SCHOLARSHIPS & FINANCIAL AID

20212022 UNDERSTANDING

YOUR FINANCIAL AID OFFER

Definitions

How to Process Your Financial Aid

Where to Begin

Processing Federal Direct Loans

Smart Borrowing Tips

Awards from Outside Sources

Revised Financial Aid Oer

Additional Options

Types of Aid

Grants

Loans

Federal and Texas College Work Study

Part-Time Employment

Disbursement

Financial Aid Disbursements

Financial Aid Refunds

Payment Information and Options

Policies

Financial Aid Oer Appeals

Extenuating Circumstances

Satisfactory Academic Progress

Changes in Enrolled Hours

Beginning Attendance

Withdrawing from the University

Renewal of the FAFSA/TASFA

Summer Aid

Services

Money Education Center

Student Employment Oce

Veteran Services Oce

Contact Information

Types of Aid Chart

WHAT’S INSIDE

Definitions

How to Process Your Financial Aid

Where to Begin

Processing Federal Direct Loans

Smart Borrowing Tips

Awards from Outside Sources

Revised Financial Aid Oer

Additional Options

Types of Aid

Grants

Loans

Federal and Texas College Work Study

Part-Time Employment

Disbursement

Financial Aid Disbursements

Financial Aid Refunds

Payment Information and Options

Policies

Financial Aid Oer Appeals

Extenuating Circumstances

Satisfactory Academic Progress

Changes in Enrolled Hours

Beginning Attendance

Withdrawing from the University

Renewal of the FAFSA/TASFA

Summer Aid

Services

Money Education Center

Student Employment Oce

Veteran Services Oce

Contact Information

Types of Aid Chart

Cost of Attendance (COA)

The COA is an estimate of what it costs a student

to attend Texas A&M. It includes tuition and fees,

housing and meals, and allowances for books,

supplies, transportation, and personal expenses.

Expected Family Contribution (EFC)

Calculated from the information you and your

parent(s) reported on the Free Application for Federal

Student Aid (FAFSA) or Texas Application for State

Financial Aid (TASFA). The EFC is used to determine

your eligibility for most nancial aid.

Direct Costs

Direct Costs will be on your bill from Texas A&M

University. This will include tuition and fees. It will

also include housing and meals if you are living on

campus.

Indirect Costs

Indirect costs will vary by student. It includes books,

supplies, transportation and personal expenses. It

will include housing and meals if you are living o

campus.

Net Cost

Net cost is Cost of Attendance minus grants and

scholarships.

Financial Need

Financial need is the basis for oering most nancial

aid programs. Financial need is determined by the

following equation:

College Financing Plan (CFP)

The CFP provides a summary of aid oered. It details

net cost for your family based on COA minus grants,

scholarships and other resources. You may use this

to compare aid oers with other universities. You can

view the CFP in the Financial Aid Portal by selecting a

printable version of your oer.

Financial Aid Offer

The oer letter combines various forms of aid to

meet your nancial need. The amount of oered aid

may not meet your entire nancial need. If this is the

case, please review the Types of Aid section in this

booklet.

DEFINITIONS

COST OF ATTENDANCE [COA]

EXPECTED FAMILY CONTRIBUTION [EFC]

FINANCIAL NEED

MINUS

EQUALS

Gift Aid (does not need to be repaid)

• Grants

• Scholarships and waivers

Self-Help

• Loans (repayable after last date of attendance) -

federal, state, institutional

• Student Employment (work and receive a

paycheck) is work-study, part-time employment,

or assistantships.

Emergency Aid

Texas A&M is committed to your success, including

overcoming temporary nancial hardships. Resources

available for nancial emergencies include emergency

aid, short-term loans, government assistance and

food resources. Visit the Emergency Aid page on our

website for more information.

Texas A&M strives to provide the greatest amount

of aid to students with the highest need and keep

loan debt to a minimum. Financial aid is awarded on

a rst-come, rst-served basis typically based on a

priority date. See the Types of Aid chart in the back

of this booklet.

Where to Begin

1. Read the Financial Aid Oer carefully before

accepting, reducing, or declining individual

awards.

2. Review the estimated cost of attendance in the

Financial Aid Portal to assist in planning how

much loan funding you may need.

3. Review the Policies section in this booklet

to understand factors that may change your

nancial aid oer.

4. Review the Process section in this booklet.

5. Accept, reduce, or decline your oered aid.

Step 1: Visit howdy.tamu.edu.

Step 2: Login using your Texas A&M Net ID.

Step 3: Click the Financial Aid Portal icon.

Step 4: Follow the instructions on the Awards

page to begin processing aid.

Processing Federal Direct Loans

The Financial Aid Oer shows your eligibility for the

Subsidized and/or Unsubsidized Federal Direct Loan

programs. After accepting a loan on the Awards page,

complete the requirements listed on the Status page

in the Financial Aid Portal. To receive your funds you

will need to complete a Master Promissory Note by

going to the Federal Student Aid website at

studentaid.gov. Interest rates are set by the federal

government each year and are subject to change.

Visit nancialaid.tamu.edu for additional details.

Loan Entrance Counseling

Students participating in the Federal Direct Loan

programs for the rst time must complete Loan

Entrance Counseling prior to the disbursement

of these loan funds. Please visit howdy.tamu.edu,

click the Financial Aid Portal icon and follow the

instructions on the Status page to complete this

counseling online.

Loan Exit Counseling

Students participating in the Federal Direct Loan

programs must complete Loan Exit Counseling upon

withdrawing, graduating, dropping below half-time,

or not returning to Texas A&M. If this is the case, you

will be provided information on how to complete this

counseling online.

PROCESS

Smart Borrowing

If borrowed responsibly, student loans can be a

great resource to assist in funding your education.

However, Texas A&M University highly encourages

you to consider the following prior to accepting any

student loan.

1. Maximize your free money. Submit your

FAFSA early and apply for scholarships every

year. Research scholarship opportunities at

scholarships.tamu.edu.

2. Manage your money so that you can minimize

your debt. Know your tuition and fees costs,

choose aordable housing, and visit

money.tamu.edu to learn how the Money

Education (ME) Center can help you to create a

budget that works.

3. Borrow only what you need. Uncertain of how

much to borrow? Contact the ME Center for help.

4. Know your student loans. Regularly review your

federal student loans on the Federal Student Aid

website at studentaid.gov. The My Loan Debt

page of the Financial Aid Portal also provides

additional information regarding your Texas A&M

student loans. Contact the ME Center if you need

help reviewing your student loan debt.

5. Understand student loan repayment. Visit

studentaid.gov for information on student loan

repayment and to calculate your estimated

monthly payment for your federal student loans

using the Loan Simulator. Research starting

salaries for your planned career eld and

compare them to the estimated monthly loan

payments to determine which student loan

repayment plans you can aord. Contact the

ME Center with any questions you may have

regarding student loan repayment.

6. Make your student loan payments on time.

Not repaying your student loans on time or

making payments late can negatively impact

your credit score and your ability to buy a house

or car, or even get a job. Can’t aord your

payments? Contact your student loan servicer(s)

at studentaid.gov or reach out to the ME Center

for help.

Awards from Outside Sources

If you receive any type of award from a source other

than Texas A&M University (typically scholarships

or corporate sponsorships) you must report it to

Scholarships & Financial Aid as soon as possible.

Changes to your nancial aid oer may be required

in accordance with federal and state rules. If you no

longer qualify for aid you have already received, you

may be required to repay it.

To report an award from an outside source, please

complete the Report Outside Scholarships &

Resources Form in the Financial Aid Portal.

Revised Financial Aid Offer

It may be necessary to revise the amount and/or

types of nancial aid oered to you. Changes to

your nancial aid oer may result from one of the

following situations: additional awards, enrollment

changes, courses not counting in your program of

study, residency status change, nancial aid eligibility

change, classication change, or Education Abroad

participation. You will be notied of any change by

email to your University email account and should

review your Financial Aid Portal for changes right

away.

Additional Options

We encourage you to explore a variety of options to

assist in paying for college while attending Texas A&M

University. Many students choose to work part-time,

while some have borrowed funds through other non-

need-based loan programs.

Grants (does not need to be repaid)

A grant is money that does not have to be repaid.

All students pursuing their rst Bachelor’s degree

and meeting eligibility requirements are oered the

Federal Pell Grant. Students can receive the Federal

Pell Grant for only the equivalent of 12 full-time

semesters. All other grants are oered to eligible

students on a rst-come, rst-served basis. Federal

Supplemental Educational Opportunity Grant (SEOG)

requires Pell Grant eligibility.

Loans (must be repaid)

A loan is nancial aid that must be repaid. Borrowers

are responsible for signing a promissory note for each

loan program. When signed, the promissory note is

a legally binding agreement to repay the loan. The

promissory note should be read carefully and a copy

should be kept.

Direct Subsidized Loan

The Subsidized Loan is a federal loan that is awarded

based on nancial need. The federal government

will pay the interest on this loan as long as you are

enrolled half-time or more. After you graduate, leave

school, or drop below half-time enrollment, you

will have a six-month grace period before you are

required to begin repaying your loan.

Direct Unsubsidized Loan

The Federal Direct Unsubsidized loan is a federal

loan that can be used to help pay college costs. You

are responsible for paying the interest on the loan.

If you choose not to pay the interest while you are in

school, your interest will accrue and be capitalized;

this means your interest will be added to the principal

amount of your loan. After you graduate, leave

school, or drop below half-time enrollment, you

will have a six-month grace period before you are

required to begin repaying your loan.

Direct Parent Loan for Undergraduate Students (PLUS)

Parents interested in borrowing a PLUS loan may

apply at studentaid.gov without any additional

information from our oce. A credit check is

required. Parents may request an amount up to the

cost of attendance minus other expected aid, as

noted on your Financial Aid Oer. You must submit a

Free Application for Federal Student Aid (FAFSA) and

must be enrolled at Texas A&M at least half-time in

order to be eligible for this loan.

Alternative Loans

Another option to assist with paying for college is an

alternative loan through a private lending institution.

These loans should be used only after other options

have been exhausted or as an alternative to the

Parent PLUS Loan. You may compare alternative loan

lenders online at nancialaid.tamu.edu. Carefully

compare lenders and interest rates. Who can borrow

from a particular lender varies.

Emergency Tuition and Fees Loan (ETFL)

This loan provides temporary funding to pay tuition

and required fees by the tuition deadline. It must be

repaid in full within 90 days during the fall and spring

semesters, and within 30 days during the summer

term. Emergency Tuition and Fees Loans have a

simple annual interest rate of 5% and a processing

fee of $10. Additional information and applications

are available at nancialaid.tamu.edu.

Short-Term Loans (STL)

You may borrow up to $1,500 to assist with expenses

other than tuition and fees. This loan must be repaid

in full within one year. Short-term loans have a simple

annual interest rate of 8% and a processing fee of

$10. This application and additional information is

available at nancialaid.tamu.edu.

TYPES OF AID

Federal and Texas College Work Study (money you earn)

The Federal and Texas College Work Study programs

promote student access to college while providing

practical work experience. These programs assist

students with nancial need by helping them secure

on-campus positions as well as some o-campus

positions assisting the community. Work Study

earnings are not applied directly to tuition and fee

expenses. If employed, you will receive a biweekly

paycheck for actual hours worked up to the amount

of the work study oer. Visit jobsforaggies.tamu.edu

for more information.

Part-time Employment

Part-time employment is another way that many

students help meet the cost of an education.

College Station Students should contact the Student

Employment Oce (SEO). The SEO assists students

in nding part-time jobs on and o-campus. You

can access the online database 24 hours a day at

jobsforaggies.tamu.edu.

Galveston Students may apply for student employment at

the Galveston Human Resources Oce.

McAllen Students should contact the Student Employment

Oce (SEO). The SEO assists students in nding

part-time jobs on and o-campus. You can access

the online database 24 hours a day at jobsforaggies.

tamu.edu.

Financial Aid Disbursements

Most types of nancial aid are credited to your

student bill no earlier than 10 days before the start

of the semester. You must be registered for courses

and all required documentation must be complete.

Scholarships and other aid from outside sources

cannot be credited until funds are received and

processed by the University. Review your billing

statement through the Howdy portal to determine

when aid has been disbursed.

Financial Aid Refunds

If your accepted nancial aid is more than your

total bill, you will receive a refund of the remaining

amount. You are required to sign up for direct

deposit. To sign up, select the Manage My Refund

preferences link from the My Finances tab in the

Howdy portal. Signing up for direct deposit will help

ensure your refund is available to you as soon as

possible.

Once you sign up for this service, all refunds, except

refunds to parents resulting from a Federal Direct

PLUS Loan, will be deposited into your chosen bank

account.

Payment Information and Options

For payment deadlines, payment plans, types of

payments accepted and more details on fees and

other charges, please visit Student Business Services

online at sbs.tamu.edu.

DISBURSEMENT

Financial Aid Offer Appeal

You have the right to appeal your nancial aid oer.

Requests for changes in the amounts and/or sources

of aid packaged must be submitted in writing or

email and must explain the reason for the request. A

Scholarships & Financial Aid advisor will respond to

the request through your Texas A&M email account.

A copy of all correspondence will be placed in your

nancial aid le. Submitting an appeal does not

guarantee adjustments can or will be made.

Extenuating Circumstances

There may be times when the Free Application for

Federal Student Aid (FAFSA) or Texas Application

for State Financial Aid (TASFA) does not reect your

family’s true nancial situation. In this case, you are

encouraged to contact the nancial aid oce and

meet with a Scholarships & Financial Aid advisor.

Additional information is located at nancialaid.tamu.

edu by searching “extenuating circumstances”.

Some common reasons for a review my include:

• Parent or student loss of income due to

unemployment

• Parent or student loss of untaxed income or

benets such as child support or social security

• Parent or student marital status has changed due

to divorce or separation

• Death of parent or spouse of a student

• Parent or student with excessive medical/dental

expenses

• Costs for an education abroad experience

• Parent attending college at least half-time

If you are a dependent student and believe there

are extenuating circumstances that may qualify

you to be considered as an independent student,

contact our oce to schedule an appointment with

an advisor. Your circumstances will be treated with

professionalism and condentiality. Requesting a

review does not guarantee an adjustment can or will

be made.

Satisfactory Academic Progress

Students must make Satisfactory Academic Progress

(SAP) to remain eligible for most forms of nancial

aid. Additional progress requirements may vary for

each aid program. There are three components to

SAP evaluation. Failure to meet these may result in a

loss of aid eligibility.

Grade Point Ratio (GPR)

The minimum GPR is 2.0 for undergraduates.

Completion Rate

You must complete at least 75% of all credit hours

attempted. This percentage includes all credit hours

attempted, regardless of whether or not nancial aid

was received or the course was taken at Texas A&M.

Courses with grades of W, F, I, U, Q, X, NG, and grade

exclusions are not considered to be completed.

Maximum Hours

You are expected to complete degree requirements

within a reasonable time frame, currently dened

as attempting no more than 134% of the credit

hours required for your degree program. This is the

maximum number of credit hours a student may

have and receive nancial aid. All transfer coursework

accepted by the University is included in this total

even if it does not apply to your academic major.

SAP notification and appeal policy

SAP is reviewed at the end of each semester for

undergraduate programs. If you fail to meet SAP

minimums you will be given a warning semester.

During that semester you will be eligible for nancial

aid. After the semester of warning, if you are not

meeting SAP minimums, you will no longer be eligible

to receive nancial aid. You will be informed of the

reason(s) for the loss of eligibility and the conditions

that must be met before your nancial aid eligibility

may be reinstated.

You may appeal loss of eligibility if you have

experienced extenuating circumstances that

impacted your academic performance. However,

the submission of an appeal is only a request and

does not guarantee it will be granted or aid will

be reinstated. For more information on SAP visit

nancialaid.tamu.edu.

Enrollment Status (Courses that Count)

All nancial aid oers are based on full-time

enrollment. However, most nancial aid programs we

oer require students to be registered at least half-

time. Students may receive federal nancial aid only

for eligible courses that count towards their program

of study. State and institutional aid are not subject

to the same restrictions. Students enrolled less than

full-time in courses that count towards their program

of study should contact our oce to determine the

impact on scholarship and nancial aid eligibility as

aid and cost of attendance may be prorated based on

the number of hours of enrollment.

For example: A Federal Pell Grant recipient is enrolled

in 12 hours, and 9 hours of the 12 hours are required

for their program of study. The recipient will receive

their Federal Pell Grant based on 9 hours. Their

Federal Pell Grant payment and cost of attendance

will be reduced based on courses that count/apply to

their degree program.

POLICIES

Federal Direct Loans for undergraduates require 6

hours of enrollment. If a student is enrolled in 12

hours and only 3 hours of the 12 hours are required

for their program of study, they cannot receive a

Federal Direct Loan. Please see the chart in the back

of this booklet to determine enrollment minimums

for nancial aid programs.

Changes in Enrolled Hours

Students enrolled less than full-time will have

adjustments made to their cost of attendance. This

may result in awards being reduced or cancelled.

Students who are considering dropping a class should

contact our oce before doing so to determine the

eect on scholarship and nancial aid eligibility.

A reduction in enrolled hours may result in the

following:

• Proration or loss of grant funds you have been

oered/paid

• Proration of your cost of attendance

• Unsatisfactory Academic Progress and loss of

future nancial aid eligibility

Beginning Attendance

Federal nancial aid regulations require conrmation

that you began attendance in at least one course in

order to establish eligibility for federal student loans.

Further, you must begin attendance in all courses if

receiving Federal Pell Grant, Federal TEACH Grant,

and/or Iraq-Afghanistan Service Grant (IASG). Based

on conrmation from faculty, adjustments to nancial

aid oer(s) may be necessary and may result in you

owing money.

Withdrawing from the University

Students who withdraw from all classes, ocially or

unocially, are eligible to keep only the nancial aid

they have earned up to the time of withdrawal. Funds

that were disbursed in excess of the earned amount

must be returned to the appropriate nancial aid

program. This situation could result in you (or your

parent) owing money to the University. To determine

the amount of federal aid you have earned up to the

time of withdrawal, Scholarships & Financial Aid will

divide the number of calendar days you attended

classes by the total number of calendar days in the

semester (minus any scheduled breaks of 5 days or

more). This percentage is then multiplied by the total

federal funds that were disbursed (either to your

billing account or refunded) for the semester. This

calculation determines the amount of federal aid

earned.

For example: If you attended 25% of the semester,

you will have earned approximately 25% of the aid

paid. The unearned amount (total aid disbursed

minus the earned amount) will be returned to the

appropriate aid program and you will be billed for

the amount returned. The calculation for state and

institutional aid earned is dierent. For detailed

information on how Scholarships & Financial Aid

returns aid for withdrawn students, visit nancialaid.

tamu.edu.

Renewal of the FAFSA/TASFA

You must re-apply for nancial aid every year by

renewing your FAFSA at studentaid.ed.gov/sa/fafsa.

Most of the renewal FAFSA will already be lled in

with information that you provided on the previous

year’s application. The application for the 2022-2023

academic year will be available October 1, 2021.

Students completing the TASFA also need to re-apply

annually. This application is typically available in early

October at howdy.tamu.edu.

Summer Aid

Limited nancial aid is available for the summer.

The current year’s FAFSA/TASFA must be completed

in order to be considered for nancial aid. You

will not be oered aid until you are registered for

summer courses at Texas A&M. Please complete the

“Report Outside Scholarships & Resources Form” in

the Financial Aid Portal if you are expecting outside

scholarship payments for the summer term.

Money Education Center

The Money Education (ME) Center educates students

about money so you can make smarter nancial

decisions in college and be nancially successful

after graduation. The ME Center provides free

presentations, one-on-one advising, and online

resources on paying for college, student loans,

eating on a budget, credit cards, credit scores, car

buying, home buying, investing, and more. For more

information, visit money.tamu.edu.

Student Employment Office

The Student Employment Oce oers free

workshops for student employees. Workshop topics

include communication skills, improving eectiveness

and professionalism in the workplace, and more. For

more information or to register, visit jobsforaggies.

tamu.edu.

Veteran Services Office

The Veteran Services Oce assists veterans and

their dependents with processing federal and state

education benets.

Assistance offered:

• How to use your GI Bill®

• How to certify your education benets

• Information about Hazlewood Exemption for

Texas residents that have exhausted GI Bill®

benets or receive less than tuition for GI Bill®

• How to apply for scholarships & nancial aid

If you are eligible to receive VA benets, please

contact our oce for assistance in applying for these

benets. For more information, visit veterans.tamu.

edu.

Scholarships

979.845.3982

scholarships.tamu.edu

Money Education Center

979.845.SAVE (7283)

Get in Line for advising at

money.tamu.edu

Student Employment

979.845.0686

jobsforaggies.tamu.edu

Veteran Services Oce

979.845.8075

Get in Line for advising at

veterans.tamu.edu

Higher Education Center

at McAllen

956.271.1300

Student Business Services

(payment & bill questions)

979.847.FEES (3337)

sbs.tamu.edu

Scholarships & Financial Aid*

Texas A&M University

P.O. Box 30016

College Station, TX 77842

979.845.3236 (Phone)

979.847.9061 (Fax)

Get in Line for advising at nancialaid.tamu.edu

*Send all documents for Health Science Center, School of

Law, Higher Education Center at McAllen to main address.

Galveston students see address below.

For frequently asked questions, ask our chatbot

Miss Rev at nancialaid.tamu.edu.

Texas A&M University Galveston Campus

Processing Address

P. O. Box 40005

College Station, TX 77842

409.740.4500

tamug.edu/naid

Student Business Services

(payment and billing questions)

409.740.4434

Veteran Benets Administrator

409.740.4500

Student Employment

409.740.4532

SERVICES

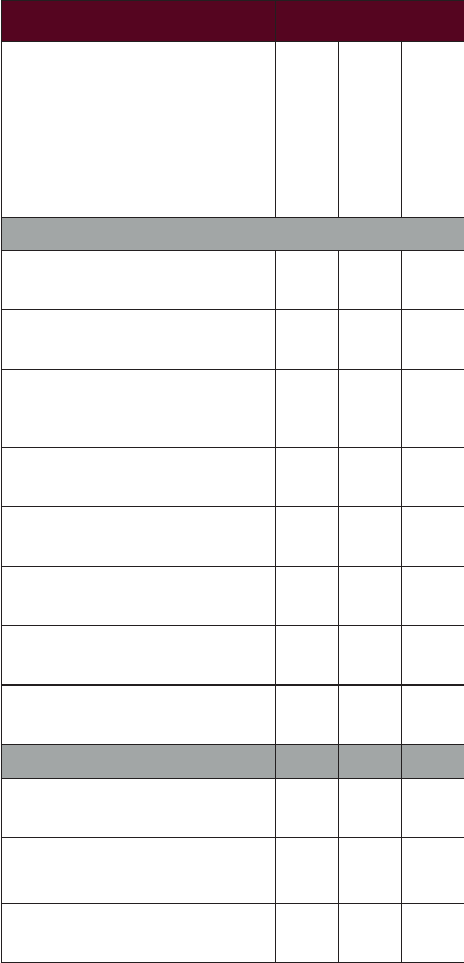

Types of Aid

Criteria

FAFSA Required

TASFA Required

(If SB 1528)

1

Minimum Enrollment

Prorated less than

full-time

Repayment Required

Interest Rate

Student (S) or Parent

(P) Borrower

Satisfactory

Academic Progress

Standards

Loan

Origination Fee

All Eligible Students

Will Receive Award

Need Based

Regents’ Scholarship

2

P P

Full

P

Federal Pell Grant

P P P P

Federal Supplemental

Educational

Opportunity Grant (FSEOG)

3

P

½

P

TEXAS Grant

4

P P

¾

P

2.5 GPA

4

Texas Public Education Grant

(TPEG)

P P

½

P P

Texas Aggie Grant/Scholarship

2

P P

½

P P

Federal/Texas College

Work Study

P P

5

½

P

Federal Direct Loan

(subsidized)

P

½

P

2.75%

7

S

P

1.057%

8

Non-Need Based

TEACH Grant

3,6

P P

varies varies S

P P

Federal Direct Loan

(unsubsidized)

P

½

P

2.75%

7

Undergrad

S

P

1.057%

8

Federal Direct PLUS Loan

P

½

P

5.3%

7

P

P

4.228%

8

1

SB 1528 = Students who qualify to pay in-state tuition, not

eligible to complete a FAFSA.

2

College Station, McAllen, and College Station/Galveston

Engineering students only

3

Availability subject to federal funding.

4

Availability subject to state funding, must complete 24 credit

hours per year.

5

Students who are eligible to work in the US may be considered

for Texas College Work Study.

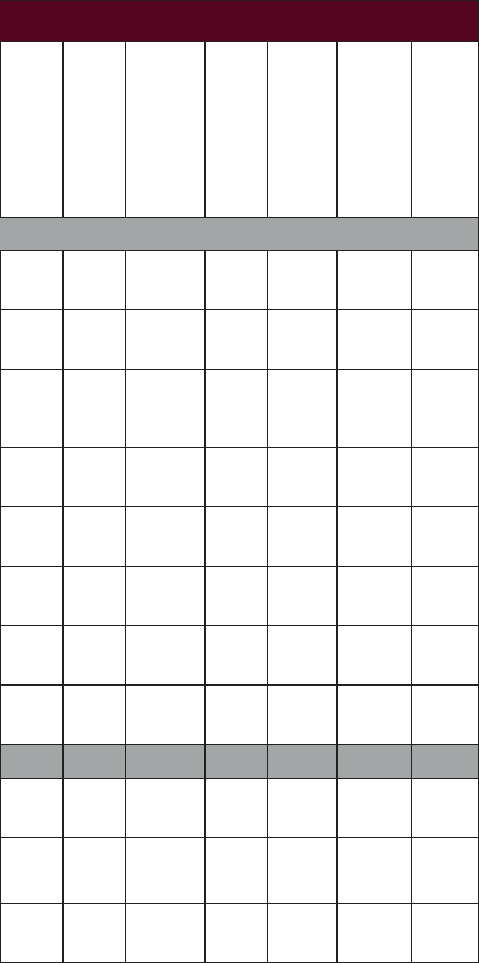

Types of Aid

Criteria

FAFSA Required

TASFA Required

(If SB 1528)

1

Minimum Enrollment

Prorated less than

full-time

Repayment Required

Interest Rate

Student (S) or Parent

(P) Borrower

Satisfactory

Academic Progress

Standards

Loan

Origination Fee

All Eligible Students

Will Receive Award

Need Based

Regents’ Scholarship

2

P P

Full

P

Federal Pell Grant

P P P P

Federal Supplemental

Educational

Opportunity Grant (FSEOG)

3

P

½

P

TEXAS Grant

4

P P

¾

P

2.5 GPA

4

Texas Public Education Grant

(TPEG)

P P

½

P P

Texas Aggie Grant/Scholarship

2

P P

½

P P

Federal/Texas College

Work Study

P P

5

½

P

Federal Direct Loan

(subsidized)

P

½

P

2.75%

7

S

P

1.057%

8

Non-Need Based

TEACH Grant

3,6

P P

varies varies S

P P

Federal Direct Loan

(unsubsidized)

P

½

P

2.75%

7

Undergrad

S

P

1.057%

8

Federal Direct PLUS Loan

P

½

P

5.3%

7

P

P

4.228%

8

6

Student must agree to serve as a full-time teacher in a high-

need subject area, in schools serving low-income students for

at least four academic years within eight years of completing

the program for which the student received the grant. If the

student does not satisfy the service obligation, the amount(s)

of the TEACH Grant(s) received are treated as a Federal Direct

Unsubsidized Loan and must be repaid with interest.

7

Interest rate subject to change July 1, 2021.

8

Origination fees subject to change October 1, 2021.

TEXAS A&M UNIVERSITY

Scholarships &

Financial Aid