DCMA Manual 4301-11, Volume 2

Management Controls: Audits and Remediation

==========================================================

Office of Primary

Responsibility Stewardship Capability

Effective: September 30, 2019

Releasability: Cleared for public release

New Issuance

Implements: DCMA-INST 4301, “Stewardship,” July 18, 2018

Internal Control: Process flow and key controls are located on the Resource Page

Labor Codes: Located on the Resource Page

Resource Page Link: https://360.intranet.dcma.mil/sites/policy/ST/SitePages/4301-

11v2r.aspx

Approved by: David H. Lewis, VADM, USN, Director

__________________________________________________________________

Purpose: This Manual is composed of several volumes, each containing its own purpose. In

accordance with the authority in DoD Directive 5105.64, “Defense Contract Management

Agency (DCMA),” this Manual implements policies and assigns procedures as defined in

DCMA Instruction 4301, “Stewardship,” and incorporates or assigns responsibility for audits and

audit readiness/remediation efforts regarding the Financial Improvement and Audit Readiness

mandate to satisfy the Department’s objective of achieving and maintaining audit readiness.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Table of Contents 2

TABLE OF CONTENTS

SECTION 1: GENERAL ISSUANCE INFORMATION ..........................................................4

1.1. Applicability .......................................................................................................................4

1.2. Policy .................................................................................................................................4

SECTION 2: RESPONSIBILITIES ............................................................................................5

2.1. Director, DCMA.................................................................................................................5

2.2 Deputy Director, DCMA. ...................................................................................................5

2.3. Executive Steering Group ..................................................................................................5

2.4. Executive Director, Financial and Business Operations .....................................................6

2.5. Chief Financial Officer Compliance Division ....................................................................6

2.6. Financial Improvement and Audit Readiness Branch ........................................................7

2.7. Component Commanders/Directors ...................................................................................8

2.8. Commanders/Directors Of Assessed Activity ....................................................................9

SECTION 3: FINANCIAL AUDIT ........................................................................................... 10

3.1. Audit Readiness Background ........................................................................................... 10

3.2. Support Roles ................................................................................................................... 10

3.3. Internal Reporting to Management ................................................................................... 11

3.4. Entity Level Controls ....................................................................................................... 11

SECTION 4: CONTRACT PAY SERVICE PROVIDER ....................................................... 12

4.1. Contract Pay Assessable Unit ........................................................................................... 12

4.2. Pre-Examination ............................................................................................................... 13

4.3. Examination ..................................................................................................................... 14

4.4. Post-Examination ............................................................................................................. 16

4.5. Communication ................................................................................................................ 16

4.6. Customers ......................................................................................................................... 17

4.7. Sub-Service Providers ...................................................................................................... 17

SECTION 5: REPORTING ENTITY ....................................................................................... 19

5.1. Business Processes ........................................................................................................... 19

5.2. Complementary User Entity Controls .............................................................................. 20

5.3. Pre-Audit .......................................................................................................................... 22

5.4. During the Audit ............................................................................................................... 22

5.5. Post-Audit ........................................................................................................................ 26

GLOSSARY .................................................................................................................................. 28

G.1. Definitions ....................................................................................................................... 28

G.2. Acronyms ........................................................................................................................ 30

REFERENCES ............................................................................................................................. 32

TABLES

Table 1. Audit Opinions .......................................................................................................... 10

Table 2. Contract Pay Control Objectives ............................................................................... 12

Table 3. Reporting Entity Business Processes ......................................................................... 19

Table 4. Non-Agency Owned Systems ................................................................................... 21

Table 5. Planning Phase - Key Tasks ...................................................................................... 23

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Table of Contents 3

Table 6. Internal Control Phase - Key Tasks ........................................................................... 24

Table 7. Testing Phase - Key Tasks ........................................................................................ 25

Table 8. Reporting Phase - Key Tasks .................................................................................... 26

FIGURES

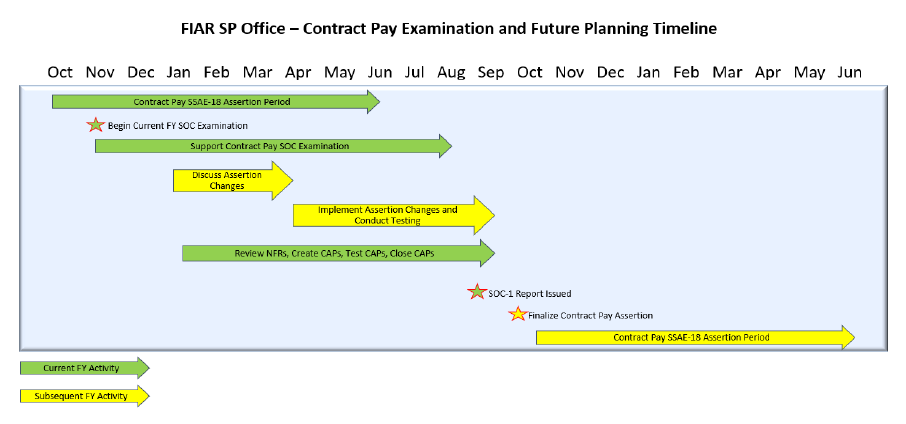

Figure 1. Service Provider Exam and Planning ....................................................................... 14

DCMA-MAN 4301-11, Volume 2,September 30, 2019

Section 1: General Issuance Information 4

SECTION 1: GENERAL ISSUANCE INFORMATION

1.1. APPLICABILITY. This issuance applies to all DCMA activities, but specifically to the

Financial and Business Operations Directorate (FB), the Contract Pay Service Provider Office,

the Financial Improvement and Audit Readiness/Remediation (FIAR) Reporting Entity Office,

and any other organizational element whose functions might have an impact on DCMA’s audit

readiness. For the purposes of this Manual, any reference to the term FIAR implies terms for

“Readiness” and “Remediation” to be used interchangeably.

1.2. POLICY. It is DCMA policy to:

a. Assign responsibility for FIAR program audit and remediation efforts and adhere to policy

issued by the Office of the Under Secretary of Defense (Comptroller) (OUSD(C)) for the

Agency’s Service Provider and Reporting Entity roles to satisfy the Department’s objective of

achieving audit readiness and Statement on Standards for Attestation Engagements (SSAE) 18

compliance. In accordance with the National Defense Authorization Act (NDAA) for Fiscal

Year (FY) 2010, Section 1003 of Public Law 111-84, the DoD should develop and maintain a

FIAR Plan to achieve auditability by September 30, 2017, and maintain semi-annual reporting on

the Plan for subsequent years.

b. Execute this Manual in a safe, efficient, effective and ethical manner.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 2: Responsibilities 5

SECTION 2: RESPONSIBILITIES

2.1. DIRECTOR, DCMA. The Director, DCMA will:

a. Confirm the Agency is in compliance with the FIAR guidance as issued by the OUSD(C).

b. Be responsible for the overall management of the FIAR Program for the Agency’s Service

Provider and Reporting Entity roles.

c. Review, approve, and sign (or delegate Signature Authority as appropriate) final Agency

annual assertion for audit readiness responses to draft and final audit reports, and follow-up

inquiries.

d. Appoint FIAR Executive Steering Group (ESG) members.

2.2. DEPUTY DIRECTOR, DCMA. The Deputy Director, DCMA will:

a. Exercise overall leadership and oversight responsibility over the Agency’s FIAR program.

b. Serve as Chairman of the FIAR ESG.

c. Provide final concurrence on Notification of Finding and Recommendation (NFR)

responses as required for Contract Pay Service Provider roles in the event the Executive

Director, FB is unavailable.

2.3. EXECUTIVE STEERING GROUP. The FIAR ESG will:

a. Serve as the Agency’s senior advising entity for FIAR initiatives with the end goal of

achieving and sustaining an unmodified audit opinion.

b. Recommend and monitor measurable goals, objectives, and meaningful metrics for

evaluating progress toward achieving and sustaining an unmodified audit opinion.

c. Provide oversight and direction to audit and remediation efforts regarding OUSD(C)

FIAR mandates to Contract Pay Service Provider and Reporting Entity teams.

d. Champion the FIAR vision, goals, and objectives within DCMA and represent FIAR

interests at various Governance Board meetings.

e. Communicate FIAR ESG activity across all DCMA organizations.

f. Execute actions and tasks as agreed upon by the FIAR ESG.

g. Provide FIAR status updates to senior leadership as required.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 2: Responsibilities 6

h. Assist the DCMA Director in fulfilling oversight responsibilities by reviewing Contract

Pay Service Provider and Reporting Entity policies and procedures, the effectiveness of internal

controls, and internal/external audit results for adherence to laws, regulations, and financial

accounting standards, to include changes from SSAE 16 as superseded by SSAE 18.

2.4. EXECUTIVE DIRECTOR, FINANCIAL AND BUSINESS OPERATIONS

DIRECTORATE. The Executive Director, FB will:

a. Exercise overall responsibility for audit and remediation efforts regarding the FIAR

mandate to satisfy the Department’s objective of achieving audit readiness.

b. Assess whether the design of agency-wide operations, performance, administrative

processes, and related internal controls and control activities that have an effect on the Agency’s

financial statements are adequately designed, documented, and operating as intended.

c. Ensure that all corrective actions of Agency systemic issues have been resolved and

implemented.

d. Select, appoint, and employ personnel, officials, and representatives as necessary to carry

out the functions, powers, and duties of the Contract Pay Service Provider and Reporting Entity

role-compliant activities.

e. Provide advice and counsel on all FIAR related matters pertaining to the Agency.

f. Provide final concurrence or non-concurrence signature on NFR responses submitted to

auditors.

g. Approve all Corrective Action Plans (CAPs) for submission to OUSD(C).

2.5. CHIEF FINANCIAL OFFICER, COMPLIANCE DIVISION. The Chief Financial

Officer, Compliance Division is responsible for operation of the Contract Pay Service Provider

Office and will:

a. Lead and manage development and deployment of strategies, policies, and procedures for

the Agency’s role as a Contract Pay Service Provider under the OUSD(C) FIAR initiative for the

following DCMA-owned systems:

(1) Mechanization of Contract Administration Services (MOCAS).

(2) MOCAS Contract Closeout (MCC).

(3) Modifications and Delivery Orders (MDO).

b. Serve as the Office of Primary Responsibility (OPR) for Contract Pay Service Provider

efforts for functions that include, but are not limited to:

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 2: Responsibilities 7

(1) Interface with auditors on behalf of the Agency during all examination phases.

(2) Advise senior leadership and the FIAR ESG on all aspects of the Contract Pay

Service Provider audit status.

(3) Interface with OUSD(C) FIAR on Contract Pay Service Provider issues and

communicate the Agency’s status.

(4) Develop the Assertion Package for the Contract Pay Service Provider Assessable

Unit.

(5) Maintain the DCMA 360 Contract Pay Service Provider site:

htps://360.intranet.dcma.mil/directorate/ph-fb/FBL/FIARSP.

(6) Conduct Contract Pay Service Provider internal testing of manual controls.

(7) Prepare and conduct training applicable to the Contract Pay Assessable Unit for the

DCMA workforce.

(8) Facilitate the development of responses to audit findings and corrective action plans.

(9) Brief external customers on the status and outcome of the Contract Pay Service

Provider examination.

(10) Engage with customers and Sub-Service Providers regarding Contract Pay Service

Provider efforts.

(11) Secure and maintain support from other organizations with interdependencies in the

Contract Pay Service Provider’s control environment.

(12) Acquire necessary services for annual audit and program support.

c. Review and provide responses to external auditor NFRs that pertain to the Contract Pay

Assessable Unit.

d. Approve CAPs to progress to remediation efforts and oversee the status of CAP

remediation activities to ensure issues are remediated as scheduled.

2.6. FINANCIAL IMPROVEMENT AND AUDIT READINESS BRANCH. The FIAR

Branch (FBLF) will serve as the OPR for all Reporting Entity efforts and will:

a. Serve as the primary point of contact (POC) for financial statement audits conducted by

independent public accounting firms and serve as the Reporting Entity over FIAR activities.

b. Implement Reporting Entity efforts to include, but not limited to:

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 2: Responsibilities 8

(1) Interface with auditors on behalf of the Agency during all examination phases.

(2) Advise senior leadership and the FIAR ESG on all aspects of the Reporting Entity

audit status.

(3) Interface with OUSD(C) FIAR on Reporting Entity issues and communicate the

Agency’s status.

(4) Develop DCMA’s Assertion Package for Reporting Entity Assessable Unit(s).

(5) Maintain the DCMA 360 FIAR Reporting Entity Office site:

https://360.intranet.dcma.mil/directorate/ph-fb/FBL/FBLF.

(6) Conduct Reporting Entity internal testing of manual controls.

(7) Prepare and conduct training designed to mitigate NFRs, close CAPs, and establish

controls for the workforce.

(8) Facilitate development of responses to audit findings and CAP activity.

(9) Monitor results of the examination under the SSAE 18 for Contract Pay Service

Providers and Sub-Service Providers.

(10) Engage with Contract Pay Service Providers and Sub-Service Providers on

Complimentary User Entity Controls (CUECs) and develop understanding of Reporting Entity

responsibility with regards to these controls.

(11) Secure and maintain support from other organizations with interdependencies in the

Reporting Entity’s control environment.

(12) Acquire necessary services for annual audits and support.

2.7. COMPONENT COMMANDERS/DIRECTORS. The Component Commanders/

Directors will:

a. Serve as focal point and coordinator for all subordinate organization corrective action

activities.

b. Validate subordinate organization corrective actions, determine whether they remain open

or can be closed, and provide letter of assurance (LOA) to FBLF to obtain final closure for all

corrective actions.

c. Participate in meetings to status of CAP activity.

d. Perform corrective action and remediation activities in accordance with approved CAPs.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 2: Responsibilities 9

e. Support FIAR and Contract Pay Service Providers by synchronizing agency initiatives,

internal testing, and changes to organizations, processes, policies, and/or tools with a strategy for

audit readiness.

2.8. COMMANDERS/DIRECTORS OF ASSESSED ACTIVITY. The Commanders/

Directors of assessed activities will:

a. Ensure the availability, responsiveness, and cooperation of personnel during the

audit/assessment.

b. Ensure requests for data, entrance conferences, responses, and other administrative

matters are coordinated with FBLF prior, during and after audits and assessments.

c. Perform corrective action and remediation activities in accordance with approved CAPs.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 3: Financial Audit 10

SECTION 3: FINANCIAL AUDIT

3.1. AUDIT READINESS BACKGROUND. Audits provide reasonable assurance that

internal controls are suitably designed, operating effectively, and that the financial statements are

presented fairly and free of material misstatements due to error or fraud in accordance with the

U.S. Generally Accepted Accounting Principles (GAAP). As mandated by the Chief Financial

Officers Act of 1990 and the FY 2010 NDAA, DoD is required to audit internal controls over

financial reporting. In preparation for the audit, DoD implements audit readiness efforts in

accordance with FIAR guidance, the DoD Financial Statement Audit Guide, and any subsequent

issuances issued by the OUSD(C).

a. DCMA is a component of the DoD consolidated audit along with other Fourth Estate

entities and therefore, does not undergo a standalone audit. Under the DoD consolidated audit,

the DoD Inspector General (DoDIG) performs internal control and substantive testing over

activities and balances reported by DCMA on an annual basis.

b. Auditors use their conclusions to form an audit opinion using the descriptions as reflected

in Table 1. Audit Opinions. The primary goal is to obtain an Unmodified audit opinion for the

Agency.

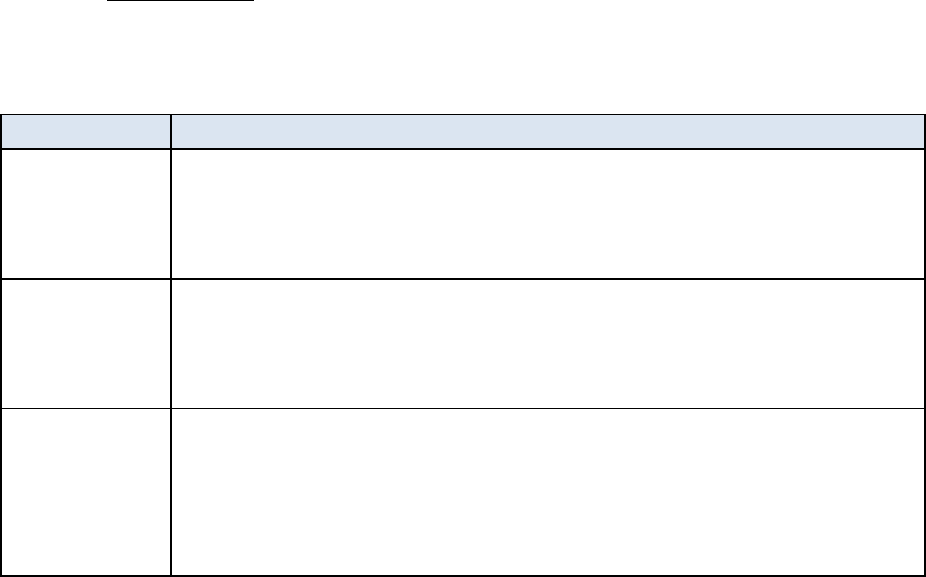

Table 1. Audit Opinions

Opinion

Description

Unmodified

Auditor concludes that the financial statements are presented fairly, in all

material respects, and in accordance with U.S. GAAP.

Modified

Auditor concludes that misstatements, individually or in aggregate, are

material but not pervasive to the financial statements.

Adverse

Auditor obtains sufficient evidence and concludes that misstatements,

individually or in aggregate, are both material and pervasive to the

financial statements.

Disclaimer of

Opinion

Auditor is unable to obtain sufficient audit evidence on which to base an

opinion, and concludes that possible misstatements, individually or in

aggregate, could be both material and pervasive.

3.2. SUPPORT ROLES. DCMA will support audits as a Contract Pay Service Provider and as

a Reporting Entity.

a. Service Provider. Service Providers are also known as service organizations. The

American Institution of Certified Public Accountants defines a service organization as “an

organization or segment of an organization that provides services to user entities, which are

likely to be relevant to those user entities' internal control over financial reporting.”

(1) As a Contract Pay Service Provider, DCMA is responsible for the oversight of

systems, data, processes, internal controls, and supporting documentation that affects the audit

readiness of their user Reporting Entities as outlined in Section 4 of this Manual.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 3: Financial Audit 11

(2) Contract Pay systems (MOCAS, MCC, and MDO) will undergo an annual

examination under the SSAE 18. This examination requires an annual risk assessment to ensure

the organization’s controls are regularly reviewed and that risks are adequately addressed or

adjusted as needed. The risk assessment is outlined in the System and Organization Control

Report (SOC-1 Report), which accounts for management’s description of DCMA as a service

organization and the suitability of the design and operating effectiveness of controls.

b. Reporting Entity. Reporting Entities are also referred to as customers, and Reporting

Entities of DCMA-owned systems rely on results of the risk assessment. A Reporting Entity is a

component with an obligation to prepare external financial reports. As a Reporting Entity,

DCMA must give an account of how taxpayer dollars are used to operate the Agency and assert

that internal controls are in place to provide reasonable assurance that financial statements are

presented correctly.

c. DoD Consolidated Audit Provided By Client (PBC) Support. The DCMA Contract

Pay Service Provider Office and Reporting Entity teams coordinate heavily with respective

DCMA activities and functions that are under audit. FIAR teams have full access to the FIAR

Audit Response Center (ARC), a tool used to manage workflow for PBC requests from DoD

Consolidated Auditors.

3.3. INTERNAL REPORTING TO MANAGEMENT. The Contract Pay Service Provider

Office and the FIAR Reporting Entity Office are required to report their activities and audit

outcomes to the DCMA Audit Committee and FIAR ESG. These groups provide oversight,

feedback, and direction on DCMA’s audit readiness and remediation efforts.

3.4. ENTITY LEVEL CONTROLS. Entity level controls (ELCs) apply to Contract Pay

Service Provider and Reporting Entity roles. ELCs have a pervasive effect on a an entity’s

internal control system and may include controls related to the entity’s risk assessment process,

control environment, service organizations, management override, and monitoring. ELC

deficiencies or gaps may impact DCMA’s internal control system as a whole. DCMA FIAR

teams will complete a matrix to identify ELCs that require testing during internal control

assessments.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 4: Contract Pay Service Provider 12

SECTION 4: CONTRACT PAY SERVICE PROVIDER

4.1. CONTRACT PAY ASSESSABLE UNIT. DCMA provides contract administration

services to the DoD Acquisition Enterprise and its partners to ensure timely and cost-effective

delivery of products and services to the warfighter. Before contract award, DCMA will provide

feedback to effectuate solicitations, identify potential risks, and develop decision criteria on

historically best-performing contractors to shape contracts that will meet the needs of the buying

Agency and their warfighting customers. After contract award, DCMA will monitor contractor

performance and management systems to verify that expenditures, delivery schedules, and

products/services are in compliance with contract terms and conditions. Contract Pay Service

Providers are responsible for their systems, data, processes, internal controls, and supporting

documentation that affect a Reporting Entity’s auditability. Customers rely on DCMA to have

reliable internal controls in place to ensure contract administration services are provided

completely and accurately. When key controls have been properly designed and are functioning

effectively, customers and their auditors can place a greater reliance on the Agency’s Contract

Pay system.

a. Contract Pay Service Provider Office. The Contract Pay Service Provider Office may

be staffed with matrixed personnel from varied functional areas, or with permanent staff that

possess functional competencies representing contracting, quality, and information technology

(IT). The Contract Pay Service Provider Office is responsible for executing and overseeing all

Contract Pay Service Provider audit readiness efforts for the agency.

b. Contract Pay End-to-End Process. The Contract Pay End-to-End Process diagram

located on the Resource Page for this Manual reflects the specific processes, sub-processes, and

areas of FIAR related responsibilities provided by DCMA to the contract payment services.

c. Contract Pay Control Objectives. The controls identified in Table 2. Contract Pay

Control Objectives are comprised of automated and manual controls. For further information on

the control activities, please refer to the most recent Contract Pay SOC-1 examination report.

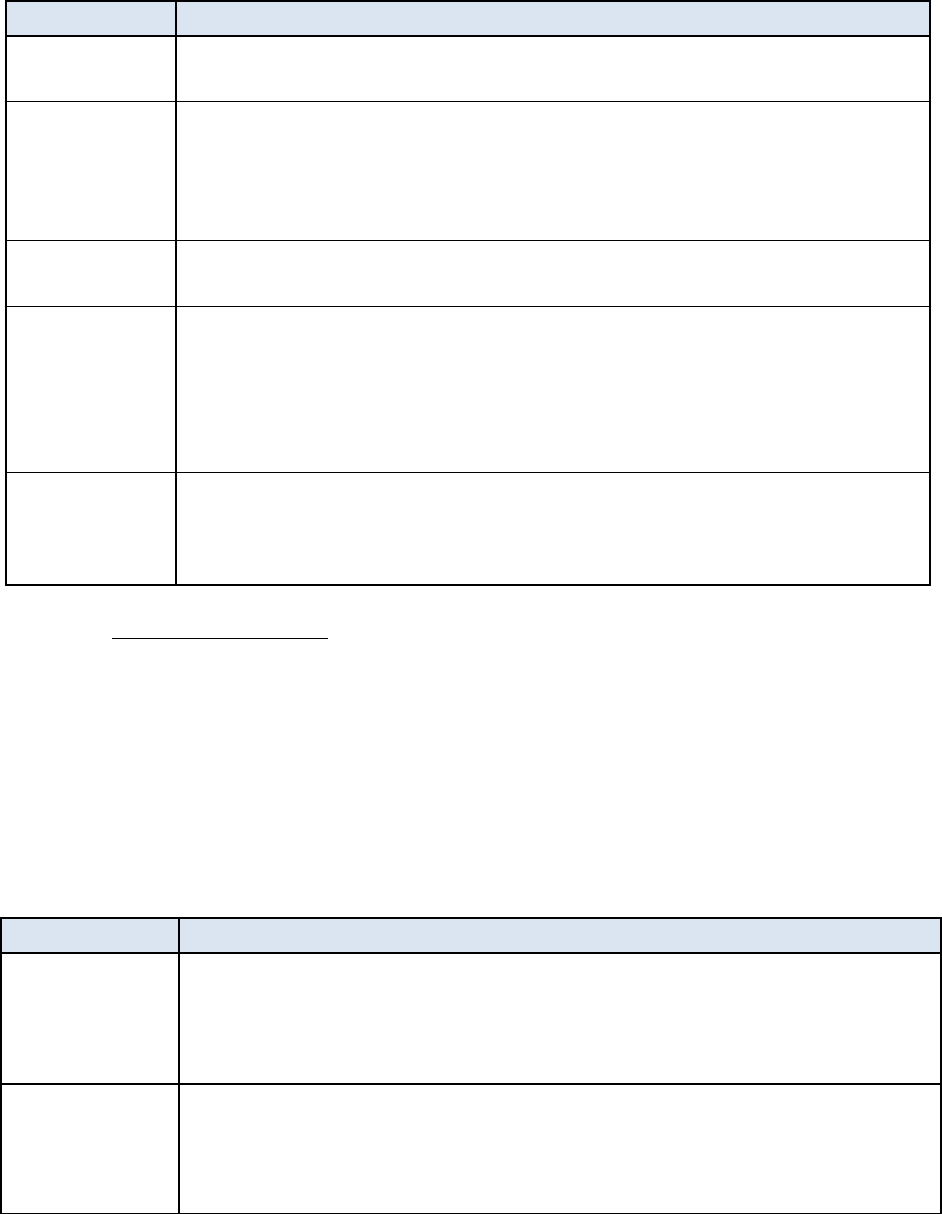

Table 2. Contract Pay Control Objectives

Control Objective Description

CO1: SECURITY

PROGRAM

MANAGEMENT

Controls provide reasonable assurance that an enterprise-wide security

program has been established and approved by management, is being

monitored, tested and maintained.

CO2: ACCESS

Controls provide reasonable assurance that logical access to MOCAS, MCC,

and MDO, as well as physical access to MCC and MDO hardware, is

restricted to authorized individuals.

CO3:

CONFIGURATION

MANAGEMENT

Controls provide reasonable assurance that changes to MOCAS, MCC and

MDO, application programs and database structures are authorized, tested,

implemented and documented.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 4: Contract Pay Service Provider 13

Table 2. Contract Pay Control Objectives, Continued

Control Objective Description

CO4:

SEGREGATION OF

DUTIES

Controls provide reasonable assurance that management has identified,

provided periodic reviews, and mitigated risks of incompatible duties across

business and IT operations within the Contract Pay process (MOCAS and

other relevant key systems).

CO5:

CONTINGENCY

PLANNING

Controls provide reasonable assurance that back-up procedures exist for

MCC and MDO.

CO6: SETUP

Controls provide reasonable assurance that MCC and MDO data

requirements are defined and documented for transactions which update the

MOCAS database.

CO7: INPUT

Controls provide reasonable assurance that contracts are received from

authorized sources and input into MOCAS completely and accurately.

CO8:

PROCESSING

Controls provide reasonable assurance that contract transactions (e.g.,

receipts and acceptance of goods and services, disallowed costs, invoice

processing, contract closeout, refunds) are authorized and processed

completely and accurately.

CO9: OUTPUT

Controls provide reasonable assurance that contract actions and outputs are

authorized, and transmitted completely and accurately. Controls around

contract and transaction reviews are defined and assessed under Control

Objectives 7 and 8.

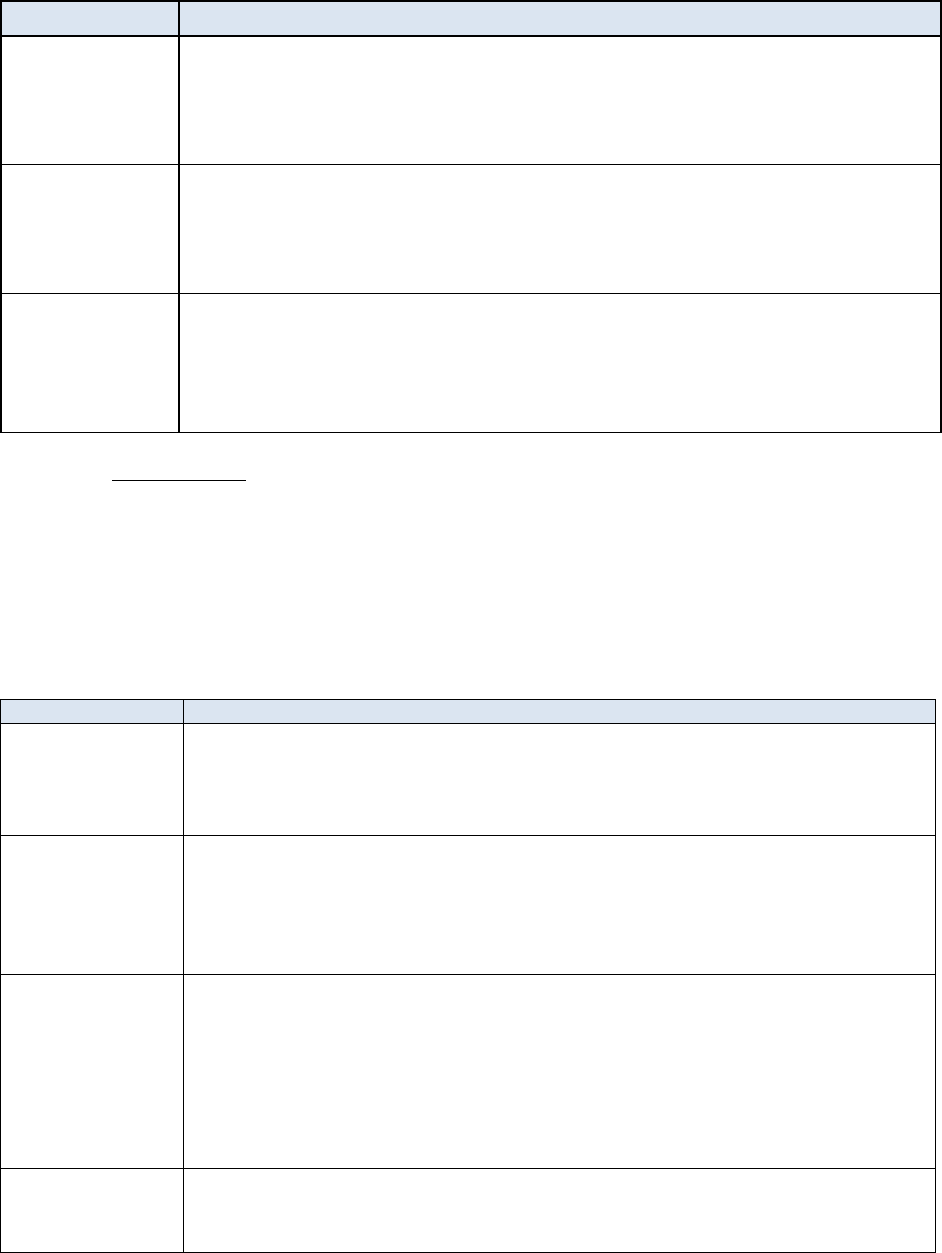

4.2. PRE-EXAMINATION. The Contract Pay process is cyclical and many pre-examination

activities for the following FY occur simultaneously with activities for the current FY examination

as depicted in the example timeline in Figure 1. Service Provider Exam and Planning. For

example, the current FY examination starts around November of each year and during this time,

the Contract Pay Service Provider Office supports the audit while discussing, implementing, and

testing changes for the next FY.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 4: Contract Pay Service Provider 14

Figure 1. Service Provider Exam and Planning

a. Internal Testing. DCMA is responsible for the design and effectiveness of controls

related to MCC and MDO and specific controls related to MOCAS. Defense Finance and

Accounting Service (DFAS) and DCMA share responsibility for maintaining all aspects of

MOCAS under the direction of the MOCAS Joint Program Management Office, which is

comprised of employees from both agencies.

(1) The Contract Pay Service Provider Office is responsible for overseeing internal testing

efforts related to the Contract Pay control objectives.

(2) The Contract Pay Service Provider Office is responsible for managing the monthly

testing process. A monthly timeline for testing manual controls is provided on the Resource Page.

The DCMA Contracting Directorate, Contract Pay Service Provider Office, and operational units

are involved in the monthly testing process and have responsibilities that are included in the

timeline.

b. Reporting. Results from monthly testing of manual controls are compiled and uploaded to

the DCMA 360 Contract Pay Service Provider Office site.

4.3. EXAMINATION. Each FY, an independent public accountant (IPA), also referred to

throughout the document as “external auditor,” is contracted to perform the SOC examination

based on DCMA’s assertion. The assertion period is 1 October to 30 June each FY, and the

auditor’s examination report must be completed by 14 August and submitted to the OUSD(C) by

15 August.

a. Entrance Conference. When a contract for IPA services has been awarded, the

Contracting Officer’s Representative (COR) will provide notification to DCMA with the

awardee’s contact information. Usually an entrance conference is required soon after award as a

contract deliverable. If not contacted by the IPA within two to three business days, the Contract

Pay Service Provider Office should reach out to the IPA and begin scheduling the conference

with the OUSD(C) FIAR COR and senior leadership.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 4: Contract Pay Service Provider 15

b. Site Visits. The Contract Pay Service Provider Office is notified by the external auditor

of all potential site visits so DCMA may coordinate with the responsible POCs regarding dates,

space, and technology needs. The Contract Pay Service Provider Office will notify Contract

Management Offices (CMOs) of the planned visits, as well as any other planning information or

requirements that are needed. This information will be forwarded to the CMO

Commander/Director in a written memorandum or by email. The external auditors will be

accompanied on all site visits by the Contract Pay Service Provider Office and/or other

designated representative(s).

c. PBC. The Contract Pay Service Provider Office will receive any PBC requests or

equivalents from the external auditor’s SharePoint site. The Contract Pay Service Provider

Office reviews PBC requests for clarity and completeness and notifies responsible directorates to

support completing the requests. PBC responses are uploaded to the applicable FY Evidentiary

Folder on the DCMA 360 Contract Pay Service Provider Office site. Once the PBC is accepted

by the Contract Pay Service Provider Office, the PBC is moved to the applicable FY Auditor

Folder and a notification is sent to the external auditor that the PBC response was uploaded. In

order to protect sensitive information, DCMA is responsible for indicating whether each PBC

item is “releasable” versus “non-releasable.”

d. NFR. Throughout the duration of the examination, deficiencies identified may result in

the issuance of NFRs by the external auditor. Once DCMA leadership and the Contract Pay

Service Provider Office receive the draft NFRs, internal meetings are held with responsible

parties to discuss the NFRs and validate that the condition, cause, effect, and criteria are

accurately stated. DCMA management will draft general comments on the findings and address

and develop planned corrective actions to remediate the deficiencies. Official responses are

consolidated and distributed to all customers and respective auditors and all NFR responses must

be approved by the Contract Pay Service Provider Office. During the SOC-1 examination, the

external auditor may also identify deficiencies that require management’s attention, but do not

rise to the level of an NFR. These deficiencies are called Management Letter Comments

(MLCs) and they appear in the Management Letter, which must be completed by mid-August.

The Contract Pay Service Provider Office tracks and monitors MLCs and NFRs.

e. CAP. As indicated in paragraph 4.3.d., deficiencies in any of the control activities that

affect the Contract Pay Service Provider audit readiness are formally documented in an NFR. A

CAP is created to address each deficiency identified in a NFR. Once the CAP is drafted, it must

be approved by the Contract Pay Service Provider Office or the Executive Director, FB. The

Contract Pay Service Provider Office is responsible for completing the CAP template, executing

CAP remediation, and tracking and monitoring CAP completion. CAP status updates will be

discussed during weekly Contract Pay Service Provider Office status meetings and follow-up

meetings with the Directorates will be conducted based on these discussions, as necessary. The

status of open CAPs will be briefed at monthly DCMA FIAR ESG meetings. When all the

corrective actions identified in the CAP have been completed, the Contract Pay Service Provider

Office must verify completion before recommending the CAP be closed. The Contract Pay

Service Provider Office will verify completion by obtaining all required supporting

documentation and perform sufficient testing to ensure remediation of the deficiency. Test

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 4: Contract Pay Service Provider 16

results will be maintained and be made available for review for a full FY following CAP closure.

All externally identified CAPs relating to the Contract Pay Service Provider control activities

will be officially closed by the IPA in the OUSD(C) NFR Database.

f. Exit Conference. The exit conference is the final official meeting between the external

auditor, Contract Pay Service Provider Office, and Agency leadership. This meeting occurs prior

to the external auditor completing the SOC-1 report.

4.4. POST-EXAMINATION. Numerous actions must take place following the conclusion of

the audit:

a. After Action Meeting. The Contract Pay Service Provider Office will hold an after

action meeting to gather lessons learned from all participants in the engagement.

b. Deactivate IPA System Access. Any access that was established for the IPA system at

the beginning of the engagement will be deactivated upon delivery of the final SOC-1 report.

c. Submit SOC-1 Report. The SOC-1 report will be received by the OUSD(C) FIAR

Directorate and distributed to corresponding agencies, as required, and uploaded to the DCMA

360 Contract Pay Service Provider site.

d. Records Naming and Retention. The Contract Pay Service Provider Office POC will

name and archive all records uploaded to the DCMA 360 Contract Pay Service Provider Office

site and retain source documents according to established timeframes. Records will be stored on

the DCMA 360 site for two years, and then copied onto a disk.

e. Monitor CAPs. CAPs will be monitored to completion and closed prior to the start of the

next FY examination.

4.5. COMMUNICATION.

a. POCs. The Contract Pay Service Provider Office POCs are listed in the “Service Provider

Program Management Office Members” section of the DCMA 360 Contract Pay Service Provider

site.

b. Email Inboxes. The Contract Pay Service Provider Office will manage an internal and

external inbox for tracking and responding to communications.

(1) Internal. The Contract Pay Service Provider Office manages an inbox for internal

testing inquiries: dcma.lee.hq.mbx.fiar-sp-he[email protected].

(2) External. The Contract Pay Service Provider Office manages an inbox for customer

inquiries and responding to communications: dcma.lee.hq.mbx.fiar-sp-in-b[email protected].

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 4: Contract Pay Service Provider 17

4.6. CUSTOMERS. DCMA partners with other DoD entities to provide contract payment

services. A DCMA customer (user entity) is any DoD agency in which contract administration

services are delegated to DCMA.

a. Service Level Agreement (SLA)/Memorandum of Understanding (MOU). The

SLA/MOU is a formal agreement between DCMA and it’s customers describing the type of

service(s) that DCMA provides for audit readiness, remediation, and sustainment. The purpose

of Contract Pay SLAs/MOUs are to outline business processes and sub-processes performed by

DCMA for it’s customers in the contract pay end-to-end cycle. The SLAs/MOUs are managed

by the Contract Pay Service Provider Office.

b. CUECs. The Contract Pay controls were designed with the assumption that certain

controls would be placed in operation by user entities. The implementation and application of

such internal controls are the responsibility of the user entities and are necessary to achieve

certain Contract Pay control objectives. The user entities and user entity auditors are responsible

for determining the applicability of the CUECs to the user entity and identifying CUECs relevant

to the user entity financial statement audit. For a listing of the CUECs, please refer to the most

recent Contract Pay SOC-1 examination report.

c. Customer Audit/Auditor Support. The Contract Pay Service Provider Office manages

customer audit/auditor inquiries through the external customer email inbox. The Contract Pay

SOC-1 examination often satisfies audit/auditor inquiries; however, the Contract Pay Service

Provider Office will engage in Contract Pay related conversations to ensure all parties have

confidence in the services DCMA provides to its customers.

4.7. SUB-SERVICE PROVIDERS. To achieve control objectives for the Contract Pay

Assessable Unit, DCMA relies on the design and operating effectiveness of control activities

performed at sub-service organizations. Control activities performed by subservice

organizations are documented in mutual agreements with DCMA and periodically monitored

through meetings, reports, or status updates.

a. Complementary Sub-service Organization Controls (CSOCs) and Monitoring. The

Contract Pay controls were designed with the assumption that certain controls would be placed in

operation by sub-service organizations. The application of sub-service organization internal

controls is necessary to achieve certain Contract Pay control objectives. When developing

CSOCs, management will review and consider CUECs, other SOC examination reports (if

available), SLAs, and MOUs. Interagency discussions will be held to determine control

effectiveness and to assess risks; and CSOCs will be individually monitored based on the level of

risk. If an issue is discovered during monitoring and risk assessment, DCMA will partner with

the applicable agency to determine the root cause and develop a remediation plan. For a listing

of the sub-service organizations, related CSOCs, and monitoring controls, please refer to the

most recent Contract Pay SOC-1 examination report.

b. Agreements. Service Agreements are in place to outline expectations between DCMA and

sub-service organizations such as Defense Information Services Agency (DISA), DFAS, U.S.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 4: Contract Pay Service Provider 18

Bank, and the Defense Logistics Agency (DLA). These Agreements are to be reviewed annually

and updated as needed.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 5: Reporting Entity 19

SECTION 5: REPORTING ENTITY

5.1. BUSINESS PROCESSES. The FIAR Reporting Entity Office is responsible for reviewing

and documenting end-to-end business processes such as those reflected in Table 3. Reporting

Entity Business Processes. These business processes are also known as assessable units. The

FIAR Reporting Entity Office must also create a crosswalk between DoD standard end-to-end

business processes and their own end-to-end business processes which cover all financial

transactions of DCMA.

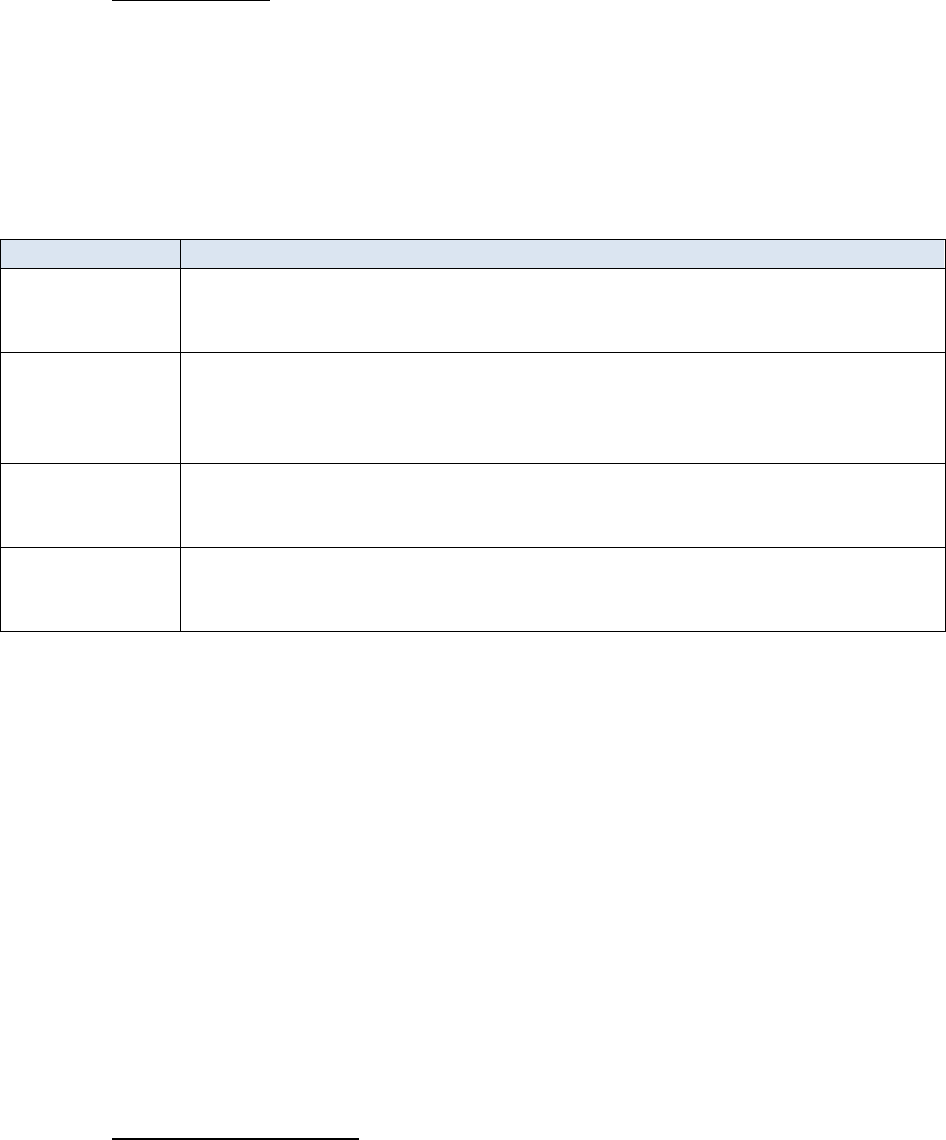

Table 3. Reporting Entity Business Processes

End-to-End Business

Process/Assessable

Units

Impacted DCMA

Directorates or

External Service

Providers

Process Description

Appropriations

Received

FB - Budget

Receipt and distribution of funds

appropriated by the President’s Budget.

Hire to Retire/

Civilian Pay

FB – Payroll, Human

Capital, Army

Service Team, and

DFAS

Civilian payroll processed in the Defense

Civilian Pay System (DCPS).

Procure to Pay

Financial & Business

– Defense Agencies

Initiative (DAI),

Travel/Defense

Travel System

(DTS), General

Services

Administration

(GSA), Washington

Headquarters

Services (WHS),

Government

Purchase Card (GPC)

Business functions necessary to obtain goods

and services including: all Contract Pay and

Vendor activities, specifically Invoicing,

Receipt, Acceptance and Property

Transfer/Syncada, GSA and WHS Facility

Rental Payments, Government Vehicles,

GPC, DTS, Permanent Change of Station,

and Reimbursable Work Order – Grantor.

Order to Cash

FB –Reimbursables

and Accounting

Business functions necessary to accept and

process customer orders for services and/or

inventory. Reimbursable Work Orders –

Acceptor.

Acquire to Retire/

Property, Plant and

Equipment

FB and IT

Business functions necessary to obtain,

manage, and dispose of DoD accountable

and reportable property through the entire

life-cycle.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 5: Reporting Entity 20

Table 3. Reporting Entity Business Processes, continued

End-to-End Business

Process/Assessable

Units

Impacted DCMA

Directorates or

External Service

Providers

Process Description

System Generated

Journal Voucher

Entries

FB - Accounting

Entries created in the Defense Departmental

Reporting System (DDRS) to bring General

Ledger (GL) accounts into balance at

specified periods of times during the

financial reporting process.

Financial

Reporting/Balance

Brought

Forward/Year End

Entries

FB - Accounting

Entries created in the source accounting

system to bring GL accounts into balance at

year-end during the financial reporting

process includes Fund Balance with

Treasury (FBWT).

a. Assessable Unit. The FIAR Reporting Entity Office is organized by assessable unit.

Each assessable unit is assigned a lead to perform activities before, during, and after the annual

audit. These activities include managing PBCs, samples, walkthroughs, Subject Matter Experts,

process narratives and flowcharts, NFR reviews and approvals, and managing

comments/concurrence.

b. Process Narratives. The FIAR Reporting Entity Office must document each end-to-end

process in a narrative which provides an independent auditor not familiar with DCMA a

thorough understanding of all activities, transactions, systems, and related controls for each

process. The document identifies the DCMA directorates and Service Providers involved in the

end-to-end process. The process narrative, which is updated annually, must describe the actual

process as it exists and include an overview, flowchart(s), key internal control listing, key

supporting document listing, and key IT system listing for systems used in the process and

CUECs. Relevant DCMA directorates and external Service Providers are frequently consulted to

ensure the completeness and accuracy of the narratives and to ensure key controls are properly

identified.

5.2. COMPLEMENTARY USER ENTITY CONTROLS. CUECs are controls that Service

Providers provide to Reporting Entities for implementation by the Reporting Entity.

Management for the FIAR Reporting Entity is responsible for implementing internal controls

over their financial information and therefore, must ensure that they fully understand what

pecuniary significant activities are outsourced to Service Providers and the effectiveness of the

Service Providers’ related internal controls.

a. The DCMA FIAR Team will coordinate with Service Providers to develop a good

understanding of the Service Provider’s user control assumptions and to test the controls to

ensure they are operating effectively. This includes reviewing SSAE 18 audit reports and related

training provided by OUSD(C). CUEC considerations should relate to the control objectives

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 5: Reporting Entity 21

specified in management’s description of the Service Provider system. DCMA uses the non-

owned systems such as those identified in Table 4. Non-Agency Owned Systems for its business

processes.

Table 4. Non-Agency Owned Systems

No.

Service

Provider

SOC-1

DoD Service Providers Used by DCMA

1

DFAS

DCPS (Civilian Pay)

2

DFAS

MOCAS, Elimination of Unmatched Disbursements, Entitlement

Automation System, Pay Pre-Validation Module, Accounting Pre-

Validation Module (APVM), Business Activity Monitoring (BAM),

Standard Contract Reconciliation Tool (Contract Pay)

3

DFAS

Defense Cash Accountability System - FBWT Distribution

4

DFAS

DDRS (Financial Reporting)

5

DFAS

Automated Disbursing System, Intra-Governmental Payment and

Collection, Megawizard (Standard Disbursing Services)

6

DFAS

Computerized Accounts Payable for Windows (CAPS-W), CAPS-W

Data Center, Operational Data Store, Defense Corporate Database/

Defense Corporate Data Warehouse, BAM, APVM (Vendor Pay)

7

DISA

Enterprise Computing Service

8

DLA

Defense Automatic Addressing System

9

DLA

DAI

10

DLA

Defense Property Accountability System

11

DLA

Invoices, Receipt, Acceptance and Property Transfer

12

Defense

Manpower

Data Center

(DMDC)

Defense Civilian Personnel Data System

13

DMDC

DTS

14

CitiBank

Travel Card

15

U.S. Bank

Access Online

16

DFAS

Department 97 Reconciliation and Reporting Tool / Cash Management

Report (Fund Balance with Treasury Reconciliation)

17

DFAS

Enterprise Local Area Network

b. The FIAR Reporting Entity Office is responsible for monitoring control activities

implemented to complement the controls implemented by Service Providers:

(1) Control activities that provide reasonable assurance that any changes to processing

options (parameters) requested by the Reporting Entity are appropriately authorized and

approved.

(2) Control activities that provide reasonable assurance that output received from the

Service Provider is routinely reconciled to relevant Reporting Entity control totals.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 5: Reporting Entity 22

(3) Control activities that provide reasonable assurance of password or Common Access

Card-enabled access to Reporting Entity controlled computer terminals or networks resides with

the Service Provider.

5.3. PRE-AUDIT. For each assessable unit, the FIAR Reporting Entity Office is required to

complete narratives, key tasks, and underlying detailed activities as prescribed in guidance issued

by OUSD(C). Before the audit, the Reporting Entity completes preparation activities to include

remediating prior audit findings and addressing internal control gaps. The Reporting Entity

reviews process narratives and flowcharts for each end-to-end process on an annual basis and

revises them as necessary.

a. The FIAR Reporting Entity Office is responsible for performing periodic testing of a

sample of transactions and corresponding control activities to ensure that processes and controls

documented in each end-to-end process narrative are operating as intended. Tests of Design

determine if a documented process control is in place and Tests of Effectiveness determine if the

controls are working as intended. Tests techniques may include one or more forms:

(1) Inquiry. Conducted by oral or written inquiries of personnel involved in the

execution of specific control activities to determine what they do or how they perform a specific

control activity. Inquiries provide the least reliable evidence and requires supplementation with

other types of control tests.

(2) Observation. Conducted by observing personnel performing control activities in the

normal course of their duties. Observations provide sufficient evidence that the control activity

is properly applied during the period; however, it provides no evidence that the control was in

operation at any other time. Observations require supplementation by corroborative evidence

obtained from other tests (e.g., inquiry and inspection) about the operation of control activities at

other times.

(3) Examination. Conducted by examining documents and records of evidence (e.g., the

existence of initials or signatures) that a control activity was applied to those documents and/or

records.

(4) Re-performance. Conducted to obtain sufficient evidence that a control activity is

operating effectively.

b. Combining 2 or more of test techniques provides greater assurance than using only 1 test

technique. The more significant the account, disclosure, or process and the greater the risk, the

more important it is to ensure the evidence extends beyond 1 testing technique.

5.4. DURING THE AUDIT. During the audit, PBCs will be sent by OUSD to the agency with

a short suspense date. The FIAR Reporting Entity Office will assist with providing key

supporting documents (KSDs) of business processes to address the PBC responses from the

agency to OUSD. It is the responsibility of the FIAR team to react quickly and decisively to

ensure the process owner or correct POC has all the available time to respond.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 5: Reporting Entity 23

a. Once auditors have reviewed PBC responses, KSDs, and any follow-up information on

procedures or clarification of processes, they will request a Universe of Transactions to perform

a sample selection for testing issued via PBC routed through the FIAR Team.

b. When sample request are issued through the ARC Tool, the FIAR Reporting Entity Office

delivers the sample requests to the assessable or sub-assessable unit (depending on the requested

documentation) via the ARC tool. As a Key Control, the FIAR Reporting Entity Office will

establish a due date for the assessable unit process owner and monitor the completion of all

sample requests to ensure KSDs are provided timely.

c. The FIAR Reporting Entity Office receives an auto-generated system notification when

process owners have responded with the requested KSDs within the ARC tool. As a Key

Control, the FIAR team thoroughly reviews each submitted document for accuracy and to ensure

the documents satisfy the request before forwarding them to OUSD(C). In addition, the team

ensures there is no Personally Identifiable Information (PII) embedded within the document(s).

d. The FIAR Reporting Entity Team submits files that have possible PII by a secured

method determined by OUSD(C).

e. Activities that occur during the phases of an audit:

(1) Planning Phase. The FIAR Reporting Entity Office is the primary POC for all phases

of the audit. Table 5. Planning Phase – Key Tasks identifies the key activities for the planning

phase of a financial statement audit.

Table 5. Planning Phase - Key Tasks

Task

Description

Entrance

Conference

The entrance conference will be attended by OUSD(C), the Reporting

Entity, Service Provider teams and leadership to kick off the audit to gain

an understanding of audit requirements, other relevant information and

plans for field and site visits.

Review End-

to-End

Processes

The Reporting Entity and Service Provider teams should review the

Reporting Entity and Service Provider end-to-end process documentation.

The review should ensure that process narratives and flowcharts are both

current and accurate before being provided to the audit team.

Onboarding

Training/

Initial

Requests

As applicable, the FIAR Reporting Entity Office in coordination with the

Program Office, will provide onboarding training to assist the audit team in

gaining an understanding of the Reporting Entity. The training will explain

the organization structure, describe the various Service Providers that are

relevant to the Reporting Entity under audit, and outline the SOC-1

examination reports that are available.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 5: Reporting Entity 24

Table 5. Planning Phase - Key Tasks, Continued

Task

Description

Obtain SOC-1

Reports

All SOC-1 reports must be obtained from the Service Provider audit

liaisons and made available for review by the audit team.

Maintain

Standard

Operating

Procedures

(SOPs)

The FIAR Reporting Entity Office should maintain and update all SOPs

and manuals for key business processes. These SOPs may ultimately be

requested by an audit team during the course of an audit.

Obtain PBC

List

The Reporting Entity and Service Provider teams should obtain the PBC list

from the audit team and/or from OUSD(C).

Identify and

Research

Significant

Account

Fluctuation

The Reporting Entity and Service Provider teams should analyze financial

statement line items on a comparative basis. Significant year-over-year

fluctuations should be identified and underlying causes researched.

Documentation should also be obtained to support explanations for

significant account fluctuations that are identified (as this information

might be requested by the audit team at a later time).

Obtain Intra-

Departmental

Supporting

Documentation

The FIAR Reporting Entity Office should collaborate with other agency

Reporting Entity audit liaisons to obtain reconciliations, control

documentation, and MOUs to support intra-Departmental funding activity

for applicable reporting entities.

(2) Internal Control Phase. During this phase the audit team will perform risk

assessment procedures and expand its understanding of internal controls from the planning

phase. As part of this phase, the audit team will test the design and operating effectiveness of

key internal control activities. Based on the evaluation of the design, implementation of internal

controls, and the results of control tests, the audit team will preliminarily assess the effectiveness

of the internal controls. The audit team will reevaluate the preliminary assessment at the

conclusion of the testing phase. Table 6. Internal Control Phase – Key Tasks identifies key tasks

involving the FIAR Reporting Entity Office for the internal control phase of a financial statement

audit.

Table 6. Internal Control Phase - Key Tasks

Task

Description

Compile

Systems

Documentation

The FIAR Reporting Entity Office will obtain and provide the auditors with

flowcharts, process narratives, and any relevant SOPs or desktop manuals

for systems used by assessable unit processes to ensure they are reviewed,

organized and made readily available for the audit team.

Coordinate

Systems

Compliance

Testing

The FIAR Reporting Entity Office will coordinate with Service Providers

and the audit team so that tests for compliance with the Federal Financial

Management Improvement Act of 1996 (FFMIA) can be conducted.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 5: Reporting Entity 25

Table 6. Internal Control Phase - Key Tasks, Continued

Task

Description

Coordinate

Systems

Compliance

Testing

The FIAR Reporting Entity Office will coordinate with Service Providers

and the audit team so that tests for compliance with the Federal Financial

Management Improvement Act of 1996 (FFMIA) can be conducted.

Fulfill Ad Hoc

Internal Control

Requests

The FIAR Reporting Entity Office will obtain various ad hoc requests

relating to internal control environment of the Reporting Entity are likely to

arise during this phase of the audit.

Coordinate

Intra-

Departmental

Internal Control

Review

The FIAR Reporting Entity Office should collaborate with other agency

Reporting Entity audit liaisons to provide process flowcharts, narratives and

internal control documentation to support intra-departmental funding

activity for applicable reporting entities. Process system walkthroughs must

also be coordinated with the audit team as requested.

(3) Testing Phase. During this phase, the audit team obtains evidence to report on the

financial statements, internal controls, systems compliance, and compliance with significant

provisions of laws and regulations. The audit team gathers the appropriate evidence by

requesting KSDs which may be in the form of documents used for recording and processing

information or procedural (systemic and/or manual) process requirements and provides them to

external auditors for testing. Table 7. Testing Phase – Key Tasks identifies key tasks for the

testing phase of a financial statement audit.

Table 7. Testing Phase - Key Tasks

Task

Description

Provide Internal

Controls Testing

Support

The FIAR Reporting Entity Office will coordinate with the respective

DCMA Program Office to assist the audit team in the performance of

walkthroughs and respond to documentation requests to demonstrate the

controls are operating effectively.

Provide

Analytical

Procedures

Response

Support

The FIAR Reporting Entity Office should obtain and provide

documentation to support explanations for significant account fluctuations

that are identified by the audit team.

Provide Detail

Testing Support

The Reporting Entity and Service Provider teams should be prepared to

fulfill a broad range and high volume of requests for documentation from

the audit team. When responding to documentation requests, the FIAR

Reporting Entity Office and the DCMA Program Office must ensure that

documentation is submitted to the audit team (through OUSD(C)) within

the agreed upon timeframes and has undergone a multi-level quality

assurance review.

Conduct

Regular Status

Meetings

The FIAR Reporting Entity Office will attend OUSD(C) hosted status

meetings with the audit team to discuss the status of the audit, any

challenges encountered, and upcoming deadlines.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 5: Reporting Entity 26

(4) Reporting Phase. The DoDIG will provide a draft audit report to OUSD(C) and

DCMA leadership prior to issuance. Upon receipt of the draft report, DCMA leadership will

review the report and provide written comments back to the audit team regarding the findings,

conclusions and recommendations contained in the draft report. If the draft report contains

NFRs, OUSD(C) and FIAR Reporting Entity Office will hold meetings internally to discuss the

NFRs. Table 8. Reporting Phase – Key Tasks identifies key tasks for the reporting phase of a

financial statement audit.

Table 8. Reporting Phase - Key Tasks

Task

Description

Support Overall

Analytical

Procedures

The FIAR Reporting Entity Office should fulfill documentation requests and

provide responses to inquiries arising as the audit team performs overall

analytical procedures necessary to complete the reporting phase of the audit.

Coordinate Exit

Conference

The FIAR Reporting Entity Office will coordinate the exit conference with

the audit team to review the results of the audit and provide feedback on

conclusions reached and recommendations made. OUSD(C) and DCMA

leadership should be in attendance.

Review Draft

Audit Report

The FIAR Reporting Entity Office will review the draft audit report and

provide it to the appropriate DCMA officials to provide an opportunity to

comment on findings and/or areas of concern.

Provide

Responses to

Audit Findings

The FIAR Reporting Entity Office will prepare, coordinate, and distribute an

official DCMA response from leadership to OUSD(C) and the audit team

5.5. POST-AUDIT.

a. Remediation/Sustainment. DCMA leadership will coordinate with OUSD(C) and

respond to audit report findings by concurring or non-concurring to the audit findings. The

FIAR Reporting Entity Office will track NFRs to resolution, and meet with assessable unit

process owners to develop CAPs with interim milestones. The FIAR Reporting Entity Office

will initiate sustainment by integrating FIAR methodology sustainment activities into the

Managers Internal Control Program.

b. NFR Database. The NFR database is a centralized system developed by OUSD(C) to

track the flow of audit findings and communicate NFRs and corrective actions to internal and

external stakeholders. The NFR Database is used by OUSD(C) to track auditor findings and

work closely with agencies to ensure CAPs are developed and remedies are made to correct the

deficiency. The FIAR Reporting Entity Office is responsible for coordinating activities in

response to NFRs:

(1) Distribution and Analysis. When received, NFRs are provided to the owning

component of the deficiency for review, research, and analysis.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Section 5: Reporting Entity 27

(2) Response to External Auditor. After the NFR is thoroughly researched, the Agency

prepares a response and addresses auditor recommendation(s). The Agency will either concur or

non-concur with the deficiency/recommendation. The NFR must be signed by the FB Executive

Director upon concurrence and the process owner is required to develop a CAP to address the

finding and correct the problem. All CAP completions must be reported to OUSD(C) within 60

days.

(3) CAPs. A CAP must be developed and tracked for each finding that receives

concurrence on the NFR. The CAP status will be briefed at monthly FIAR ESG meetings.

Current year assertion packages must include relative CAPs with current status and previous

audit findings.

(4) Tracking. External auditor NFRs and CAPs will be tracked in the NFR Database.

c. Corrective Actions. In the Corrective Action process, the FIAR Reporting Entity Office

will:

(1) Identify and define deficiencies in internal controls and supporting documentation.

(2) Develop CAP(s) to resolve each deficiency identified during the Testing Phase, to

include budget estimates of required resources (e.g. funding and staffing) to execute CAPs.

(3) Implement and execute CAP milestones and confirm that all audit readiness critical

capabilities have been addressed.

(4) Close the CAP in the NFR database when all corrective actions have been completed

and verified by FIAR Reporting Entity Office. All CAPs relating to Service Provider assessable

unit control activities will be officially closed by the Contract Pay Service Provider Office, or

designee. Prior to recommending closure, the OPR must obtain required documentation and/or

perform sufficient testing to ensure remediation of the deficiency. Results of testing and

validation must be maintained by the OPR and be available a full FY following CAP closure.

The CAP POC will update the internal CAP Tracker and external NFR Database.

d. Status Reporting. The FIAR Reporting Entity Office will report remediation progress to

the OUSD(C) FIAR Directorate every 60 days via the NDAA Scorecard and an interim

milestone tracking chart, as applicable. The FIAR Reporting Entity Office will also perform

detailed NFR/CAP status reporting to the OUSD(C) FIAR Directorate using the NFR Database

each month. The FIAR Reporting Entity Office is responsible for preparing and/or updating

assessable unit process documentation (e.g., process narratives and flowcharts), assessing the

design, and testing the operating effectiveness of its internal controls. As part of sustainment, the

FIAR Reporting Entity Office is also responsible for identifying and resolving internal control

deficiencies noted during testing in a timely manner (e.g., before the next annual reporting

cycle). The FIAR Reporting Entity Office does so by implementing concrete, measurable and

attainable CAPs.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Glossary - Definitions 28

GLOSSARY

G.1. DEFINITIONS.

Assertion. A management assertion letter declaring that a financial statement/selected elements

of the financial statement are audit ready in conformity with the internal control and supporting

documentation criteria.

Assessable Unit. A process that is capable of being evaluated or audited. Functions include

documentation, identification, and insertion of controls associated with a specific sub-functions

in order to mitigate identified risks.

Assessments. Encompasses inspections, evaluations, assistance, and teach and train functions of

the identified entity.

CAP. The detailed plan identifying management controls, tactics, techniques, procedures,

training, resources, and working environment changes likely to preclude future non-compliance.

ELC. Established internal guidelines around governance that sets forth an organization’s values

through policies and procedures to provide reasonable assurance that objectives related to the

entity as a unit are met.

FIAR Guidance. A document that defines the Department’s goals, strategy and methodology

for becoming audit ready, including roles and responsibilities, and processes for reporting

entities, Service Providers, and executive agents.

Finding. Areas that are non-compliant with a regulation or policy/instruction requirement. Any

finding will have a recommendation associated with it. Each finding will also quantify whether

it is systemic in nature or a one-time occurrence.

Key Control. The policies, procedures (manual and automated) and activities that are part of a

control framework, designed and operated to ensure that risks are contained within the level that

an organization is willing to accept.

Line of Accounting. A document that captures the component’s level of assurance over internal

controls over reporting, internal controls over operations, and internal controls over compliance.

The lines of accounting must take one of the following forms: Unmodified (no material

weaknesses); Modified (one or more material weaknesses identified), Adverse (one or more

misstatements are both material and pervasive), and Disclaimer of Opinion (auditor unable to

provide sufficient audit evidence on which to base an opinion). Letter of Assurance is also

known as Statement of Assurance.

NFR. Document issued by the auditors indicating there is a potential audit finding.

PBC. A request for information or documentation from the auditors which allows them to

perform testing of management assertions in the financial statement audit.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Glossary - Definitions 29

Reporting Entity. A unit where it is reasonable to expect that there are users dependent on a

general purpose financial report to gain an understanding of the financial position and

performance of the unit, and to make decisions based on this financial information and other

information contained in the financial report.

Service Provider. An agency that provides other organizations with accounting, consulting,

legal, education, communications, storage, processing, or other services.

Universe of Transactions. The entirety of underlying, individual, and accounting actions that

support a financial statement line or balance. Accounting actions that support a financial

statement.

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Glossary – Acronyms 30

GLOSSARY

G.2. ACRONYMS.

APVM Accounting Pre-Validation Module

ARC Audit Response Center

BAM Business Activity Monitoring

CAP Corrective Action Plan

CAPS-W Computerized Accounts Payable for Windows

CMO Contract Management Office

COR Contracting Officer’s Representative

CSOC Complementary Sub-service Organization Control

CUEC Complementary User Entity Control

DAI Defense Agencies Initiative

DCPS Defense Civilian Pay System

DDRS Defense Departmental Reporting System

DFAS Defense Finance and Accounting Service

DMDC Defense Manpower Data Center

DTS Defense Travel System

ELC Entity Level Controls

ESG Executive Steering Group

FB Financial and Business Operations Directorate

FBLF Financial Improvement and Audit Remediation Branch

FBWT Fund Balance with Treasury

FFMIA Federal Financial Management Improvement Act of 1996

FIAR Financial Improvement and Audit Readiness/Remediation

FY Fiscal Year

GAAP Generally Accepted Accounting Principles

GL General Ledger

GPC Government Purchase Card

GSA General Services Administration

IPA Independent Public Accountant

IT Information Technology

KSD Key Supporting Document

MCC MOCAS Contract Closeout

MDO Modification and Delivery Order

MLC Management Letter Comments

DCMA-MAN 4301-11, Volume 2, September 30, 2019

Glossary – Acronyms 31

MOCAS Mechanization of Contract Administration Services

MOU Memorandum of Understanding

NDAA National Defense Authorization Act

NFR Notification of Finding and Recommendation

OPR Office of Primary Responsibility

OUSD(C) Office of the Undersecretary of Defense – Comptroller

PBC Provided by Client

PII Personally Identifiable Information

POC Point of Contact

SLA Service Level Agreement

SOC 1 Report System and Organization Controls Report

SOP Standard Operating Procedure

SSAE Statement on Standards for Attestation Engagements

WHS Washington Headquarters Services

DCMA-MAN 4301-11, Volume 2, September 30, 2019

References 32

REFERENCES

Chief Financial Officers Act of 1990 (Public Law 101-576)

DoD Directive 5105.64, “Defense Contract Management Agency (DCMA),” January 10, 2013

DoD Financial Statement Audit Guide, May 2018

Federal Financial Management Improvement Act of 1996 (FFMIA)

National Defense Authorization Act (NDAA) For Fiscal Year 2010 (Public Law 111-84),

Section 1003, October 28, 2009

Office of the Under Secretary of Defense (Comptroller)/CFO, “DoD Financial Statement Audit

Guide,” May 2018

Statement on Stadards for Attestation Engagements No. 18, May 1, 2017