THE

CONSTITUTION

OF

THE

STATE OF FLORIDA

As revised in

1968

And subsequently amended

November 2022

The Florida Legislature

Office of Legislative Services

Division of Law Revision

2022

Tallahassee, Florida

History

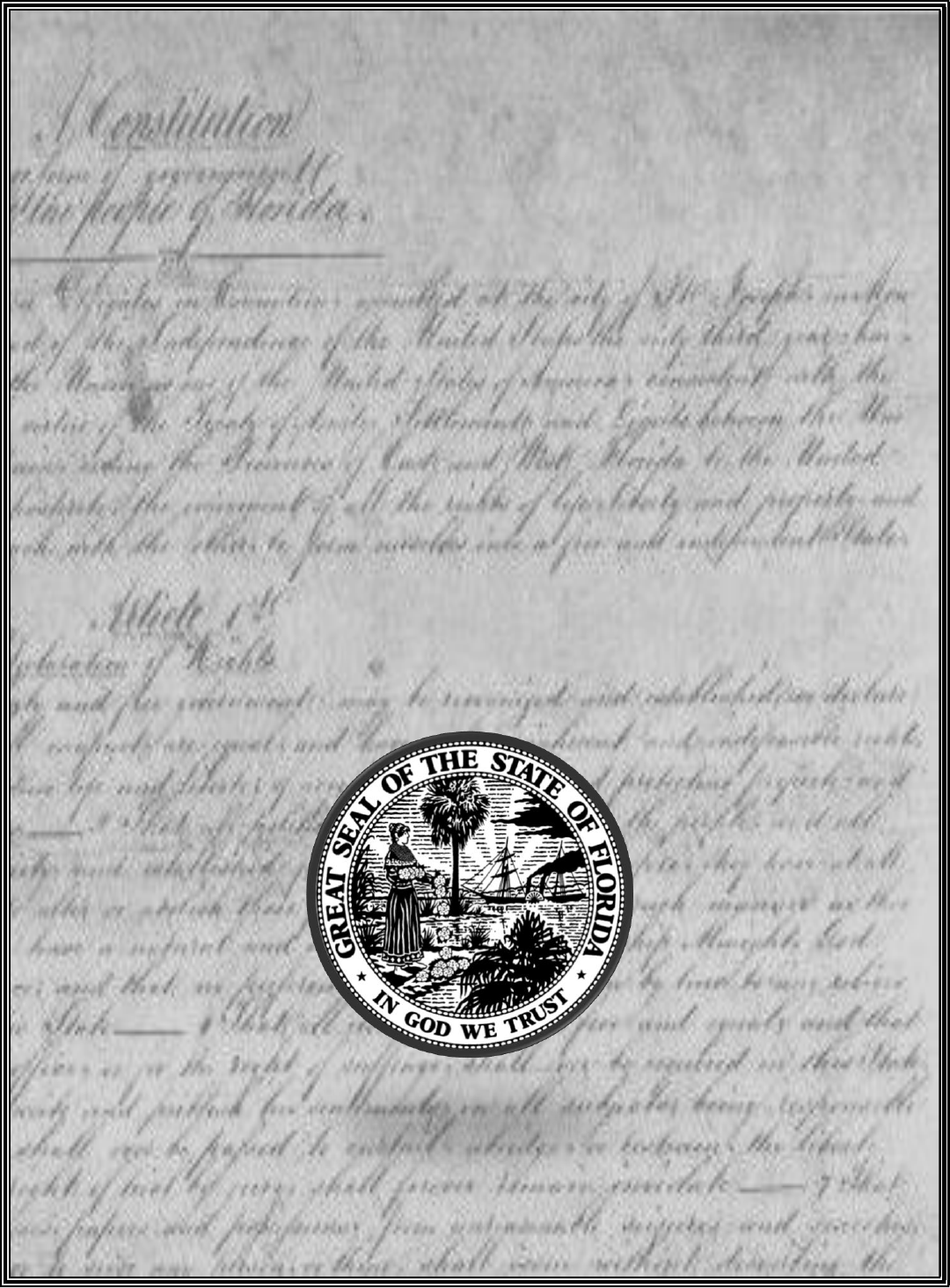

In preparation for statehood, fifty-six delegates from Florida’s twenty counties

assembled in the Panhandle town of Saint Joseph (near Port St. Joe) to frame the 1838

Constitution (cover). The delegates were mainly planters and lawyers from thirteen

of the nation’s twenty-six states and four foreign countries; only three were native

Floridians. Three delegates would later become U.S. Senators; two, governors; and

five, members of the state supreme court. The convention was called to order on

December 3, 1838 and elected Robert Raymond Reid of St. Augustine as president.

The constitution divided the government into the traditional three branches – an

executive headed by the governor elected to a single four year term, a bicameral

legislature that met annually, and a judiciary headed by a supreme court. It banned

bank officers, clergymen, and duelists from election to the legislature and

governorship; and declared free men equal while at the same time preserving slavery.

The constitution was approved by popular vote in 1839 and served as Florida’s

constitution from statehood in 1845 until Florida seceded from the Union in 1861.

The original 1838 Constitution, signed by forty-one delegates on January 11, 1839,

has disappeared. The only surviving handwritten copy is a clerk’s copy signed by

Reid and Joshua Knowles, convention secretary, found by the William N. “Bill”

Galphin family in Fernandina Beach in 1982. The family inherited the copy from

Galphin’s grandfather William Thompson. Thompson married the niece of Judge

John C. McGehee, a delegate to the 1838 convention and president of the Secession

Convention of 1861.

The 1838 Constitution is one of many historical documents that may be found at

the Florida State Archives. Located in the R.A. Gray Building in Tallahassee, the

Archives is mandated by law to collect and preserve documentation of Florida’s past;

including photographs, state records, and private papers of individuals and

organizations.

http://dos.myflorida.com/library-archives/

Cover Page: The background is the image of a page from the 1838 Constitution of

Florida, courtesy of the State Photographic Archives, Florida Department of State.

History: Summary is provided courtesy of the Florida Department of State’s

Division of Library and Information Services.

Additional copies or alternative formats available from:

Law Book Services Office

Division of Law Revision

(850) 488-2323

www.flalegistore.com

CONSTITUTION

OF THE

STATE OF FLORIDA

AS REVISED IN 1968 AND SUBSEQUENTLY AMENDED

The Constitution of the State of Florida as revised in 1968 consisted of certain revised

articles as proposed by three joint resolutions which were adopted during the special session of

June 24-July 3, 1968, and ratified by the electorate on November 5, 1968, together with one

article carried forward from the Constitution of 1885, as amended. The articles proposed in

House Joint Resolution 1-2X constituted the entire revised constitution with the exception of

Articles V, VI, and VIII. Senate Joint Resolution 4-2X proposed Article VI, relating to suffrage

and elections. Senate Joint Resolution 5-2X proposed a new Article VIII, relating to local

government. Article V, relating to the judiciary, was carried forward from the Constitution of

1885, as amended.

Sections composing the 1968 revision have no history notes. Subsequent changes are

indicated by notes appended to the affected sections. The indexes appearing at the beginning

of each article, notes appearing at the end of various sections, and section and subsection

headings are added editorially and are not to be considered as part of the constitution.

1

PREAMBLE

We, the people of the State of Florida, being grateful to Almighty God for our constitutional

liberty, in order to secure its benefits, perfect our government, insure domestic tranquility,

maintain public order, and guarantee equal civil and political rights to all, do ordain and

establish this constitution.

ARTICLE I

DECLARATION OF RIGHTS

Sec.

1. Political power.

2. Basic rights.

3. Religious freedom.

4. Freedom of speech and press.

5. Right to assemble.

6. Right to work.

7. Military power.

8. Right to bear arms.

9. Due process.

10. Prohibited laws.

11. Imprisonment for debt.

12. Searches and seizures.

13. Habeas corpus.

14. Pretrial release and detention.

15. Prosecution for crime; offenses committed by

children.

16. Rights of accused and of victims.

17. Excessive punishments.

18. Administrative penalties.

19. Costs.

20. Treason.

21. Access to courts.

22. Trial by jury.

23. Right of privacy.

24. Access to public records and meetings.

25. Taxpayers’ Bill of Rights.

26. Claimant’s right to fair compensation.

27. Marriage defined.

SECTION 1. Political power.—All political power is

inherent in the people. The enunciation herein of certain

rights shall not be construed to deny or impair others

retained by the people.

SECTION 2. Basic rights.—All natural persons,

female and male alike, are equal before the law and

have inalienable rights, among which are the right to

enjoy and defend life and liberty, to pursue happiness,

to be rewarded for industry, and to acquire, possess and

protect property. No person shall be deprived of any

right because of race, religion, national origin, or

physical disability.

History.—Am. S.J.R. 917, 1974; adopted 1974; Am. proposed by Constitution

Revision Commission, Revision No. 9, 1998, filed with the Secretary of State May 5,

1998; adopted 1998; Am. proposed by Constitution Revision Commission, Revision

No. 6, 2018, filed with the Secretary of State May 9, 2018; adopted 2018.

SECTION 3. Religious freedom.—There shall be

no law respecting the establishment of religion or

prohibiting or penalizing the free exercise thereof.

Religious freedom shall not justify practices inconsistent

with public morals, peace or safety. No revenue of the

state or any political subdivision or agency thereof shall

ever be taken from the public treasury directly or

indirectly in aid of any church, sect, or religious

denomination or in aid of any sectarian institution.

SECTION 4. Freedom of speech and press.—

Every person may speak, write and publish sentiments

on all subjects but shall be responsible for the abuse of

that right. No law shall be passed to restrain or abridge

the liberty of speech or of the press. In all criminal

prosecutions and civil actions for defamation the truth

may be given in evidence. If the matter charged as

defamatory is true and was published with good

motives, the party shall be acquitted or exonerated.

History.—Am. proposed by Constitution Revision Commission, Revision No.

13, 1998, filed with the Secretary of State May 5, 1998; adopted 1998.

SECTION 5. Right to assemble.—The people

shall have the right peaceably to assemble, to instruct

their representatives, and to petition for redress of

grievances.

SECTION 6. Right to work.—The right of persons

to work shall not be denied or abridged on account of

membership or non-membership in any labor union or

labor organization. The right of employees, by and

through a labor organization, to bargain collectively shall

not be denied or abridged. Public employees shall not

have the right to strike.

SECTION 7. Military power.—The military power

shall be subordinate to the civil.

SECTION 8. Right to bear arms.—

(a) The right of the people to keep and bear arms in

defense of themselves and of the lawful authority of the

state shall not be infringed, except that the manner of

bearing arms may be regulated by law.

(b) There shall be a mandatory period of three days,

excluding weekends and legal holidays, between the

purchase and delivery at retail of any handgun. For the

purposes of this section, “purchase” means the transfer

of money or other valuable consideration to the retailer,

and “handgun” means a firearm capable of being carried

and used by one hand, such as a pistol or revolver.

Holders of a concealed weapon permit as prescribed in

Florida law shall not be subject to the provisions of this

paragraph.

ARTICLE I CONSTITUTION OF THE STATE OF FLORIDA ARTICLE I

2

(c) The legislature shall enact legislation implement-

ing subsection (b) of this section, effective no later than

December 31, 1991, which shall provide that anyone

violating the provisions of subsection (b) shall be guilty

of a felony.

(d) This restriction shall not apply to a trade in of

another handgun.

History.—Am. C.S. for S.J.R. 43, 1989; adopted 1990.

SECTION 9. Due process.—No person shall be

deprived of life, liberty or property without due process

of law, or be twice put in jeopardy for the same offense,

or be compelled in any criminal matter to be a witness

against oneself.

History.—Am. proposed by Constitution Revision Commission, Revision No.

13, 1998, filed with the Secretary of State May 5, 1998; adopted 1998.

SECTION 10. Prohibited laws.—No bill of attain-

der, ex post facto law or law impairing the obligation of

contracts shall be passed.

SECTION 11. Imprisonment for debt.—No per-

son shall be imprisoned for debt, except in cases of

fraud.

SECTION 12. Searches and seizures.—The right

of the people to be secure in their persons, houses,

papers and effects against unreasonable searches and

seizures, and against the unreasonable interception of

private communications by any means, shall not be

violated. No warrant shall be issued except upon

probable cause, supported by affidavit, particularly

describing the place or places to be searched, the

person or persons, thing or things to be seized, the

communication to be intercepted, and the nature of

evidence to be obtained. This right shall be construed in

conformity with the 4th Amendment to the United States

Constitution, as interpreted by the United States Su-

preme Court. Articles or information obtained in viola-

tion of this right shall not be admissible in evidence if

such articles or information would be inadmissible under

decisions of the United States Supreme Court constru-

ing the 4th Amendment to the United States Constitu-

tion.

History.—Am. H.J.R. 31-H, 1982; adopted 1982.

SECTION 13. Habeas corpus.—The writ of ha-

beas corpus shall be grantable of right, freely and

without cost. It shall be returnable without delay, and

shall never be suspended unless, in case of rebellion or

invasion, suspension is essential to the public safety.

SECTION 14. Pretrial release and detention.—

Unless charged with a capital offense or an offense

punishable by life imprisonment and the proof of guilt is

evident or the presumption is great, every person

charged with a crime or violation of municipal or county

ordinance shall be entitled to pretrial release on reason-

able conditions. If no conditions of release can reason-

ably protect the community from risk of physical harm to

persons, assure the presence of the accused at trial, or

assure the integrity of the judicial process, the accused

may be detained.

History.—Am. H.J.R. 43-H, 1982; adopted 1982.

SECTION 15. Prosecution for crime; offenses

committed by children.—

(a) No person shall be tried for capital crime without

presentment or indictment by a grand jury, or for other

felony without such presentment or indictment or an

information under oath filed by the prosecuting officer of

the court, except persons on active duty in the militia

when tried by courts martial.

(b) When authorized by law, a child as therein

defined may be charged with a violation of law as an

act of delinquency instead of crime and tried without a

jury or other requirements applicable to criminal cases.

Any child so charged shall, upon demand made as

provided by law before a trial in a juvenile proceeding,

be tried in an appropriate court as an adult. A child found

delinquent shall be disciplined as provided by law.

SECTION 16. Rights of accused and of victims.

(a) In all criminal prosecutions the accused shall,

upon demand, be informed of the nature and cause of

the accusation, and shall be furnished a copy of the

charges, and shall have the right to have compulsory

process for witnesses, to confront at trial adverse

witnesses, to be heard in person, by counsel or both,

and to have a speedy and public trial by impartial jury in

the county where the crime was committed. If the county

is not known, the indictment or information may charge

venue in two or more counties conjunctively and proof

that the crime was committed in that area shall be

sufficient; but before pleading the accused may elect in

which of those counties the trial will take place. Venue

for prosecution of crimes committed beyond the bound-

aries of the state shall be fixed by law.

(b) To preserve and protect the right of crime victims

to achieve justice, ensure a meaningful role throughout

the criminal and juvenile justice systems for crime

victims, and ensure that crime victims’ rights and

interests are respected and protected by law in a

manner no less vigorous than protections afforded to

criminal defendants and juvenile delinquents, every

victim is entitled to the following rights, beginning at

the time of his or her victimization:

(1) The right to due process and to be treated with

fairness and respect for the victim’s dignity.

(2) The right to be free from intimidation, harass-

ment, and abuse.

(3) The right, within the judicial process, to be

reasonably protected from the accused and any person

acting on behalf of the accused. However, nothing

contained herein is intended to create a special relation-

ship between the crime victim and any law enforcement

agency or office absent a special relationship or duty as

defined by Florida law.

(4) The right to have the safety and welfare of the

victim and the victim’s family considered when setting

bail, including setting pretrial release conditions that

protect the safety and welfare of the victim and the

victim’s family.

(5) The right to prevent the disclosure of information

or records that could be used to locate or harass the

victim or the victim’s family, or which could disclose

confidential or privileged information of the victim.

ARTICLE I CONSTITUTION OF THE STATE OF FLORIDA ARTICLE I

3

(6) A victim shall have the following specific rights

upon request:

a. The right to reasonable, accurate, and timely

notice of, and to be present at, all public proceedings

involving the criminal conduct, including, but not limited

to, trial, plea, sentencing, or adjudication, even if the

victim will be a witness at the proceeding, notwithstand-

ing any rule to the contrary. A victim shall also be

provided reasonable, accurate, and timely notice of any

release or escape of the defendant or delinquent, and

any proceeding during which a right of the victim is

implicated.

b. The right to be heard in any public proceeding

involving pretrial or other release from any form of legal

constraint, plea, sentencing, adjudication, or parole, and

any proceeding during which a right of the victim is

implicated.

c. The right to confer with the prosecuting attorney

concerning any plea agreements, participation in pre-

trial diversion programs, release, restitution, senten-

cing, or any other disposition of the case.

d. The right to provide information regarding the

impact of the offender’s conduct on the victim and the

victim’s family to the individual responsible for conduct-

ing any presentence investigation or compiling any

presentence investigation report, and to have any

such information considered in any sentencing recom-

mendations submitted to the court.

e. The right to receive a copy of any presentence

report, and any other report or record relevant to the

exercise of a victim’s right, except for such portions

made confidential or exempt by law.

f. The right to be informed of the conviction,

sentence, adjudication, place and time of incarceration,

or other disposition of the convicted offender, any

scheduled release date of the offender, and the release

of or the escape of the offender from custody.

g. The right to be informed of all postconviction

processes and procedures, to participate in such

processes and procedures, to provide information to

the release authority to be considered before any

release decision is made, and to be notified of any

release decision regarding the offender. The parole or

early release authority shall extend the right to be heard

to any person harmed by the offender.

h. The right to be informed of clemency and

expungement procedures, to provide information to

the governor, the court, any clemency board, and

other authority in these procedures, and to have that

information considered before a clemency or expunge-

ment decision is made; and to be notified of such

decision in advance of any release of the offender.

(7) The rights of the victim, as provided in subpar-

agraph (6)a., subparagraph (6)b., or subparagraph (6)

c., that apply to any first appearance proceeding are

satisfied by a reasonable attempt by the appropriate

agency to notify the victim and convey the victim’s views

to the court.

(8) The right to the prompt return of the victim’s

property when no longer needed as evidence in the

case.

(9) The right to full and timely restitution in every

case and from each convicted offender for all losses

suffered, both directly and indirectly, by the victim as a

result of the criminal conduct.

(10) The right to proceedings free from unreasonable

delay, and to a prompt and final conclusion of the case

and any related postjudgment proceedings.

a. The state attorney may file a good faith demand

for a speedy trial and the trial court shall hold a calendar

call, with notice, within fifteen days of the filing demand,

to schedule a trial to commence on a date at least five

days but no more than sixty days after the date of the

calendar call unless the trial judge enters an order with

specific findings of fact justifying a trial date more than

sixty days after the calendar call.

b. All state-level appeals and collateral attacks on

any judgment must be complete within two years from

the date of appeal in non-capital cases and within five

years from the date of appeal in capital cases, unless a

court enters an order with specific findings as to why the

court was unable to comply with this subparagraph and

the circumstances causing the delay. Each year, the

chief judge of any district court of appeal or the chief

justice of the supreme court shall report on a case-by-

case basis to the speaker of the house of representa-

tives and the president of the senate all cases where the

court entered an order regarding inability to comply with

this subparagraph. The legislature may enact legislation

to implement this subparagraph.

(11) The right to be informed of these rights, and to be

informed that victims can seek the advice of an attorney

with respect to their rights. This information shall be

made available to the general public and provided to all

crime victims in the form of a card or by other means

intended to effectively advise the victim of their rights

under this section.

(c) The victim, the retained attorney of the victim, a

lawful representative of the victim, or the office of the

state attorney upon request of the victim, may assert

and seek enforcement of the rights enumerated in this

section and any other right afforded to a victim by law in

any trial or appellate court, or before any other authority

with jurisdiction over the case, as a matter of right. The

court or other authority with jurisdiction shall act

promptly on such a request, affording a remedy by

due course of law for the violation of any right. The

reasons for any decision regarding the disposition of a

victim’s right shall be clearly stated on the record.

(d) The granting of the rights enumerated in this

section to victims may not be construed to deny or

impair any other rights possessed by victims. The

provisions of this section apply throughout criminal

and juvenile justice processes, are self-executing, and

do not require implementing legislation. This section

may not be construed to create any cause of action for

damages against the state or a political subdivision of

the state, or any officer, employee, or agent of the state

or its political subdivisions.

(e) As used in this section, a “victim” is a person who

suffers direct or threatened physical, psychological, or

financial harm as a result of the commission or

attempted commission of a crime or delinquent act or

against whom the crime or delinquent act is committed.

The term “victim” includes the victim’s lawful represen-

tative, the parent or guardian of a minor, or the next of

ARTICLE I CONSTITUTION OF THE STATE OF FLORIDA ARTICLE I

4

kin of a homicide victim, except upon a showing that the

interest of such individual would be in actual or potential

conflict with the interests of the victim. The term “victim”

does not include the accused. The terms “crime” and

“criminal” include delinquent acts and conduct.

History.—Am. S.J.R. 135, 1987; adopted 1988; Am. proposed by Constitution

Revision Commission, Revision No. 13, 1998, filed with the Secretary of State May

5, 1998; adopted 1998; Am. proposed by Constitution Revision Commission,

Revision No. 1, 2018, filed with the Secretary of State May 9, 2018; adopted 2018.

SECTION 17. Excessive punishments.—Exces-

sive fines, cruel and unusual punishment, attainder,

forfeiture of estate, indefinite imprisonment, and un-

reasonable detention of witnesses are forbidden. The

death penalty is an authorized punishment for capital

crimes designated by the legislature. The prohibition

against cruel or unusual punishment, and the prohibition

against cruel and unusual punishment, shall be con-

strued in conformity with decisions of the United States

Supreme Court which interpret the prohibition against

cruel and unusual punishment provided in the Eighth

Amendment to the United States Constitution. Any

method of execution shall be allowed, unless prohibited

by the United States Constitution. Methods of execution

may be designated by the legislature, and a change in

any method of execution may be applied retroactively. A

sentence of death shall not be reduced on the basis that

a method of execution is invalid. In any case in which an

execution method is declared invalid, the death sen-

tence shall remain in force until the sentence can be

lawfully executed by any valid method. This section

shall apply retroactively.

History.—Am. H.J.R. 3505, 1998; adopted 1998; Am. H.J.R. 951, 2001;

adopted 2002.

SECTION 18. Administrative penalties.—No ad-

ministrative agency, except the Department of Military

Affairs in an appropriately convened court-martial action

as provided by law, shall impose a sentence of

imprisonment, nor shall it impose any other penalty

except as provided by law.

History.—Am. proposed by Constitution Revision Commission, Revision No.

13, 1998, filed with the Secretary of State May 5, 1998; adopted 1998.

SECTION 19. Costs.—No person charged with

crime shall be compelled to pay costs before a judgment

of conviction has become final.

SECTION 20. Treason.—Treason against the state

shall consist only in levying war against it, adhering to its

enemies, or giving them aid and comfort, and no person

shall be convicted of treason except on the testimony of

two witnesses to the same overt act or on confession in

open court.

SECTION 21. Access to courts.—The courts shall

be open to every person for redress of any injury, and

justice shall be administered without sale, denial or

delay.

SECTION 22. Trial by jury.—The right of trial by

jury shall be secure to all and remain inviolate. The

qualifications and the number of jurors, not fewer than

six, shall be fixed by law.

SECTION 23. Right of privacy.—Every natural

person has the right to be let alone and free from

governmental intrusion into the person’s private life

except as otherwise provided herein. This section shall

not be construed to limit the public’s right of access to

public records and meetings as provided by law.

History.—Added, C.S. for H.J.R. 387, 1980; adopted 1980; Am. proposed by

Constitution Revision Commission, Revision No. 13, 1998, filed with the Secretary of

State May 5, 1998; adopted 1998.

SECTION 24. Access to public records and

meetings.—

(a) Every person has the right to inspect or copy any

public record made or received in connection with the

official business of any public body, officer, or employee

of the state, or persons acting on their behalf, except

with respect to records exempted pursuant to this

section or specifically made confidential by this Con-

stitution. This section specifically includes the legisla-

tive, executive, and judicial branches of government

and each agency or department created thereunder;

counties, municipalities, and districts; and each con-

stitutional officer, board, and commission, or entity

created pursuant to law or this Constitution.

(b) All meetings of any collegial public body of the

executive branch of state government or of any collegial

public body of a county, municipality, school district, or

special district, at which official acts are to be taken or at

which public business of such body is to be transacted

or discussed, shall be open and noticed to the public

and meetings of the legislature shall be open and

noticed as provided in Article III, Section 4(e), except

with respect to meetings exempted pursuant to this

section or specifically closed by this Constitution.

(c) This section shall be self-executing. The legis-

lature, however, may provide by general law passed by

a two-thirds vote of each house for the exemption of

records from the requirements of subsection (a) and the

exemption of meetings from the requirements of sub-

section (b), provided that such law shall state with

specificity the public necessity justifying the exemption

and shall be no broader than necessary to accomplish

the stated purpose of the law. The legislature shall enact

laws governing the enforcement of this section, includ-

ing the maintenance, control, destruction, disposal, and

disposition of records made public by this section,

except that each house of the legislature may adopt

rules governing the enforcement of this section in

relation to records of the legislative branch. Laws

enacted pursuant to this subsection shall contain only

exemptions from the requirements of subsections (a) or

(b) and provisions governing the enforcement of this

section, and shall relate to one subject.

(d) All laws that are in effect on July 1, 1993 that limit

public access to records or meetings shall remain in

force, and such laws apply to records of the legislative

and judicial branches, until they are repealed. Rules of

court that are in effect on the date of adoption of this

section that limit access to records shall remain in effect

until they are repealed.

History.—Added, C.S. for C.S. for H.J.R.’s 1727, 863, 2035, 1992; adopted

1992; Am. S.J.R. 1284, 2002; adopted 2002.

ARTICLE I CONSTITUTION OF THE STATE OF FLORIDA ARTICLE I

5

1

SECTION 25. Taxpayers’ Bill of Rights.—By

general law the legislature shall prescribe and adopt a

Taxpayers’ Bill of Rights that, in clear and concise

language, sets forth taxpayers’ rights and responsibil-

ities and government’s responsibilities to deal fairly with

taxpayers under the laws of this state. This section shall

be effective July 1, 1993.

History.—Proposed by Taxation and Budget Reform Commission, Revision No.

2, 1992, filed with the Secretary of State May 7, 1992; adopted 1992.

1

Note.—This section, originally designated section 24 by Revision No. 2 of the

Taxation and Budget Reform Commission, 1992, was redesignated section 25 by

the editors in order to avoid confusion with section 24 as contained in H.J.R.’s 1727,

863, 2035, 1992.

SECTION 26. Claimant’s right to fair compensa-

tion.—

(a) Article I, Section 26 is created to read “Clai-

mant’s right to fair compensation.” In any medical

liability claim involving a contingency fee, the claimant

is entitled to receive no less than 70% of the first

$250,000.00 in all damages received by the claimant,

exclusive of reasonable and customary costs, whether

received by judgment, settlement, or otherwise, and

regardless of the number of defendants. The claimant is

entitled to 90% of all damages in excess of

$250,000.00, exclusive of reasonable and customary

costs and regardless of the number of defendants. This

provision is self-executing and does not require im-

plementing legislation.

(b) This Amendment shall take effect on the day

following approval by the voters.

History.—Proposed by Initiative Petition filed with the Secretary of State

September 8, 2003; adopted 2004.

SECTION 27. Marriage defined.—Inasmuch as

marriage is the legal union of only one man and one

woman as husband and wife, no other legal union that is

treated as marriage or the substantial equivalent thereof

shall be valid or recognized.

History.—Proposed by Initiative Petition filed with the Secretary of State

February 9, 2005; adopted 2008.

ARTICLE II

GENERAL PROVISIONS

Sec.

1. State boundaries.

2. Seat of government.

3. Branches of government.

4. State seal and flag.

5. Public officers.

6. Enemy attack.

7. Natural resources and scenic beauty.

8. Ethics in government.

9. English is the official language of Florida.

SECTION 1. State boundaries.—

(a) The state boundaries are: Begin at the mouth of

the Perdido River, which for the purposes of this

description is defined as the point where latitude

30˚16´53´´ north and longitude 87˚31´06´´ west inter-

sect; thence to the point where latitude 30˚17´02´´ north

and longitude 87˚31´06´´ west intersect; thence to the

point where latitude 30˚18´00´´ north and longitude

87˚27´08´´ west intersect; thence to the point where the

center line of the Intracoastal Canal (as the same

existed on June 12, 1953) and longitude 87˚27´00´´

west intersect; the same being in the middle of the

Perdido River; thence up the middle of the Perdido River

to the point where it intersects the south boundary of the

State of Alabama, being also the point of intersection of

the middle of the Perdido River with latitude 31˚00´00´´

north; thence east, along the south boundary line of the

State of Alabama, the same being latitude 31˚00´00´´

north to the middle of the Chattahoochee River; thence

down the middle of said river to its confluence with the

Flint River; thence in a straight line to the head of the St.

Marys River; thence down the middle of said river to the

Atlantic Ocean; thence due east to the edge of the Gulf

Stream or a distance of three geographic miles which-

ever is the greater distance; thence in a southerly

direction along the edge of the Gulf Stream or along a

line three geographic miles from the Atlantic coastline

and three leagues distant from the Gulf of Mexico

coastline, whichever is greater, to and through the

Straits of Florida and westerly, including the Florida

reefs, to a point due south of and three leagues from the

southernmost point of the Marquesas Keys; thence

westerly along a straight line to a point due south of and

three leagues from Loggerhead Key, the westernmost

of the Dry Tortugas Islands; thence westerly, northerly

and easterly along the arc of a curve three leagues

distant from Loggerhead Key to a point due north of

Loggerhead Key; thence northeast along a straight line

to a point three leagues from the coastline of Florida;

thence northerly and westerly three leagues distant

from the coastline to a point west of the mouth of the

Perdido River three leagues from the coastline as

measured on a line bearing south 0˚01´00´´ west from

the point of beginning; thence northerly along said line

to the point of beginning. The State of Florida shall also

include any additional territory within the United States

adjacent to the Peninsula of Florida lying south of the St.

Marys River, east of the Perdido River, and south of the

States of Alabama and Georgia.

(b) The coastal boundaries may be extended by

statute to the limits permitted by the laws of the United

States or international law.

SECTION 2. Seat of government.—The seat of

government shall be the City of Tallahassee, in Leon

County, where the offices of the governor, lieutenant

governor, cabinet members and the supreme court shall

be maintained and the sessions of the legislature shall

be held; provided that, in time of invasion or grave

emergency, the governor by proclamation may for the

period of the emergency transfer the seat of govern-

ment to another place.

SECTION 3. Branches of government.—The

powers of the state government shall be divided into

legislative, executive and judicial branches. No person

belonging to one branch shall exercise any powers

appertaining to either of the other branches unless

expressly provided herein.

ARTICLE I CONSTITUTION OF THE STATE OF FLORIDA ARTICLE II

6

SECTION 4. State seal and flag.—The design of

the great seal and flag of the state shall be prescribed by

law.

SECTION 5. Public officers.—

(a) No person holding any office of emolument

under any foreign government, or civil office of emolu-

ment under the United States or any other state, shall

hold any office of honor or of emolument under the

government of this state. No person shall hold at the

same time more than one office under the government

of the state and the counties and municipalities therein,

except that a notary public or military officer may hold

another office, and any officer may be a member of a

constitution revision commission, taxation and budget

reform commission, constitutional convention, or statu-

tory body having only advisory powers.

(b) Each state and county officer, before entering

upon the duties of the office, shall give bond as required

by law, and shall swear or affirm:

“I do solemnly swear (or affirm) that I will support,

protect, and defend the Constitution and Government of

the United States and of the State of Florida; that I am

duly qualified to hold office under the Constitution of the

state; and that I will well and faithfully perform the duties

of

(title of office) on which I am now about to enter. So

help me God.”,

and thereafter shall devote personal attention to the

duties of the office, and continue in office until a

successor qualifies.

(c) The powers, duties, compensation and method

of payment of state and county officers shall be fixed by

law.

History.—Am. H.J.R. 1616, 1988; adopted 1988; Am. proposed by Constitution

Revision Commission, Revision No. 13, 1998, filed with the Secretary of State May

5, 1998; adopted 1998.

SECTION 6. Enemy attack.—In periods of emer-

gency resulting from enemy attack the legislature shall

have power to provide for prompt and temporary

succession to the powers and duties of all public offices

the incumbents of which may become unavailable to

execute the functions of their offices, and to adopt such

other measures as may be necessary and appropriate

to insure the continuity of governmental operations

during the emergency. In exercising these powers, the

legislature may depart from other requirements of this

constitution, but only to the extent necessary to meet

the emergency.

SECTION 7. Natural resources and scenic

beauty.—

(a) It shall be the policy of the state to conserve and

protect its natural resources and scenic beauty. Ade-

quate provision shall be made by law for the abatement

of air and water pollution and of excessive and

unnecessary noise and for the conservation and

protection of natural resources.

(b) Those in the Everglades Agricultural Area who

cause water pollution within the Everglades Protection

Area or the Everglades Agricultural Area shall be

primarily responsible for paying the costs of the abate-

ment of that pollution. For the purposes of this

subsection, the terms “Everglades Protection Area”

and “Everglades Agricultural Area” shall have the

meanings as defined in statutes in effect on January

1, 1996.

(c) To protect the people of Florida and their

environment, drilling for exploration or extraction of oil

or natural gas is prohibited on lands beneath all state

waters which have not been alienated and that lie

between the mean high water line and the outermost

boundaries of the state’s territorial seas. This prohibition

does not apply to the transportation of oil and gas

products produced outside of such waters. This sub-

section is self-executing.

History.—Am. by Initiative Petition filed with the Secretary of State March 26,

1996; adopted 1996; Am. proposed by Constitution Revision Commission, Revision

No. 5, 1998, filed with the Secretary of State May 5, 1998; adopted 1998; Am.

proposed by Constitution Revision Commission, Revision No. 4, 2018, filed with the

Secretary of State May 9, 2018; adopted 2018.

SECTION 8. Ethics in government.—A public

office is a public trust. The people shall have the right

to secure and sustain that trust against abuse. To

assure this right:

(a) All elected constitutional officers and candidates

for such offices and, as may be determined by law, other

public officers, candidates, and employees shall file full

and public disclosure of their financial interests.

(b) All elected public officers and candidates for

such offices shall file full and public disclosure of their

campaign finances.

(c) Any public officer or employee who breaches the

public trust for private gain and any person or entity

inducing such breach shall be liable to the state for all

financial benefits obtained by such actions. The manner

of recovery and additional damages may be provided by

law.

(d) Any public officer or employee who is convicted

of a felony involving a breach of public trust shall be

subject to forfeiture of rights and privileges under a

public retirement system or pension plan in such

manner as may be provided by law.

(e) No member of the legislature or statewide

elected officer shall personally represent another per-

son or entity for compensation before the government

body or agency of which the individual was an officer or

member for a period of two years following vacation of

office. No member of the legislature shall personally

represent another person or entity for compensation

during term of office before any state agency other than

judicial tribunals. Similar restrictions on other public

officers and employees may be established by law.

(f)(1) For purposes of this subsection, the term

“public officer” means a statewide elected officer, a

member of the legislature, a county commissioner, a

county officer pursuant to Article VIII or county charter, a

school board member, a superintendent of schools, an

elected municipal officer, an elected special district

officer in a special district with ad valorem taxing

authority, or a person serving as a secretary, an

executive director, or other agency head of a depart-

ment of the executive branch of state government.

(2) A public officer shall not lobby for compensation

on issues of policy, appropriations, or procurement

before the federal government, the legislature, any state

ARTICLE II CONSTITUTION OF THE STATE OF FLORIDA ARTICLE II

7

government body or agency, or any political subdivision

of this state, during his or her term of office.

(3) A public officer shall not lobby for compensation

on issues of policy, appropriations, or procurement for a

period of six years after vacation of public position, as

follows:

a. A statewide elected officer or member of the

legislature shall not lobby the legislature or any state

government body or agency.

b. A person serving as a secretary, an executive

director, or other agency head of a department of the

executive branch of state government shall not lobby

the legislature, the governor, the executive office of the

governor, members of the cabinet, a department that is

headed by a member of the cabinet, or his or her former

department.

c. A county commissioner, a county officer pur-

suant to Article VIII or county charter, a school board

member, a superintendent of schools, an elected

municipal officer, or an elected special district officer

in a special district with ad valorem taxing authority shall

not lobby his or her former agency or governing body.

(4) This subsection shall not be construed to prohibit

a public officer from carrying out the duties of his or her

public office.

(5) The legislature may enact legislation to imple-

ment this subsection, including, but not limited to,

defining terms and providing penalties for violations.

Any such law shall not contain provisions on any other

subject.

(g) There shall be an independent commission to

conduct investigations and make public reports on all

complaints concerning breach of public trust by public

officers or employees not within the jurisdiction of the

judicial qualifications commission.

(h)(1) A code of ethics for all state employees and

nonjudicial officers prohibiting conflict between public

duty and private interests shall be prescribed by law.

(2) A public officer or public employee shall not

abuse his or her public position in order to obtain a

disproportionate benefit for himself or herself; his or her

spouse, children, or employer; or for any business with

which he or she contracts; in which he or she is an

officer, a partner, a director, or a proprietor; or in which

he or she owns an interest. The Florida Commission on

Ethics shall, by rule in accordance with statutory

procedures governing administrative rulemaking, define

the term “disproportionate benefit” and prescribe the

requisite intent for finding a violation of this prohibition

for purposes of enforcing this paragraph. Appropriate

penalties shall be prescribed by law.

(i) This section shall not be construed to limit

disclosures and prohibitions which may be established

by law to preserve the public trust and avoid conflicts

between public duties and private interests.

(j) Schedule—On the effective date of this amend-

ment and until changed by law:

(1) Full and public disclosure of financial interests

shall mean filing with the custodian of state records by

July 1 of each year a sworn statement showing net

worth and identifying each asset and liability in excess

of $1,000 and its value together with one of the

following:

a. A copy of the person’s most recent federal

income tax return; or

b. A sworn statement which identifies each sepa-

rate source and amount of income which exceeds

$1,000. The forms for such source disclosure and the

rules under which they are to be filed shall be prescribed

by the independent commission established in subsec-

tion (g), and such rules shall include disclosure of

secondary sources of income.

(2) Persons holding statewide elective offices shall

also file disclosure of their financial interests pursuant to

paragraph (1).

(3) The independent commission provided for in

subsection (g) shall mean the Florida Commission on

Ethics.

History.—Proposed by Initiative Petition filed with the Secretary of State July 29,

1976; adopted 1976; Ams. proposed by Constitution Revision Commission,

Revision Nos. 8 and 13, 1998, filed with the Secretary of State May 5, 1998;

adopted 1998; Am. proposed by Constitution Revision Commission, Revision No. 7,

2018, filed with the Secretary of State May 9, 2018; adopted 2018.

SECTION 9. English is the official language of

Florida.—

(a) English is the official language of the State of

Florida.

(b) The legislature shall have the power to enforce

this section by appropriate legislation.

History.—Proposed by Initiative Petition filed with the Secretary of State August

8, 1988; adopted 1988.

ARTICLE III

LEGISLATURE

Sec.

1. Composition.

2. Members; officers.

3. Sessions of the legislature.

4. Quorum and procedure.

5. Investigations; witnesses.

6. Laws.

7. Passage of bills.

8. Executive approval and veto.

9. Effective date of laws.

10. Special laws.

11. Prohibited special laws.

12. Appropriation bills.

13. Term of office.

14. Civil service system.

15. Terms and qualifications of legislators.

16. Legislative apportionment.

17. Impeachment.

18. Conflict of Interest.

19. State Budgeting, Planning and Appropriations

Processes.

20. Standards for establishing congressional district

boundaries.

21. Standards for establishing legislative district

boundaries.

SECTION 1. Composition.—The legislative power

of the state shall be vested in a legislature of the State of

Florida, consisting of a senate composed of one senator

elected from each senatorial district and a house of

ARTICLE II CONSTITUTION OF THE STATE OF FLORIDA ARTICLE III

8

representatives composed of one member elected from

each representative district.

SECTION 2. Members; officers.—Each house

shall be the sole judge of the qualifications, elections,

and returns of its members, and shall biennially choose

its officers, including a permanent presiding officer

selected from its membership, who shall be designated

in the senate as President of the Senate, and in the

house as Speaker of the House of Representatives. The

senate shall designate a Secretary to serve at its

pleasure, and the house of representatives shall

designate a Clerk to serve at its pleasure. The

legislature shall appoint an auditor to serve at its

pleasure who shall audit public records and perform

related duties as prescribed by law or concurrent

resolution.

SECTION 3. Sessions of the legislature.—

(a) ORGANIZATION SESSIONS. On the four-

teenth day following each general election the legisla-

ture shall convene for the exclusive purpose of organi-

zation and selection of officers.

(b) REGULAR SESSIONS. A regular session of

the legislature shall convene on the first Tuesday after

the first Monday in March of each odd-numbered year,

and on the second Tuesday after the first Monday in

January of each even-numbered year.

(c) SPECIAL SESSIONS.

(1) The governor, by proclamation stating the pur-

pose, may convene the legislature in special session

during which only such legislative business may be

transacted as is within the purview of the proclamation,

or of a communication from the governor, or is

introduced by consent of two-thirds of the membership

of each house.

(2) A special session of the legislature may be

convened as provided by law.

(d) LENGTH OF SESSIONS. A regular session of

the legislature shall not exceed sixty consecutive days,

and a special session shall not exceed twenty con-

secutive days, unless extended beyond such limit by a

three-fifths vote of each house. During such an exten-

sion no new business may be taken up in either house

without the consent of two-thirds of its membership.

(e) ADJOURNMENT. Neither house shall adjourn

for more than seventy-two consecutive hours except

pursuant to concurrent resolution.

(f) ADJOURNMENT BY GOVERNOR. If, during

any regular or special session, the two houses cannot

agree upon a time for adjournment, the governor may

adjourn the session sine die or to any date within the

period authorized for such session; provided that, at

least twenty-four hours before adjourning the session,

and while neither house is in recess, each house shall

be given formal written notice of the governor’s intention

to do so, and agreement reached within that period by

both houses on a time for adjournment shall prevail.

History.—Am. C.S. for S.J.R. 380, 1989; adopted 1990; Am. S.J.R. 2606, 1994;

adopted 1994; Am. proposed by Constitution Revision Commission, Revision No.

13, 1998, filed with the Secretary of State May 5, 1998; adopted 1998; Am. proposed

by Constitution Revision Commission, Revision No. 5, 2018, filed with the Secretary

of State May 9, 2018; adopted 2018.

SECTION 4. Quorum and procedure.—

(a) A majority of the membership of each house shall

constitute a quorum, but a smaller number may adjourn

from day to day and compel the presence of absent

members in such manner and under such penalties as it

may prescribe. Each house shall determine its rules of

procedure.

(b) Sessions of each house shall be public; except

sessions of the senate when considering appointment

to or removal from public office may be closed.

(c) Each house shall keep and publish a journal of its

proceedings; and upon the request of five members

present, the vote of each member voting on any

question shall be entered on the journal. In any

legislative committee or subcommittee, the vote of

each member voting on the final passage of any

legislation pending before the committee, and upon

the request of any two members of the committee or

subcommittee, the vote of each member on any other

question, shall be recorded.

(d) Each house may punish a member for contempt

or disorderly conduct and, by a two-thirds vote of its

membership, may expel a member.

(e) The rules of procedure of each house shall

provide that all legislative committee and subcommittee

meetings of each house, and joint conference commit-

tee meetings, shall be open and noticed to the public.

The rules of procedure of each house shall further

provide that all prearranged gatherings, between more

than two members of the legislature, or between the

governor, the president of the senate, or the speaker of

the house of representatives, the purpose of which is to

agree upon formal legislative action that will be taken at

a subsequent time, or at which formal legislative action

is taken, regarding pending legislation or amendments,

shall be reasonably open to the public. All open meet-

ings shall be subject to order and decorum. This section

shall be implemented and defined by the rules of each

house, and such rules shall control admission to the

floor of each legislative chamber and may, where

reasonably necessary for security purposes or to

protect a witness appearing before a committee,

provide for the closure of committee meetings. Each

house shall be the sole judge for the interpretation,

implementation, and enforcement of this section.

History.—Am. S.J.R.’s 1990, 2, 1990; adopted 1990.

SECTION 5. Investigations; witnesses.—Each

house, when in session, may compel attendance of

witnesses and production of documents and other

evidence upon any matter under investigation before

it or any of its committees, and may punish by fine not

exceeding one thousand dollars or imprisonment not

exceeding ninety days, or both, any person not a

member who has been guilty of disorderly or contemp-

tuous conduct in its presence or has refused to obey its

lawful summons or to answer lawful questions. Such

powers, except the power to punish, may be conferred

by law upon committees when the legislature is not in

session. Punishment of contempt of an interim legisla-

tive committee shall be by judicial proceedings as

prescribed by law.

ARTICLE III CONSTITUTION OF THE STATE OF FLORIDA ARTICLE III

9

SECTION 6. Laws.—Every law shall embrace but

one subject and matter properly connected therewith,

and the subject shall be briefly expressed in the title. No

law shall be revised or amended by reference to its title

only. Laws to revise or amend shall set out in full the

revised or amended act, section, subsection or para-

graph of a subsection. The enacting clause of every law

shall read: “Be It Enacted by the Legislature of the State

of Florida:”.

SECTION 7. Passage of bills.—Any bill may

originate in either house and after passage in one

may be amended in the other. It shall be read in each

house on three separate days, unless this rule is waived

by two-thirds vote; provided the publication of its title in

the journal of a house shall satisfy the requirement for

the first reading in that house. On each reading, it shall

be read by title only, unless one-third of the members

present desire it read in full. On final passage, the vote

of each member voting shall be entered on the journal.

Passage of a bill shall require a majority vote in each

house. Each bill and joint resolution passed in both

houses shall be signed by the presiding officers of the

respective houses and by the secretary of the senate

and the clerk of the house of representatives during the

session or as soon as practicable after its adjournment

sine die.

History.—Am. S.J.R. 1349, 1980; adopted 1980.

SECTION 8. Executive approval and veto.—

(a) Every bill passed by the legislature shall be

presented to the governor for approval and shall

become a law if the governor approves and signs it,

or fails to veto it within seven consecutive days after

presentation. If during that period or on the seventh day

the legislature adjourns sine die or takes a recess of

more than thirty days, the governor shall have fifteen

consecutive days from the date of presentation to act on

the bill. In all cases except general appropriation bills,

the veto shall extend to the entire bill. The governor may

veto any specific appropriation in a general appropria-

tion bill, but may not veto any qualification or restriction

without also vetoing the appropriation to which it relates.

(b) When a bill or any specific appropriation of a

general appropriation bill has been vetoed, the governor

shall transmit signed objections thereto to the house in

which the bill originated if in session. If that house is not

in session, the governor shall file them with the

custodian of state records, who shall lay them before

that house at its next regular or special session,

whichever occurs first, and they shall be entered on

its journal. If the originating house votes to re-enact a

vetoed measure, whether in a regular or special

session, and the other house does not consider or

fails to re-enact the vetoed measure, no further

consideration by either house at any subsequent

session may be taken. If a vetoed measure is presented

at a special session and the originating house does not

consider it, the measure will be available for considera-

tion at any intervening special session and until the end

of the next regular session.

(c) If each house shall, by a two-thirds vote, re-enact

the bill or reinstate the vetoed specific appropriation of a

general appropriation bill, the vote of each member

voting shall be entered on the respective journals, and

the bill shall become law or the specific appropriation

reinstated, the veto notwithstanding.

History.—Ams. proposed by Constitution Revision Commission, Revision Nos.

8 and 13, 1998, filed with the Secretary of State May 5, 1998; adopted 1998.

SECTION 9. Effective date of laws.—Each law

shall take effect on the sixtieth day after adjournment

sine die of the session of the legislature in which

enacted or as otherwise provided therein. If the law is

passed over the veto of the governor it shall take effect

on the sixtieth day after adjournment sine die of the

session in which the veto is overridden, on a later date

fixed in the law, or on a date fixed by resolution passed

by both houses of the legislature.

SECTION 10. Special laws.—No special law shall

be passed unless notice of intention to seek enactment

thereof has been published in the manner provided by

general law. Such notice shall not be necessary when

the law, except the provision for referendum, is condi-

tioned to become effective only upon approval by vote of

the electors of the area affected.

SECTION 11. Prohibited special laws.—

(a) There shall be no special law or general law of

local application pertaining to:

(1) election, jurisdiction or duties of officers, except

officers of municipalities, chartered counties, special

districts or local governmental agencies;

(2) assessment or collection of taxes for state or

county purposes, including extension of time therefor,

relief of tax officers from due performance of their

duties, and relief of their sureties from liability;

(3) rules of evidence in any court;

(4) punishment for crime;

(5) petit juries, including compensation of jurors,

except establishment of jury commissions;

(6) change of civil or criminal venue;

(7) conditions precedent to bringing any civil or

criminal proceedings, or limitations of time therefor;

(8) refund of money legally paid or remission of

fines, penalties or forfeitures;

(9) creation, enforcement, extension or impairment

of liens based on private contracts, or fixing of interest

rates on private contracts;

(10) disposal of public property, including any interest

therein, for private purposes;

(11) vacation of roads;

(12) private incorporation or grant of privilege to a

private corporation;

(13) effectuation of invalid deeds, wills or other

instruments, or change in the law of descent;

(14) change of name of any person;

(15) divorce;

(16) legitimation or adoption of persons;

(17) relief of minors from legal disabilities;

(18) transfer of any property interest of persons under

legal disabilities or of estates of decedents;

(19) hunting or fresh water fishing;

(20) regulation of occupations which are regulated by

a state agency; or

ARTICLE III CONSTITUTION OF THE STATE OF FLORIDA ARTICLE III

10

1

(21) any subject when prohibited by general law

passed by a three-fifths vote of the membership of

each house. Such law may be amended or repealed by

like vote.

(b) In the enactment of general laws on other

subjects, political subdivisions or other governmental

entities may be classified only on a basis reasonably

related to the subject of the law.

1

Note.—See the following for prohibited subject matters added under the

authority of this paragraph:

s. 112.67, F.S. (Pertaining to protection of public employee retirement benefits).

s. 121.191, F.S. (Pertaining to state-administered or supported retirement

systems).

s. 145.16, F.S. (Pertaining to compensation of designated county officials).

s. 189.031(2), F.S. (Pertaining to independent special districts).

s. 190.049, F.S. (Pertaining to the creation of independent special districts

having the powers enumerated in two or more of the paragraphs of s. 190.012, F.S.).

s. 215.845, F.S. (Pertaining to the maximum rate of interest on bonds).

s. 298.76(1), F.S. (Pertaining to the grant of authority, power, rights, or privileges

to a water control district formed pursuant to ch. 298, F.S.).

s. 373.503(2)(b), F.S. (Pertaining to allocation of millage for water management

purposes).

s. 1011.77, F.S. (Pertaining to taxation for school purposes and the Florida

Education Finance Program).

s. 1013.37(5), F.S. (Pertaining to the “State Uniform Building Code for Public

Educational Facilities Construction”).

SECTION 12. Appropriation bills.—Laws making

appropriations for salaries of public officers and other

current expenses of the state shall contain provisions on

no other subject.

SECTION 13. Term of office.—No office shall be

created the term of which shall exceed four years except

as provided herein.

SECTION 14. Civil service system.—By law there

shall be created a civil service system for state employ-

ees, except those expressly exempted, and there may

be created civil service systems and boards for county,

district or municipal employees and for such offices

thereof as are not elected or appointed by the governor,

and there may be authorized such boards as are

necessary to prescribe the qualifications, method of

selection and tenure of such employees and officers.

SECTION 15. Terms and qualifications of legis-

lators.—

(a) SENATORS. Senators shall be elected for

terms of four years, those from odd-numbered districts

in the years the numbers of which are multiples of four

and those from even-numbered districts in even-num-

bered years the numbers of which are not multiples of

four; except, at the election next following a reapportion-

ment, some senators shall be elected for terms of two

years when necessary to maintain staggered terms.

(b) REPRESENTATIVES. Members of the house

of representatives shall be elected for terms of two

years in each even-numbered year.

(c) QUALIFICATIONS. Each legislator shall be at

least twenty-one years of age, an elector and resident of

the district from which elected and shall have resided in

the state for a period of two years prior to election.

(d) ASSUMING OFFICE; VACANCIES. Members

of the legislature shall take office upon election.

Vacancies in legislative office shall be filled only by

election as provided by law.

SECTION 16. Legislative apportionment.—

(a) SENATORIAL AND REPRESENTATIVE DIS-

TRICTS. The legislature at its regular session in the

second year following each decennial census, by joint

resolution, shall apportion the state in accordance with

the constitution of the state and of the United States into

not less than thirty nor more than forty consecutively

numbered senatorial districts of either contiguous,

overlapping or identical territory, and into not less

than eighty nor more than one hundred twenty con-

secutively numbered representative districts of either

contiguous, overlapping or identical territory. Should

that session adjourn without adopting such joint resolu-

tion, the governor by proclamation shall reconvene the

legislature within thirty days in special apportionment

session which shall not exceed thirty consecutive days,

during which no other business shall be transacted, and

it shall be the mandatory duty of the legislature to adopt

a joint resolution of apportionment.

(b) FAILURE OF LEGISLATURE TO APPORTION;

JUDICIAL REAPPORTIONMENT. In the event a

special apportionment session of the legislature finally

adjourns without adopting a joint resolution of appor-

tionment, the attorney general shall, within five days,

petition the supreme court of the state to make such

apportionment. No later than the sixtieth day after the

filing of such petition, the supreme court shall file with

the custodian of state records an order making such

apportionment.

(c) JUDICIAL REVIEW OF APPORTIONMENT.

Within fifteen days after the passage of the joint

resolution of apportionment, the attorney general shall

petition the supreme court of the state for a declaratory

judgment determining the validity of the apportionment.

The supreme court, in accordance with its rules, shall

permit adversary interests to present their views and,

within thirty days from the filing of the petition, shall

enter its judgment.

(d) EFFECT OF JUDGMENT IN APPORTION-

MENT; EXTRAORDINARY APPORTIONMENT SES-

SION. A judgment of the supreme court of the state

determining the apportionment to be valid shall be

binding upon all the citizens of the state. Should the

supreme court determine that the apportionment made

by the legislature is invalid, the governor by proclama-

tion shall reconvene the legislature within five days

thereafter in extraordinary apportionment session which

shall not exceed fifteen days, during which the legis-

lature shall adopt a joint resolution of apportionment

conforming to the judgment of the supreme court.

(e) EXTRAORDINARY APPORTIONMENT SES-

SION; REVIEW OF APPORTIONMENT. Within fif-

teen days after the adjournment of an extraordinary

apportionment session, the attorney general shall file a

petition in the supreme court of the state setting forth the

apportionment resolution adopted by the legislature, or

if none has been adopted reporting that fact to the court.

Consideration of the validity of a joint resolution of

apportionment shall be had as provided for in cases of

such joint resolution adopted at a regular or special

apportionment session.

(f) JUDICIAL REAPPORTIONMENT. Should an

extraordinary apportionment session fail to adopt a

ARTICLE III CONSTITUTION OF THE STATE OF FLORIDA ARTICLE III

11

resolution of apportionment or should the supreme court

determine that the apportionment made is invalid, the

court shall, not later than sixty days after receiving the

petition of the attorney general, file with the custodian of

state records an order making such apportionment.

History.—Am. proposed by Constitution Revision Commission, Revision No. 8,

1998, filed with the Secretary of State May 5, 1998; adopted 1998.

SECTION 17. Impeachment.—

(a) The governor, lieutenant governor, members of

the cabinet, justices of the supreme court, judges of

district courts of appeal, judges of circuit courts, and

judges of county courts shall be liable to impeachment

for misdemeanor in office. The house of representatives

by two-thirds vote shall have the power to impeach an

officer. The speaker of the house of representatives

shall have power at any time to appoint a committee to

investigate charges against any officer subject to

impeachment.

(b) An officer impeached by the house of represen-

tatives shall be disqualified from performing any official

duties until acquitted by the senate, and, unless

impeached, the governor may by appointment fill the

office until completion of the trial.

(c) All impeachments by the house of representa-

tives shall be tried by the senate. The chief justice of the

supreme court, or another justice designated by the

chief justice, shall preside at the trial, except in a trial of

the chief justice, in which case the governor shall

preside. The senate shall determine the time for the

trial of any impeachment and may sit for the trial

whether the house of representatives be in session or

not. The time fixed for trial shall not be more than six

months after the impeachment. During an impeachment

trial senators shall be upon their oath or affirmation. No

officer shall be convicted without the concurrence of

two-thirds of the members of the senate present.

Judgment of conviction in cases of impeachment shall

remove the offender from office and, in the discretion of

the senate, may include disqualification to hold any

office of honor, trust or profit. Conviction or acquittal

shall not affect the civil or criminal responsibility of the

officer.

History.—Am. S.J.R. 459, 1987; adopted 1988; Am. proposed by Constitution

Revision Commission, Revision No. 13, 1998, filed with the Secretary of State May

5, 1998; adopted 1998.

1

SECTION 18. Conflict of Interest.—A code of

ethics for all state employees and nonjudicial officers

prohibiting conflict between public duty and private

interests shall be prescribed by law.

History.—Am. proposed by Constitution Revision Commission, Revision No.

13, 1998, filed with the Secretary of State May 5, 1998; adopted 1998.

1

Note.—This section was repealed effective January 5, 1999, by Am. proposed

by Constitution Revision Commission, Revision No. 13, 1998, filed with the

Secretary of State May 5, 1998; adopted 1998. See s. 5(e), Art. XI, State

Constitution, for constitutional effective date. Identical language to s. 18, Art. III,

State Constitution, was enacted in s. 8(h), Art. II, State Constitution, by Revision No.

13, 1998.

SECTION 19. State Budgeting, Planning and

Appropriations Processes.—

(a) ANNUAL BUDGETING.

(1) General law shall prescribe the adoption of

annual state budgetary and planning processes and

require that detail reflecting the annualized costs of the

state budget and reflecting the nonrecurring costs of the

budget requests shall accompany state department and

agency legislative budget requests, the governor’s

recommended budget, and appropriation bills.

(2) Unless approved by a three-fifths vote of the

membership of each house, appropriations made for

recurring purposes from nonrecurring general revenue

funds for any fiscal year shall not exceed three percent

of the total general revenue funds estimated to be

available at the time such appropriation is made.

(3) As prescribed by general law, each state depart-

ment and agency shall be required to submit a

legislative budget request that is based upon and that

reflects the long-range financial outlook adopted by the

joint legislative budget commission or that specifically

explains any variance from the long-range financial

outlook contained in the request.

(4) For purposes of this section, the terms depart-

ment and agency shall include the judicial branch.

(b) APPROPRIATION BILLS FORMAT. Separate

sections within the general appropriation bill shall be

used for each major program area of the state budget;

major program areas shall include: education enhance-

ment “lottery” trust fund items; education (all other

funds); human services; criminal justice and correc-

tions; natural resources, environment, growth manage-

ment, and transportation; general government; and

judicial branch. Each major program area shall include

an itemization of expenditures for: state operations;

state capital outlay; aid to local governments and

nonprofit organizations operations; aid to local govern-

ments and nonprofit organizations capital outlay; federal

funds and the associated state matching funds; spend-

ing authorizations for operations; and spending author-

izations for capital outlay. Additionally, appropriation

bills passed by the legislature shall include an item-

ization of specific appropriations that exceed one million

dollars ($1,000,000.00) in 1992 dollars. For purposes of

this subsection, “specific appropriation,” “itemization,”

and “major program area” shall be defined by law. This

itemization threshold shall be adjusted by general law

every four years to reflect the rate of inflation or deflation

as indicated in the Consumer Price Index for All Urban

Consumers, U.S. City Average, All Items, or successor

reports as reported by the United States Department of

Labor, Bureau of Labor Statistics or its successor.

Substantive bills containing appropriations shall also be

subject to the itemization requirement mandated under

this provision and shall be subject to the governor’s

specific appropriation veto power described in Article III,

Section 8.

(c) APPROPRIATIONS PROCESS.

(1) No later than September 15 of each year, the

joint legislative budget commission shall issue a long-

range financial outlook setting out recommended fiscal

strategies for the state and its departments and

agencies in order to assist the legislature in making

budget decisions. The long-range financial outlook must

include major workload and revenue estimates. In order

to implement this paragraph, the joint legislative budget

commission shall use current official consensus esti-

mates and may request the development of additional

official estimates.

ARTICLE III CONSTITUTION OF THE STATE OF FLORIDA ARTICLE III

12

(2) The joint legislative budget commission shall

seek input from the public and from the executive and

judicial branches when developing and recommending

the long-range financial outlook.

(3) The legislature shall prescribe by general law

conditions under which limited adjustments to the

budget, as recommended by the governor or the chief

justice of the supreme court, may be approved without

the concurrence of the full legislature.

(d) SEVENTY-TWO HOUR PUBLIC REVIEW PER-

IOD. All general appropriation bills shall be furnished

to each member of the legislature, each member of the

cabinet, the governor, and the chief justice of the

supreme court at least seventy-two hours before final

passage by either house of the legislature of the bill in

the form that will be presented to the governor.

(e) FINAL BUDGET REPORT. A final budget re-

port shall be prepared as prescribed by general law. The

final budget report shall be produced no later than the