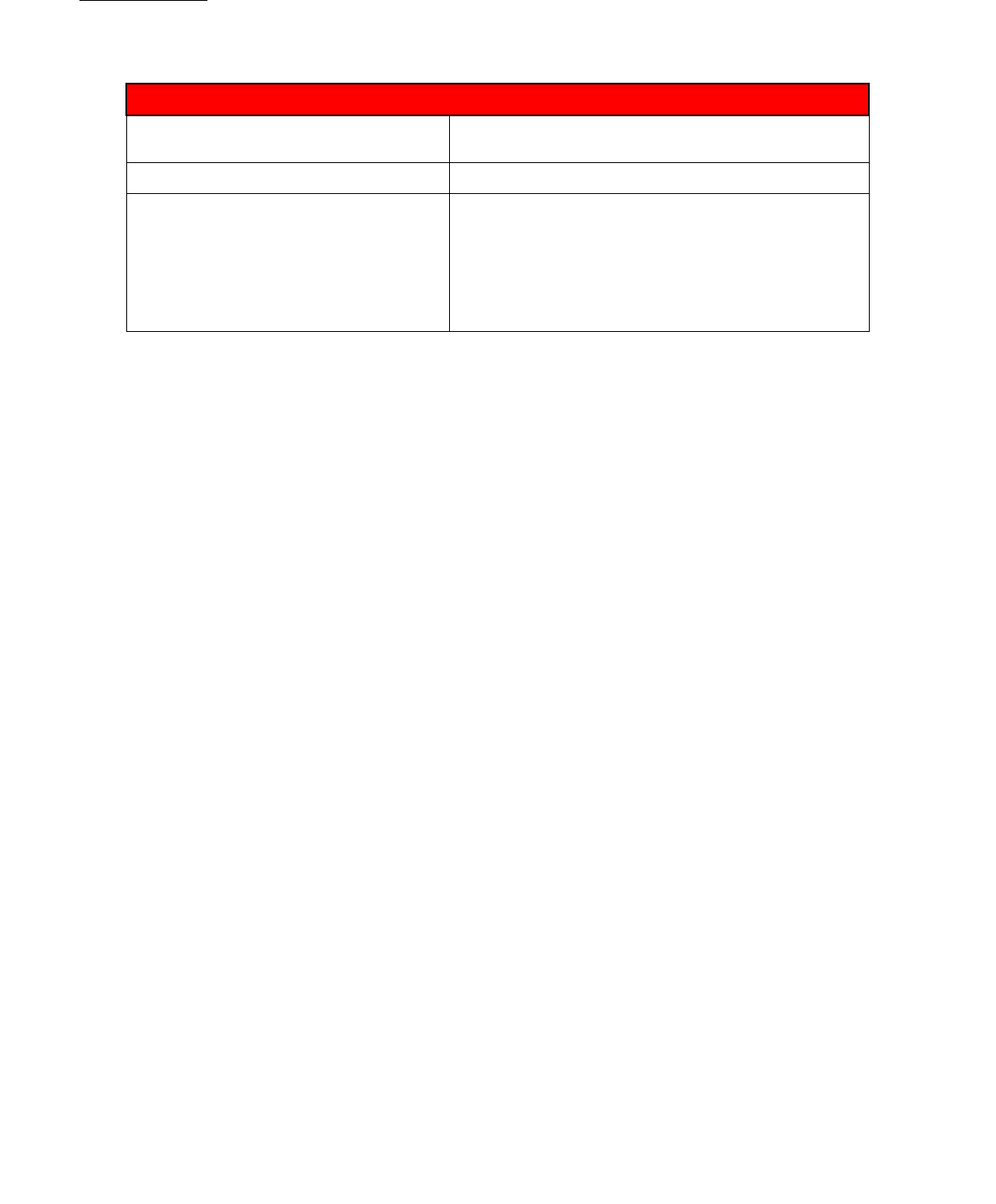

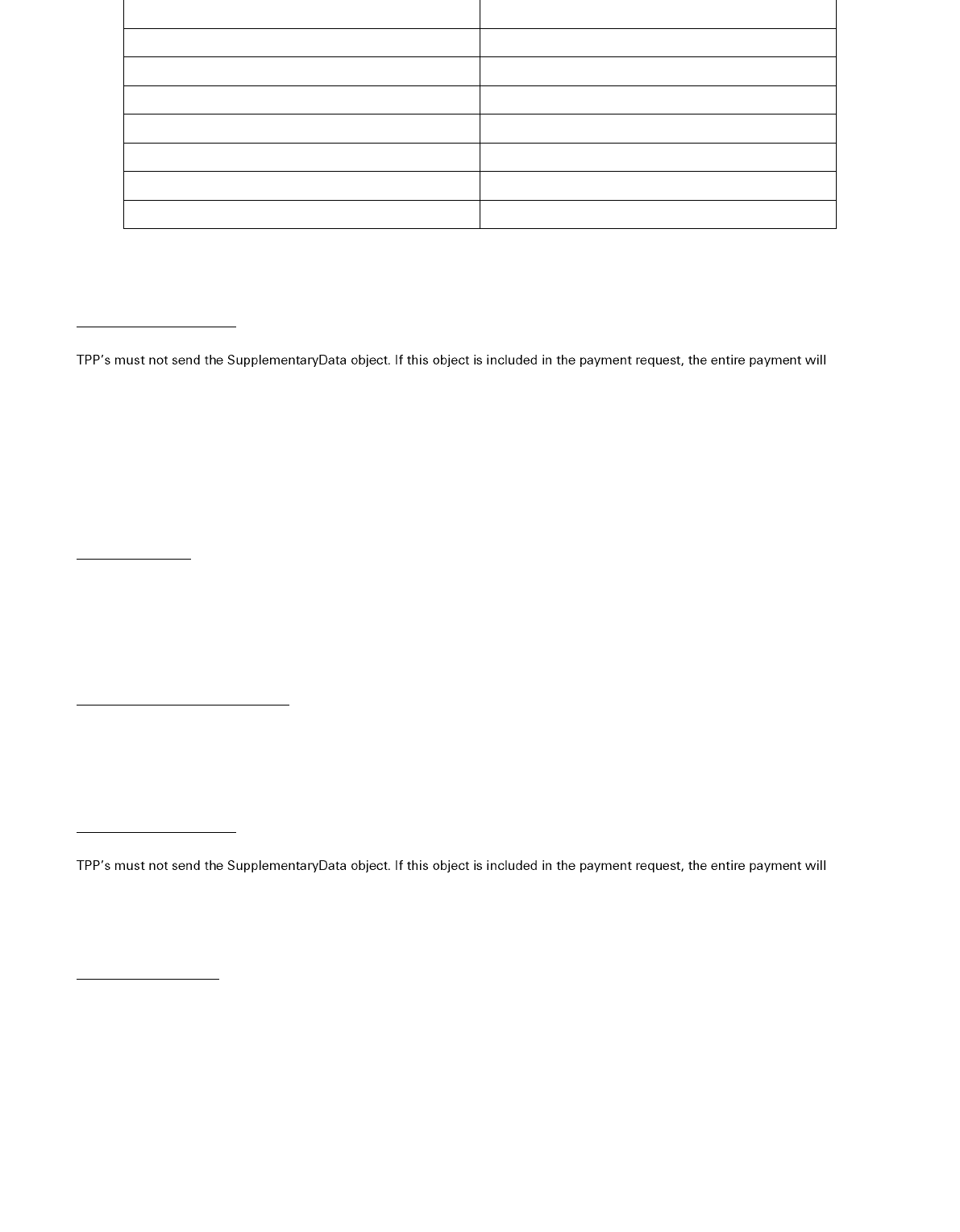

The following fields can be updated via PUT/register:

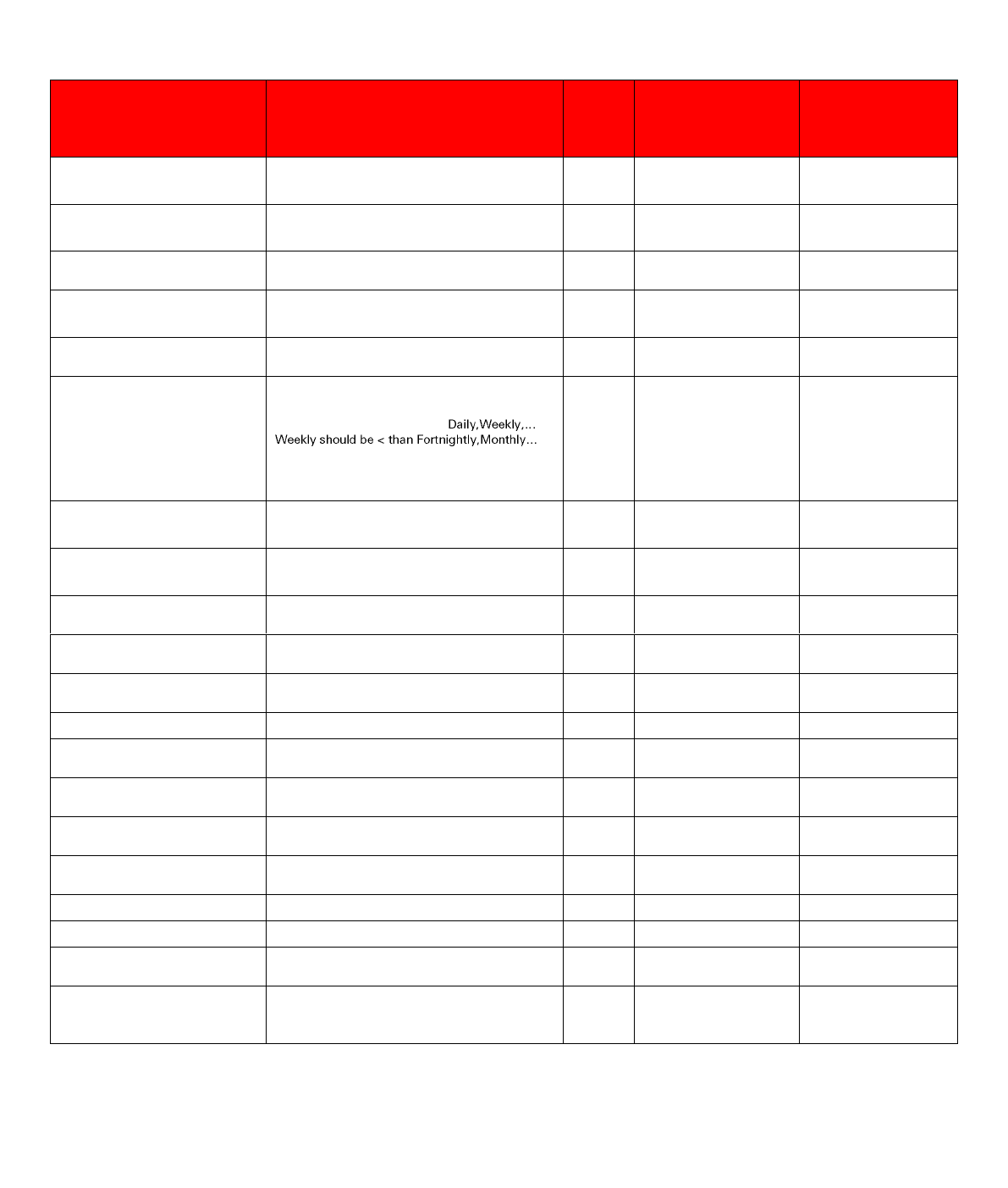

Fields which can be updated using PUT/register

exp

response_types

grant_types

scope

iat

software_id

id_token_signed_response_alg

software_statement

iss

request_object_signing_alg

jti

token_endpoint_auth_method

redirect_uris

token_endpoint_auth_signing_alg

4.2.4. Supported token_endpoint_auth_method

Method

Supported

private_key_jwt

Y

client_secret_jwt

N

client_secret_basic

N

client_secret_post

N

tls_client_auth

Y

17

PUBLIC

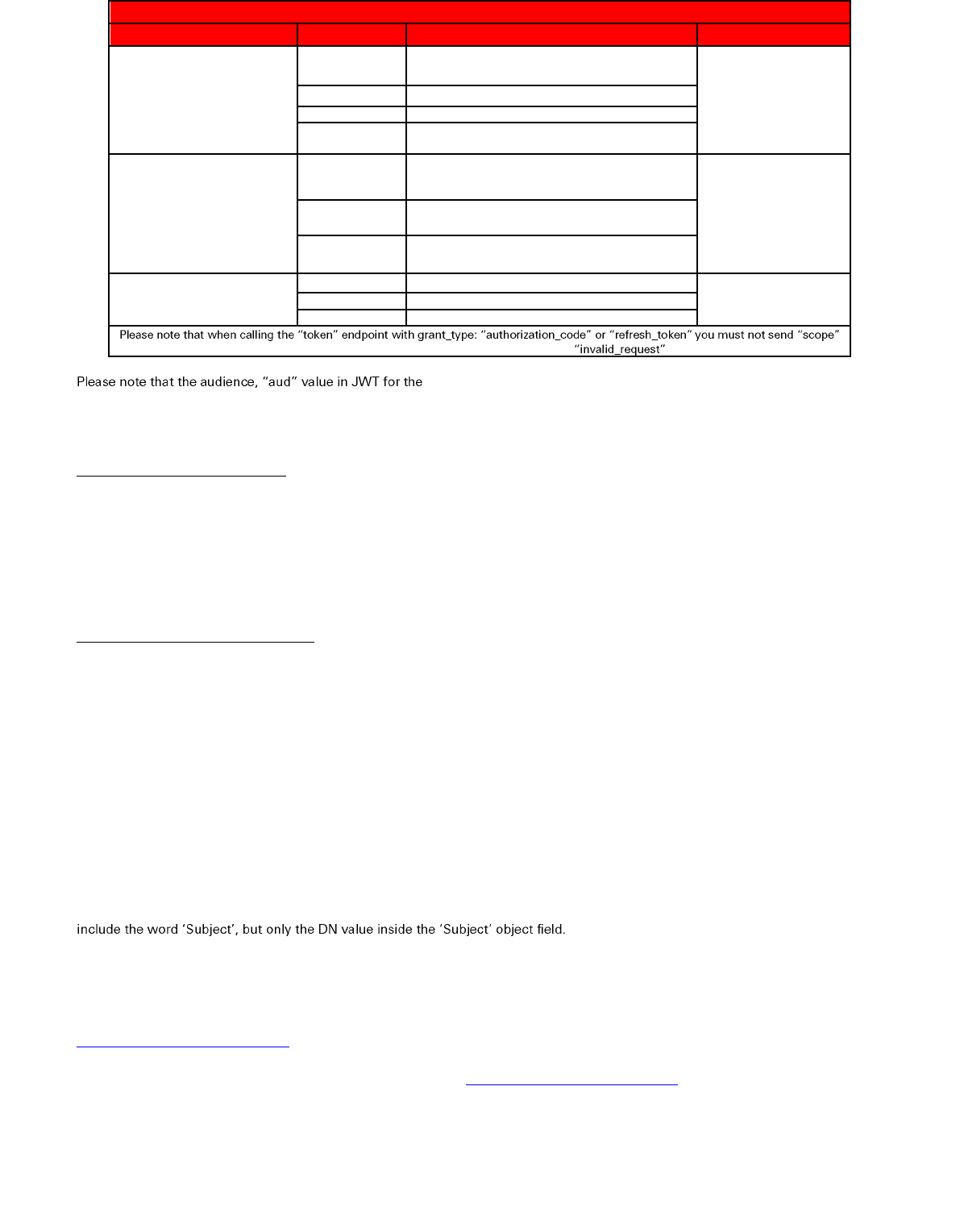

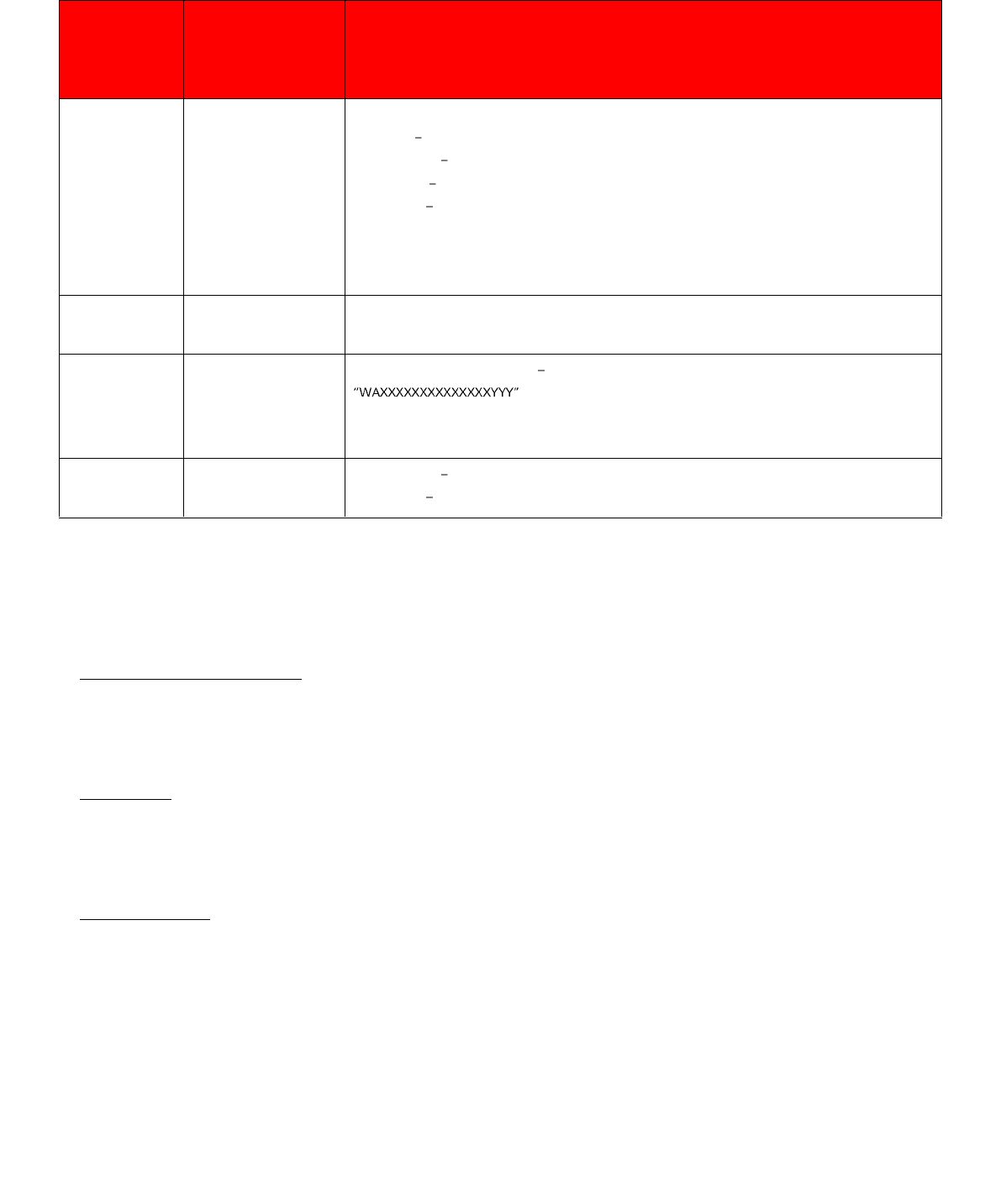

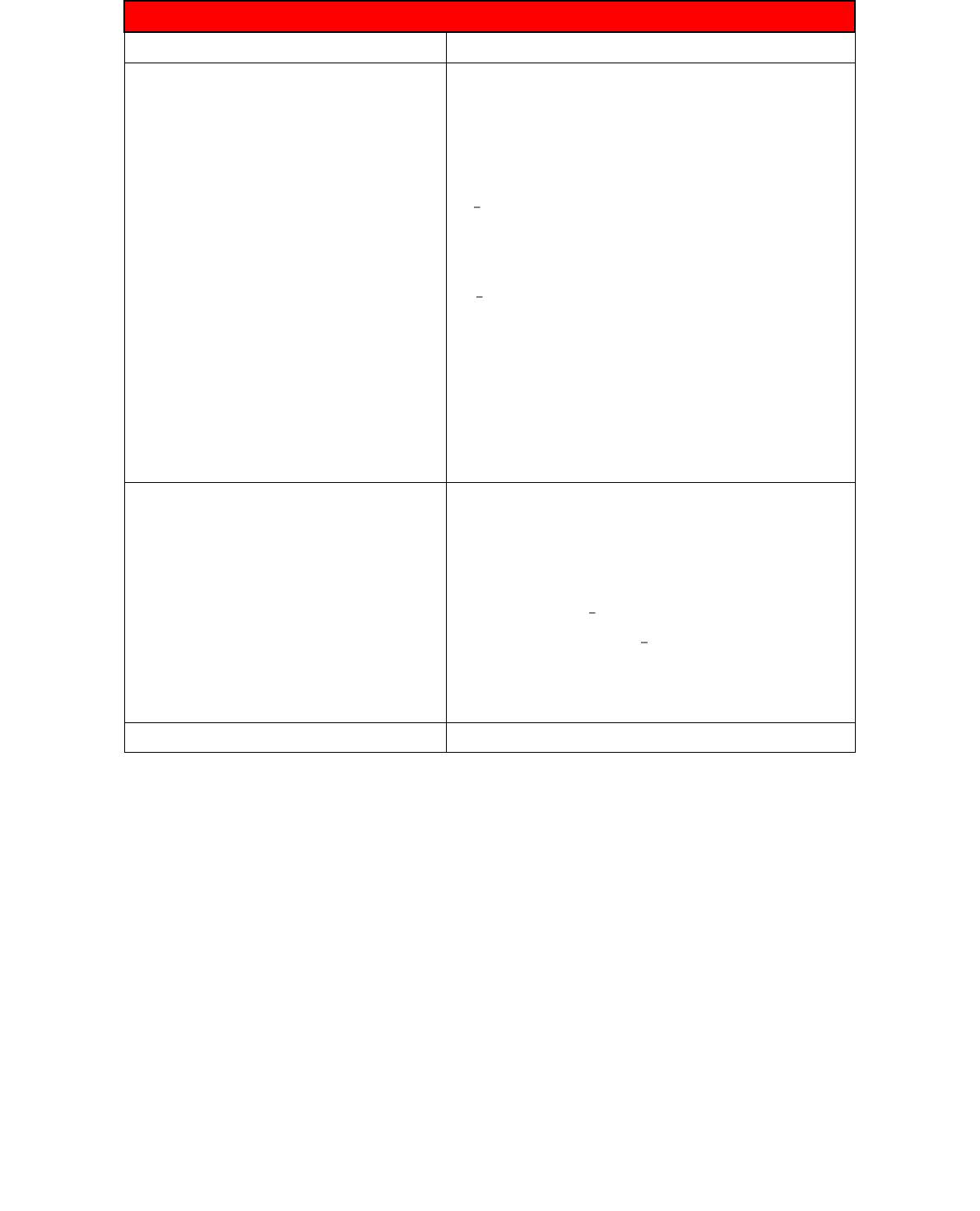

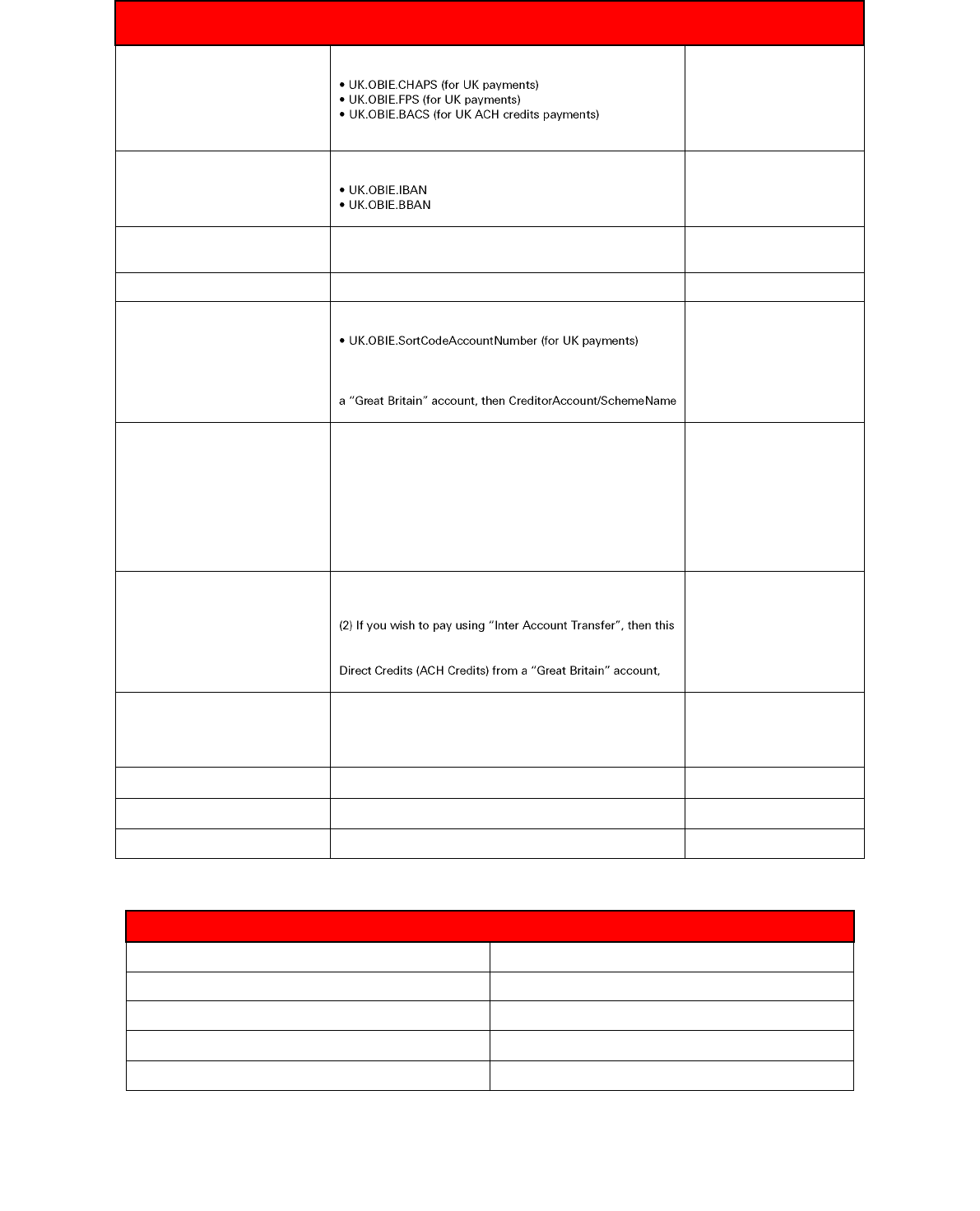

Clarification on Scope parameter

Endpoint

Journey

Scopes

Notes

/register

PIS

"scope": "openid payments"

A Journey needs to be

chosen based on TPP

specialization

AIS

"scope": "openid accounts"

CoF

"scope": "openid fundsconfirmations"

PIS, AIS, CoF

"scope": "openid payments accounts

"fundsconfirmations"

/token with "client_credentials"

grant type

PIS

"scope": "payments"

OpenID should not be

included in client

credentials

AIS

"scope": "accounts"

CoF

"scope": " fundsconfirmations "

/authorize

PIS

"scope":"openid payments"

A Journey needs to be

chosen based on TPP

specialization

AIS

"scope":"openid accounts"

CoF

"scope":"openid fundsconfirmations"

parameter. If you do, this will result in the error code

:

/token endpoint should be:

https://<banking area>/obie/open-banking/v1.1/oauth2/token.

For example: https://api.ob.hsbc.co.uk/obie/open-banking/v1.1/oauth2/token for HSBC Personal.

/authorize endpoint should be:

https://<banking area>

For example: https://api.ob.hsbc.co.uk for HSBC Personal.

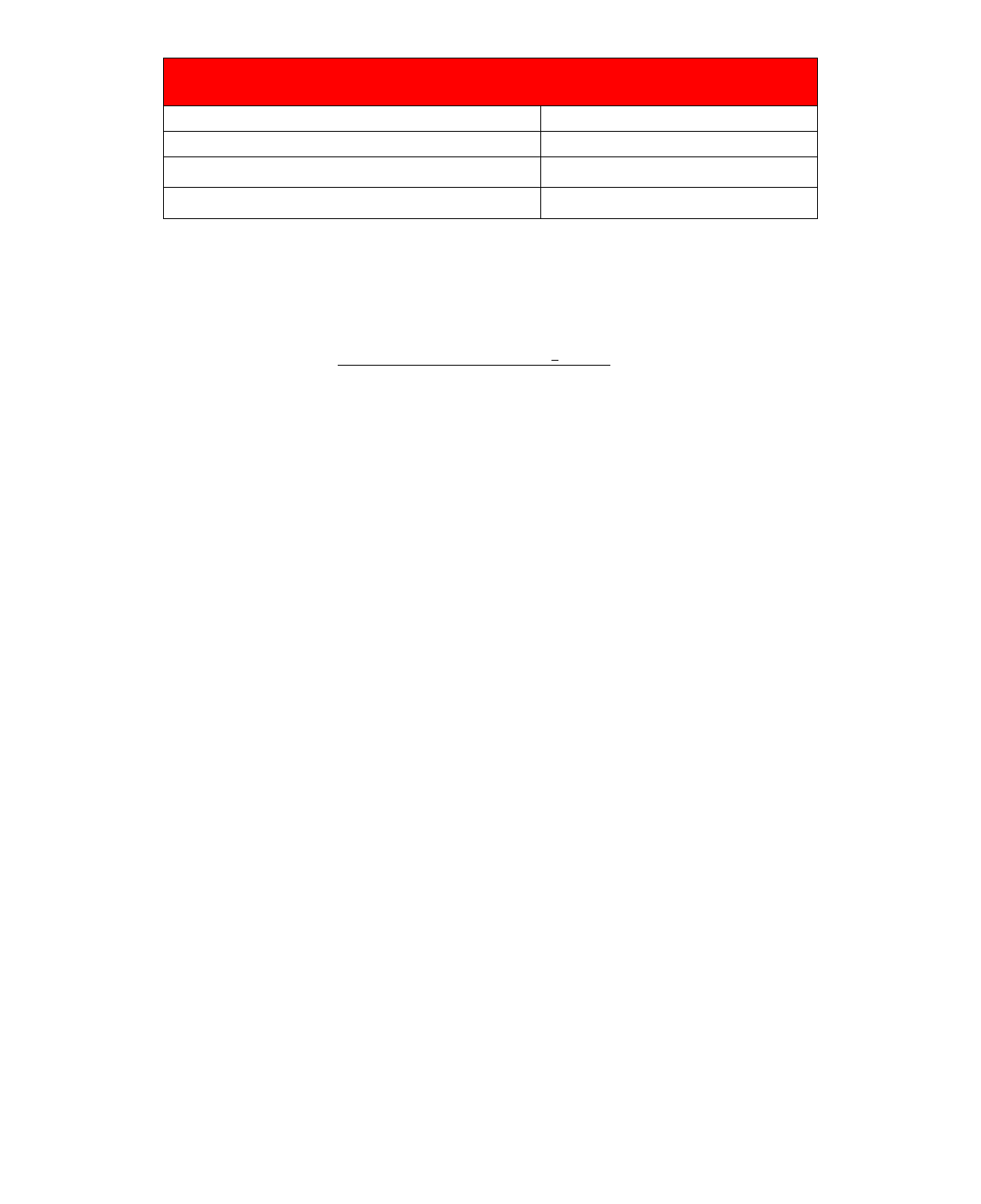

4.2.5. MTLS when token_endpoint_auth_method is tls_client_auth

If MTLS tls_client_auth is used the tls_client_auth_subject_dn claim in the registration JWT must contain the full DN (Distinguished

Name) of the transport (QWAC, OBWAC) certificate that the TPP will present to the ASPSP token endpoint to establish mutual TLS

connection. The order of the attributes must also be the same as in the certificate subject value. Please note that this should not

For example, a valid value would be: CN=00158000016i44JAAQ,2.5.4.97=#131050534447422D4643412D373635313132,O=HSBC

UK Bank Plc,C=GB

Expected format of tls_client_auth_subject_dn follows a string representation -- as defined in [RFC4514] -- of the DN. Please refer to

https://tools.ietf.org/html/rfc4512#section-2 for formal definition of DN, RDN and attribute value assertion (AVA).

Currently supported short names for attribute types (descriptor - https://tools.ietf.org/html/rfc4514#section-2)

18

PUBLIC

CN (2.5.4.3)

DNQUALIFIER (2.5.4.46)

C (2.5.4.6)

DNQ (2.5.4.46)

L (2.5.4.7)

SURNAME (2.5.4.4)

S (2.5.4.8)

GIVENNAME (2.5.4.42)

ST (2.5.4.8)

INITIALS (2.5.4.43)

O (2.5.4.10)

GENERATION (2.5.4.44)

OU (2.5.4.11)

EMAIL (1.2.840.113549.1.9.1)

T (2.5.4.12)

EMAILADDRESS (1.2.840.113549.1.9.1)

IP (1.3.6.1.4.1.42.2.11.2.1)

UID (0.9.2342.19200300.100.1.1)

STREET (2.5.4.9)

SERIALNUMBER (2.5.4.5)

DC (0.9.2342.19200300.100.1.25)

Multiple keywords are available for one OID.

Attribute types not present on above list should be encoded as the dotted-

Example: 1.3.6.1.4.1.311.60.2.1.3=PL

Full Example:

CN=[value],serialNumber=[value],OU=[value],O=[value],C=[value],ST=[value],2.5.4.97=[value],2.5.4.15=[value],1.3.6.1.4.1.311.60.2.1.

3=[value]

*[value] represents any value it is a placeholder for real value.

4.3. Authentication Journey

Whenever a timeout occurs on the authentication UI, or the PSU closes a web/mobile browser the consent status will be saved in

The consent status can be checked with dedicated endpoints.

In order to restart the authentication journey for the already created consent, instead of creating a new one, TPPs should call

GET/authorize to start the authentication OAUTH journey again.

4.4. Consent Expiry Date

Consent expiry is an optional field.

If consent expiry date is not populated, the consent will never expire (unless revoked by the TPP).

If consent expiry date is populated, its maximum value must be before 19/01/2038.

19

PUBLIC

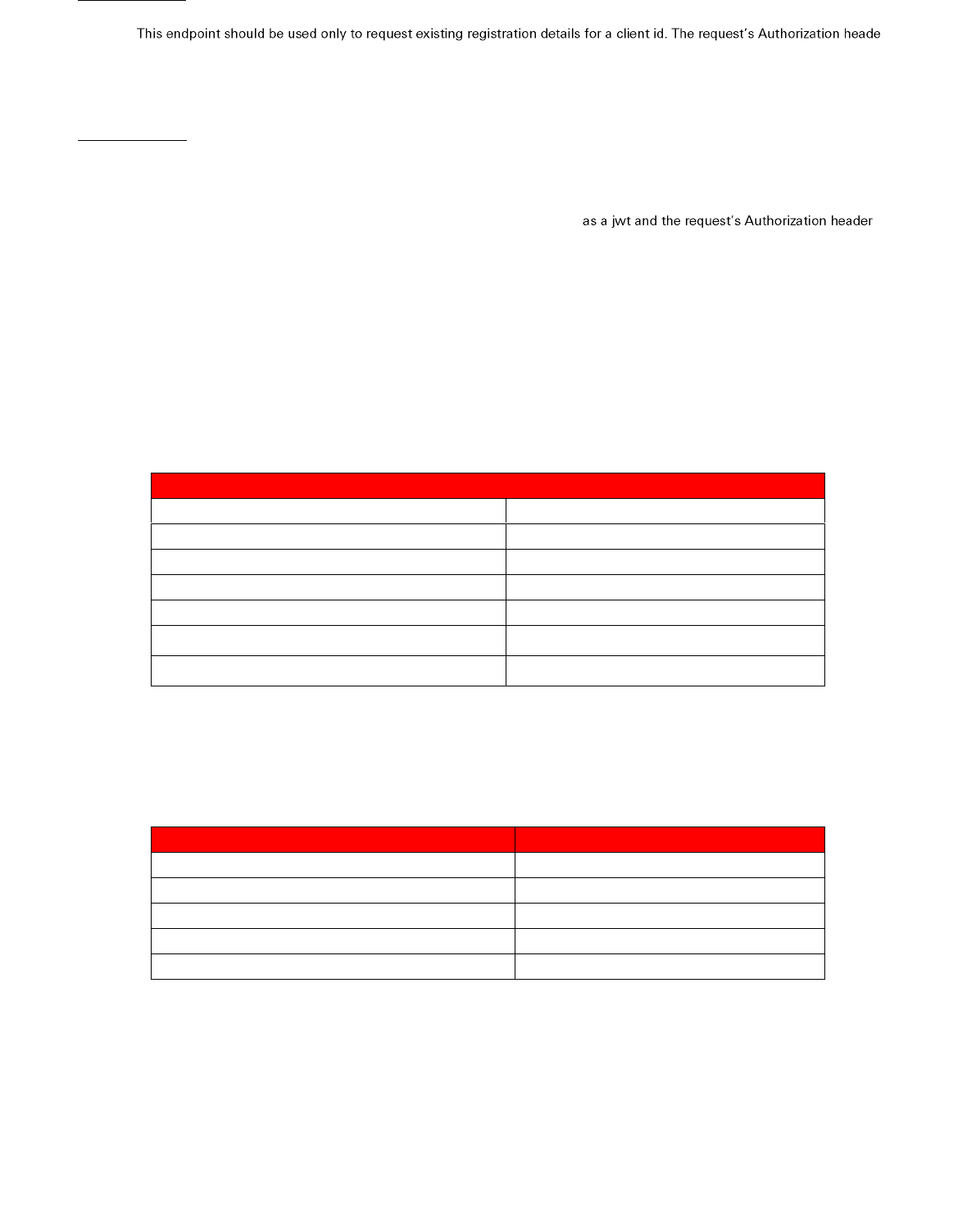

4.5. Authorisation Code in OAuth Authorisation Framework

The auth_authorisation code obtained after consent-confirmation completion is only valid for 60 seconds. Within this time-frame, the

TPP must exchange the auth_authorisation code for an access token.

Please note the JWT expiry parameter (exp) in the request body should be set to a maximum of 30 mins.

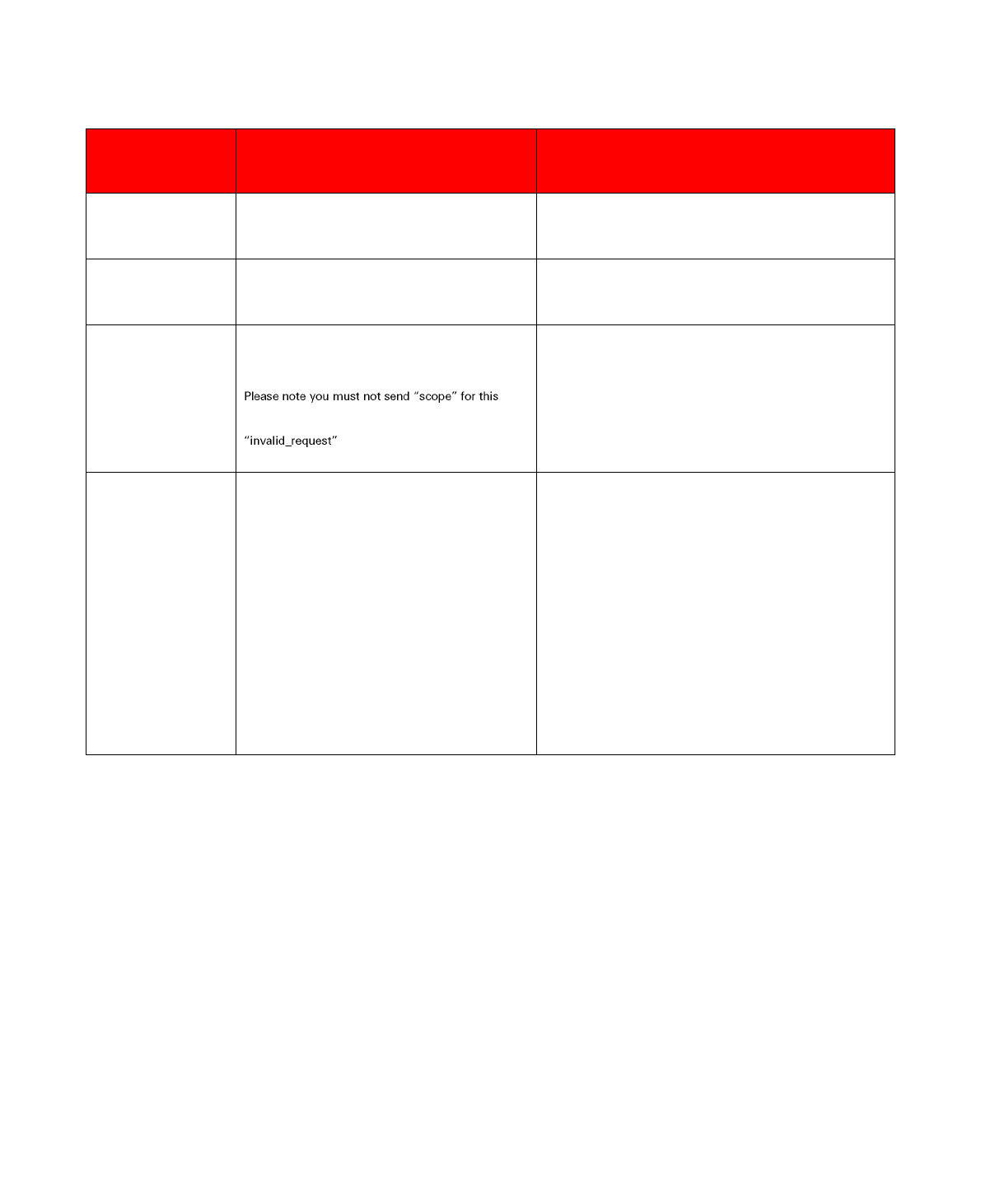

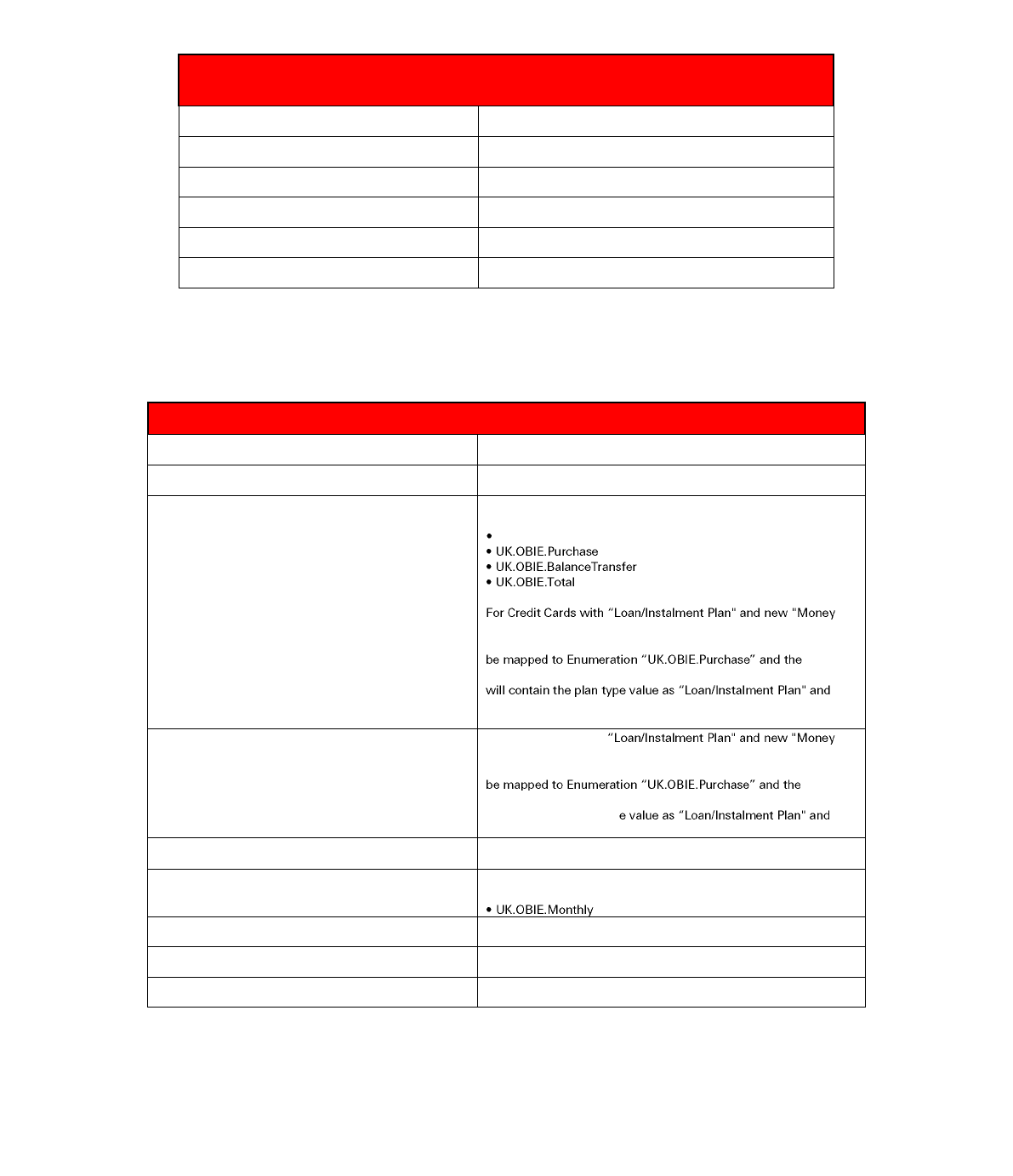

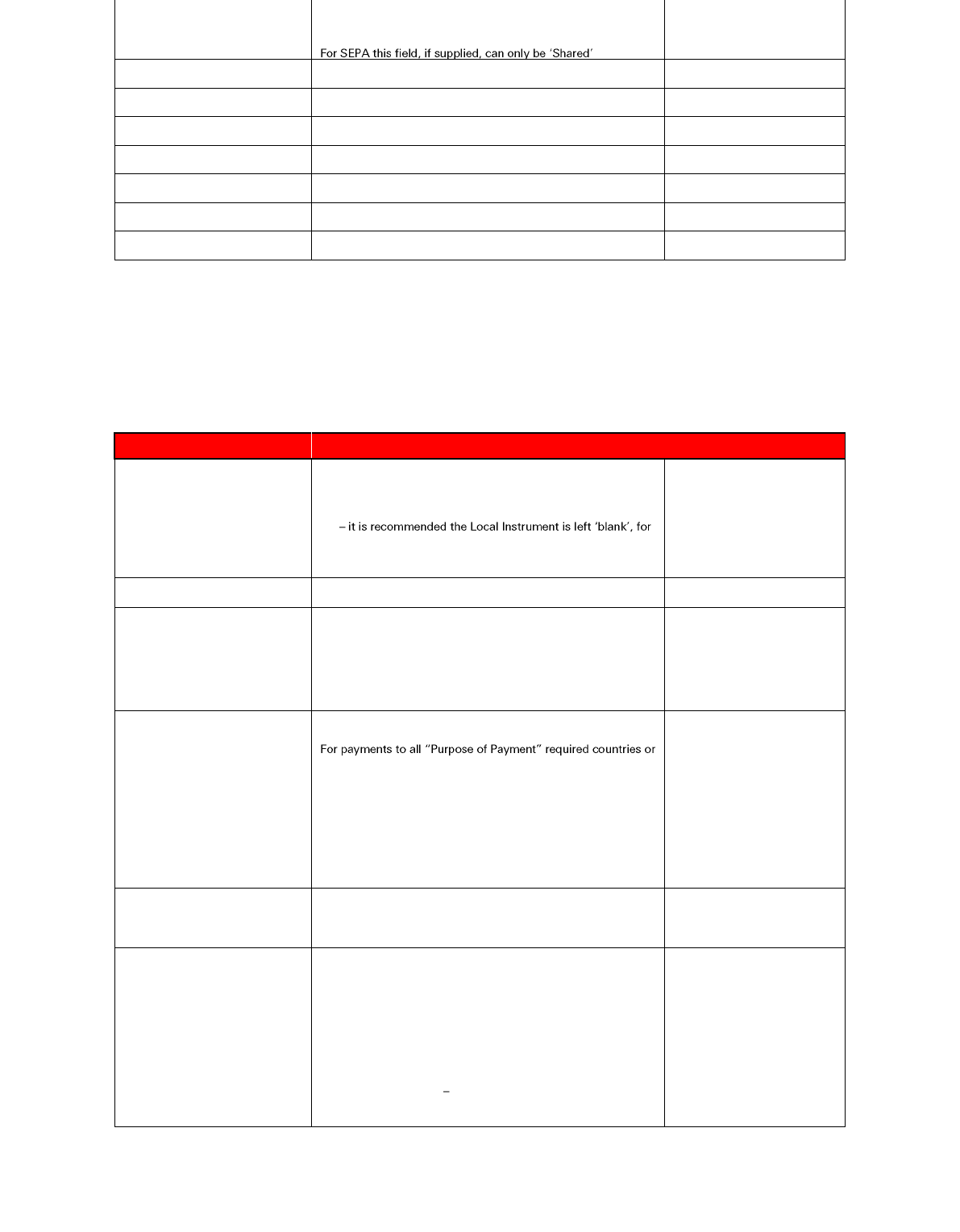

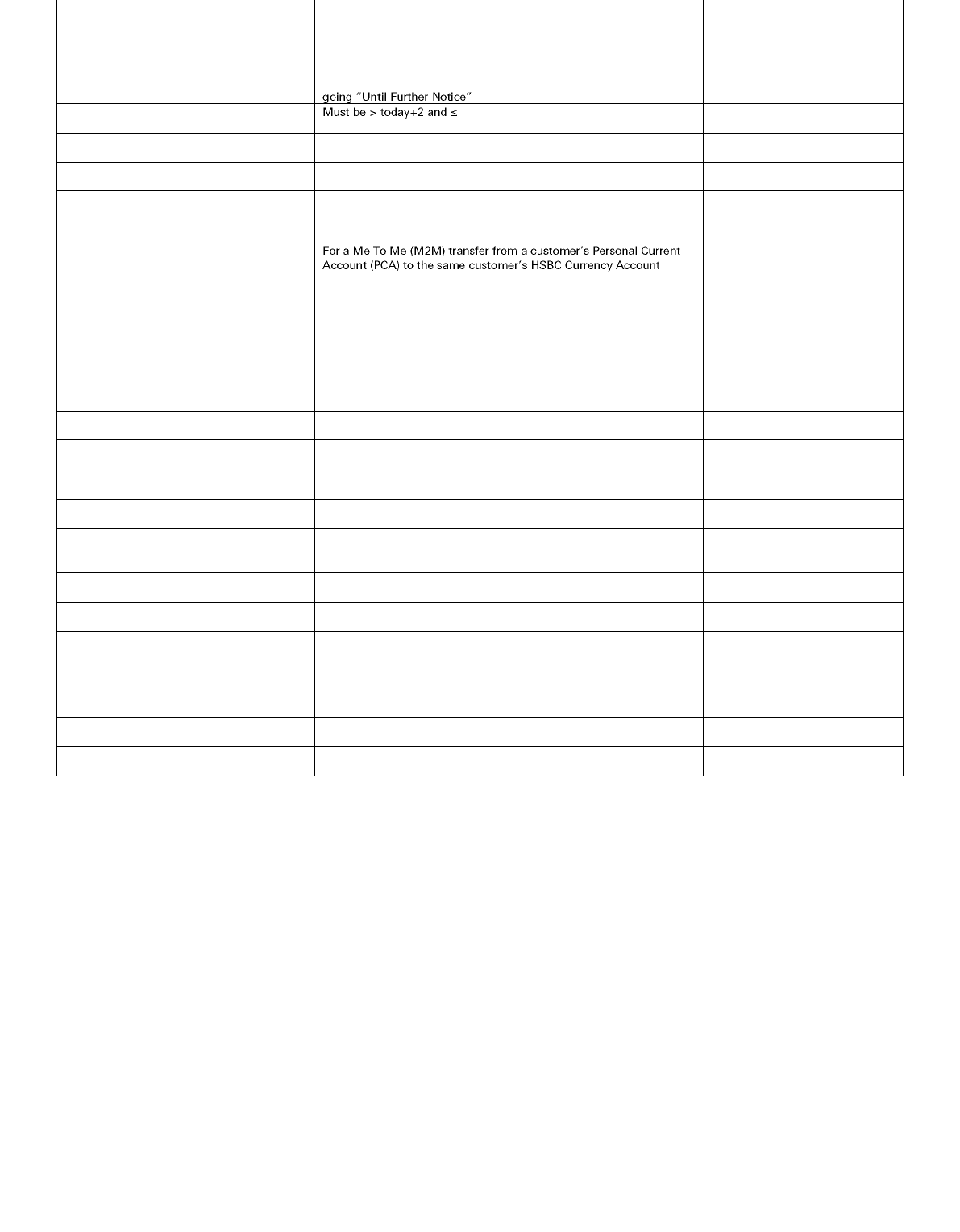

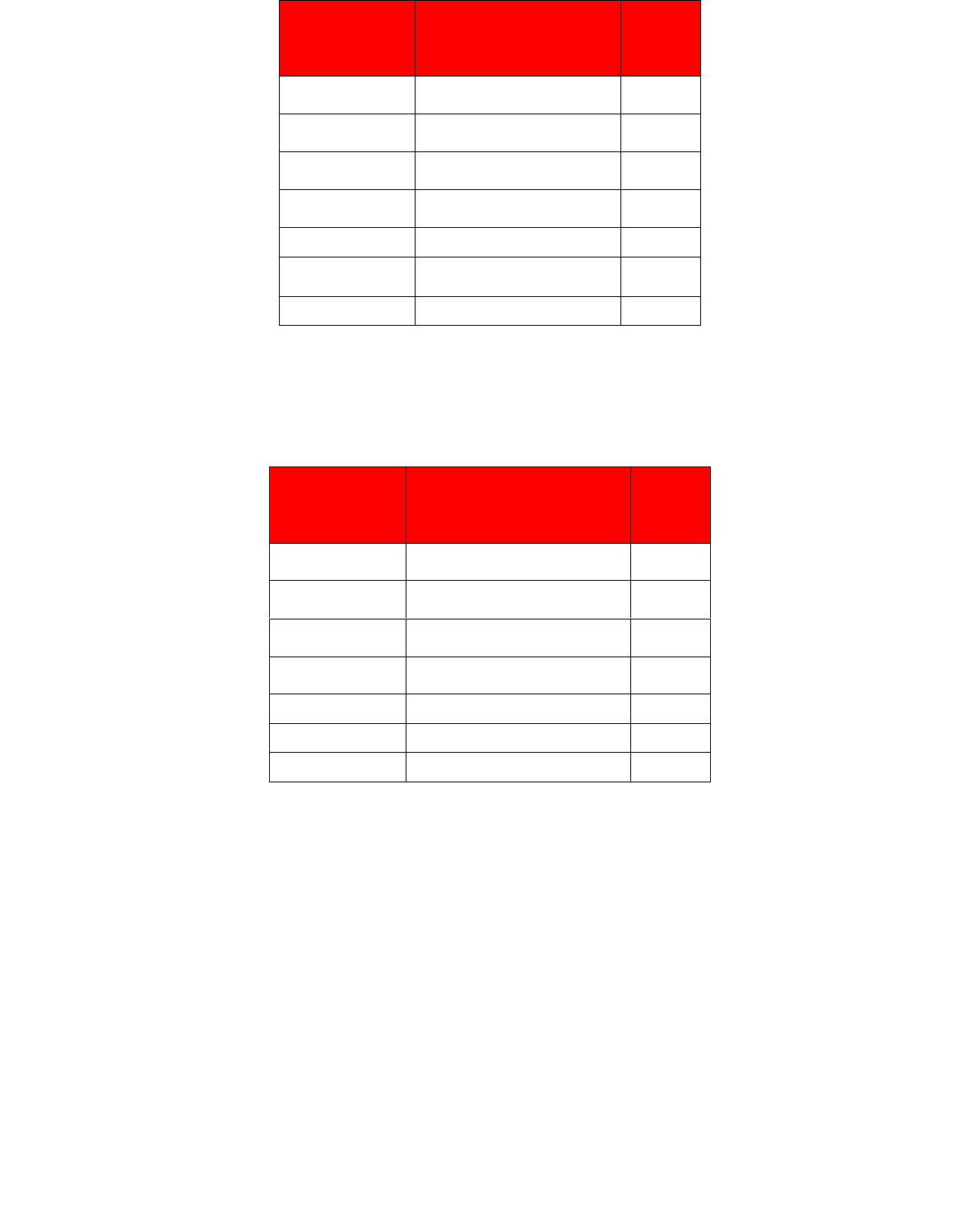

Please see the summary table for token validities below:

Token

Endpoint

Time To Live

Auth Code

GET /authorize

1 minute

Access Token

POST/token

grant type: client credentials

5 minutes

Access Token

POST/token

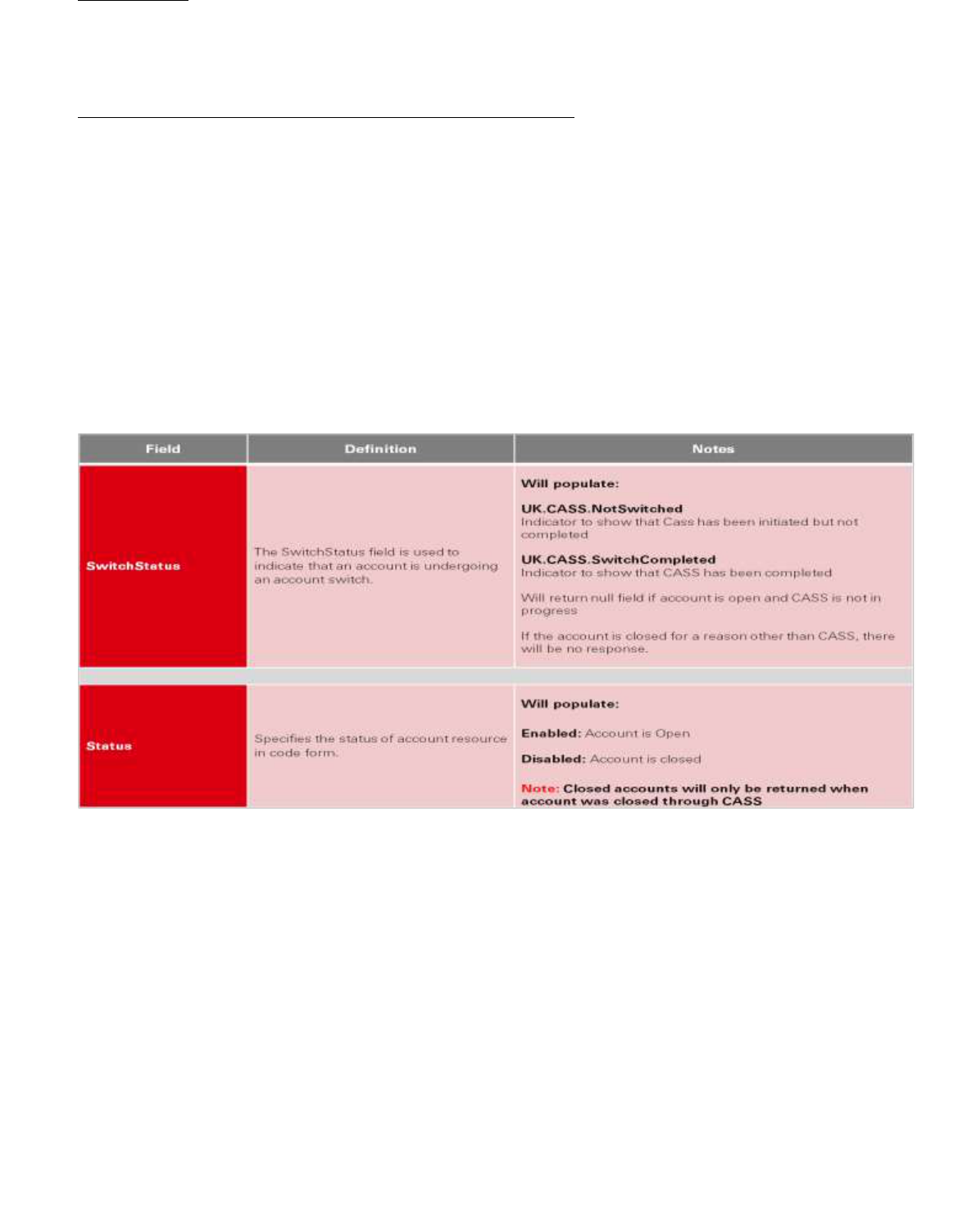

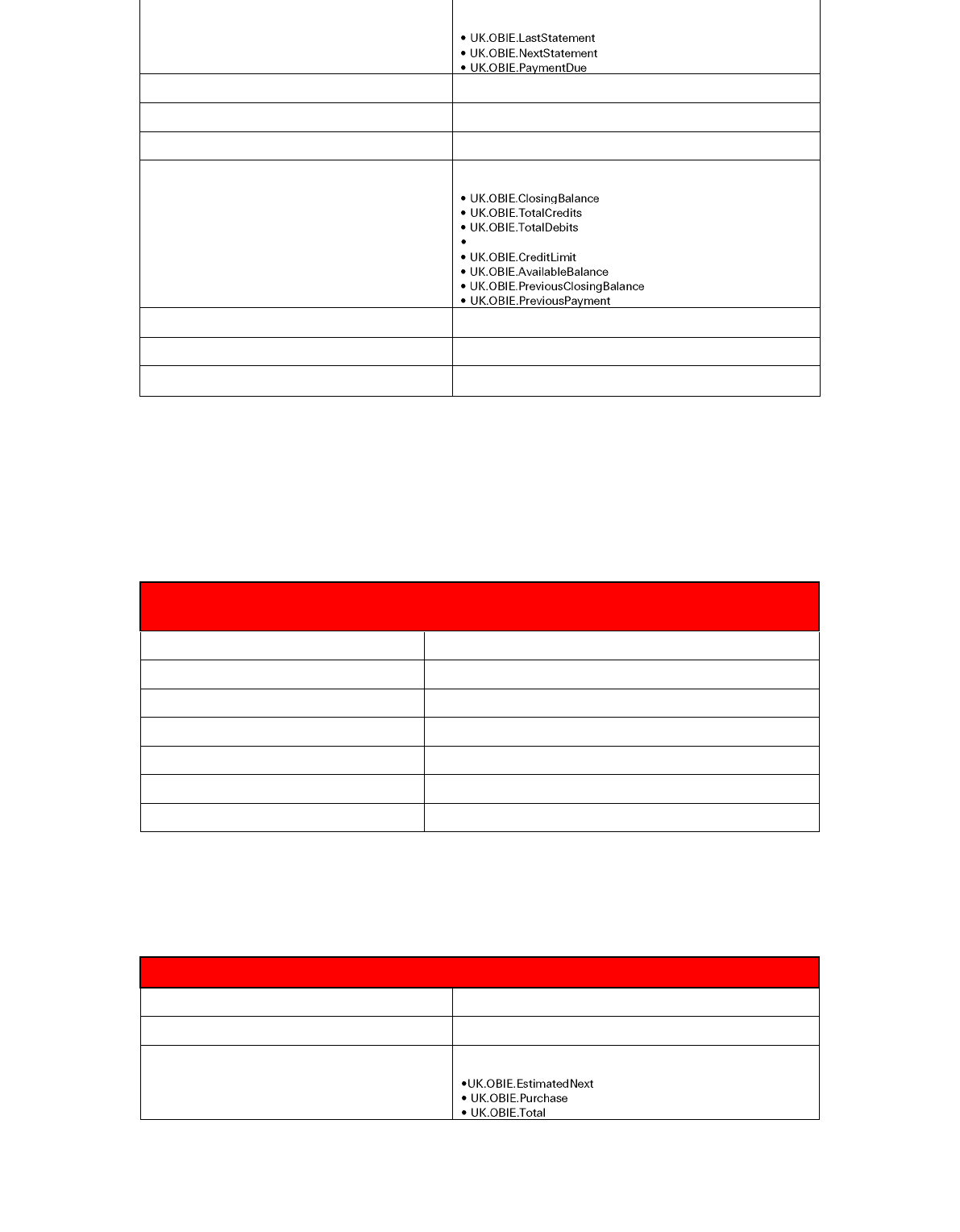

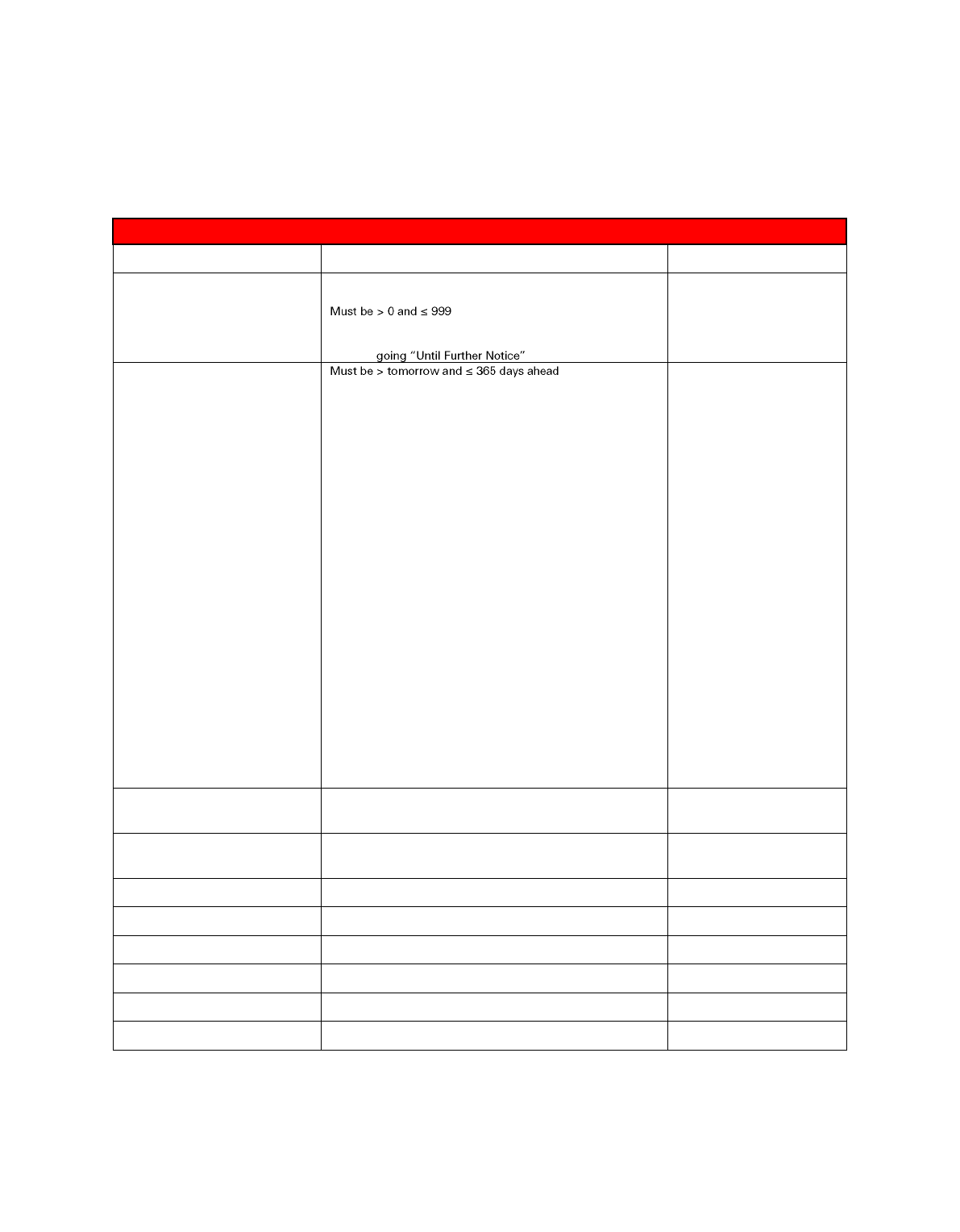

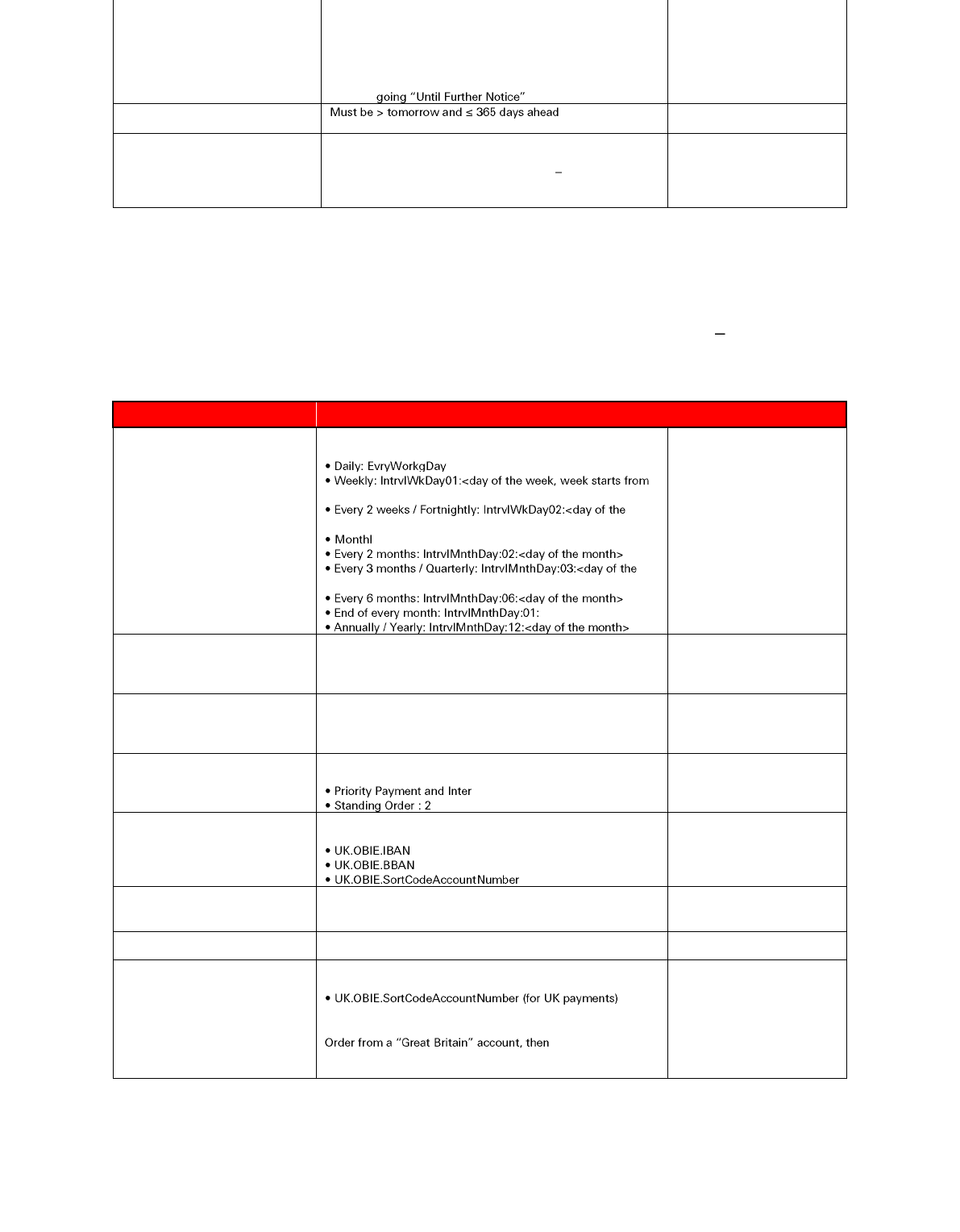

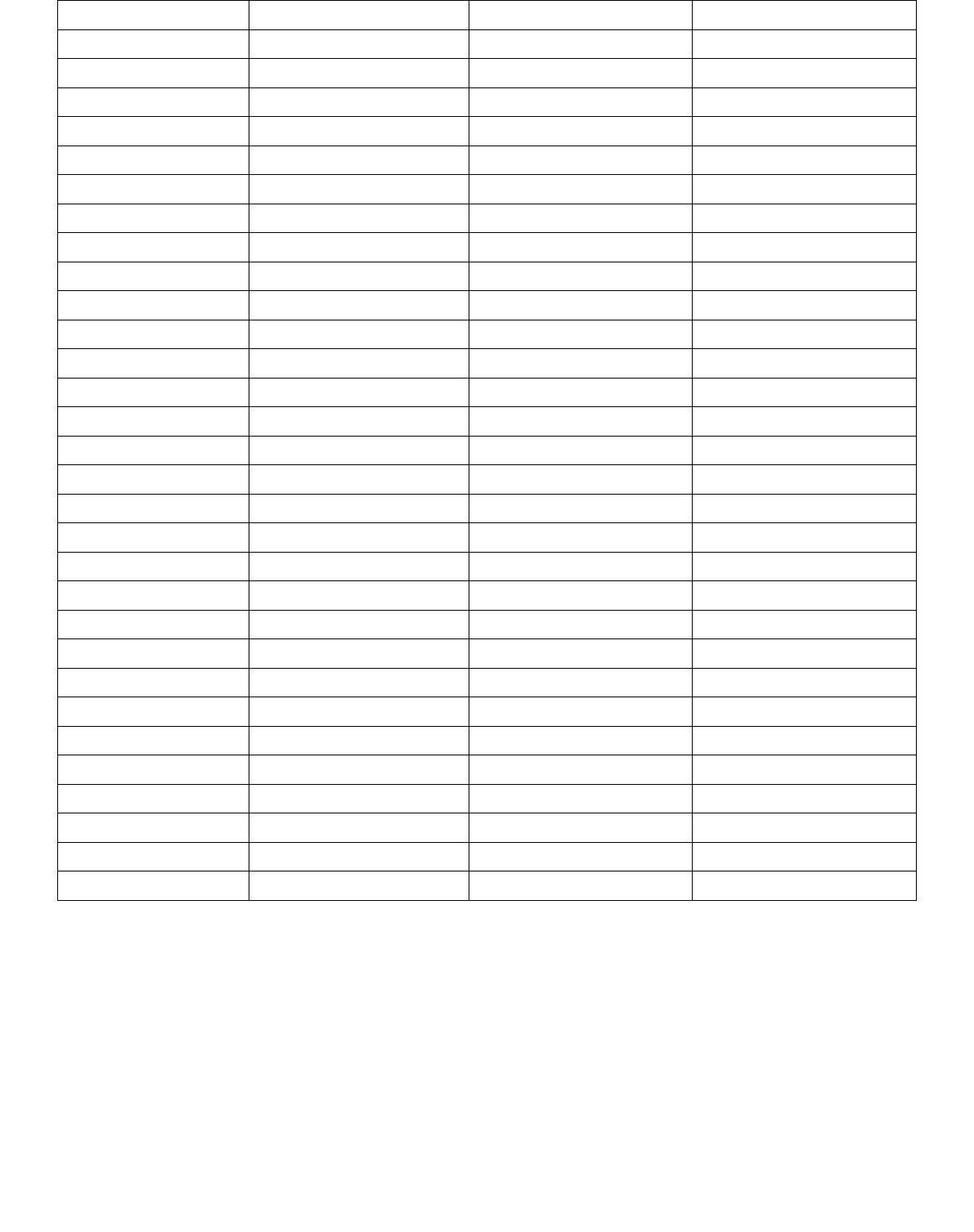

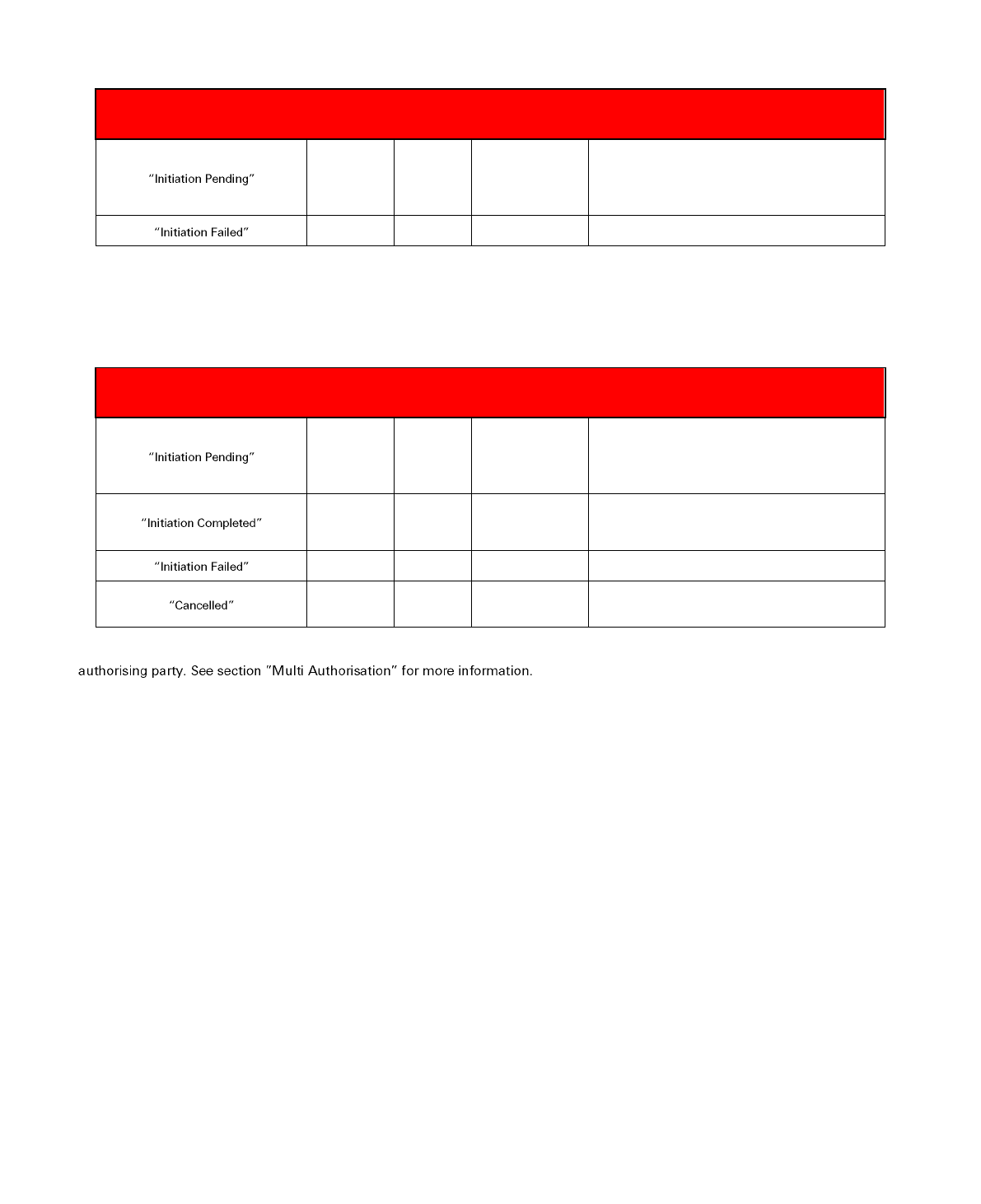

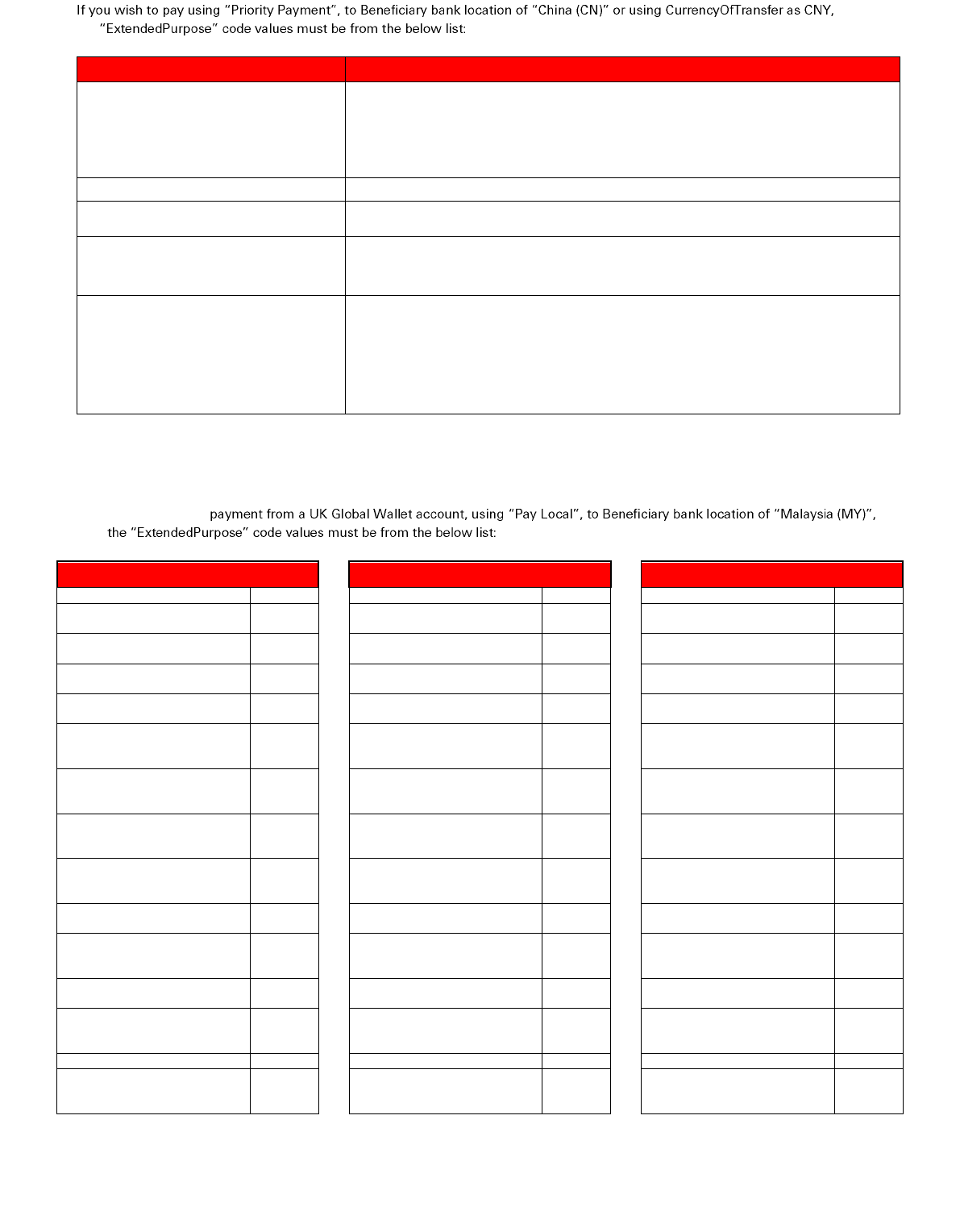

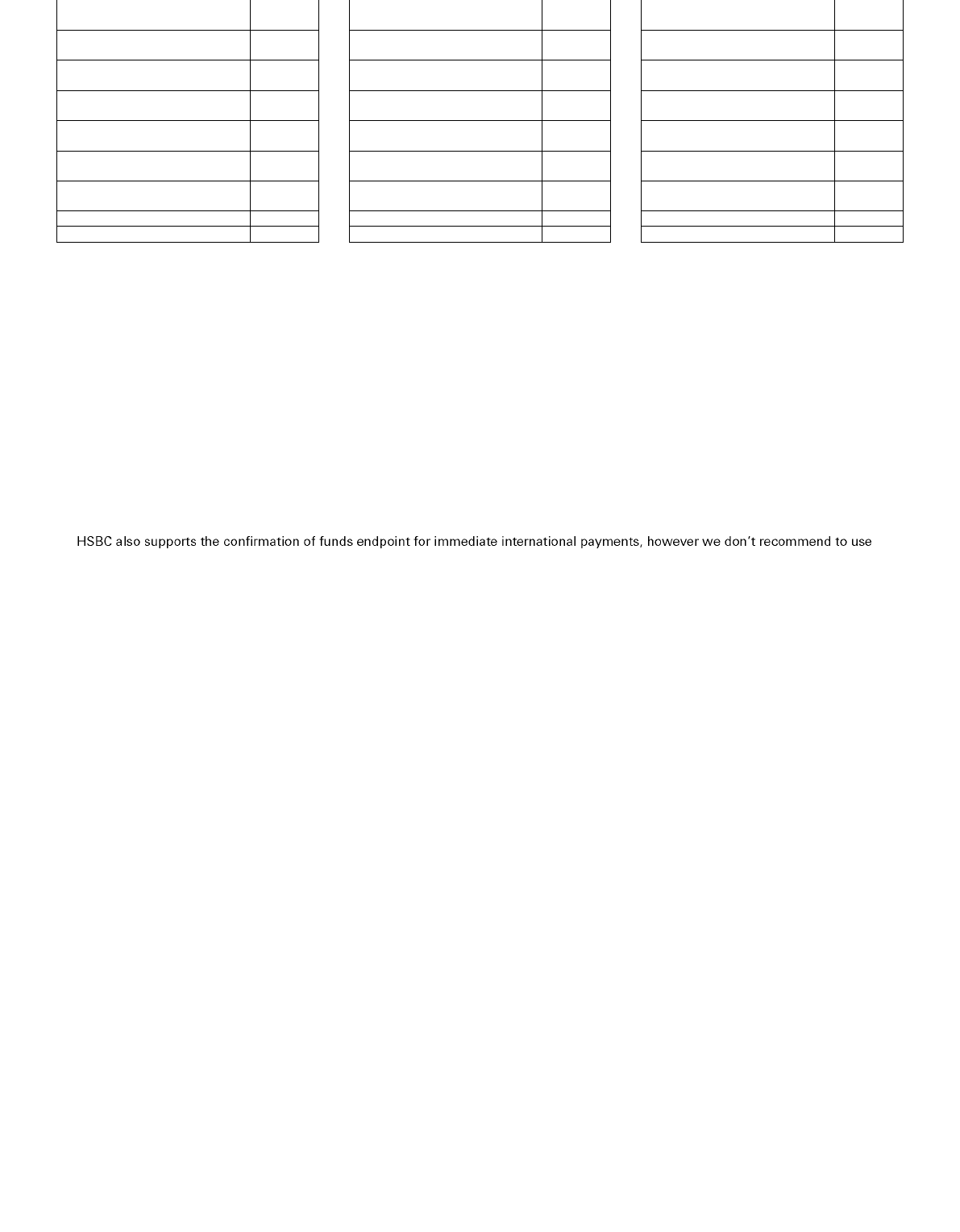

grant type: authorization_code